- Home

- »

- Advanced Interior Materials

- »

-

U.S. Windows And Doors Market Size, Industry Report, 2030GVR Report cover

![U.S. Windows And Doors Market Size, Share & Trends Report]()

U.S. Windows And Doors Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Windows, Doors), By Window Product Type (Sliding, Casement), By End-use, By Door Mechanism, By Window Material, By Door Material, By State, And Segment Forecasts

- Report ID: GVR-4-68040-442-7

- Number of Report Pages: 77

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Windows And Doors Market Trends

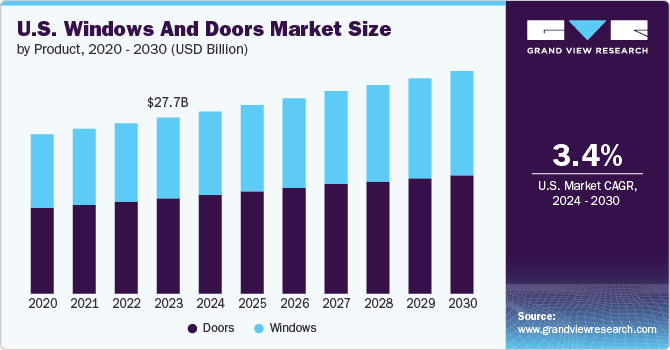

The U.S. windows and doors market size was estimated at USD 27.71 billion in 2023 and is expected to grow at a CAGR of 3.4% from 2024 to 2030. This growth can be attributed to rising product demand in the construction and refurbishment of buildings. Rapid urbanization and industrialization are expected to further drive the growth of the U.S. windows & doors market. As homeowners seek to enhance energy efficiency and aesthetics, there is a growing demand for advanced windows and doors that offer better insulation, soundproofing, and security features.

The shift towards smart homes and sustainable building practices has further fueled the adoption of energy-efficient products, including double-glazed and low-emissivity windows, which contribute to reduced energy consumption. In addition, government incentives and regulations promoting energy-efficient upgrades in buildings, such as the Energy Star program, have boosted the market for high-performance windows and doors.

One of the distinct growth factors in the U.S. windows & doors market is the rising focus on aesthetics and the increasing consumer preference for customization. Homeowners and architects are seeking products that not only provide functional benefits but also enhance the visual appeal of buildings. This trend is driving demand for a wider variety of design options, including custom shapes, sizes, and colors, as well as unique finishes and materials for modern architectural trends.

Moreover, the shift towards urbanization and the growth of multi-family housing units leads to a growing trend towards high-rise apartments and condos. This shift is boosting demand for windows and doors that meet specific needs such as soundproofing, safety, and compliance with stringent fire and building codes in densely populated areas. Products that cater to these requirements are in high demand, driving market growth as manufacturers develop specialized solutions for urban living spaces.

The fluctuating cost of raw materials such as aluminum, glass, and vinyl, which directly affects manufacturing costs and product pricing. These cost variations can lead to reduced profit margins for manufacturers and higher prices for consumers, potentially dampening demand. In addition, construction industry in the U.S. is susceptible to economic downturns, interest rate fluctuations, and changes in housing market dynamics. These economic uncertainties and rising interest rates could lead to reduced investment in new construction and renovations, thereby affecting market growth.

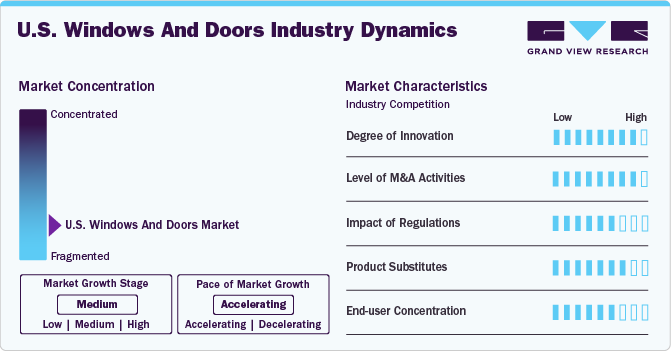

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The industry is characterized by a mix of large multinational corporations and smaller, regional players such as Andersen Corporation, JELD-WEN, Inc., Pella Corporation, and Marvin Windows and Doors These players account for the majority of market share with extensive distribution networks, strong brand recognition, and a broad portfolio of products.

