U.S. Video Streaming Market Size, Share & Trends Analysis Report By Streaming Type, By Solution, By Platform, By Service, By Revenue Model, By Deployment Type, By User, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-203-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. Video Streaming Market Size & Trends

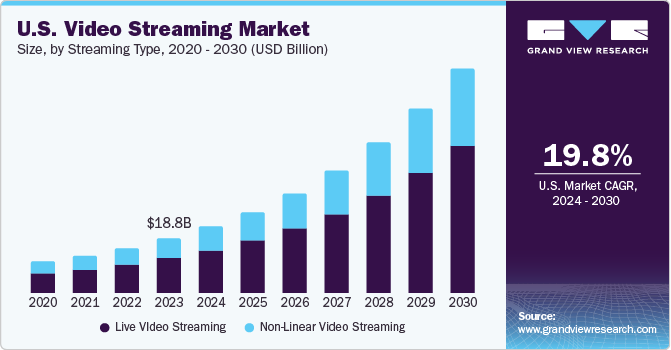

The U.S. video streaming market size was estimated at USD 18.79 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 19.8% between 2024 and 2030. Prevailing trends, such as rising internet penetration, evolving consumer preferences and increasing footfall of 5G services, have brought a paradigm shift in the regional landscape. Low latency and tremendous speed have made 5G a valuable proposition for faster downloads, enhanced performance, and smoother playback. Homes using online video services, including Netflix, Hulu, Disney+, and Amazon Prime, could overtake traditional multichannel in the ensuing period. Better streaming and high-profile theatrical content and digital sports make video streaming services a happy hunting ground.

Shifting user behavior towards 4K, 8K, full HD, and HD has engineered robust market growth in the U.S. The global average data consumption per smartphone from video streaming is likely to be pegged at 16.3 GB (by the end of 2024). The ubiquitous presence of streaming services in American homes has encouraged leading players to inject funds into the landscape. For instance, Netflix reported (as of December 31, 2023) around 260.28 million global paid memberships, with the U.S. and Canada accounting for 80.13 million subscribers.

While the COVID-19 pandemic wracked havoc globally, video streaming giants cashed in on the unprecedented demand for home entertainment. With theaters being shut down and consumers spending more leisure time at home, at-home video consumption grew by leaps and bounds. The outbreak also led to the launch of new content and services, as staying put in homes led to soaring demand for OTT services. For instance, New York, Washington, Orlando, Norfolk, Milwaukee, Denver, Chicago, Illinois and California witnessed a phenomenal rise in streaming consumption.

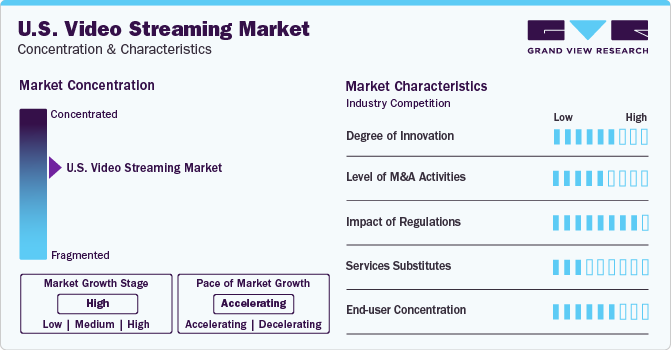

Market Concentration and Characteristics

As U.S. consumers are expected to inject funds into video entertainment in 2024 and beyond, innovations are likely to hold precedents in the landscape. For instance, Prime Video uses computer vision to automatically detect recaps, credits and introductions in content at scale. In April 2023, the American video streaming behemoth joined forces with the University of Texas at Austin to introduce the UT Austin-Amazon Science Hub. Prime Video is working on research areas, including video picture quality, compression and delivery; video understanding and augmentation; forecasting, automation and metrics; and search and recommendation.

Technology advancements in machine learning and AI have brought a tectonic shift in content creation, distribution and consumption. In essence, hybrid video on demand is opening new avenues of growth in the North American region. Trends, such as improved streaming quality, automated video editing and production (through AI), content personalization, and combatting against online piracy (through forensic watermarking and enhanced monitoring & detection), redefine the regional outlook.

Industry dynamics, such as mergers & acquisitions, regulations, availability of substitutes and end-user concentration, have reshaped the U.S. video streaming market revenue. To illustrate, in August 2023, sports leagues, including the NBA, NFL, and UFC, pushed for updates in the Digital Millennium Copyright Act (DMCA) for fast takedowns on pirate systems.

Streaming companies could witness tax streaming services (akin to local networks) as some states and cities have implemented taxes, most of which are passed on to the end-use customer. Prominently, video streaming has challenged the traditional relationship among service providers, users, copyright owners, and intermediaries.

Streaming Type Insights

The live video streaming segment spearheaded the market, accounting for 64.2% of the U.S. video streaming market revenue share in 2023. An unprecedented surge in internet penetration and heightened demand for ad-free content, analytics tracking, and mobile viewing have boded well for the market forecast. Live streaming in 4K, 3D, and mono formats modes will continue to receive an impetus. Stakeholders are expected to bank on live streaming for increased engagement and real-time feedback.

