- Home

- »

- Medical Devices

- »

-

U.S. Wearable Medical Devices Market Size Report, 2030GVR Report cover

![U.S. Wearable Medical Devices Market Size, Share & Trends Report]()

U.S. Wearable Medical Devices Market Size, Share & Trends Analysis Report By Product (Diagnostic Devices), By Site (Handheld), By Grade Type, By Distribution Channel, By Application, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-198-6

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

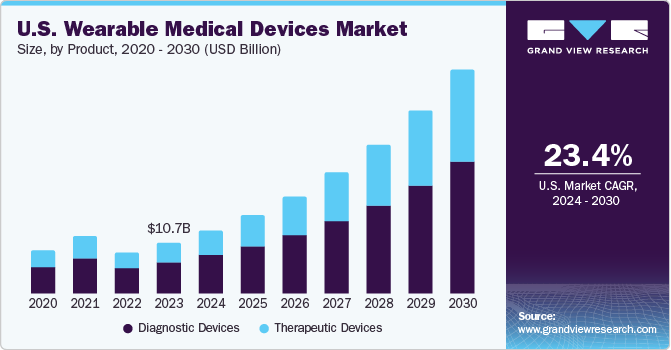

The U.S. wearable medical devices market size was valued at USD 10.73 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 23.4% from 2024 to 2030. Technological advancements, growing adoption of wearable technology, increasing prevalence of chronic diseases, and rising consumer awareness are some of the key factors driving the growth of the U.S. wearable medical devices market. The wearable medical devices market in the U.S. is expected to experience rapid growth in forthcoming years, driven by multiple factors involving increasing adoption of digital health technologies and a growing emphasis on preventive healthcare.

Wearable medical devices are designed to monitor, track, and manage various health conditions, providing real-time data to patients and healthcare providers. These devices offer convenience, mobility, and continuous monitoring, enabling early detection of health issues and facilitating personalized healthcare interventions. This exchange of real-time health data is expected to deliver more accurate outcomes in treating any chronic condition in a highly personalized way.

Market players invest significantly in research and development and increase their production capacity. These companies are working to avail the wearable devices to the population with competitive pricing and advanced health features attracting the customers. The adoption of wearable medical devices in the U.S. has been steadily increasing in recent years, driven by a combination of factors such as advancements in technology, changing healthcare delivery models, growing consumer interest in health and wellness, and a greater emphasis on preventive care. Wearable medical devices are revolutionizing how healthcare is delivered and managed, allowing patients to monitor their health in real-time and empowering healthcare providers with valuable data for more personalized and proactive care. Furthermore, high-end data privacy is maintained, ensuring the cyber security of the real-time and past health data generated by wearable medical devices.

Some of the key players operating in the U.S. wearable medical devices market include Apple Inc., Fitbit Inc., Garmin Ltd., Koninklijke Philips N.V., Omron Corp., and Medtronic, among others. These companies offer wearable devices, including smartwatches, fitness trackers, continuous glucose monitors, and remote patient monitoring systems. For instance, in June 2023, Apple, Inc. announced mental health and vision health features for the Apple watch. These features are beneficial in tracing anxiety and depression or any mood an individual is experiencing with an accurate assessment and determining the risk level. Apple, Inc. also introduced the ability to measure time spent in the daylight for better vision health. This move is expected to create strong competition with technological advancement in the wearable medical devices market.

Market Concentration & Characteristics

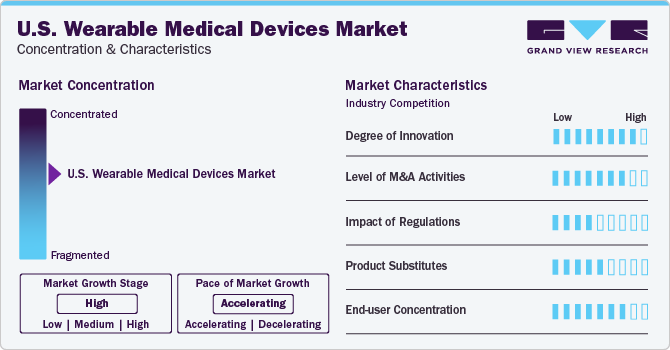

The U.S. wearable medical devicesmarket growth stage is high, and the market growth is accelerating. The U.S. wearable medical devices market is characterized by a high degree of innovation due to research and development driven by factors involving health applications and technologically advanced hardware systems. Subsequently, increasing innovation in wearable devices is expected to contribute to the constant growth of the U.S. wearable medical devices market.

