U.S. Viral Vector And Plasmid DNA Manufacturing Market Size, Share & Trends Analysis Report By Vector Type (AAV, Lentivirus), By Workflow (Upstream, Downstream), By Application, By End-use, By Disease, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-300-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

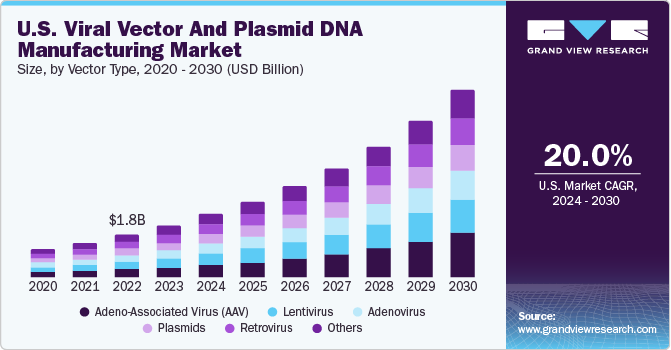

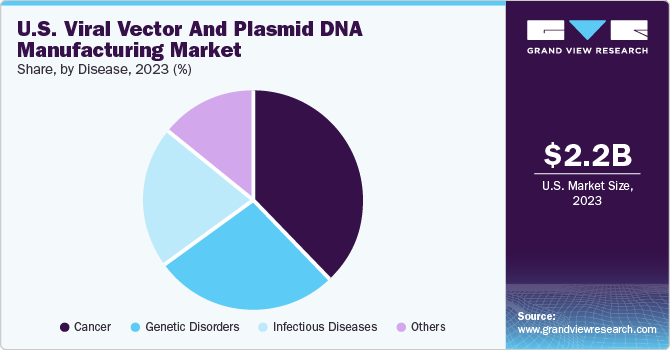

The U.S. viral vector and plasmid DNA manufacturing market size was estimated at USD 2.2 billion in 2023 and is anticipated to grow at a CAGR of 20.0% from 2024 to 2030. This can be attributed to the growing engagement of companies in research and product development in gene & cell therapy coupled with a substantial number of contract development organizations in the U.S. In addition, homegrown firms are expanding their manufacturing facilities in the country.

The U.S. viral vector and plasmid DNA manufacturing market accounted for a 42.0% share of the global market in 2023. The increasing number of government investments and the growing prevalence of targeted diseases fuel the market. In 2020, the Spinal Muscular Atrophy Foundation stated that approximately 10,000 to 25,000 adults and children in the U.S. were affected by spinal muscular atrophy, making it a relatively common disease among rare diseases.

Due to many contract manufacturers and research organizations, the cell & gene therapy manufacturing market space is highly competitive. In addition, the entry of new players and expanding facilities by existing players have intensified the competition in the U.S. market. Thermo Fisher Scientific, Inc. and Lonza are major players in this market. These companies have undertaken various strategies to strengthen their market presence. For instance, in July 2021, Thermo Fisher Scientific Inc. in Carlsbad, California, announced the addition of a new current GMP viral vectors and plasmid DNA manufacturing facility, allowing the company to meet the growing demand for vital mRNA-based vaccines and plasmid DNA-based therapies.

Vector Type Insights

Based on vector type, the adeno-associated virus (AAV) segment dominated the market with the largest revenue share of 19.8% in 2023. Recovery of vectors and clarification process using robust technologies boost revenue generation through this segment. Centrifugation or Tangential-Flow Filtration (TFF) followed by an alkaline or heat lysis method is majorly employed to recover pDNA from biomass. In addition, filtration techniques using depth filters are used to carry out the harvesting process for vector manufacturing. The most widely adopted method for harvesting lentivectors involves ultracentrifugation at 50,000 g/2h. At this ultra-high speed, current rotors generally exhibit a small volume capacity.

The lentivirus segment is projected to grow at the fastest CAGR of 20.1% during the forecast period. Lentiviral vectors are most frequently produced through transient transfection of adherent human-derived HEK293 cell lines in bovine serum-containing media using Polyethylenimine (PEI) transfection reagent. Although adherent systems-based small-scale lentivirus manufacturing is not expensive, it is difficult for companies to conduct high-throughput screening experiments. Owing to this, bioprocessing technology is being used to produce lentiviruses in quantities ranging from a few to hundreds of liters. This, in turn, is aiding in revenue generation for this segment.

Workflow Insights

Based on workflow, the downstream processing segment dominated the market with the largest revenue share of 53.3% in 2023. Downstream processes involve several purification methods that consist of multiple steps and are distinguished into three stages: capture, intermediate purification, and polishing. Chromatography and ultrafiltration techniques are employed for intermediate purification and final polishing steps. Chromatography techniques using ion exchange and affinity methods are the most preferred techniques employed in the industry. Nevertheless, these methods pose certain challenges, for example, these techniques require other purification methods for product purification, which results in loss of yield.

The upstream processing segment is expected to grow at a CAGR of 19.1% over the forecast period. The initial processing stage, known as upstream processing, involves introducing cells to the virus, growing these cells, and then extracting the virus from them. The growth in innovative product development, such as the ambr 15 microbioreactor system for high throughput upstream process development, is anticipated to boost this particular area.

Application Insights

Based on the application, the vaccinology segment accounted for the largest revenue share of 22.0% in 2023. The high demand for vaccines in several health conditions and cancer is anticipated to drive market growth over the forecast period.

