- Home

- »

- Clothing, Footwear & Accessories

- »

-

U.S. Wellness & Fitness Products Market Size, Report, 2030GVR Report cover

![U.S. Wellness & Fitness Products Market Size, Share & Trends Report]()

U.S. Wellness & Fitness Products Market Size, Share & Trends Analysis Report By Product (Apparel, Footwear), By Price Range (Mass, Premium), By Distribution Channel (Online, Sporting Goods Retailers), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-317-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

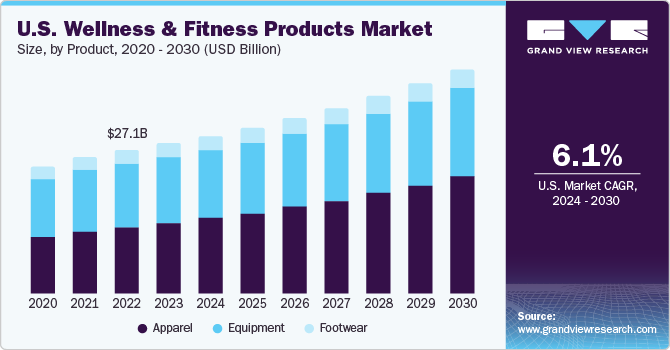

The U.S. wellness & fitness products market size was estimated at USD 28.46 billion in 2023 and is expected to grow at a CAGR of 6.1% from 2024 to 2030. The shift in consumer values toward a wellness-oriented lifestyle is significantly changing behaviors and consumption patterns. The COVID-19 pandemic further accelerated this change, driving the digital transformation of the wellness and fitness industry. As lockdowns and social distancing measures restricted traditional gym access, fitness enthusiasts turned to alternative methods to maintain their routines. This led to a surge in the popularity of at-home exercises, virtual fitness classes, live-streamed workouts, and on-demand fitness content. As a result adoption of health and wellness products including apparel, footwear, and accessories increased driving the industry growth.

The wellness & fitness industry is adopting specialized training approaches and diverse exercise modalities to cater to individual preferences, driving demand for wellness and fitness products such as apparel, footwear, and accessories. From traditional gym workouts and group fitness classes to yoga, consumers have a wide array of options to match their interests, fitness goals, and personal preferences. There is a growing emphasis on holistic well-being, increasingly focusing on mental health, mindfulness, and overall wellness. As a result, consumers are increasingly opting for yoga, weight training, cardio, and others resulting in increasing demand for various wellness & fitness products.

The fitness industry has witnessed a transformation in recent years, with a shift toward more diverse and personalized workout experiences. This shift has contributed to a heightened demand for home gym equipment, including weight training apparatus, as individuals seek convenient and flexible solutions to meet their fitness goals. Moreover, a growing awareness of the importance of cardiovascular health and an increasing focus on fitness and wellness primarily drive the market for cardio equipment in the U.S. As individuals become more health-conscious, there is a heightened demand for convenient and effective ways to incorporate exercise into daily routines, and cardio equipment offers a solution. The prevalence of sedentary lifestyles and the rising rates of obesity and related health issues further contribute to the urgency for accessible fitness options.

As individuals increasingly prioritize fitness and holistic well-being, these mind-body exercises have gained immense popularity. Yoga, with its focus on flexibility, strength, and mental balance, has become a mainstream activity appealing to people of all ages and fitness levels. Pilates, known for its core-strengthening benefits, has also found a dedicated following, especially among those seeking low-impact workouts that deliver results. Barre, a fusion of ballet, Pilates, and yoga elements, has gained traction for its ability to sculpt and tone muscles effectively.

Beyond physical fitness, yoga has various benefits such as improved flexibility, stress reduction, mental clarity, and emotional well-being. Due to these advantages, a wider range of people are now practicing yoga. As per a survey conducted by Yoga Alliance in 2022, approximately 38.4 million people in the U.S., which is around 10% of the total population, practice yoga regularly. Manufacturers are launching new products in the market owing to the increasing demand for these products. For instance, in January 2022, Reform RX introduced a digitally connected Pilates reformer, providing users with innovative fitness experiences at home guided by elite instructors.

