- Home

- »

- Water & Sludge Treatment

- »

-

U.S. Water Treatment As A Service Market, Industry Report 2030GVR Report cover

![U.S. Water Treatment As A Service Market Size, Share & Trends Report]()

U.S. Water Treatment As A Service Market Size, Share & Trends Analysis Report By End Use (Residential, Commercial), By Technology (Water Softeners, Filtration Systems), By Model, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-275-5

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

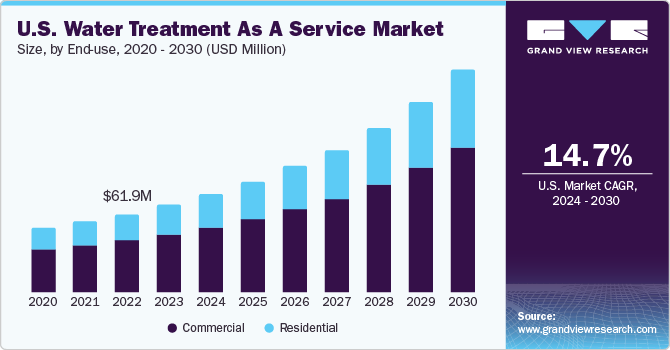

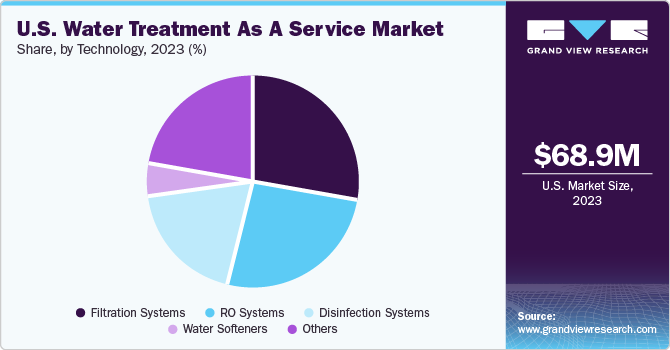

The U.S. water treatment as a service market size was valued at USD 68.9 million in 2023 and is projected to grow at a CAGR of 14.7% from 2024 to 2030. The growing demand for clean water, coupled with the rising health awareness among the population, is expected to drive market growth. In addition, the surging water pollution is expected to increase the demand for water treatment as a service, as consumers seek advanced solutions to ensure the safety and quality of their water supply. This trend is driving the growth of the water treatment as a service market in the U.S.

The U.S. population has been growing at an exponential rate, putting tremendous pressure on natural resources, particularly air and water. Population growth, ongoing industrialization, and increased agricultural operations are predicted to increase the demand for water treatment systems, thereby driving the demand for water treatment as a service.

Moreover, the faulty water distribution networks are anticipated to lead to water supply contamination by the release of stormwater and untreated wastewater to consumers through the main water supply line. This is likely to contribute to the spread of various waterborne diseases and pose health risks across cities. The frequent incidence of floods in the U.S. is expected to expedite the transmission of waterborne diseases such as Rift Valley fever, leptospirosis, and malaria. These factors are projected to fuel the demand for water treatment services in the coming years.

For instance, every year, waterborne pathogens are responsible for 7,000 fatalities, 120,000 hospitalizations, 7 million illnesses, and incurred healthcare expenses amounting to USD 3 billion in the U.S., according to the Centers for Disease Control and Prevention 2022 Report. CDC has also calculated the costs that waterborne diseases have incurred for the American healthcare system, and they total approximately USD 3.33 billion and up to USD 8.77 billion as of 2023. Such a high figure highlights the increasing necessity for water treatment systems to be installed in commercial and residential sectors, driving the demand for water treatment as a service market.

Market Concentration & Characteristics

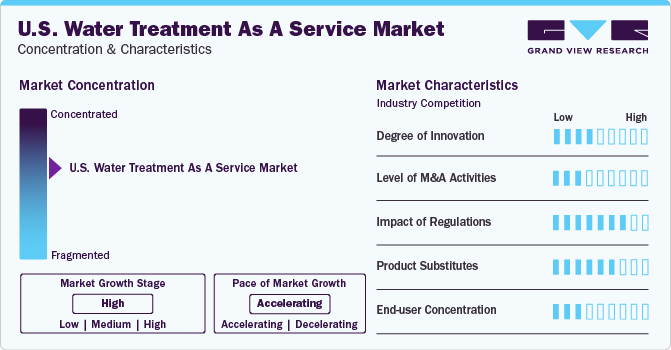

The industry growth stage is high, and the pace of the industry growth is accelerating. The water-treatment-as-a-service industry is characterized by a high degree of competition owing to the various cost-efficient technologies adopted by the industry players. Further, the U.S. has been witnessing low rainfall and depletion of groundwater resources, thereby raising the demand for potable water across the commercial and residential end-use segments. Thus, the growing demand for the cost-effective water supply in the U.S. is driving the competition between the industry players.

