- Home

- »

- Medical Devices

- »

-

U.S. Wearable Breast Pump Market, Industry Report, 2030GVR Report cover

![U.S. Wearable Breast Pumps Market Size, Share & Trends Report]()

U.S. Wearable Breast Pumps Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Wearable Pumps, Accessories), By Technology (Battery Powered Pumps, Smart Pumps, Manual Pumps), And Segment Forecasts

- Report ID: GVR-4-68040-293-8

- Number of Report Pages: 78

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Wearable Breast Pumps Market Trends

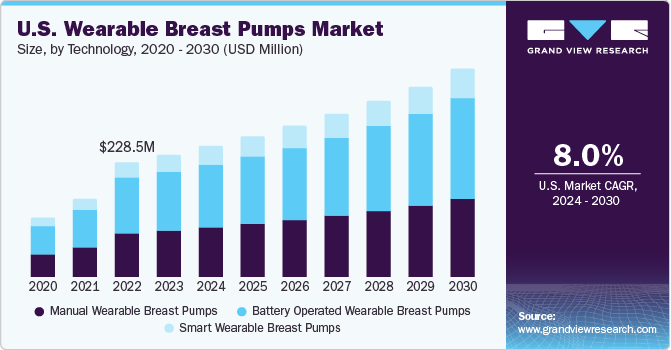

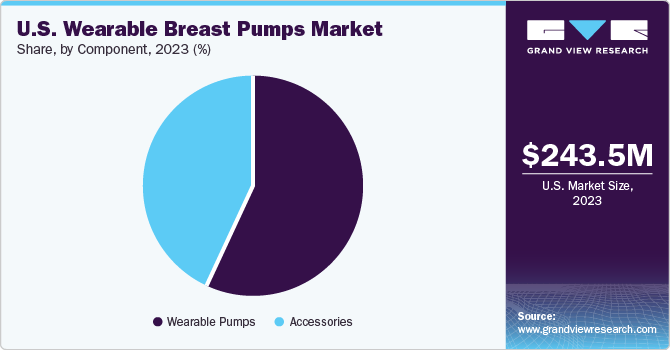

The U.S. wearable breast pumps market size was estimated at USD 243.5 million in 2023 and is estimated to grow at a CAGR of 8.02% from 2024 to 2030. Major factors contributing to this growth include the increasing women’s employment rates, increased healthcare expenditure, and well-established healthcare infrastructure.

The U.S. wearable breast pumps market accounted for a 44% share of the global wearable breast pumps market. The high demand for wearable breast pumps is driven by modernization and rising rates of women in workforce. According to the U.S. Bureau of Labor Statistics, in 2019, 57.4% of all women participated in the labor force, which was up from 57.1% in 2018. Thus, working mothers generally prefer using wearable pumps, as they can easily extract more milk in less time. This can positively impact market growth.

Similarly, according to the Center for American Progress, in December 2022, more than 993,000 mothers were working in America and labor force participation rate for women reached 77.0%. In addition, working women have a relatively high disposable income and less time to breastfeed their babies and thus, are ideal customers for wearable breast pumps.

Various public and private companies offer insurance coverage for breast pumps. For example, Medela provides insurance coverage for breast pump products. Under Medicaid insurance plans governed by the Affordable Care Act, personal-use standard electric and manual breast pumps are covered. However, North Carolina Medicaid does not offer insurance coverage for breast pumps; nevertheless, a 15% discount is available on all breast pumps. The increasing number of milk banks in U.S. is expected to drive up the demand for breast pumps.

The U.S. has various non-profit organizations, such as the United States Breastfeeding Committee (USBC) and Massachusetts Breastfeeding Coalition (MBC) that work towards creating awareness about the benefits of breastfeeding for mothers and newborns. Additionally, the Association of State and Territorial Health Officials collaborates with public health agencies to improve breastfeeding in workplaces, hospitals, and communities. Such factors are anticipated to drive growth of the wearable breast pumps market.