The U.S. wearable medical devices market players are involved in merger and acquisition (M&A) activities. This is due to several factors, including the desire to gain a new customer base, the need to consolidate in a rapidly growing market, and strengthening the wearable medical device portfolio and increasing market presence, eventually contributing to the U.S. wearable medical devices market value. For instance, in 2020, Boston Scientific Corporation announced its acquisition of Preventice Solutions, a developer of wearable cardiac monitoring devices, for USD 375 million. The acquisition expanded Boston Scientific's portfolio of cardiac monitoring technologies and strengthened its position in the growing market for remote patient monitoring and digital health solutions.

The wearable medical device industry in the U.S. has experienced significant growth in recent years due to the increasing demand for personalized healthcare and the proliferation of smartphones and other connected devices. However, the industry is subject to a complex regulatory environment expected to impact its development and commercialization. The U.S. Food and Drug Administration (FDA) is crucial in regulating wearable medical devices. The FDA classifies these devices based on their intended use and level of risk. Low-risk devices, such as fitness trackers, are classified as Class I medical devices and do not require pre-market approval (PMA). However, high-risk devices, such as continuous glucose monitors, are classified as Class II or Class III medical devices and require PMA or pre-market notification (PMN) before they are marketed.

Moreover, the regulatory process for wearable medical devices is expected to be lengthy and costly, that is expected to deter some companies from entering the market. The FDA's guidance on wearable medical devices is evolving, that is expected to create uncertainty and indecisiveness for manufacturers. For instance, in 2018, the FDA issued a draft guidance on the classification of software as a medical device, that is expected to impact the classification and regulation of many wearable medical devices.

Product Insights

The diagnostic devices segment dominated the market and accounted for a share of 61.3% in 2023 due to growing demand for personalized medicine, remote patient monitoring, and Cost-effectiveness. As the technology continues to advance, it is expected to witness an increase in the number of wearable devices developed and further integrated into healthcare systems worldwide. Wearable medical devices are becoming increasingly popular as they offer convenience, ease of use, and real-time data collection that helps in early disease detection and management.

The glucose monitors in the therapeutic devices segment are expected to show the highest growth rate in the forecast period due to the increasing prevalence of diabetes. These devices monitor blood sugar levels and provide real-time feedback to users on their dietary and lifestyle habits. ECG monitors are gaining popularity due to their ability to detect heart conditions such as arrhythmias early through continuous monitoring of heart activity over time. Respiratory monitors are also gaining traction due to their potential use in managing respiratory diseases such as asthma and chronic obstructive pulmonary disease (COPD). These devices monitor respiratory rate, airflow volume (FEV1), and other respiratory parameters to help users manage their conditions more effectively.

Integrating electronic health records (EHR) and technological advancements provides access to valuable data to more informed patient care decisions leading to better outcomes and increased demand for these devices. The continuous improvement in technology is expected to lead to the development of more accurate, user-friendly, and affordable wearable devices. These advancements are expected to increase the possibilities for individuals to monitor their health status and track their progress in real-time, empowering them to take a more proactive role in managing their health goals.

Some popular wearable medical devices in the product segment include smartwatches, fitness trackers, glucose monitors, electrocardiogram (ECG) monitors, and respiratory monitors. These devices are widely used for monitoring physical activity levels, sleep patterns, heart rate, blood oxygen levels (SpO2), and other vital signs to help users maintain a healthy lifestyle.

The wearable medical devices are emerging as a promising tool in diagnostics, offering numerous benefits involving early detection of health issues, personalized healthcare, and continuous monitoring. For instance, according to Apple Inc., the Health app available on Apple devices allows users to store and view over 150 different types of health data from various sources, including Apple Watch, iPhone, and connected third-party applications. Additionally, it supports health records data from institutions in the U.S., UK, and Canada. This centralized view of health information is expected to empower users to monitor their well-being comprehensively and make informed decisions about health and fitness.