The degree of innovation is moderate owing to the rise of smart home technologies which presents an untapped opportunity for the integration of smart windows and doors, equipped with sensors and automation capabilities. There is also a growing trend towards customization, where consumers are seeking custom designs that reflect their personal style and fit specific architectural needs. This trend opens opportunities for manufacturers to offer a wider range of styles, colors, and materials, appealing to a broader customer base.

The U.S. windows & doors market is significantly influenced by stringent energy efficiency regulations and building codes, such as those outlined by the International Energy Conservation Code (IECC) and ENERGY STAR standards. These regulations drive manufacturers to innovate and produce products that meet or exceed energy efficiency requirements, pushing the market towards high-performance windows and doors.

The market serves a diverse range of end-users, with significant concentration in the residential segment, including both new construction and renovation projects. Commercial applications, though smaller in comparison, are growing steadily, particularly in office buildings and hospitality sectors. Homeowners, builders, and remodelers are the primary consumers, with a high level of demand for energy-efficient and aesthetically appealing products that align with modern design trends.

Product Insights

Doors accounted for the largest market share of 54.1% in 2023 owing to its superior insulation, security features, and aesthetically pleasing properties. The doors segment encompasses both interior and exterior doors, including product types such as hinged, sliding, bi-fold, and French doors. Exterior doors, in particular, are crucial for security, weather resistance, and curb appeal.

Windows segmental revenue is anticipated to grow at the fastest CAGR of 3.8% over the forecast period. The windows segment includes a variety of product types such as double-hung, casement, sliding, fixed, and bay windows, among others. Windows are essential for allowing natural light, ventilation, and views, while also contributing to the energy efficiency and aesthetic appeal of a building. This segment is driven by increasing demand for energy-efficient solutions such as double-glazed, low-emissivity, and smart windows that help reduce energy costs and enhance indoor comfort.

Window Material Insights

Vinyl accounted for the fastest and largest market share of 41.5% in 2023 owing to their affordability, low maintenance, and excellent energy efficiency. Made from polyvinyl chloride (PVC), these windows provide good insulation, helping to reduce heating and cooling costs. They are resistant to moisture, which prevents warping, cracking, and peeling, making them ideal for various climates.

Metal windows are projected to reach USD 5.90 billion by 2030 due to their strength, durability, and sleek, modern appearance. Aluminum windows are lightweight, resistant to corrosion, and require minimal maintenance. Furthermore, they are often used in commercial buildings owing to their ability to support larger panes of glass. Steel windows are stronger than aluminum and are often used in industrial or high-end residential applications.

Door Material Insights

Wooden doors accounted for the largest market share of 31.9% in 2023 due to their natural beauty, warmth, and design flexibility. In addition, they can be easily customized with various finishes, paints, and stains, making them suitable for a wide range of architectural styles. Wood doors also offer good insulation but require regular maintenance to protect against weathering, rot, and insect damage.

Vinyl doors are expected to grow at the fastest CAGR of 3.4% in terms of revenue over the projected years. Vinyl doors, particularly in patio door applications, are favored for their low cost, ease of maintenance, and good insulating properties. They are generally available in standard sizes and styles, with fewer options for customization compared to wood or metal doors.

Window Product Type Insights

Single/double hung windows accounted for the largest market share of 49.0% in 2023. Single hung windows have a fixed upper sash and a movable lower sash whereas double hung feature two movable sashes, allowing for better ventilation and ease of cleaning. Their growth is driven by their affordability, ease of maintenance, and traditional aesthetic. They are often chosen for their balance between cost and functionality, especially in areas where budget constraints are significant.

Casement segment is projected to grow at the fastest CAGR of 4.4% over 2024 to 2030 due to their superior airtightness and energy efficiency, which meet the rising consumer demand for environmentally friendly and cost-effective solutions. The modern design of casement windows aligns with contemporary architectural trends, and improvements in hardware have enhanced their functionality and durability, leading to their growth.