The U.S. water treatment as a service industry is also characterized by a high degree of service innovation and research & development in water treatment technologies, which results in the development of cost-effective water treatment services. Further, the U.S. water treatment as a service market is consolidated, with a few major players such as Aquatech International LLC Quench USA, Inc. dominating the industry and some smaller companies competing for the regional market share.

Moreover, in the U.S. water treatment as a service market, key industry players adopted strategies like acquisitions and regional expansion. Strategic acquisitions can lead to increased industry penetration for an industry player by entering new segments and expanding its customer base. In August 2021, Chart Industries acquired a water treatment technology solution provider AdEdge Holdings, LLC, for a price of USD 40 million. This acquisition helped the company to improve its water treatment and desalination solutions.

End Use Insights

The commercial segment is expected to dominate the market by holding a 66.4% market share in 2023. The water treatment requirements of malls, offices, commercial spaces, restaurants, hotels, manufacturing plants, schools, laboratories, and other organizations with high-volume consumption of high-quality water are largely met by commercial water treatment systems. Large volumes of water are treated using commercial water treatment systems at high flow rates. Water as a service allows commercial establishments to access advanced water treatment systems without the requirement for substantial initial capital investments.

The residential segment is anticipated to witness the highest growth over the forecast period, owing to surging awareness among the masses about new contaminants and the rising demand for high-quality drinking water in the country. Consumers are not only becoming highly aware of contaminants such as poly-fluoroalkyl substances (PFAS) but are also conscious about water quality, as well as waterborne diseases, such as cholera, typhoid, acute diarrhea, and viral hepatitis caused by low-quality water.

Model Insights

The pay-as-you-go model dominated the market in 2023 and is anticipated to witness the highest CAGR over the forecast period, as it democratizes access to high-quality water treatment solutions cost-effectively. Under this model, customers are billed according to the quantity of permeated or treated water generated, with the water treatment companies assuming the responsibilities of installation and maintenance. This pioneering approach offers a range of advantages, fostering a streamlined, accessible, and economical future for water treatment.

The subscription model is anticipated to witness the second-highest CAGR over the forecast period. A subscription model for water treatment as a service involves customers paying a regular fee to access and benefit from water treatment services provided by a third-party service provider. Customers benefit from a predictable and consistent cost structure, as they pay a fixed subscription fee. This allows for budgeting and financial planning, eliminating the uncertainty associated with variable costs.

Technology Insights

The filtration system segment dominated the market in 2023 and is anticipated to witness the highest CAGR over the forecast period, owing to its capability to remove contaminants, sediments, and impurities from water sources. These systems enhance water quality and make it suitable for various applications. Regular maintenance and replacement of filtration components create a continuous need for professional services. Furthermore, filtration systems with remote monitoring capabilities offer significant benefits by enabling real-time supervision and control of water treatment processes.

The RO system segment is anticipated to witness the second-highest CAGR over the forecast period. The RO system is a highly effective method of purifying water. It removes contaminants, ions, and particles through a semi-permeable membrane, ensuring high-quality water output. The complexity of RO systems and the need for precise maintenance create a market for water treatment services.

Country Insights

In the U.S., Florida is likely to dominate the market in 2023 due to the prevalence of water shortage in the state and growing water demand. In November 2023, the South Florida Water Management District (SFWMD) proclaimed a water shortage condition and issued temporary guidelines to protect the groundwater in Lee County, Florida. This water shortage condition is continuing amid dry conditions on the Southwest Coast. Hence, to cater to this rising demand for adequate water supply, the water treatment as a service market is expected to grow in Florida over the forecast period.