Site Insights

The strap, clip, and bracelet segment accounted for the largest market revenue share of 51.4% in 2023, contributing to the U.S. wearable medical devices market share. This is attributable to the rising consumer awareness and adoption and regulatory support and approval processes. The class I wearable medical devices, according to the FDA, pose the lowest risk to patients and are generally exempt from the stringent PMA process. The class I devices typically require a 510(k) submission, demonstrating that the device is substantially equivalent to a legally marketed device or the predicate device not subject to PMA. The manufacturers of class I wearable medical devices are expected to adhere to the Quality System Regulation (QSR), which outlines requirements for design control, documentation, and manufacturing processes.

In addition, they must ensure compliance with other relevant regulatory requirements, such as labeling, advertising, and post-market surveillance. The strap, clip, and bracelet fall under the class I wearable medical devices and are low risk compared to other class II and class III medical devices involving continuous glucose monitors. The ease of availability of these devices and technological advancements are expected to boost the segment in the forecast period.

The shoe sensors segment is expected to show the highest growth rate in the forecast period owing to the growth opportunities due to their multiple-purpose applications. The shoe sensors are used for various purposes involving distance measurement for blind people, water level estimation for fire-fighters, temperature measurement for the inhabitants living in cold regions, altitude sensors for climbers and trekkers, magnetic flux detection, gyroscopic sensors for tracking angular movement, walking patterns and sever twist measurements in feet.

Application Insights

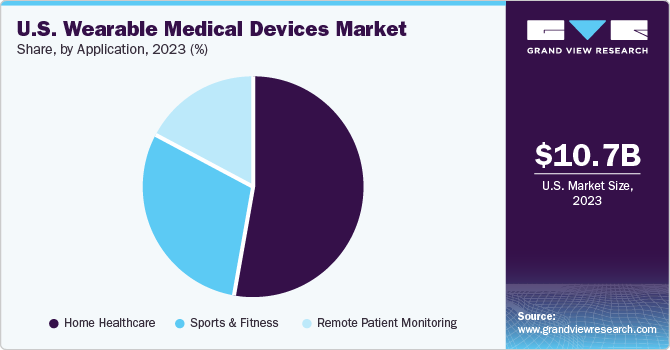

The home healthcare segment dominated with the largest market revenue share of 53.2% in 2023. This is attributable to the rising prevalence of chronic diseases involving diabetes, asthma, and cardiac diseases and the rising geriatric population in the U.S. For instance, according to Centers for Disease Control and Prevention, 6 in 10 inhabitants in the U.S. are living with chronic diseases, and about 4 in 10 adults have two or more chronic diseases. This prevalence rate of chronic diseases is expected to positively impact the U.S. wearable medical devices market, increasing the market value.

The U.S. is experiencing a rapid increase in its geriatric population. This demographic shift has significant implications for healthcare systems, as the geriatric population is more susceptible to chronic diseases, disabilities, and cognitive decline. This growing population of older adults is expected to demand increased access to healthcare services, including home healthcare, to manage their health needs and maintain their quality of life. The home healthcare services, including wearable medical devices, are expected to support the geriatric population. For instance, according to America's Health Rankings, the top states of the U.S. with the percentage of population aging 65 and older reported included Maine, Florida, Vermont, West Virginia, and Delaware.

The sports and fitness segment is expected to grow with the fastest rate. The growth is attributed to rising sports injuries and the promotion of sports activities. The wearable devices offer a wide range of features, from tracking daily activity and workout progress to monitoring biometric data and providing personalized insights to improve overall health and well-being. These devices offer a wide range of features, from tracking daily activity and workout progress to monitoring biometric data and providing personalized insights to improve overall health and well-being.