Door Mechanism Insights

Swinging accounted for the largest market share of 33.8% in 2023 due to their wide usage in residential settings. These doors offer a sturdy, traditional aesthetic and are valued for their security and energy efficiency. Their growth is supported by increasing home improvement activities and new construction projects where durability and style are prioritized.

Sliding doors are expected to grow at the fastest CAGR of 3.5% in terms of revenue over the forecast period. The segment including patio and sliding glass doors, are gaining popularity for their space-saving design and ability to create a seamless transition between indoor and outdoor spaces. Advances in sliding door technology, such as improved insulation, better seals, and enhanced security features, have also contributed to their growth.

End-use Insights

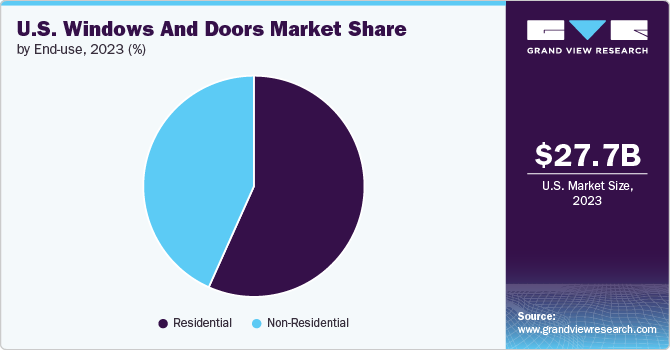

Residential accounted for the fastest and largest market share of 56.7% in 2023 owing to a strong housing market in the U.S. and increasing trends for home renovations. Moreover, the rising popularity of energy efficiency, smart home integration, and customization is further driving growth of residential windows and doors.

The non-residential segment includes commercial and institutional buildings. Growth in this sector is fueled by rising construction activity, stricter building codes, and a demand for energy-efficient products. Non-residential projects often require high-performance windows and doors that meet specific regulatory standards for energy efficiency, security, and durability, which drives innovation and market expansion in this segment.

State Insights

Texas windows and doors market led the market with 9.8% revenue share in 2023 due to the state’s rapid population growth, expanding housing market, and a booming construction sector. In addition, the diverse climate across Texas, from hot and humid to temperate, fuels the need for a wide range of window and door solutions tailored to different environmental conditions.

Arizona windows and doors market is expected to be the fastest growing segment with a CAGR of 3.9% in terms of revenue over the forecast period. The need for products suited to its extreme temperatures and dry climate leads to high demand for heat-resistant windows and doors. The expanding housing market, coupled with an increasing focus on modern designs and energy efficiency, supports market growth.

Florida windows and doors market accounted for USD 1.97 billion for 2023 owing to increasing demand for products that can withstand the state’s severe weather conditions, including hurricanes. As a result, there is a significant emphasis on impact-resistant windows and doors.

Utah’s windows and doors market is growing due to its strong residential construction sector, driven by a steady influx of new residents and a high rate of homebuilding. The demand for energy-efficient and high-performance windows and doors is increasing, reflecting both the state’s climate needs and consumer preferences for sustainable and cost-effective solutions. With a growing focus on modern home designs and energy conservation, the market is expected to expand as more homeowners and builders invest in advanced window and door systems.

Key Windows And Doors Company Insights

Some of the key players operating in the market JELD-WEN, Inc., ANDERSEN CORPORATION, Pella Corporation, and Cornerstone Building Brands, Inc.

-

JELD-WEN, Inc. produces different types of windows and doors from wood, vinyl, aluminum, and other related products for applications in construction, remodeling, and repair of residential & commercial buildings.

-

ANDERSEN CORPORATION is involved in the designing, manufacturing, and marketing of windows and doors. It offers awnings, bay and bow, casement, double- & single-hung, gliding, picture, specialty, and pass-through windows.

