- Home

- »

- Healthcare IT

- »

-

U.S. Vital Signs Monitoring Devices Market, Industry Report, 2030GVR Report cover

![U.S. Vital Signs Monitoring Devices Market Size, Share & Trends Report]()

U.S. Vital Signs Monitoring Devices Market Size, Share & Trends Analysis Report By Product (BP Monitors, Pulse Oximeters), By End-use Hospitals, Ambulatory Centers), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-277-1

- Number of Report Pages: 18

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

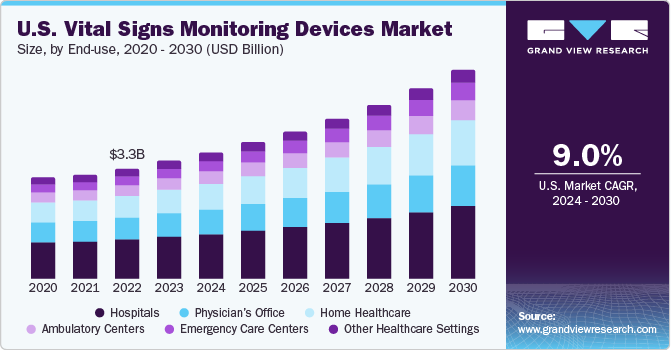

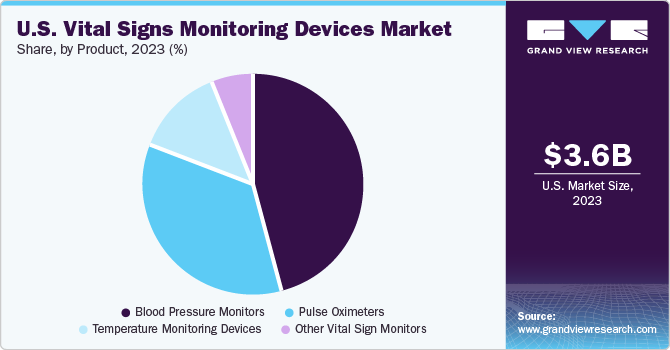

The U.S. vital signs monitoring devices market size was estimated at USD 3.6 billion in 2023 and is estimated to grow at a CAGR of 9.0 % from 2024 to 2030.The growth is attributed to the rising development of innovative devices, growing healthcare settings, and increasing prevalence of chronic diseases such as cancer, diabetes, and more. Moreover, surge in demand for homecare healthcare settings which further expected to drive the market growth.

The U.S. vital signs monitoring market accounted for over 38% of the global vital signs monitoring market in 2023. Over the years, innovation has evolved the U.S. vital signs device market to a large extent. Consumers as well as manufacturers have shifted their focus from traditional devices to the novel multipurpose vital sign measurement device thereby driving the market over the forecast years. Moreover, evolution of these devices resulted in the inclusion of data monitoring and alarm systems which can be helpful and efficient for various healthcare settings such as hospitals, clinics,0020`and ambulatory centers.

The surge in the number of hospitals is primarily driven by a rise in population, growing number of elderly patients, expanding reach of medical insurance, and increasing trend of medical tourism in developing nations. As per the data published by American Hospital Association, there are more than 6200 hospitals and 400 healthcare settings in the country.

Rising prevalence of chronic conditions among the younger population is leading to a significant increase in patients with cardiovascular disease and diabetes. This surge underscores the necessity for more vigilant monitoring of vital signs. According to an article published by NIH, approximately 45% of people in the U.S. are affected with at least one chronic disease, and the number consistently increasing.