While live streaming will continue to amass traction, non-linear (video-on-demand) streaming will be highly sought-after across the region. American consumers have depicted a strong demand for VOD due to convenience and ease as it is pre-recorded and can be made available for streaming anytime. In essence, video-on-demand has added a fillip to the U.S. market with surging footfall of summits, town halls, exhibitions, and conferences. U.S. consumers have also depicted demand for news and sports (apart from series and movies), prompting industry leaders to infuse funds into the non-linear portfolio.

Solution Insights

The over-the-top (OTT) segment contributed the largest revenue share in 2023. Video streaming behemoths, such as Netflix, Disney+ and Amazon Prime Video, have observed notable growth since the lockdown. OTT giants have even joined forces with film studios and producers to gain a competitive edge in the market. Predominantly, advanced IT infrastructure and expanding footfall of 5G have fared well for the market growth.

Pay TV has continued to gain an impetus as a home entertainment device in the North American country. While the challenges posed by OTT have been evident, sports enthusiasts have often banked on cable TV to watch live games. Moreover, U.S. consumers seek pay TV networks for live broadcasts of events, news updates, live broadcasts and breaking stories. Besides, areas with unreliable internet connections are expected to observe robust demand for pay TV.

Platform Insights

The smartphones and tablets segment accounted for the largest market revenue share in 2023. The growth is partly due to the soaring adoption of advanced devices across the region. In April 2023, the U.S. Census Bureau noted that four out of five households with children owned tablets. To put this in perspective, 64% of U.S. households owned a tablet computer in 2021. Furthermore, 5G penetration and soaring demand for iPhone and Android devices reinforce the growth outlook of smartphones.

Gaming consoles have emerged as one of the most common home entertainment devices. Flagship products of Xbox and Microsoft have redefined the gaming industry. With internet connection becoming more robust and 5G becoming palpable, gaming traffic has witnessed an unprecedented spike. The emergence of 4K TVs has furthered the penetration of home consoles. Prevailing trends suggest AR/VR-based consoles could hold traction in the ensuing period.

Service Insights

The training and support service contributed significant U.S. video streaming market revenue share in 2023 and will continue to gain an uptick on the back of soaring demand for employee training and development. Video streaming (both live and pre-recorded) has bridged the gap between learners and educators, emerging as a game-changer in the training and support landscape. To illustrate, live video streaming can bolster real-time collaboration and eradicate the need for travel and accommodation expenses.

Managed services have received an impetus to take away the burden of maintaining the infrastructure, underpin the personalization experience, and prevent downtime. Besides, video conferencing solutions have gained an uptake as corporates continue to bank on innovative technologies. Furthermore, managed OTT platforms have gained ground in the wake of surging demand for subscription management, content management and content analytics.

Revenue Model Insights

The subscription-based model depicted the largest revenue share in 2023 and is expected to gain considerable traction during the forecast period. Subscription-based revenue (with recurring annual or monthly fees) has amassed huge popularity across the U.S. The trend has prompted industry leaders to inject funds into high-quality and original content. Lately, video streaming service providers have focused on OTT content covering meditations, training, workouts and recipes.

The advertising segment is poised to exhibit notable growth against the backdrop of the expectation of increased revenue by selling advertising space to other businesses. For instance, YouTube offers pre-roll, mid-roll and in-video ads for advertising companies. Predominantly, Pay TV is one of the largest markets for advertisers. In addition, advertising is also seen as a considerable revenue source during live streaming of sports events and tournaments.

Deployment Type Insights

The cloud deployment segment exhibited the largest revenue share in 2023 and will observe an uptick on the back of increased scalability. Robust projection is partly attributed to the demand for personalized content and the adoption of a pay-as-you-go business model. Predominantly, cloud-based solutions offer agility, capacity, and flexibility to handle fluctuations in traffic. The advanced solution has also helped video service providers to monetize offerings through targeted advertising.

The on-premise deployment has gained prominence to avoid bandwidth constraints and foster smooth network accessibility for seamless video streaming. Besides, sensitive content is profoundly retained on-premise for security and control. The growth is also attributed to the innate ability of the model to ensure virtually 100% uptime by negating service outages and interruptions. In essence, on-premise for OTT platforms could be resource-intensive with high upfront costs.

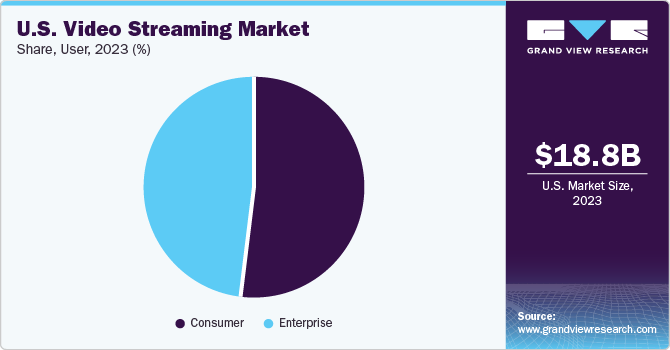

User Insights

The consumer segment accounted for the largest revenue share in 2023 and is poised to observe an uptick on the back of trends for gaming, e-learning, real-time entertainment, and social networking. In essence, live video and non-linear streaming providing e-learning and gaming have witnessed a massive uptick among consumers. Consumers will continue to bank on video streaming of theater performances, live concerts, vising museums and sporting events.