Kömmerling, Steves & Sons Inc., PGT INNOVATIONS, and Marvin are some of the emerging market participants:

-

Kömmerling is involved in the production of vinyl sheets and door & window systems. It operates in several countries, including Austria, Belarus, Belgium, Bulgaria, Croatia, Czech Republic, Estonia, France, Germany, the UK, Greece, Ireland, Italy, Latvia, Kosovo, Lithuania, Luxembourg, Macedonia, the Netherlands, Poland, Romania, Serbia, Slovakia, Slovenia, Spain, Switzerland, Ukraine, Bangladesh, Afghanistan, India, Indonesia, Costa Rica, Brazil, Chile, Peru, Australia, and New Zealand.

-

Marvin is a family-owned business operating in the production of windows, doors, and skylights. It caters to builders, architects, and homeowners. The company also manufactures impact-resistant windows and doors for residential and commercial construction.

Key U.S. Windows And Doors Companies:

- JELD-WEN, Inc.

- ANDERSEN CORPORATION

- Pella Corporation

- Cornerstone Building Brands, Inc.

- PGT INNOVATIONS

- Marvin

- Masonite

- SIERRA PACIFIC WINDOWS

- Kömmerling

- Steves & Sons Inc.

Recent Developments

-

In April 2024, Andersen Corporation announced the expansion of its retractable screen portfolio by launching a retractable screen for Andersen patio doors. This new product focuses on offering seamless access to fresh air and unobstructed views while keeping insects out by combining form with function for enhanced functionality and comfort.

-

In February 2024, Pella Corporation introduced the Steady Set Interior Installation System at the International Builders’ Show (IBS) in Las Vegas, Nevada in the U.S. The new system is already being recognized by builders and media as an industry-changing one. It was nominated as a finalist for the IBS Best of Show awards in the Window & Door Products and Most Innovative Construction Tool categories.

U.S. Windows And Doors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 28.67 billion

Revenue forecast in 2030

USD 35.03 billion

Growth rate

CAGR of 3.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, window material, door material, window product type, door mechanism, end-use, state

Country scope

U.S.

State scope

Arizona; California; Texas; Washington; Utah; Nevada; New Mexico; Oregon; Florida; Oklahoma; Louisiana

Key companies profiled

JELD-WEN, Inc.; ANDERSEN CORPORATION; Pella Corporation; Cornerstone Building Brands, Inc.; PGT INNOVATIONS; Marvin; Masonite; SIERRA PACIFIC WINDOWS; Kömmerling; Steves & Sons Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Windows And Doors Market Report Segmentation

This report forecasts revenue growth at country and state levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. windows and doors market report based on product, window material, door material, window product type, door mechanism, end use, and state:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Windows

-

Doors

-

-

Windows Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Vinyl

-

Wood

-

Metal

-

Other Materials

-

-

Doors Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Vinyl

-

Wood

-

Metal

-

Other Materials

-

-

Window Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sliding Windows

-

Casement Windows

-

Single/Double hung Windows

-

Awning Windows

-

Tilt & Turn Windows

-

Other Product Types

-

-

Door Mechanism Outlook (Revenue, USD Billion, 2018 - 2030)

-

Swinging

-

Sliding

-

Folding

-

Overhead

-

Other Mechanisms

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Non-residential

-

-

State Outlook (Revenue, USD Billion, 2018 - 2030)

-

Arizona

-

California

-

Texas

-

Washington

-

Utah

-

Nevada

-

New Mexico

-

Oregon

-

Florida

-

Oklahoma

-

Louisiana

-

Frequently Asked Questions About This Report

b. The U.S. windows and doors market size was estimated at USD 27.71 billion in 2023 and is expected to reach USD 28.67 billion in 2024.

b. The U.S. windows and doors market is expected to grow at a compound annual growth rate of 3.4% from 2024 to 2030, reaching USD 35.03 billion by 2030.

b. Residential dominated the U.S. windows and doors market with a share of 56.7% in 2023 owing to the strong housing market and increasing home renovations.

b. Some of the key players operating in the U.S. windows and doors market are JELD-WEN, Inc., ANDERSEN CORPORATION, Pella Corporation, Cornerstone Building Brands, Inc., PGT INNOVATIONS, Marvin, and Masonite.

b. The key factors that drive U.S. windows and doors include robust construction industry, particularly the surge in residential housing starts and remodeling activities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.