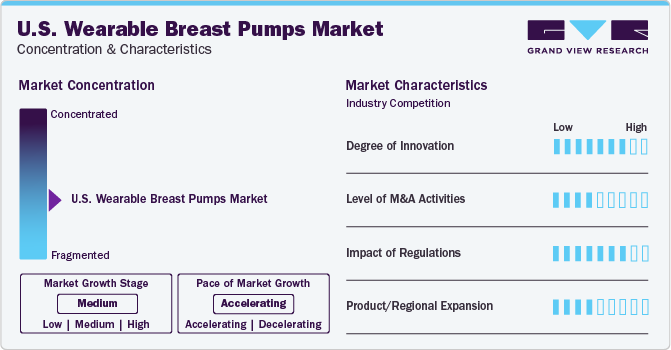

Market Concentration & Characteristics

The wearable medical devices industry exhibits high fragmentation, with numerous players contributing to a diverse landscape. The market is highly competitive, with established companies and emerging startups focusing on product design, enhancing user experience, andincorporating advanced technologies to meet the evolving needs of lactating mothers.

The wearable breast pump industry is experiencing significant innovation due to the technological advancements and adoption of advanced products, technological advancements have been continuous, with the emergence of smart and connected devices. Companies investing in these technologies are gaining a competitive edge, driving industry growth. For instance, in January 2023, Willow Innovations, Inc. launched Willow 3.0, the first breast pump companion app, for Apple Watches. This supports breastfeeding parents to easily track, control, and view their pumping sessions.

Strategic partnerships and collaborations are essential for growth and innovation in the breast pump industry. By leveraging the expertise and resources of diverse organizations, companies can enhance their portfolios, consolidate in a rapidly growing market, and improve patient outcomes. For instance, In February 2023, Madela AG and Sarah Wells collaborated to introduce the Allie Sling Bag, enhancing Medela's Freestyle Hands-free Breast Pump portfolio.

The U.S. wearable breast pumps companies are also focusing on expanding regionally to enhance their competitive advantage and broaden their market presence. This strategy involves establishing partnerships, acquiring businesses, and implementing localized marketing tactics to strengthen their footprint in key geographical areas.

Breast pumps are medical devices regulated by the U.S. Food and Drug Administration (FDA) and are often used by breastfeeding women to express breast milk. FDA regulates breast pumps under the Medical Device Regulation Act and has specific regulations for their classification and premarket notification procedures. Additionally, the presence of laws for reimbursement of breastfeeding accessories can help increase product sales in the U.S. Several legislations, such as the Fair Labor Standards Act of 1938 and Employment Standards Act, of 2000, entitle a working mother to breaks to express (pump) breast milk for her baby.

Component Insights

Wearable pumps segment dominated the market with a share of 57% in 2023. The growth of this segment is driven by factors such as rising female employment rates, increased healthcare spending, and well-developed healthcare facilities. According to the U.S. Bureau of Statistics, 57.4% of females were part of the labor force in 2019. Furthermore, working mothers favor wearable pumps due to their efficiency, which positively influences market expansion.

The wearable breast accessories segment is expected to experience substantial growth at significant CAGR from 2024 to 2030. This includes nipple care items, breast shells, breast pads, cleaning products, breastmilk storage and feeding solutions, perineal cooling pads, breast heating pads, breast cooling pads, and more. Government initiatives and campaigns play a crucial role in increasing awareness about breastfeeding. Additionally, insurance coverage provided by both private and public companies contributes to the expansion of this segment. These factors are projected to drive the demand for breast accessories in this country.

Technology Insights

Battery-operated wearable breast pumps held the largest market share in 2023. The surge in women's employment rates, increasing awareness about technologically advanced breast pumps, and enhancement of healthcare infrastructure are key factors driving the wearable breast pump market growth. They are ideal for mothers who require occasional pumping and prefer not to use manual pumps. Furthermore, companies are continuously investing in R&D to create smaller and lighter battery-operated wearable breast pumps. This technology is gaining acceptance among working women, thereby increasing the demand for these products.