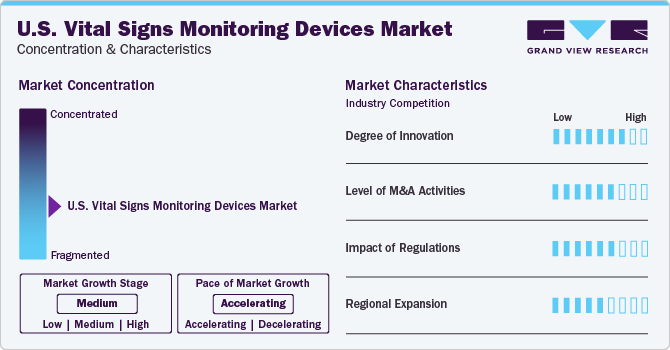

Market Concentration & Characteristics

U.S. Vital Signs Monitoring Devices industry is moderately fragmented due to presence of many companies that hold market shares operating in the market.

Due to the intense competition, major companies are prioritizing innovation and technological advancements to enhance their position in this industry. For instance, in January 2024,Blue Spark Technologies announced the launch of a Multi-vital remote patient monitoring platform that is named VitalTraqTM. This unique innovative device is integrated with AI technology sensors and can be operated remotely.

Engaging in strategic acquisitions enables industries to strengthen their market position by enhancing capabilities, expanding product offerings, and reinforcing competencies. For instance, in Mach 2023, Heartbeam announced the acquisition of all assets from Livmor, a remote monitoring manufacturer. This acquisition would expand the company’s reach in remote monitoring and detection.

Regulatory bodies such as the U.S. FDA influence the approval process of blood pressure monitors and further support the innovation and product expansion strategies pursued by industry. Players. For instance, in March 2022, Biobeat announced the 510(k) clearance from the US FDA for its wearable remote patient monitoring device. This device helps to monitor respiratory rate and temperature, blood pressure, blood oxygen saturation, and pulse rate. This approval would help healthcare to transmit real-time patient data.

Several key companies are actively pursuing regional expansion initiatives to broaden their geographic reach and cater to the demands of consumers in those regions. For instance, In August 2022, BioIntelliSense announced partnership with Medtronic to expand its U.S. distribution of wearable for continuous remote patient monitoring from hospitals and home.

Product Insights

Blood pressure monitors held the largest share of 45% in 2023.This growth can be attributed to the increasing demand, innovation of blood pressure monitors and prevalence of hypertension. As per the CDC statistics, in U.S., hypertension is the leading cause of death. Hypertension further result in heart disease and stroke. Hence, there is surge in demand of blood pressure monitors in the healthcare settings and home. Moreover, technological advancements and related updates are also some of the key drivers for market growth. For instance, in January 2021, Biospectal Company with the Swiss Centre for Electronics and Microtechnology (CSEM) launched OptiBP which is a cuffless blood measurement algorithm application. This app will empower people for blood pressure monitoring using their smartphones.

The other vital sign monitors segment is projected to expand at the fastest CAGR of 16% from 2024 to 2030 owing to reimbursement coverages provided by government bodies and rising awareness about non-communicable diseases and monitoring of vital signs thereby fueling the market growth.

End-use Insights

Hospitals dominated the market with highest share of 35.4% in 2023 owing to higher demand of vital sign monitoring devices in hospital. Healthcare facilities such as hospitals require these devices in their ICU, nurse stations, OPD’s, operation theaters and outpatient ward to consult their patients. Moreover, technologically advanced monitoring devices are generally preferred by hospitals to increase the comfort of patients as well as doctors further leading to a boost the product demand.

The home healthcare segment is expected to witness growth at the fastest CAGR over the forecast years. Increasing prevalence of chronic diseases such as cardiovascular diseases, hypertension, stroke, and respiratory diseases among the population necessitates vital sign monitoring devices at home to improve patient care and measurement of signs. Moreover, government insurance coverage for such devices is likely to increase the segment growth.

Key U.S. Vital Signs Monitoring Devices Company Insights

Key companies operating in the vital signs monitoring devices devices market include General Electric, Masimo,, Nonin Medical Inc. American Diagnostic Corporation,Suntech Medical, Inc Inc. and GE Healthcare.

The adoption of competitive strategies such as mergers & acquisitions, strategic alliances, collaborative agreements, and partnerships helps to sustain the intense competition. Industry growth is directly associated with rising investments by manufacturers for the development of cost-effective, innovative, and easy-to-use products.

