- Home

- »

- Advanced Interior Materials

- »

-

U.S. Windows & Patio Doors Market For Single Family Homes, Report, 2030GVR Report cover

![U.S. Windows & Patio Doors Market For Single Family Homes Size, Share & Trends Report]()

U.S. Windows & Patio Doors Market For Single Family Homes Size, Share & Trends Analysis Report By Product, By End Use (New Construction, Refurbishment), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-340-8

- Number of Report Pages: 105

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

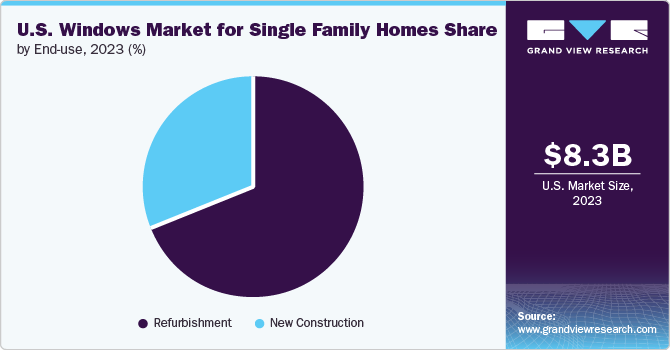

The U.S. windows & patio doors market for single family homes was estimated at USD 8.29 billion in 2023 and is projected to grow at a CAGR of 3.2% from 2024 to 2030. The stability of the U.S. construction industry is expected to fuel the demand for new construction and renovation projects for single family homes, which is likely to drive the windows and patio doors market. In addition, stringent regulations in the U.S. regarding the use of sustainable building materials prompt end users to replace old windows and patio doors with sustainable products, thereby driving the market growth.

The U.S. has been witnessing increased demand for residential spaces on account of the growing population and the rising buying power of consumers in the U.S. According to the U.S. Census Bureau, the construction of new homes in the U.S. increased by 9.8% in February 2023 compared to January 2023. Single-family housing also witnessed an uptrend of 1.1% in February 2023 compared to January 2023, specifically, in the Northeast and West parts of the U.S. Thus, rising construction activities are expected to provide growth opportunities to the U.S. windows & patio door market for single family homes.

Rising refurbishment activities are further supporting the U.S. market growth. Refurbishment has become a common practice in urban areas, due to changing consumer tastes & market trends and increasing disposable income. People are actively investing and reinvesting to modify their homes. Furthermore, refurbishment costs less when compared to the redevelopment of the entire structure; hence, it is mostly preferred for residential areas. This helps modify the existing design with components, which is fueling the market for windows and patio doors in the U.S.

Additionally, there has been a growing trend of DIY, which reduces the overall renovation cost. Home renovation increases the resale value of the property. Renovations can enhance the aesthetic appeal and functionality of the home and easily attract buyers. With rising renovation activities, the demand for windows is likely to grow in the coming years.

However, windows and patio doors are responsible for waste accumulation. The raw materials used in product manufacturing often cause environmental degradation. The waste compromises the quality of soil, contributes to high transportation costs, causes water pollution, and occupies a large portion of land. This factor is expected to negatively affect the adoption of products in the U.S.

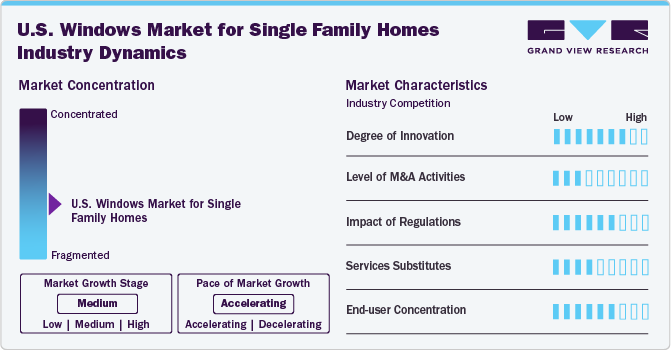

Industry Dynamics

The market growth stage is medium and the pace of growth is accelerating. The industry is fragmented based on the presence of numerous major players offering a variety of products in different materials. Furthermore, players are focusing on achieving optimal operational costs, enhancing product quality, and maximizing production output, which is intensifying the competition among market participants.

The development of advanced energy-efficient glass windows and patio doors, such as low-emission and smart windows and patio doors, is expected to boost the demand for sustainable solutions. Moreover, major players in the market are focusing on research and development for the automation of technologies such as automatic windows and patio door control through sensors.

Technological advancements facilitate manufacturers to opt for automated windows and patio doors. With the increasing automation trend in the fenestration industry of replacing mechanical windows and patio doors with automated and application-operated windows and patio doors, thereby creating a medium threat of substitution.

The presence of a large number of small and medium-scale players in the market increases the end user concentration. Also, a large number of manufacturers offer a similar range of options at a uniform price range. Hence, a low level of product differentiation and a large number of manufacturers increase the buyer power, and this trend is expected to continue over the forecast period.

