- Home

- »

- Clothing, Footwear & Accessories

- »

-

U.S. Walking And Running Wear Market Size, Report, 2030GVR Report cover

![U.S. Walking And Running Wear Market Size, Share & Trends Report]()

U.S. Walking And Running Wear Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Apparel, Footwear), By Price Range (Mass, Premium), By Distribution Channel (Sporting Goods Retailers), And Segment Forecasts

- Report ID: GVR-4-68040-315-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

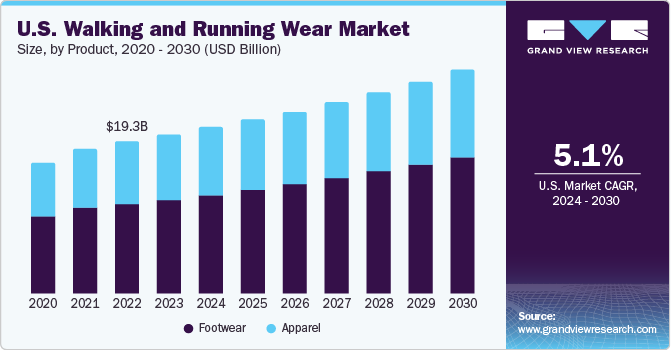

The U.S. walking and running wear market size was estimated at USD 20.16 billion in 2023 and is expected to expand at a CAGR of 5.1% from 2024 to 2030. The growing awareness of the health benefits associated with regular physical activities has significantly influenced the U.S. market for walking and running wear. With rising rates of obesity and related health issues, more people are adopting healthier lifestyles, leading to increased demand for appropriate athletic wear. This trend is further supported by public health campaigns and initiatives promoting physical fitness, which encourage individuals to engage in regular exercise.

Running and walking have become increasingly popular forms of exercise in the U.S., with more and more people taking to the streets and trails to stay fit and healthy. Along with this rise in popularity, there has also been a surge in the demand for specialized apparel and gear designed specifically for these activities. From high-performance running shoes to moisture-wicking tops and compression leggings, the market for running and walking apparel in the U.S. has grown significantly in recent years.

The growing trend toward a healthier and more active lifestyle has driven the demand for walking and running apparel. Nowadays, companies are using innovative fabrics that are lightweight, breathable, and moisture-wicking, making them ideal for intense physical activities for both men and women. These materials not only enhance performance but also provide comfort and protection to the wearer.

The popularity of running and walking events, including marathons, half-marathons, charity walks, and fun runs, has surged in recent years. These events often require participants to invest in specialized apparel that offers comfort and performance benefits. Additionally, the emergence of virtual races and challenges, particularly during the COVID-19 pandemic, has further driven the demand for walking and running wear as more people participate in these activities from their local areas.

Furthermore, innovations in fabric technology have revolutionized the walking & running wear market. High-performance materials that provide superior comfort, breathability, moisture-wicking, and durability are now widely available. Advances such as smart fabrics, which can integrate technology like fitness trackers, appeal to tech-savvy consumers who seek both functionality and modernity in their athletic wear. These technological improvements enhance the overall exercise experience, making high-quality apparel a sought-after commodity.

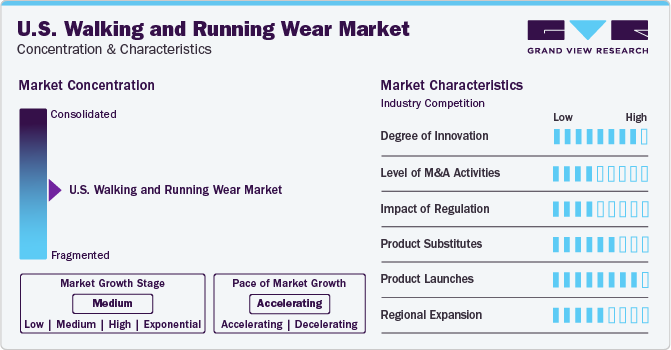

Market Concentration & Characteristics

The U.S. walking & running wear market is characterized by a high degree of innovation, particularly in fabric technology and smart apparel. Brands are continuously developing new materials that enhance comfort, breathability, moisture-wicking, and durability. Technological advancements have led to the creation of smart fabrics integrated with fitness tracking capabilities, offering consumers advanced features like real-time performance monitoring.

Merger and acquisition (M&A) activities in the walking & running wear market have been moderate to high, driven by strategic moves to consolidate market position, expand product lines, and enter new markets. Established brands often acquire smaller, innovative companies to enhance their technological capabilities and diversify their product offerings.

Regulations impacting the walking & running wear industry primarily revolve around safety, environmental standards, and fair labor practices. Compliance with these regulations is crucial for brands to avoid legal penalties and maintain their reputation. Environmental regulations have prompted companies to adopt sustainable practices, including the use of eco-friendly materials and reducing carbon footprints.