Key U.S. Vital Signs Monitoring Devices Companies:

- General Electric

- Masimo

- Nonin Medical Inc.

- Suntech Medical, Inc.

- Compass Health Brands

- American Diagnostic Corporation

- Smiths Medical

- Aed.Us, A Coro Medical Company

- Telatemp Corporation

- Nanowear

- Valencell

- Honeywell

Recent Developments

-

In January 2024, Nanowear announced the US FDA 510(K) clearance for SimpleSence BP device. SimpleSence BP is which a non-invasive, cuffless continuous blood pressure monitor manufactured using AI. This approval would enhance the company’s intellectual property portfolio

-

In January 2023, Valencell announced the launch of a calibration-free, cuff less Blood Pressure Monitoring Solution to improve cardiovascular functions measuring during physical exercise. This novel product is designed to assist individuals in monitoring and managing hypertension by providing an accurate blood pressure measurement from the finger without the need for a cuff or calibration.

-

In April 2023, Honeywell announced the development real-time monitoring device. This device helps in recording vital signs within healthcare and homecare settings.

-

In September 2022, Garmin Ltd. announced US FDA clearance approval for Index TM BPM smart blood pressure monitor. Index BPM is a stand-alone device that consists of an integrated display to quickly view measurements and can be operated using Wi-Fi.

U.S. Vital Signs Monitoring Devices Market Report Scope

Report Attribute

Details

The U.S. market size value in 2024

USD 3.9 billion

The U.S. revenue forecast for 2030

USD 6.4 billion

Growth Rate

CAGR of 8.6 % from 2024 to 2030

Actual estimates

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million & CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Country Scope

U.S.

Key companies profiled

General Electric ; Masimo; Nonin Medical Inc.; Suntech Medical, Inc.; Medtronic; Compass Health Brands; American Diagnostic Corporation; Smiths Medical; Aed.Us, A Coro Medical Company; Telatemp Corporation, Nanowear; Valencell; Honeywell

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Vital Signs Monitoring Devices Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. vital signs monitoring devices marketbased on product and end-use:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Blood Pressure Monitors

-

Aneroid Blood Pressure Monitors

-

Digital Blood Pressure Monitor

-

Ambulatory Blood Pressure Monitors

-

Blood Pressure Instrument Accessories

-

Instrument & Accessories

-

-

Pulse Oximeters

-

Table-top/Bedside Pulse Oximeters

-

Fingertip Pulse Oximeter

-

Hand-held pulse Oximeters

-

Wrist-Worn Pulse Oximeters

-

Pediatric Pulse Oximeters

-

Pulse Oximeter Accessories

-

-

Temperature Monitoring Devices

-

Mercury Filled Thermometers

-

Digital Thermometers

-

Infrared Thermometers

-

Liquid Crystal Thermometer

-

Temperature Monitoring Device Accessories

-

-

Other Vital Sign Monitors

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Physician’s Office

-

Home Healthcare

-

Ambulatory Centers

-

Emergency Care Centers

-

Other Healthcare Settings

-

Frequently Asked Questions About This Report

b. The U.S. vital signs monitoring devices market size was estimated at USD 3.6 billion in 2023 and is expected to reach USD 3.9 billion in 2024.

b. The U.S. vital signs monitoring devices market is expected to grow at a compound annual growth rate of 8.6% from 2024 to 2030 to reach USD 6.4 billion by 2030.

b. Blood pressure monitors held the largest share of 45% in 2023. This growth can be attributed to the increasing demand, innovation of blood pressure monitors and prevalence of hypertension.

b. Key companies operating in the vital signs monitoring devices market include General Electric, Masimo,, Nonin Medical Inc. American Diagnostic Corporation, Suntech Medical, Inc Inc. and GE Healthcare.

b. The growth is attributed to the rising development of innovative devices, growing healthcare settings, and increasing prevalence of chronic diseases such as cancer, diabetes, and more. Moreover, surge in demand for homecare healthcare settings which further expected to drive the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."