Windows Product Insights

Double/single-hung windows are the most preferred choice among all types of windows and the segment dominated the market with a revenue share of 52.8% in 2023. Single-hung windows have a bottom sash that moves and can be opened and closed as per the requirements while their top sash is fixed. In double-hung windows, the two sashes can move independently. The design of the double-hung windows offers high ventilation flexibility.

Casement windows are anticipated to grow at the fastest CAGR of 4.2% from 2024 to 2030. Due to temperature fluctuations, casement windows are gaining popularity in the U.S., especially in the Midwest. These windows are highly resistant to windy weather as they are free from dividing sashes used in single/double-hung windows. Casement windows are completely sealed when they are fully closed. They insulate homes from extreme temperature changes. These factors make casement windows more energy-efficient than other types of windows.

Sliding windows generally slide horizontally and are among the most preferred options as they provide easy ventilation and allow light to enter the rooms. These types of windows are the most suitable for modern homes with large areas, including the living and dining rooms. Sliding windows provide an unobstructed view of the outdoors with minimal framing. Moreover, they are easy to use and maintain. Hence, they are considered the most affordable replacement choice for conventional windows owing to their simple sliding mechanism.

Windows End Use Insights

Based on end use, the U.S. windows market for single family homes is segmented into new construction and refurbishment. Refurbishment end use dominated the market with the revenue share of 69% in 2023 and is further expected to grow at a fastest CAGR over forecast period. Refurbishment, or renovation, involves updating and improving existing windows in older buildings. Many homes, particularly in the U.S., are aging and have outdated windows that lack efficiency and proper insulation properties. Moreover, the issues of wear & tear, rot, and difficulty in operations are prompting homeowners to refurbish and replace them.

The construction industry in the U.S. is growing at a higher pace, owing to the increasing population. This is boosting the demand for family homes in the country. Windows are essential components of a home, as they enhance its esthetic appeal. This is further driving the demand for windows and window materials in the U.S. The new construction windows market is characterized by the growing emphasis on energy efficiency, advanced materials, and innovative technologies.

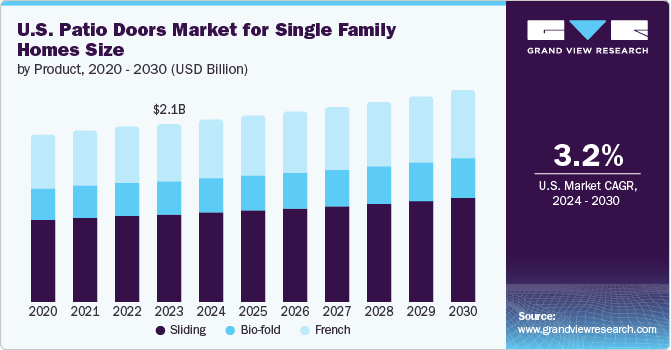

Patio Doors Product Insights

Based on product, the U.S. patio doors market for single family home is segmented into sliding, bio-fold, and French. The sliding doors segment held the largest revenue share of 43.3% in 2023 and is expected to grow at the fastest pace over the forecast period. Sliding doors are generally used in contemporary houses as they showcase a wider view. Unlike traditional hinged doors, these doors open horizontally along a track rather than swinging open like traditional doors.

Sliding doors generally feature a wide, sliding glass panel enclosed by a frame, which enables natural light to pass, provides easy access to the outdoors, and can be customized to fit any opening. Moreover, these doors have a mechanism that lifts the door slightly off the track for easier sliding and a tighter seal when closed.

A French patio door, also known as a French door or French window, is a classic and elegant architectural feature commonly used to connect indoor living spaces with outdoor areas such as patios, gardens, or balconies. These doors are characterized by their design, which typically includes multiple glass panes set on a frame and can extend the full height of the door. Additionally, this product is opted on account of various advantages such as low-cost and durable options, easy access, and open 180 degrees.

Patio Doors End Use Insights

Based on end use, the U.S. patio doors market for single family homes is segmented into new construction and refurbishment. The refurbishment end use segment dominated the market with a revenue share of 59% in 2023 and is expected to grow at the fastest CAGR from 2024 to 2030. Homeowners often choose to refurbish patio doors to update the look of their homes. The use of modern designs and different materials can significantly enhance the visual appeal of both the interior and exterior sections of the homes. Moreover, refurbished patio doors offer an unobstructed view of the landscape for properties located in scenic areas.

Patio doors are a popular choice when designing a new home. Selecting the best type of door for new construction involves considering factors like budget, design preferences, and functional requirements. Various materials used for patio door manufacturing include aluminum, vinyl, fiberglass, steel, and wood composite.

