- Home

- »

- Healthcare IT

- »

-

U.S. Virtual Care Market Size & Share, Industry Report,2030GVR Report cover

![U.S. Virtual Care Market Size, Share & Trends Report]()

U.S. Virtual Care Market (2025 - 2030) Size, Share & Trends Analysis Report By Consultation Mode (Audio, Messaging, Video), By Application (Family Medicine, Internal Medicine, Cardiology, Endocrionology), And Segment Forecasts

- Report ID: GVR-4-68039-943-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Virtual Care Market Size & Trends

The U.S. virtual care market size was estimated at USD 8.83 billion in 2024 and is expected to grow at CAGR of 32.35% from 2025 to 2030. The lack of primary care physicians and healthcare specialists in the U.S. is one of the major factors expected to accelerate the market growth in the U.S. For instance, as per the Association of American Medical Colleges (AAMC) estimates, the U.S. is expected to face a shortage of between 37,800 and 124,000 physicians by 2034, including a shortage of primary and specialty physicians. In addition, the widespread adoption of digital technologies is fueling the market growth.

The rise in the prevalence of chronic diseases necessitates a proactive approach to healthcare management. Virtual care platforms and solutions leverage technology to better monitor, communicate, and engage patients and healthcare providers. These solutions facilitate personalized care plans and remote patient monitoring. As healthcare organizations recognize the importance of addressing the needs of an aging population with chronic illnesses, the demand for innovative virtual care platforms is expected to grow over the forecast period. For instance, market players such as Caregility, HealthSnap , Inc., and Aetonix Systems provide virtual care platforms for chronic disease management.

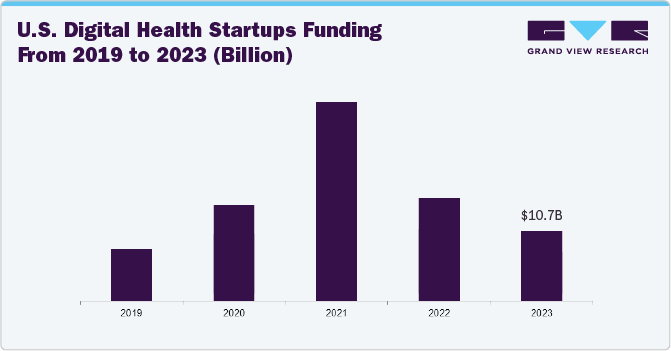

The U.S. government is making massive investments in digital health and boosting healthcare IT and virtual care platform adoption, which is expected to stimulate market growth. According to Rock Health's annual year-end funding report U.S. digital health startups raising USD 10.7 billion across 492 deals in 2023.

Moreover, in February 2021, the United States Department of Agriculture (USDA) spent USD 42 million on telemedicine infrastructure and remote learning to improve health outcomes and education. Through the Distance Learning and Telemedicine (DLT) program, the USDA financed 86 projects in rural regions to help individuals by offering healthcare education and grants to purchase telemedicine interactive telecommunications distance learning technology.

Furthermore, market players are adopting various strategies such as mergers and acquisitions, partnerships and collaborations, new service launches, and geographical expansion to capture a larger market share. For instance, in May 2022, CVS Health introduced CVS Health Virtual Primary Care, a new virtual care solution to enhance primary care through virtual or at-home health services available through a single digital platform.

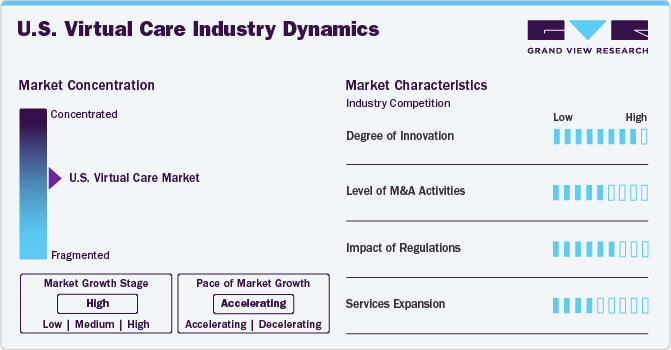

Market Concentration & Characteristics

Market players are adopting various strategies such as mergers and acquisitions, partnerships and collaborations, new service launches, and geographical expansion to capture a larger market share. For instance, in March 2023, Koninklijke Philips N.V., a healthtechnology company, introduced Philips Virtual Care Management, a comprehensive portfolio of flexible services and solutions to help healthcare organizations, payers, providers, and employer groups to connect with patients from virtually anywhere.

The U.S. virtual care market is characterized by a medium level of M&A activities undertaken by leading players. Several companies are undertaking this strategy to strengthen their portfolio. For instance, in August 2024, Stryker entered a definitive agreement to acquire care.ai, a provider of AI-assisted virtual care platforms. This strategy aims to strengthen Stryker’s growing healthcare IT offerings.