Market Concentration & Characteristics

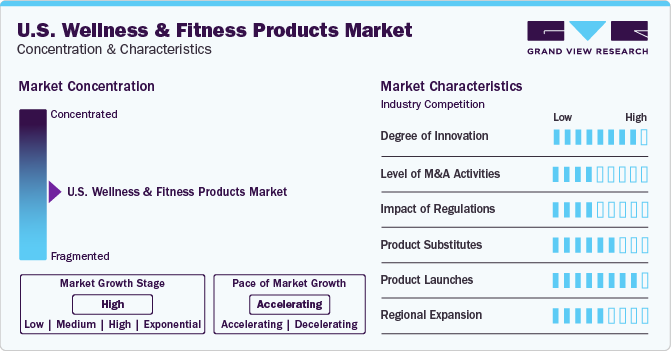

The industry is characterized by continuous innovation. Companies are constantly developing new technologies and products to enhance user experience, such as wearable fitness trackers, smart gym equipment, and advanced materials for apparel and footwear. The integration of AI and machine learning into fitness apps and equipment is also becoming more prevalent, offering personalized training and performance analytics.

The level of mergers & acquisitions is moderate in the industry. Companies are opting for mergers & acquisitions as a strategic initiative to expand their market share, diversify product offerings, and integrate new technologies.

The impact of regulations in the industry is also moderate. Regulations primarily impact the wellness and fitness industry through product safety standards, consumer protection laws, and environmental regulations. Compliance with these regulations is essential, especially for equipment and apparel manufacturers.

There are various substitutes for traditional gyms and yoga. Consumers can opt for various sports such as running, badminton, soccer, and others to stay fit. However, the social aspects of gyms and yoga studios remain irreplaceable for many enthusiasts.

The market also sees regular product launches, driven by innovation and consumer demand. Fitness brands frequently introduce new lines of apparel and footwear, leveraging the latest materials and designs for improved performance and comfort. Similarly, new fitness equipment and accessories are launched to meet evolving fitness trends and technological advancements.

Companies in the wellness and fitness industry are increasingly expanding their presence across different regions in the U.S. This expansion is driven by growing consumer interest in health and wellness

Product Insights

The apparel segment is expected to grow at the fastest CAGR of 7.8% from 2024 to 2030. Gym and yoga apparel are designed to improve comfort and performance during exercise. Technological developments in fabric, its ability to wick away moisture, and its ergonomic design are the main forces behind market innovation. Additionally, environmental awareness is becoming more and more popular in the sportswear industry. To appeal to environmentally conscious consumers, many brands are implementing eco-friendly materials, sustainable practices, and ethical manufacturing methods. Various companies have been concentrating on using recycled plastic in the manufacturing of yoga and fitness wear.

The equipment segment accounted for a revenue share of 44.03% in 2023. Advancements in technology have played a significant role in shaping the equipment market. The integration of smart features, interactive interfaces, and connectivity options in treadmills, elliptical trainers, stationary bikes, and other cardio machines enhances the overall user experience, making workouts more engaging and motivating. Fitness enthusiasts are drawn to these innovations, which allow them to track their progress, set goals, and participate in virtual workouts, creating a more personalized and dynamic exercise environment. In November 2023, Life Fitness introduced a new cardio line called Symbio, consisting of four machines designed to blur the lines between exercisers and equipment. The collection features advanced biomechanics, luxurious design, and personalized experiences to enhance workout performance and comfort.