Furthermore, the smart wearable breast pump segment is anticipated to witness at fastest CAGR from 2024 to 2030. Technological advancements and the presence of trending features such as time recording, and milk volume monitoring through smartphone applications are expected to boost the segment growth. Moreover, key companies are focusing on innovative product launches which will likely accelerate market growth over the forecast period. For instance, in January 2023, Tommee Tippee introduced a hands-free wearable breast pump with app connectivity. This Made for Me Double Electric Breast Pump is designed to fit into parents' busy lifestyles and empower them on their feeding journey.

Key U.S. Wearable Breast Pumps Company Insights

Key companies in the U.S. ophthalmic device market include Freemie, Ameda, Inc, Willow Innovations, Inc., and Babybuddha Products, LL among others. These companies implement strategic initiatives including innovative product launches, M&A activities, and regional expansion to enhance their portfolio.

Key U.S. Wearable Breast Pumps Companies:

- Freemie

- Ameda, Inc

- Willow Innovations, Inc.

- Babybuddha Products, Llc

- Spectra

- IAPOY

- Lavie Mom

- Motif Medical

- Fridababy, Llc

- Bodily

- Lansinoh Laboratories, Inc.

- Kindred Bravely

- Bravado Designs

- The Honest Company

- Motherlove Herbal Company

Recent Developments

-

In February 2023, Madela AGand Sarah Wells collaborated to introduce the Allie Sling Bag, enhancing Medela's Freestyle Hands-free Breast Pump portfolio.

-

In August 2023, Lansinoh launched the wearable breast pump as part of their commitment to supporting mothers. This pump offers hands-free pumping anytime and anywhere, without cords or tubes, providing lightweight and portable pumping.

-

In June 2023, Momcozy announced the launch of GoMini Plus, the company’s second-generation of GoMini Electric Breast Pump.

U.S. Wearable Breast Pumps Market Report Scope

Report Attribute

Details

The revenue forecast for 2030

USD 413.4 million

Growth rate

CAGR of 8.02% from 2024 to 2030

Actual estimates

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology

Country scope

U.S.

Key companies profiled

Freemie; Ameda, Inc; Willow Innovations, Inc.; Babybuddha Products, Llc; Spectra; IAPOY; Lavie Mom; Motif Medical; Fridababy, Llc; Bodily; Lansinoh Laboratories, Inc.; Kindred Bravely; Bravado Designs; The Honest Company; Motherlove Herbal Company

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Wearable Breast Pumps Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. wearable breast pumps market report based on component, and technology:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Wearable Pumps

-

Accessories

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual Wearable Breast Pumps

-

Battery Operated Wearable Breast Pumps

-

Smart Wearable Breast Pumps

-

Frequently Asked Questions About This Report

b. The U.S. wearable breast pumps market size was estimated at USD 243.5 million in 2023 and is expected to reach USD 260.22 million in 2024.

b. The U.S. wearable breast pumps market is expected to grow at a compound annual growth rate of 8.02% from 2024 to 2030 to reach USD 413.4 million by 2030.

b. The wearable pumps segment dominated the U.S. wearable breast pumps market with a share of 56.51% in 2023. This can be accredited to the rise in population and increasing number of working women.

b. Some key players operating in the U.S.wearable breast pumps market include Medela AG; Ameda, Inc.; Willow Innovations, Inc; Koninklijke Philips N.V.; Elvie (Chiaro Component Ltd); Freemie; BabyBuddha Products, LLC; Spectra; iAPOY; Lavie Mom; Pigeon Corporation

b. Key factors that are driving the market growth include surge in women employment rates, growing awareness about the wearable breast pumps, presence of favorable demographics, and increasing number of milk banks.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.