Digital health technologies such as telehealth, virtual care platforms and telemedicine are subject to various regulatory frameworks across the U.S. The structured regulatory framework positively impacts market access, growth, and compliance. In the U.S., the FDA has developed guidelines for digital health technologies. In October 2023, the U.S. FDA created a new Digital Health Advisory Committee to resolve the digital health technologies (DHTs) issues and ultimately promote digital technologies in healthcare.

Several companies are expanding their services by launching new services to maintain a competitive edge. For instance, in September 2023, Wheel Health, Inc., a provider of a virtual care platform, unveiled the virtual care platform to help enterprise organizations build seamless care experiences.

Consultation Mode Insights

By consultation mode, the audio segment in U.S. virtual care market held the largest revenue share of 45.4% in 2024. Easy access and a higher preference for phone calls drive the segment growth. Moreover, many people reside on the side of the digital divide, where access to technology and high-speed internet service is limited. For instance, according to an article published in Mayo Clinic Proceedings: Digital Health journal in September 2023, over 21 million individuals in the U.S. live in "digital deserts" (without broadband access). Both rural and urban residents are affected by this issue. For these individuals, audio-only visits have proven to be a successful means of overcoming barriers to care, such as mobility issues, lack of transportation, and lack of nearby providers.

Moreover, audio-only consultations have expanded access to crucially needed behavioral health services. For example, Call 4 Health, ALL, a virtual consultation company in the U.S., provides audio call services for health consultations.

The video segment is anticipated to witness the fastest CAGR growth over the forecast period. Virtual care encompasses phone and message consultations, and the frequency of telehealth appointments conducted by video has risen dramatically. For instance, a Telehealth Satisfaction Study conducted by The J.D. Power reported that 67% of surveyed individuals in the U.S. accessed video services in 2022. Thus, the rise in the adoption of video consultation services boosts the segment growth.

Application Insights

By application, the family medicine segment in U.S. virtual care market held the largest revenue share of 29.6% in 2024. A high number of online consultations for acute and primary care is the main factor driving the segment's growth. For instance, Virtual Care for Families, a U.S.-based digital health company, provides personalized virtual care from the comfort of users' homes and develops a custom treatment plan. Moreover, the American Academy of Family Physicians (AAFP) recommends expanding the use of telemedicine as an efficient and appropriate means of enhancing health when handled by adequate standards of care. Thus, increasing adoption of virtual care by family physicians is expected to fuel the segment's growth.

The others segment is anticipated to witness the fastest CAGR over the forecast period. The others segment comprises gastroenterology, gynecology, and psychiatry services. Shifting trends from traditional care methods to patient-centric and personalized care support adopting virtual care platforms. For instance, in September 2024, Iris Telehealth, a provider of transformative behavioral health services, introduced the Iris Insights and Virtual Clinic platforms to integrate behavioral healthcare into their patient journeys seamlessly.

Key U.S. Virtual Care Company Insights

Key participants in the U.S. virtual care market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key U.S. Virtual Care Companies:

- CVS Health

- virtuwell.com.

- MeMD

- HealthTap, Inc.

- iCliniq

- Teladoc Health Inc.

- American Well

- MDLIVE

- Doctor On Demand

- Sesame, Inc.

Recent Developments

-

In October 2024, Confluence Health, a Washington -based healthcare company, partnered with KeyCare, a virtual care provider, to allow patients to access care 24/7 from home or travel across Washington seamlessly.

-

In February 2024, AvaSure, an AI-powered virtual care company, launched AvaSure Episodic, a solution for virtual episodic care. It has the following features,

U.S. Virtual Care Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.40 billion

Revenue forecast in 2030

USD 46.29 billion

Growth rate

CAGR of 32.35% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Consultation mode and application

Country scope

U.S.

Key companies profiled

CVS Health; virtuwell.com.; MeMD; HealthTap, Inc.; iCliniq; Teladoc Health Inc.; American Well; MDLIVE; Doctor On Demand; Sesame, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Virtual Care Market Segmentation

This report forecasts revenue growth in the U.S. virtual care market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. virtual care market based on consultation mode, and application.

-

Consultation Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Audio

-

Messaging

-

Video

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Family Medicine

-

Internal Medicine

-

Cardiology

-

Pediatrics

-

Endocrionology

-

Rheumatology

-

Pulmonology

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. virtual care market size was estimated at USD 8.83 billion in 2024 and is expected to reach USD 11.40 billion in 2025.

b. The U.S. virtual care market is expected to grow at a compound annual growth rate of 32.35% from 2025 to 2030 to reach USD 46.29 billion by 2030.

b. The audio segment dominated the U.S. virtual care market with a share of 45.4% in 2024. In the United States, nearly 50 % of the 85.5 million virtual interactions covered by the Kaiser Permanente System health plan were conducted via phone.

b. Some key players operating in the U.S. virtual care market include Teladoc Health, Inc., American Well Corporation, MDLIVE, Doctor on Demand, Inc., Virtuwell, CVS Health, MeMD, HealthTap, Inc., iCliniq, and Sesame, Inc. .

b. Key factors that are driving the U.S. virtual care market growth include strong government support, shift towards convenient care, and rising prevalence of chronic diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.