Price Range Insights

Based on price range, the mass segment dominated the market with the largest revenue share in 2023. Mass products are often more affordable and cater to a broader consumer base, including home users and budget-conscious fitness enthusiasts. They are typically available through various retail outlets, both in-store and online. Mass products including equipment are often aimed at home users, beginners, or those on a budget. Mass-market equipment might include basic dumbbells, barbells, weight plates, and simple home gym systems. Prices for these items can vary, but they generally tend to be more budget-friendly compared to premium alternatives.

Premium products are expected to grow at the highest CAGR from 2024 to 2030. Premium products are designed for enthusiasts, professional athletes, or those seeking higher-end features, durability, and precision in their workout apparel, footwear, and equipment. Premium options may include advanced technology, innovative designs, and materials that contribute to a higher price point. These products are often found in specialty fitness stores, and the cost can be significantly higher compared to mass-market alternatives. Moreover, premium pricing is associated with products that offer superior quality, advanced technology, or exclusive branding. Premium products often target a niche market segment that values top-notch materials, durability, and advanced design, attracting fitness enthusiasts willing to invest in a more exclusive and high-performance experience.

Distribution Channel Insights

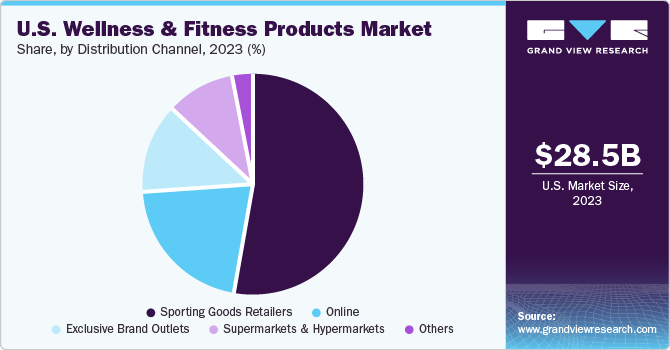

The sporting goods stores dominated the market with the largest revenue share in 2023. Sporting goods stores offer a wide range of specialized fitness products, including apparel, footwear, equipment, and accessories, which cater specifically to fitness enthusiasts and athletes. Staff at these stores are often knowledgeable about the products they sell and can provide valuable advice and recommendations to customers, enhancing the shopping experience and ensuring that customers find the right products for their needs. Moreover, these stores typically carry high-quality, reputable brands, giving customers confidence in the durability and performance of the products they purchase.

The online segment is expected to grow at the highest CAGR from 2024 to 2030. Online shopping allows consumers to purchase products from the comfort of their homes at any time, offering convenience compared to physical stores. Online channels offer a broader range of products, including niche and specialty items that may not be available in local stores. Competitive pricing, with frequent discounts, deals, and promotional offers are other factors that attract price-sensitive customers. Additionally, consumers can easily compare prices, features, and reviews of different products across multiple online retailers, ensuring they get the best value.

Key U.S. Wellness & Fitness Products Company Insights

Peloton Interactive, Inc., iFIT Health & Fitness Inc., Life Fitness, Nike, Inc., and Lululemon Athletica are the dominant players operating in the U.S. wellness & fitness products market.

-

With around 5.9 million community members, Peloton Interactive, Inc. offers technology-enabled fitness and instructor-led boutique classes to its members. Moreover, members of the community can also use the Peloton Bike, Peloton Tread, Peloton Bike+, Peloton Guide, and Peloton App on any iOS or Android device, as well as select smart TVs, to access the Peloton library, which contains thousands of live and on-demand classes at the gym, at home, on the road, or wherever they choose to move.

-

The hardware designed for fitness equipment by iFIT Health & Fitness Inc. is intelligent as it allows interaction with software and experiential content, ensuring an immersive experience for consumers. iFIT hardware and technology are protected by over 400 active and pending patents.

Key U.S. Wellness & Fitness Products Companies:

- Peloton Interactive, Inc.

- Performance Health

- Black Mountain Products, Inc.

- Life Fitness

- iFIT Health & Fitness Inc.

- Adidas

- Nike, Inc.