Furthermore, wearable devices in sports and fitness are designed to track and analyze physical activity, performance metrics, and biometric data. These devices provide athletes and fitness enthusiasts with valuable insights into their training, helping them optimize their workouts, prevent injuries, and enhance overall performance, increasing the demand for wearable medical devices. The devices include fitness trackers, smartwatches, heart rate monitors, and GPS-enabled sports watches. The wearable medical devices allow healthcare professionals to monitor patients' health status remotely, often in real-time. This is beneficial for individuals with chronic conditions, post-operative patients, or those living in remote areas with limited access to healthcare facilities. Remote patient monitoring helps detect potential health issues early, prevent hospitalizations, and improve overall patient outcomes.

Grade Type Insights

The consumer-grade wearable medical devices segment in the grade type segment dominated with the largest market revenue share of 77.5% in 2023. The consumer-grade wearable medical devices are expected to experience a significant increase in demand in the forecast period. This growth is attributed to various factors, including technological advancements, changing consumer preferences, and the need for remote health monitoring, rising awareness and adoption, and reasonable use of wearable medical devices.

There has been a shift in consumer attitudes towards healthcare, with people becoming more proactive about their health and well-being. This has led to an increased interest in personal health monitoring and fitness tracking, that has driven the demand for consumer-grade wearable medical devices. Consumer-grade wearable medical devices are widely available and generally more affordable than professional-grade medical equipment. This accessibility has made it easier for people to invest in their health and well-being. For instance, according to CNBC, in December 2023, Apple, Inc.'s wearables business achieved a remarkable revenue of USD 39.8 billion by the end of September 2023. This signifies the rising demand for wearable medical devices.

The clinical wearable medical devices segment is expected to show the fastest growth rate in the forecast period owing to rising clinical applications of medical devices for their ability to generate high-accuracy real-time health data and reduce the time required to manage the disease.

Distribution Channel Insights

The pharmacies segment dominated the market with a revenue share of 39.6% in 2023. This is attributable to the rising prevalence of chronic diseases in the U.S. For instance, according to the Centers for Disease Control and Prevention, approximately 38.4 million people are living with diabetes, that is 11.6% of the U.S. population, and about 97.6 million people aged 18 years and above are prediabetic, that is 38.0% of the adult U.S. population. The prevalence rate of diabetes in the U.S. is expected to positively impact the U.S. wearable medical devices market, specifically on continuous glucose monitor demand, further increasing the market value.

The hypermarkets segment is expected to have lucrative growth in the forecast period. The demand for wearable medical devices in U.S. hypermarkets has been steadily increasing. The hypermarkets, with their vast product offerings and wide customer base, play a crucial role in making these devices accessible to a broad range of consumers. To cater to this growing demand, hypermarkets in the U.S. are expanding their offerings of wearable medical devices.

The hypermarkets are partnering with leading manufacturers and retailers to provide a diverse range of products, including fitness trackers, smartwatches, heart rate monitors, blood pressure monitors, and other health-focused devices. Additionally, hypermarkets are investing in in-store displays, educational materials, and knowledgeable staff to help customers make informed decisions about the devices that best suit customer needs. The demand for wearable medical devices in U.S. hypermarkets is rising due to aging population, growing health consciousness, technological advancements, affordability, and insurance coverage.

Key U.S. Wearable Medical Devices Market Company Insights

Some of the key players operating in the market include Apple Inc. and Koninklijke Philips N.V.

-

Apple Inc. is an American multinational technology company that designs, develops, and sells consumer electronics, computer software, and online services. It is best known for its innovative products such as the iPhone, iPad, Mac, and Apple Watch

-

Koninklijke Philips N.V. operates in various sectors, including healthcare, lighting, and consumer lifestyle, and is known for its innovations in medical technology, such as magnetic resonance imaging systems, ultrasound equipment, and patient monitoring devices

Fitbit, Garmin, Medtronic, Omron Corp.,Basis Science are some of the other market participants in the U.S. wearable medical devices market.

-

Fitbit is known for its line of activity trackers and smartwatches that help users monitor and track their daily physical activity, exercise, sleep patterns, and overall health

-

Medtronic is a healthcare technology company that offers medical devices, pharmaceuticals, and other healthcare-related products operating in various segments

Key U.S. Wearable Medical Devices Companies:

The following are the leading companies in the U.S. wearable medical devices market . These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these U.S. wearable medical devices companies are analyzed to map the supply network

- Koninklijke Philips N.V.

