U.S. Windows Market Size, Share & Trends Analysis Report By Frame Material (Vinyl, Wood, Aluminum), By Type (Sliding Windows, Double/Single-hung Windows), By End-use (New Construction, Refurbishment), By State, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-125-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Report Overview

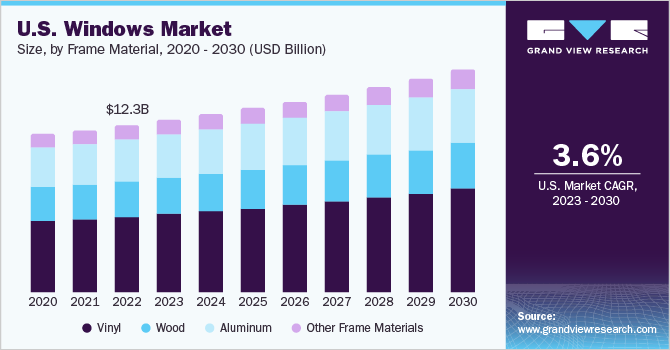

The U.S. windows market size was valued at USD 12.32 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.6% from 2023 to 2030. This growth can be attributed to rising product demand in the construction and refurbishment of buildings. Moreover, rapid urbanization and industrialization are expected to further lead to the growth of the U.S. windows industry. The significant growth of the fenestration industry can be attributed to the increased construction activities in the market. The growth of commercial spaces, including hospitals, restaurants, and others across the U.S., is projected to drive the construction industry, thereby propelling the demand for windows over the forecast period.

The U.S. is considered a mature market in windows. Strong market position, favorable business environment, and improving commodity prices are projected to fuel market growth in the U.S. The growth of the country’s tourism industry is driving increased investments toward establishing tourist infrastructure such as hotels, resorts, and restaurants. Moreover, factor such as the rising population is expected to further augment the need for residential spaces, thereby providing a significant boost to the construction industry and, consequently, increasing the demand for windows over the coming years.

The manufacturers distribute their products through independent dealers, wholesale distributors, retailers, individual customers, and contractors. For instance, PGT Innovations Inc. distributes its products through national building supply distributors, U.S. home building’s in-home sales/custom order division, improvement supply retailers, direct-consumer channels, and through independently owned dealers and distributors. This vast and robust distribution network is a prominent factor offering a competitive edge and boosting product sales of the company.

Frame Material Insights

The construction industry in the U.S. is growing at a higher pace owing to the increasing population and ongoing industrialization. This is driving the demand for different construction materials in the U.S. Vinyl is one such material used in the construction industry for developing window frames. This material is preferred owing to its higher durability and affordability than wood, metals, etc.

Wooden window frames accounted for a revenue share of 21.2% in 2022, and it is expected to grow at a significant rate over the coming years. This is because these frames can be sturdy and long-lasting with proper maintenance and upkeep. In areas with extreme temperatures, wooden window frames are a better choice than frames developed from other materials. Wooden window frames are free from warping or splitting unlike vinyl window frames if they are properly sealed. Moreover, their chances of expansion and contraction with temperature changes are less than metal window frames.

Aluminum is a lightweight and durable material that is used for developing window frames. In harsh weather, aluminum window frames are used as they are not distorted or fractured due to their weather-resistance quality. Aluminum is highly resistant to outdoor elements such as air and moisture. Hence these frames have a long service life. These factors are expected to increase the demand for aluminum windows in the coming years.

Type Insights

The double/single-hung windows segment was valued at USD 6.65 billion in 2022. The growth of this segment can be attributed to the fact that these windows are the most preferred choice among all types of windows. They are increasingly common in areas with a large population wherein apartments and houses are congested, as they are space-saving and are free from swinging like awning and casement windows. Double-hung windows are preferred in regions with cold climates, including the Northeast and Midwest of the U.S. as they allow versatile ventilation.

The casement windows segment of the market is projected to grow at the highest CAGR of 4.1% over the forecast period. They are gaining popularity in the U.S., especially in the Midwest owing to temperature fluctuations. These windows are highly resistant to windy weather as they are free from dividing sashes used in single/double-hung windows. Casement windows are completely sealed when they are fully closed. They insulate homes from extreme temperature changes. These factors make them more energy efficient than other types of windows.

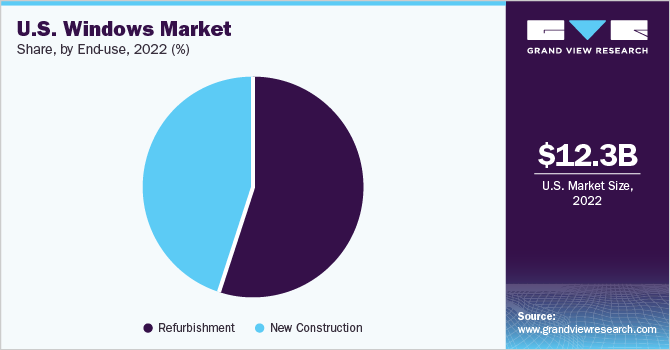

End-use Insights

The new construction end-use segment of the U.S. windows market is expected to expand at a CAGR of 3.2% over the forecast period. U.S. states such as Texas and Florida have established themselves as thriving and rapidly growing markets, making them highly desirable for businesses and commercial development. These states offer favorable business climate, low taxes, and ample job opportunities, which have attracted a significant influx of companies and raised the need for new commercial spaces. As commercial construction continues to surge, the demand for windows is expected to increase.