The market for walking and running wear faces moderate threats from substitutes such as general fitness apparel, athleisure wear, and multi-sport clothing. While specialized walking and running wear offer specific performance benefits, consumers might opt for versatile athletic wear that can be used for various activities. Additionally, home workout trends and indoor fitness regimes could lead to a preference for more casual and comfortable attire over specialized gear.

Product launches in the walking & running wear industry are frequent and often highlight the latest innovations and trends. Brands regularly introduce new collections featuring advanced materials, enhanced performance features, and fashionable designs. Recent launches have seen a significant focus on sustainability, with products made from recycled materials and designed with eco-friendly manufacturing processes. Companies in the walking & running wear industry are increasingly expanding their presence across different regions in the U.S. This expansion is driven by growing consumer interest in walking & running.

Product Insights

The footwear segment dominated the market with the largest revenue share of 59.54% in 2023. The growing health and fitness consciousness among consumers has increased participation in walking and running activities, boosting demand for appropriate footwear. The popularity of running and walking events, virtual races, and fitness challenges further drives the need for specialized shoes. Additionally, the athleisure trend has popularized the use of athletic footwear for casual and social occasions, expanding the market. Health professionals, such as podiatrists and orthopedic specialists, emphasize the importance of proper footwear for preventing injuries and ensuring biomechanical efficiency. Recommendations from these professionals significantly influence consumer behavior, leading to a greater focus on investing in high-quality walking and running shoes.

The apparel segment is expected to grow at a CAGR of 4.4% from 2024 to 2030 due to increasing health and fitness awareness, a surge in participation in walking and running events, and the growing popularity of athleisure wear. Advances in fabric technology and sustainability, such as eco-friendly materials and smart fabrics, are also driving consumer interest. Additionally, the expansion of e-commerce, the influence of social media and fitness influencers, and a focus on inclusivity and size diversity are enhancing market accessibility and appeal.

Price Range Insights

Based on price, the mass segment dominated the market with the largest revenue share in 2023 due to its affordability and accessibility, appealing to a broad consumer base. The increasing health and fitness awareness across various demographics has driven demand for budget-friendly options that offer reasonable quality and performance. Additionally, the proliferation of e-commerce and discount retail channels has made it easier for consumers to purchase mass-market products. Brands in this segment often leverage economies of scale to offer competitive prices without compromising essential features, making them attractive to both new and casual fitness enthusiasts who seek value for money.

The premium segment is expected to grow at a CAGR of 5.8% from 2024 to 2030 owing to the increasing consumer demand for high-quality, technologically advanced, and performance-enhancing apparel. As fitness and wellness become integral parts of more consumers' lifestyles, there is a willingness to invest in superior products that offer enhanced comfort, durability, and functionality. Premium brands are also focusing on sustainability and eco-friendly materials, which attract environmentally conscious buyers. Additionally, the influence of professional endorsements, innovative design features, and the growing trend of personalized and customizable options further drive the appeal and demand for premium walking and running wear.

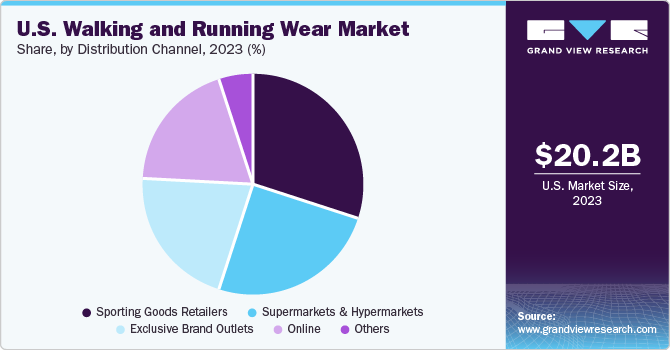

Distribution Channel Insights

The sales of walking & running wear through sporting goods stores dominated the market with the largest revenue share in 2023 as these stores offer a specialized shopping experience with a wide range of products tailored to athletes and fitness enthusiasts. Consumers prefer sporting goods stores for their knowledgeable staff, ability to try on products for fit and comfort, and the opportunity to compare different brands and models in person. Additionally, these stores often host events and promotions that attract a dedicated customer base. The comprehensive selection and expertise available in sporting goods stores create a trusted environment for purchasing walking and running wear, leading to their dominant market share.

Sales through online channels are expected to grow at the fastest CAGR during the forecast period owing to the increasing convenience and accessibility of online shopping. Consumers are attracted to the ease of browsing and purchasing products from the comfort of their homes, the ability to access a broader range of products, and competitive pricing offered by e-commerce platforms. The rise of mobile shopping improved online customer service, and the integration of advanced technologies such as virtual try-ons and personalized recommendations enhance the online shopping experience. Additionally, the global reach of online channels allows brands to tap into a wider audience, further driving growth in this segment.