- Apple Inc.

- Fitbit

- Basis Science

- Garmin

- Medtronic

- Omron Corp.

- Withings

- Vital Connect

- Polar Electro

- Everist Genomics

- Intelesens Ltd.

- Sotera Wireless

- AbbVie Inc.

Recent Developments

-

In 2024, Apple Inc. launched a vision health tracker in the health app for iWatch and iPhone. This is expected to increase the adoption and application of the feature to improve eye health from myopia conditions and increase the customer base

-

In January 2024, Garmin unveiled the Lily 2 series smartwatches, introducing enhanced health, wellness, and connectivity features. This announcement is expected to impact the wearable medical devices market by introducing refined and fashionable smartwatches with advanced health and wellness features

-

In January 2024, Sennheiser collaborated with Polar Electro to launch the Momentum Sport earbuds, marking the first time Polar's bio-sensing capabilities extend beyond its products. This collaboration is poised to impact the wearable medical devices market by expanding bio-sensing capabilities into audio devices for enhanced fitness monitoring and guidance

U.S. Wearable Medical Devices Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 46.89 billion

Growth Rate

CAGR of 23.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, site, application, grade type, distribution channel

Country scope

U.S.

Key companies profiled

Koninklijke Philips N.V.; Apple Inc.; Fitbit; Basis Science; Garmin; Medtronic; Omron Corp.; Withings; Vital Connect; Polar Electro; Everist Genomics; Intelesens Ltd.; Sotera Wireless; AbbVie Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Wearable Medical Devices Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. wearable medical devices market report based on product, site, application, grade type, and distribution channel.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Devices

-

Vital Sign Monitor

-

Heart Rate Monitors

-

Activity Monitors

-

Electrocardiographs

-

Pulse Oximeters

-

Spirometers

-

Blood Pressure Monitors

-

Others

-

-

Sleep Monitoring Device

-

Sleep Trackers

-

Wrist Actigraphs

-

Polysomnographs

-

Others

-

-

Electrocardiographs Fetal & Obstetric Devices

-

Neuromonitoring Devices

-

EEG

-

EMG

-

Others

-

-

-

Therapeutic Devices

-

Pain Management Devices

-

Neurostimulation Devices

-

Others

-

-

Insulin Monitoring Devices

-

Insulin Pumps

-

Others

-

Autoinjectors

-

Other Insulin Devices

-

-

-

Rehabiliation Devices

-

Accelerometers

-

Sensing Devices

-

Ultrasound Platform

-

Others

-

-

Respiratory Therapy Devices

-

Ventilators

-

CPAP

-

Portable Oxygen Concentrators

-

Others

-

-

-

Site Outlook (Revenue, USD Million, 2018 - 2030)

-

Handheld

-

Headband

-

Strap, Clip, Bracelet

-

Shoe Sensors

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports & Fitness

-

Remote Patient Monitoring

-

Home Healthcare

-

Grade Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer-grade Wearable Medical Devices

-

Clinical Wearable Medical Devices

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmacies

-

Online Channels

-

Hypermarkets

-

Frequently Asked Questions About This Report

b. The U.S. wearable medical devices market size was estimated at USD 10.73 billion in 2023 and is expected to reach USD 13.3 billion in 2024.

b. The U.S. wearable medical devices market is expected to grow at a compound annual growth rate (CAGR) of 23.4% from 2024 to 2030 to reach USD 46.89 billion by 2030.

b. The consumer-grade wearable medical devices segment dominated the market, with the largest market share of 77.5% in 2023. This high share is attributable to technological advancements, changing consumer preferences, the need for remote health monitoring, rising awareness and adoption, and the adoption of wearable medical devices.

b. Some of the key players operating in the U.S. wearable medical devices market include Koninklijke Philips N.V., Apple Inc., Fitbit, Basis Science, Garmin, Covidien (Medtronic), Omron Corp., Withings, Vital Connect, Polar Electro, Everist Genomics, Intelesens Ltd., Sotera Wireless, AbbVie Inc, among others.

b. Key factors driving the market growth include increasing technological advancements, increasing prevalence of chronic diseases, rising consumer awareness, and regulatory support and approval processes.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."