South Carolina is expected to witness the highest CAGR over the forecast period. In South Carolina, rainfall has reduced significantly below the normal levels. According to an article by the National Weather Service (NWS) in November 2023, 48 percent of South Carolina experienced moderate or worse drought conditions until mid-November. This reduction in rainfall contributed to the adoption of water recycling and water reuse measures in the residential and commercial sectors. Hence, to outsource the potable water needs, commercial facilities, and educational institutes are adopting water treatment as a service to maintain their operational efficiency.

Key U.S. Water Treatment As A Service Company Insights

Some of the key players operating in the market include Aquatech International LLC.,Waterleau, Quench USA, Inc., Seven Seas Water Group, and Chart Industries.

-

Aquatech International LLC offers innovative technologies to solve the water scarcity problem. It has been working in four segments. Water reuse and zero liquid discharge involve systems for the recycling of water and elimination of wastewater discharge. The second segment involves critical minerals & metals resource recovery. It currently has 2000+ installations across the globe and can treat more than 1.6 billion gallons of water daily. With 700+ global water experts financing to undertake comprehensive & sustainable water solutions.

-

Seven Seas Water Group has extensive experience in the global water sector and pioneered water as a service approach. The company has operations across the U.S., Caribbean, and Latin American countries. It supplies water and wastewater treatment solutions to industrial, municipal, various governmental, and hospitality customers. It has more than 150 water treatment plants and provides a water-as-a-service model for the last 20 years.

-

Clearford Water Systems is the largest operator of privately held communal water & wastewater treatment systems in Ontario. It provides unified water infrastructure solutions. The company has a dedicated team of compliance specialists, licensed engineers, and operators delivering services with regard to water & wastewater infrastructure.

-

Bawat Water Technologies AB has a deep maritime understanding of customer needs and an excellent network to cater to them. It has been developing innovative, state-of-the-art, targeted solutions for the maritime industry.

Key U.S. Water Treatment As A Service Companies:

- Seven Seas Water Group

- Waterleau

- Oneka Technologies

- Clearford Water Systems

- Quench USA, Inc.

- Chart Industries

- OriginClear

- Aquatech International LLC.

- Bawat Water Technologies AB

Recent Developments

-

In November 2023, Aquatech International LLC. expanded its water treatment solutions with three robust, cutting-edge membrane technologies. This initiative has helped the company diversify its market offerings. Further, these innovative technologies have helped the company deliver solutions across various water treatment applications, including potable water generation and water desalination.

-

In October 2023, OriginClear's subsidiary Water On Demand and Fortune Rise Acquisition entered into a business combination agreement (BCA) to create a Nasdaq-listed company. This agreement represents a pro forma equity valuation of approximately USD 72.0 million for the combined company.

U.S. Water Treatment As A Service Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 77.3 million

Revenue forecast in 2030

USD 176.1 million

Growth Rate

CAGR of 14.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends

Segments covered

End-use, technology, model, region

Regional scope

Florida; Georgia; South Carolina; North Carolina

Key companies profiled

Seven Seas Water Group; Waterleau; Oneka Technologies; Clearford Water Systems; Quench USA, Inc.; Chart Industries; OriginClear; Aquatech International LLC.; Bawat Water Technologies AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Water Treatment As A Service Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. water treatment as a service market report based on end-use, technology, model, and region.

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Cruise Ships

-

Retail Shops

-

Hospitality

-

Office Buildings

-

Educational Institute

-

Others

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Water Softeners

-

Filtration Systems

-

RO Systems

-

Disinfection Systems

-

Others

-

-

Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Pay-as-you-go Model

-

Subscription Model

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Florida

-

Georgia

-

South Carolina

-

North Carolina

-

Frequently Asked Questions About This Report

b. The U.S. water treatment as a service market size was estimated at USD 68.9 million in 2023 and is expected to be USD 77.3 million in 2024.

b. The U.S. water treatment as a service market, in terms of revenue, is expected to grow at a compound annual growth rate of 14.7% from 2024 to 2030 to reach USD 176.1 million by 2030

b. Florida region dominated the market and accounted for a 7.3% share in 2023, owing to the prevalence of water shortage in the state. This water shortage condition is continuing amid dry conditions in the Florida.

b. Some of the key players operating in the U.S. water treatment as a service market include Seven Seas Water Group, Waterleau, Oneka Technologies, Clearford Water Systems, Quench USA, Inc., Chart Industries, OriginClear, Aquatech International LLC., Bawat Water Technologies AB.

b. The key factors that are driving the U.S. water treatment as a service market include the rising water pollution, growing demand for potable clean water, and rising health awareness among the population.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."