Key Walking And Running Wear Company Insights

-

Nike, Inc., Adidas AG, New Balance, and Brooks Sports, Inc., among others, are the dominant players operating in the U.S. walking & running wear market.

-

Nike offers a selection of running shoes designed for off-road running and challenging terrains. Specific models, such as the Nike Air Zoom Terra Kiger or Nike Wildhorse, cater to the needs of trail runners by providing stability, protection, and responsiveness on uneven surfaces. The company also offers a wide range of running clothing designed to optimize comfort, performance, and style for runners of all levels. These running apparel are crafted from a breathable, lightweight fabric called Nike Dri-FIT.

-

The North Face offers a selection of running shoes specifically engineered for off-road adventures. These shoes feature durable materials and innovative designs, catering to the unique demands of trail running.

Key U.S. Walking And Running Wear Companies:

- Nike, Inc.

- Adidas AG

- New Balance

- Brooks Sports, Inc. (Berkshire Hathaway)

- The North Face

- Under Armour, Inc.

- Salomon

- ALTRA RUNNING

- Puma SE

- Skechers USA., Inc.

Recent Developments

-

In January 2024, Brooks Sports, Inc announced its partnership with Kara Goucher, a popular icon in American distance running. Renowned for her accomplishments at the World Championships and Olympics, Goucher has earned widespread respect through her engaging speaking engagements, writings, and passion for the sport. This collaboration aligns seamlessly with Brooks's enduring culture of running. Timed to coincide with the upcoming Olympic Trials, Brooks will enhance its promotional efforts through the Hyperion House, a pop-up experience set to feature prominently at key events within the running sports culture

-

In July 2023, Nike introduced the Ultrafly Trail Racing Shoe, a high-performance runner designed for speed, sleekness, and exceptional grip. This Nike trail shoe delivers impressive performance and was developed in collaboration with Vibram, which is renowned for its cutting-edge rubber soles. The Ultrafly incorporates Vibram's agile outsole design and lug technology, ensuring lightweight traction and optimum performance on varied terrains

-

In August 2022, Saucony, a brand owned by Wolverine World Wide, Inc., unveiled a fresh line of apparel in collaboration with Cycora by Ambercycle. The Saucony x Cycora collection presents a diverse array of high-performance running tops tailored for both men and women. The collection features a crop top, fitted tank, short sleeve, and singlet, all crafted from breathable, sweat-wicking jersey fabric. These garments integrate up to 23% Cycora material and represent a commitment to sustainability without compromising on functionality

-

In June 2022, Salomon unveiled the latest iteration of its renowned trail running shoe, the Speedcross 6, continuing the legacy established in 2006. The Speedcross 6 boasts a lighter design at 298g and a more robust, grippy connection to the ground, particularly in wet conditions. This improved grip is attributed to a revamped outsole featuring Y-shaped lugs designed to expel mud more efficiently

U.S. Walking And Running Wear Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 28.29 billion

Growth rate (revenue)

CAGR of 5.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, price range, distribution channel

Key companies profiled

Nike, Inc.; Adidas AG; New Balance; Brooks Sports, Inc. (Berkshire Hathaway); The North Face; Under Armour, Inc.; Salomon; ALTRA RUNNING; Puma SE; Skechers USA., Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Walking And Running Wear Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. walking and running wear market report based on product, price range, and distribution channel.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Apparel

-

Footwear

-

-

Price Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass

-

Premium

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Sporting Goods Retailers

-

Supermarkets & Hypermarkets

-

Exclusive Brand Outlets

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. walking and running wear market size was estimated at USD 20.16 billion in 2023 and is expected to reach USD 21.04 billion in 2024.

b. The U.S. walking and running wear market is expected to grow at a compounded growth rate of 5.1% from 2024 to 2030 to reach USD 28.29 billion by 2030.

b. Walking & running footwear dominated the U.S. walking & running wear market with a share of 59.54% in 2023. The growing health and fitness consciousness among consumers has increased participation in walking and running activities, boosting demand for appropriate footwear. The popularity of running and walking events, virtual races, and fitness challenges further drives the need for specialized shoes. Additionally, the athleisure trend has popularized the use of athletic footwear for casual and social occasions, expanding the market

b. Some key players operating in white spirits market include Nike, Inc.; Adidas AG; New Balance; Brooks Sports, Inc. (Berkshire Hathaway); The North Face; Under Armour, Inc.; Salomon; ALTRA RUNNING; Puma SE; Skechers USA., Inc.

b. The growing awareness of the health benefits associated with regular physical activities such as walking and running has significantly influenced the U.S. market for walking and running wear. With rising rates of obesity and related health issues, more people are adopting healthier lifestyles, leading to increased demand for appropriate athletic wear. This trend is further supported by public health campaigns and initiatives promoting physical fitness, which encourage individuals to engage in regular exercise

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.