Key U.S. Windows & Patio Doors Market For Single Family Homes Company Insights

Some of the key players operating in the market include Jeld-Wen, Inc.; Cornerstone Building Brands; and VELUX Group

-

Jeld-Wen, Inc. produces multiple windows and patio doors made of wood, vinyl, aluminum, and other related products used in the construction, remodeling, and repair of residential and commercial buildings. Its portfolio is segmented into various product lines such as auraline composite, brickmould vinyl, custom wood, flat casing vinyl, and premium atlantic vinyl.

-

VELUX Group is engaged in manufacturing netting materials. It manufactures roof windows, modular skylights, and flat roof skylights. It offers accessories like roller shutters, blinds, and sensor-driven or remote-controlled smart home systems

Starline Windows, Apogee Enterprises, Inc., and Harvey Building Products are some of the emerging market participants in market.

-

Starline Windows is engaged in manufacturing and installing a wide range of windows for various applications including residential and hospitality projects. Furthermore, it sells its products through categories including high-rise, low-rise, and residential.

-

Harvey Building Products owns four brands, namely Harvey Windows & Doors, Thermo-Tech Windows & Doors LLC, SoftLite Windows & Doors, and Northeast Building Products, LLC. These brands manufacturer windows, doors, and patio doors.

Key U.S. Windows & Patio Doors Market For Single Family Homes Companies:

- Andersen Corporation

- Jeld-Wen, Inc.

- The Pella Corporation

- Profine International Group

- PGT Innovation, Inc.

- Cornerstone Building Brands

- Starline Windows

- MI Windows and Doors

- Marvin

- VELUX Group

- Harvey Building Products

- Apogee Enterprises, Inc.

- Associated Materials Incorporated

Recent Developments

-

In March 2024, MITER Brands, a manufacturer of windows and doors, acquired PGT Innovation, Inc. This acquisition will help MITER Brands to enhance its product offerings, expand market reach, and accelerate innovations.

-

In March 2024, Cornerstone Building Brands announced its plan to acquire Harvey Building Products, a producer of doors and windows. Harvey Building Products operates with different brands such as SoftLite, Thermo-Tech, and Harvey. This acquisition will help Harvey Building Products explore the market of repair and remodeling.

-

In March 2022, Harvey Building Products’ distribution business was acquired by Lansing Building Products. After the acquisition, the company has been operating in 113 branches in 35 states in the U.S. Moreover, the manufacturing business was not a part of the deal, hence customers will receive products branded as Harvey Windows and Doors. The deal closed in April 2022, bringing 36 Harvey branches under the Lansing brand.

U.S. Windows & Patio Doors Market For Single Family Homes Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.51 billion

Revenue forecast in 2030

USD 10.30 billion

Growth rate

CAGR of 3.2% from 2024 to 2030

Base year for estimation

2023

Actual estimates/Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use

Country scope

U.S.

Key companies profiled

Andersen Corporation; Jeld-Wen, Inc.; The Pella Corporation; Profine International Group; PGT Innovation, Inc.; Cornerstone Building Brands; Starline Windows; MI Windows and Doors; Marvin; VELUX Group; Harvey Building Products; Apogee Enterprises, Inc.; Associated Materials Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Windows & Patio Doors Market For Single Family Homes Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. windows & patio doors market for single family homes based on product and end use:

-

Windows Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sliding Windows

-

Double/Single Hung Windows

-

Casement Windows

-

Awning Windows

-

Tilt & Turn Windows

-

Other Windows

-

-

Windows End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

New Construction

-

Vinyl

-

Wood

-

Aluminum

-

Steel

-

Other Frame Materials

-

-

Refurbishment

-

Vinyl

-

Wood

-

Aluminum

-

Steel

-

Other Frame Materials

-

-

-

Patio Doors Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sliding

-

Bio-fold

-

French

-

-

Patio Doors End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

New Construction

-

Vinyl

-

Wood

-

Aluminum

-

Fiberglass

-

Steel

-

Other Frame Materials

-

-

Refurbishment

-

Vinyl

-

Wood

-

Aluminum

-

Fiberglass

-

Steel

-

Other Frame Materials

-

-

Frequently Asked Questions About This Report

b. The U.S. windows & patio doors market for single family homes market size was estimated at USD 8.29 billion in 2023 and is expected to reach USD 8.51 billion in 2024.

b. The U.S. windows & patio doors market for single family homes is expected to grow at a compound annual growth rate of 3.2% from 2024 to 2030 to reach USD 10.30 billion by 2030.

b. The double/single-hung windows segment of the market accounted for the largest revenue share of 52.8% in 2023 owing to the fact that these windows are the most preferred choice among all types of windows on account of their flexible designs.

b. Some of the key players operating in the U.S. windows & patio doors market for single family homes include Andersen Corporation, Jeld-Wen, Inc., The Pella Corporation, PGT Innovation, Inc., Cornerstone Building Brands, Starline Windows, MI Windows and Doors, VELUX Group, Harvey Building Products, and Apogee Enterprises, Inc.

b. The key factors that are driving the U.S. windows & patio doors market for single family homes includes increasing home renovation and remodeling activities coupled with rising consumer expenditure on home improvement.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."