Refurbishments provide an opportunity to update and improve the performance and aesthetics of existing buildings, and windows play a crucial role in achieving these goals. Refurbishment projects often aim to increase the value and market appeal of buildings. Upgrading windows can significantly enhance the overall appearance and attractiveness of a property, improving its marketability and potentially commanding higher rental or sale prices. Potential tenants and buyers increasingly prioritize modern, well-maintained buildings with upgraded windows that offer improved aesthetics and functionality. These factors are driving refurbishment activities across the U.S., thereby fueling the market growth.

State Insights

New York is one of the significant contributors to the U.S. windows market. The state is growing at the fastest rate in commercial real estate. New York has one of the most saturated real estate markets with high population growth. This has resulted in a rising population and increased investments in the construction sector which has led to the adoption of windows in the state, thereby fueling market growth.

The windows market in Florida contributes significantly to the U.S. windows market owing to the higher population and growing real estate sector. Since the outbreak of COVID-19, the number of people migrating to Florida has increased drastically due to low taxes, better job opportunities, and business-friendly government. This has triggered the demand for rental condos and apartments. Additionally, the booming tourism industry in Miami has also increased investments in hospitality construction projects such as hotels, restaurants, and resorts. This has increased the demand for windows in the state.

The state of Ohio has growing job opportunities, attracting more and more people. This has led to an increase in building and construction activities in the region, which is propelling the demand for windows. Ohio is also known for its manufacturing industries as it is a base for about 18,000 industrial units, including Honda of America Manufacturing, Inc. and the P&G Group. Due to this, the region has a number of small commercial projects, such as retail outlets, restaurants, and entertainment centers, which is contributing to the growth of the windows market.

Tennessee is ranked as one of the most affordable states to live in the U.S. as it exerts no state income taxes and levies a reasonable property tax. The state has headquarters for several major players such as Nissan, Amazon, HCA, AllianceBernstein, Mitsubishi, Dollar General, and FedEx. The majority of these companies offer high-quality and high-paying jobs, which is why the migration of people is high. This has attracted many commercial projects, including residential apartments, shopping complexes, and schools. Tennessee's urban areas are growing and revitalizing, attracting new residents and fueling construction and renovation activity. The growth of residential properties in urban areas increases the demand for windows in both new construction and renovation projects in the state.

Key Companies & Market Share Insights

The market exhibits high competition owing to the presence of established players in this industry. Some competitors also focus on strategies such as new product development, expansion of production capacities and distribution networks, competitive pricing, and mergers and acquisitions to gain a competitive edge.

Key players also engage in research and development (R&D) to increase the usage of sustainable materials to manufacture windows technologies, thus, creating strong competition for new entrants. Moreover, the rapidly increasing construction activities for residential and commercial buildings have led to intense rivalry among manufacturers. Some prominent players in the U.S. windows market include:

-

Jeld-Wen Inc.

-

PGT Innovation, Inc.

-

Cornerstone Building Brands

-

Andersen Corporation

-

The Pella Corporation

-

Starline Windows

-

MI Windows and Doors

-

Marvin

-

VELUX Group

-

Harvey Building Products

-

Apogee Enterprises, Inc.

-

Associated Materials Incorporated

-

Profine International Group

U.S. Windows Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 12.72 billion |

|

Revenue forecast in 2030 |

USD 16.41 billion |

|

Growth rate |

CAGR of 3.6% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Frame material, type, end-use, state |

|

Country scope |

U.S. |

|

State scope |

Texas; New York; California; Florida; Pennsylvania; Ohio; Massachusetts; Georgia; Illinois; Arizona; Virginia; North Carolina; Michigan; Tennessee; Wisconsin; Washington; Colorado; Indiana; New Jersey; Louisiana |

|

Key companies profiled |

Jeld-Wen Inc.; PGT Innovation, Inc.; Cornerstone; Building Brands; Andersen Corporation; The Pella Corporation; Starline Windows; MI Windows and Doors; Marvin; VELUX Group; Harvey Building Products; Apogee Enterprises, Inc.; Associated Materials Incorporated; Profine International Group |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, state, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Windows Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. windows market report based on frame materials, type, end-use, and state:

-

Frame Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Vinyl

-

Wood

-

Aluminum

-

Other Frame Materials

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Sliding Windows

-

Double/Single-hung Windows

-

Casement Windows

-

Awning Windows

-

Tilt & Turn Windows

-

Other Windows

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

New Construction

-

Refurbishment

-

-

State Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Texas

-

New York

-

California

-

Florida

-

Pennsylvania

-

Ohio

-

Massachusetts

-

Georgia

-

Illinois

-

Arizona

-

Virginia

-

North Carolina

-

Michigan

-

Tennessee

-

Wisconsin

-

Washington

-

Colorado

-

Indiana

-

New Jersey

-

Louisiana

-

-

Frequently Asked Questions About This Report

b. The U.S. windows market size was estimated at USD 12.32 billion in 2022 and is expected to reach USD 12.72 billion in 2023.

b. The U.S. windows market is expected to grow at a compound annual growth rate, a CAGR of 3.6% from 2023 to 2030, to reach USD 16.41 billion by 2030.

b. The vinyl segment of U.S. windows market accounted for the largest revenue share of 45.12% in 2022. The market is driven by its characteristics, such as high energy efficiency and minimal maintenance.

b. Some key players operating in the U.S. windows market include Jeld-Wen Inc., PGT Innovation, Inc., Cornerstone, Building Brands, Andersen Corporation, The Pella Corporation, Starline Windows, MI Windows and Doors, and Marvin.

b. Key factors that are driving the market growth include the rising investments in residential and non-residential construction. Moreover, growing refurbishment activities across the country are further expected to fuel the market’s demand.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."