- Home

- »

- Electronic & Electrical

- »

-

U.S. Wine Cooler Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Wine Cooler Market Size, Share & Trends Report]()

U.S. Wine Cooler Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Free-Standing, Countertop, Built-In), By Type (Compressor-based, Thermoelectric), By End-use, By Price Range, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-443-5

- Number of Report Pages: 60

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Wine Cooler Market Size & Trends

The U.S. wine cooler market size was valued at USD 360.0 million in 2024 and is projected to grow at a CAGR of 4.7% from 2025 to 2030. The growth in product adoption can be attributed to the increasing consumption of wine in American households. Consumers buy wine coolers and store the bottles at home, making the product a basic necessity.

Multiple home appliance companies have recently launched new products, propelling the market growth. For instance, in November 2024, TCL, one of the brands operating in the television and technology innovation industry, expanded its home appliances portfolio with the launch of a wine and beverage cooler. The new Display Case Wine Cooler (WC18L1S) by TCL allows users to store 18 wine bottles while displaying their favorites. Stainless steel doors with adjustable shelving capabilities, personalized LED color lighting, temperature controls, and freestanding design are the product's key features.

Adopting home appliances with multi-functional features is an upcoming trend for the residential user as it offers enhanced convenience. Moreover, along with alcohol, the consumption of non-alcoholic wines amongst millennials has been on the rise over the past few decades. One of the crucial functions of a wine cooler, which is driving its rapid deployment in the residential and commercial sectors, is its ability to protect wine collections from damaging natural elements and contaminations.

Some of the other factors that contribute to the growth of this market include ease of accessibility through online portals and e-commerce websites, availability of technologically advanced appliances, and inclusion of appealing aesthetics by the manufacturers. In recent years, growth in wine connoisseurship and increasing availability of information regarding wines, different tastes and flavors of wine, quality of wine, and more have added to the growth opportunities for this market.

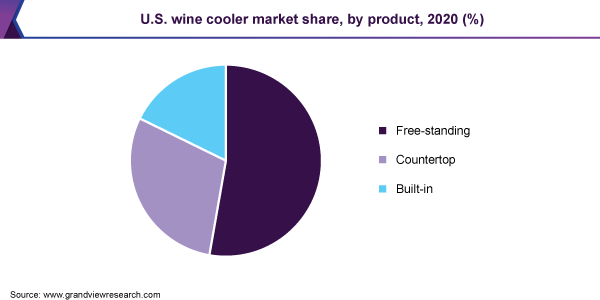

Product Insights

The free-standing wine cooler segment dominated the U.S. wine cooler market, with a revenue share of 52.2% in 2024. Free-standing equipment is more affordable and offers various benefits over its counterparts. In addition, unlike regular refrigerators, a wine cooler helps store a collection of wines at a suitable temperature, maintaining their precise taste and, thus, driving the segment's growth.

The countertop wine cooler segment is projected to experience the highest CAGR during the forecast period. Countertop equipment is considered a convenient solution for households with less floor space. The appliance occupies the least space and features similar abilities and aesthetic appeal. The ease of availability facilitated by e-commerce and online company stores adds to the growth opportunities of this market.

Type Insights

The compressor-based segment held the largest revenue share of the U.S. wine cooler industry in 2024. Compressor-based wine coolers use refrigerant gas and compressor capabilities to develop heated vapors, which are converted into colder air with the help of a condenser. Ease of use, enhanced capacities in terms of temperature maintenance, and the existing number of users contribute to this segment's dominance.

The thermoelectric wine cooler segment is projected to experience the fastest CAGR during the forecast period. This market is primarily influenced by the energy efficiency offered by the product. The absence of moving parts in thermoelectric wine coolers also ensures less noise than compressor-based wine coolers. Increasing awareness regarding sustainability and comparatively reduced environmental impact developed by thermoelectric wine coolers are expected to drive demand for this segment in the approaching years.

End-use Insights

The commercial users segment held the largest revenue share of the U.S. wine cooler industry in 2024. The commercial users include luxury hotels, wine-serving restaurants, social gathering halls and banquets, cafes, bars, lounges, beach resorts, and others. Commercial users primarily used display-driven, aesthetically appealing, energy-efficient wine coolers with advanced technologies and enhanced storage capacities. The growth experienced by the tourism and hospitality industry in the U.S. is expected to influence the development of this market.