- lululemon athletica

- Sunny Health and Fitness

- Johnson Health Tech (Matrix)

Recent Developments

-

In March 2024, at the 2024 IHRSA Convention & Trade Show, Life Fitness unveiled its premium cardio line known as the Symbio product series. Concurrently, the company is introducing Life Fitness Digital Solutions, a platform dedicated to delivering personalized workout experiences for both trainers and exercisers. Centered around advanced biomechanics and tailored fitness encounters, the Symbio product series comprises the Symbio Runner, Symbio Incline Elliptical, Symbio SwitchCycle, and Symbio Recumbent Cycle. Life Fitness strives to inject fresh vitality into the cardio space with these groundbreaking products, aiming to redefine and enhance the fitness experience.

-

In February 2024, Herbalife launched the Herbalife GLP-1 Nutrition Companion, a new range of food and supplement products to support individuals on GLP-1 and other weight-loss medications. These product combos aim to address nutritional deficiencies by providing protein, fiber, and essential vitamins. The company's independent distributors offer support to help consumers develop healthy nutrition habits. Herbalife emphasizes the importance of proper nutrition and lifestyle changes for sustainable weight loss. The products are available in the U.S. and Puerto Rico through Herbalife Independent Distributors.

-

In October 2023Nike launched its line of strength equipment, including dumbbells, bumper plates, barbells, kettlebells, benches, and a squat rack. Nike has entered the strength equipment market for the first time. The products are endorsed by various Nike-sponsored athletes and are available online and at select retailers. The equipment comes in a variety of weight options and colors, with prices starting at USD 35 for bumper plates and USD 250 for barbells. Nike's entry into the strength equipment market is seen as an attempt to break into the CrossFit scene following the success of its Metcon training shoes.

U.S. Wellness & Fitness Products Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 28.46 billion

Revenue forecast in 2030

USD 42.68 billion

Growth Rate (Revenue)

CAGR of 6.1% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, price range, distribution channel

Key companies profiled

Peloton Interactive, Inc.;Performance Health;Black Mountain Products, Inc.;Sunny Health and Fitness;Life Fitness;iFIT Health & Fitness Inc.;Johnson Health Tech (Matrix);Adidas ;Nike, Inc.; and lululemon athletica

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Wellness & Fitness Products Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. wellness & fitness products market report based on product, price range, and distribution channel.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Apparel

-

Footwear

-

Equipment

-

Cardio Equipment

-

Stationary Bikes

-

Treadmills

-

Exercise Cycles/ Bikes

-

Elliptical Machines

-

Others

-

-

Strength Training Equipment

-

Free Weights

-

Exercise Benches

-

Single/ Multi Station Selectorized Machines

-

AB Machines

-

Others

-

-

Fitness Accessories

-

-

-

Price Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass

-

Premium

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Sporting Goods Retailers

-

Supermarkets & Hypermarkets

-

Exclusive Brand Outlets

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. wellness & fitness products market size was estimated at USD 28.46 billion in 2023 and is expected to reach USD 29.91 billion in 2024.

b. The U.S. wellness & fitness products market is expected to grow at a compounded growth rate of 6.1% from 2024 to 2030 to reach USD 42.68 billion by 2030.

b. Wellness & fitness apparel dominated the U.S. wellness & fitness products market with a share of 44.03% in 2023. Technological developments in fabric, its ability to wick away moisture, and its ergonomic design are the main forces behind market innovation.

b. Some key players operating in the U.S. wellness & fitness products market include Peloton Interactive, Inc.; Performance Health; Black Mountain Products, Inc.; Life Fitness; iFIT Health & Fitness Inc.; Adidas; Nike, Inc.; lululemon athletica; Sunny Health and Fitness; and Johnson Health Tech (Matrix)

b. As individuals become more health-conscious, there is a heightened demand for convenient and effective ways to incorporate exercise into daily routines resulting in increased demand for wellness & fitness products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."