The cell therapy segment is expected to grow at the fastest CAGR over the forecast period. Cell therapy-based medicines are increasingly being adopted owing to the advent of next-generation transfer vectors. These vectors are proven to be safe and efficacious. Patient samples are generally expanded, extracted, and further transduced by using gene therapy vectors. These modified transduced cells are then re-implanted into patients for therapeutic applications.

End-use Insights

Based on end-use, the research institutes segment dominated the market with the largest revenue share of 58.0% in 2023 owing to the high demand for vectors for conducting research and the increasing involvement of scientific communities in gene and cell therapy research.

The pharmaceutical & biotechnology companies segment is expected to grow at a CAGR of 20.3% over the forecast period. With increasing investments in the field of cell and gene therapy, several biopharmaceutical companies are shifting their focus toward these advanced therapies. This has resulted in more research studies being conducted by companies to evaluate the potential of gene and cell therapies. Biotechnology and pharmaceutical companies are actively engaged in development of advanced therapies for several life-threatening diseases. Abeona Therapeutics is actively assessing AAV9-based gene therapies for CLN1 and CLN3 diseases. Similarly, a U.S.-based company-StrideBio-offers AAV-mediated gene therapy solutions based on their research studies.

Disease Insights

Based on diseases, the cancer segment dominated the market with the largest revenue share of 38.0% in 2023. An increase in the adoption of vectors for the development of cancer therapies, a large number of research programs, and recent approvals of gene therapy products have led to the growth of the market. Companies have a robust pipeline of cancer gene therapy products, which is expected to boost market growth throughout the forecast period.

The genetic disorders are expected to grow rapidly during the forecast period. Genetic diseases are most commonly congenital; however, some diseases can be acquired by random mutations. The most common genetic diseases include sickle cell anemia and hemophilia, which are characterized by the formation of blood clots and the production of hemoglobin, affecting the oxygen-carrying capacity of the blood.

Key U.S. Viral Vector And Plasmid DNA Manufacturing Company Insights

Thermo Fisher Scientific, Inc., Catalent Inc., and Waisman Biomanufacturing are some of the key players operating in the market.

-

Thermo Fisher Scientific, Inc. manufactures and provides laboratory reagents, equipment, analytical instruments, consumables, & diagnostic products. The company operates through numerous brands, such as Thermo Scientific, Applied Biosystems, Fisher Scientific, Invitrogen, and Unity Lab Services. It operates in four reportable segments: analytical instruments, life sciences solutions, specialty diagnostics, and laboratory products & services.

-

Catalent, Inc. serves various pharmaceutical companies through its innovative manufacturing services. The company operates across five continents with 30 facilities that are located in different parts of the world. Its services include the manufacturing and packing of a wide variety of injectable, oral, and respiratory dosage forms. The company develops and delivers more than 70 billion doses for over 7,000 products.

Key U.S. Viral Vector And Plasmid DNA Manufacturing Companies:

- Thermo Fisher Scientific, Inc.

- Catalent Inc.

- Waisman Biomanufacturing

- Genezen

- Revvity (SIRION Biotech)

- Virovek Incorporation

- Charles River Laboratories (Cobra Biologics)

- RegenxBio, Inc.

Recent Developments

-

In August 2022, Thermo Fisher Scientific Inc. expanded its viral vector manufacturing unit in Plainville Massachusetts. This facility would support the testing, development, and manufacturing of viral vectors, which is important to commercialize & develop gene therapies.

U.S. Viral Vector And Plasmid DNA Manufacturing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 2.2 billion |

|

Revenue forecast in 2030 |

USD 8.0 billion |

|

Growth rate |

CAGR of 20.0% from 2024 to 2030 |

|

Base year |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Vector type, workflow, application, end-use, disease |

|

Country scope |

U.S. |

|

Key companies profiled |

Thermo Fisher Scientific, Inc.; Catalent Inc.; Waisman Biomanufacturing; Genezen; Revvity (SIRION Biotech); BioMarin; Virovek Incorporation; Charles River Laboratories (Cobra Biologics); RegenxBio, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Viral Vector And Plasmid DNA Manufacturing Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. viral vector and plasmid DNA manufacturing market report based on vector type, workflow, application, end use, and disease:

-

Vector Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Adenovirus

-

Retrovirus

-

Adeno-Associated Virus (AAV)

-

Lentivirus

-

Plasmids

-

Others

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Upstream Manufacturing

-

Vector Amplification & Expansion

-

Vector Recovery/Harvesting

-

-

Downstream Manufacturing

-

Purification

-

Fill Finish

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Antisense & RNAi Therapy

-

Gene Therapy

-

Cell Therapy

-

Vaccinology

-

Research Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biopharmaceutical Companies

-

Research Institutes

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Genetic Disorders

-

Infectious Diseases

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. viral vector and plasmid DNA manufacturing market size was estimated at USD 2.24 billion in 2023.

b. The U.S. viral vector and plasmid DNA manufacturing market is expected to witness a compound annual growth rate of 19.8% from 2024 to 2030 to reach USD 8.0 billion by 2030.

b. AAV is expected to witness a compound annual growth rate of 19.8% owing to the development of ocular and orthopedic gene therapy treatment exhibiting increased efficacy and efficiency.

b. Fujifilm Diosynth Biotechnologies; Thermo Fisher Scientific; Catalent Inc.; Waisman Biomanufacturing; Genezen laboratories; Virovek Incorporation; BioMarin Pharmaceutical; RegenxBio, Inc.; Avidbio; Packgene Biotech; Elegen; and Addgene are some key companies operating in the U.S. viral vector and plasmid DNA manufacturing market.

b. Some of the factors boosting the market growth include robust pipeline for gene therapies and viral vector vaccines and technological advancements in manufacturing vectors.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."