The residential users segment is expected to experience the fastest growth during the forecast period. This is attributed to the increasing adoption of technological advancements in manufacturing processes, leading to reduced costs and price points. Additionally, ease of use, availability and accessibility, the introduction of energy-efficient wine coolers, the entry of multiple domestic players in the market, and effective distribution by key companies are adding growth opportunities for this market.

Price Range Insights

Based on price range, wine coolers available in a range of > USD 1,500 dominated the U.S. industry in 2024. The increasing demand from commercial buyers, such as luxury hotels with premium range wine collections, primarily influences the growth of this segment. Wine coolers priced > USD 1,500 are typically used in commercial spaces, such as hotels, restaurants, bars, pubs, cafes, and resorts, as they can store many bottles at a time. The large number of household users and enhanced accessibility through online marketplaces are adding to the growth opportunities.

Wine coolers priced less than USD 500 are projected to experience the fastest growth in demand during the forecast period. This is primarily attributed to the increasing number of household users, changing lifestyles, availability of energy-efficient appliances, and urban consumer preferences, which often include countertop wine coolers. Effective distribution of products in this price range through popular supermarket and hypermarket chains and other organized retail industry participants is adding to the growth of this segment.

Distribution Channel Insights

The electronic stores segment held the largest revenue share of the U.S. wine cooler market in 2024. This is attributed to the increasing number of customers approaching local electronic stores to purchase various home appliances. This offline shopping experience enables them to examine the wine cooler's multiple product features, quality, utility, and aesthetic appeal. Immediate possession and post-sale services offered by the local store owners also contribute to the growing inclination among consumers to purchase wine coolers from these stores.

The online distribution segment is anticipated to experience the fastest CAGR during the forecast period. Factors associated with online shopping experiences, such as ease of use, convenience, availability of detailed product descriptions, virtual reality-driven features, a wide range of products listed on the portal, reviews by previous buyers, and others, are driving the segment growth. Services such as return or replacement, doorstep delivery, and enhanced customer assistance provided by businesses also increase customer engagement.

Key U.S. Wine Cooler Company Insights

Some of the key companies in the U.S. wine cooler industry are Whirlpool Corporation, Danby, Frigidaire, Haier, Bosch and others. Multiple companies have embraced strategies such as innovation-based product developments, launching products in different price ranges, energy-efficient technologies, and more to address growing competition and increasing demand from residential users.

-

Whirlpool Corporation, a manufacturer of home appliances and other technology-driven products, offers a range of brands, including Whirlpool, KitchenAid, MAYTAG, JENNAIR, BRASTEMP, Consul, across, AMANA, GLADIATOR, SWASH, every drop, and others. Its wine cooler offerings feature a 15-inch under-counter wine center and a 24-inch wide under-counter wine center.

-

Vinotemp offers a range of wine storage solutions, including refrigerators & coolers, racks, dispensers, cabinets, and more. It also provides dishwashers, microwaves, ice makers, cooling systems, wine walls, custom wine storage, glass wine cellars, wood wine cellars, and others.

Key U.S. Wine Cooler Companies:

- Whirlpool Corporation

- Danby

- Frigidaire

- Haier Inc.

- NewAir

- kalamera

- Robert Bosch GmbH

- EdgeStar

- Avanti Products

- Vinotemp

Recent Developments

-

In November 2024, Dacor, one of the subsidiaries of Samsung Electronics America, introduced undercounter collection of luxury range kitchen appliances. This includes collection available in beverage refrigeration and wine cellar configurations. The wine cellar comprises dual temperature zones, precision rails and GlideRack system of company made with high end oak wood.

U.S. Wine Cooler Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 383.3 million

Revenue forecast in 2030

USD 481.7 million

Growth Rate

CAGR of 4.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, price range, distribution channel, end-use, region

Key companies profiled

Whirlpool Corporation; Danby; Frigidaire; Haier Inc.; NewAir; kalamera; Robert Bosch GmbH; EdgeStar; Avanti Products; Vinotemp

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Wine Cooler Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the U.S. wine cooler industry report based on product, type, price range, distribution channel, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Free-standing

-

Countertop

-

Built-in

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Compressor-based

-

Thermoelectric

-

-

Price Range Outlook (Revenue, USD Million, 2018 - 2030)

-

< USD 500

-

USD 501 to 1,500

-

> USD 1,500

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Electronic Stores

-

Exclusive Brand Outlets

-

Online

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.