Enterprises have emerged as significant recipients of video streaming services as the demand for training, knowledge sharing & collaborations, and marketing & client engagement have soared recently. In essence, video streaming services have been sought for corporate communication to help leaders convey important information effectively. Corporations are banking on video platforms to bolster their internal and external communication strategies.

Key U.S. Video Streaming Company Insights

Some of the key players operating in the market include Apple Inc., Google LLC, IBM and Netflix, Inc. Some dynamics reshaping the U.S. market are delineated below:

-

In January 2023, IBM announced the rollout of a live mobile video streaming app to foster workplace communication globally. It is reported that the features added to the app are in line with businesses, such as closed captioning (AI-powered).

-

In March 2023, Apple reportedly acquired WaveOne, a startup that uses AI to compress videos. The AI-powered scene and object detection is expected to help understand a video frame and save bandwidth.

-

In February 2024, Netflix was reported to be contemplating a foray into video games with the launch of the streaming service. The twin innovations of subscription and streaming can redefine the gaming landscape.

Some emerging companies, such as Hulu and Stacked, have augmented their strategies to gain a competitive edge in the industry.

-

In November 2023, The Walt Disney Company announced it would acquire Hulu in a USD 8.6 billion deal. It is likely to help the former underpin its streaming business.

-

In August 2022, Stacked was reported to be making a video streaming platform for gaming content—Twitch for web3 users. The startup is reconfiguring its video streaming service with NFT and crypto features.

Key U.S. Video Streaming Companies:

- Amazon Web Services, Inc.

- Apple Inc.

- Cisco Systems, Inc.

- Google LLC

- Kaltura, Inc.

- Netflix, Inc.

- International Business Machine Corporation (IBM Cloud Video)

- Wowza Media Systems, LLC

- Hulu, LLC (Walt Disney)

Recent Developments

-

In February 2023, Amazon asserted that it augmented content spending to USD 16.6 billion in 2022. Approximately USD 7 billion of that figure was earmarked for Amazon Originals, licensed third-party video content included with Prime and live sports programming.

-

In October 2023, Apple is gearing up to inject funds into Formula 1 as it contemplates gaining exclusive streaming rights for Formula 1 racing. The American giant is apparently seeking a 7-year deal, while global rights are expected to become accessible five years into the deal.

U.S. Video Streaming Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 22.42 billion |

|

Revenue Forecast in 2030 |

USD 66.41 billion |

|

Growth Rate |

CAGR of 19.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Streaming type; Solution; Platform; Service; Revenue Model; Deployment Type; User |

|

Key Companies Profiled

|

Amazon Web Services, Inc.; Apple Inc.; Cisco Systems, Inc.; Google LLC; Kaltura, Inc.; Netflix, Inc.; International Business Machine Corporation (IBM Cloud Video); Wowza Media Systems, LLC; Hulu, LLC (Walt Disney) |

|

Customization Scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Video Streaming Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. video streaming market report based on streaming type, solution, platform, service, revenue model, deployment type, and user.

-

Streaming Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Live Video Streaming

-

Non-Linear Video Streaming (Video on Demand)

-

-

Solution Outlook (Revenue, USD Billion, 2017 - 2030)

-

Internet Protocol TV

-

Over-the-Top (OTT)

-

Pay TV

-

-

Platform Outlook (Revenue, USD Billion, 2017 - 2030)

-

Gaming Consoles

-

Laptops & Desktops

-

Smartphones & Tablets

-

Smart TV

-

-

Service Outlook (Revenue, USD Billion, 2017 - 2030)

-

Consulting

-

Managed Services

-

Training & Support

-

-

Revenue Model Outlook (Revenue, USD Billion, 2017 - 2030)

-

Advertising

-

Rental

-

Subscription

-

-

Deployment Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-Premises

-

-

User Outlook (Revenue, USD Billion, 2017 - 2030)

-

Enterprise

-

Corporate Communications

-

Knowledge Sharing & Collaborations

-

Marketing & Client Engagement

-

Training & Development

-

-

Consumer

-

Real-Time Entertainment

-

Web Browsing & Advertising

-

Gaming

-

Social Networking

-

E-Learning

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the U.S. video streaming market include Amazon Web Services, Inc.; Apple Inc.; Cisco Systems, Inc.; Google LLC; Kaltura, Inc.; Netflix, Inc.; International Business Machine Corporation (IBM Cloud Video); Wowza Media Systems, LLC; Hulu, LLC (Walt Disney)

b. Key factors that are driving the market growth include Technology advancements in machine learning and AI, and soaring Internet Penetration

b. The global U.S. video streaming market size was estimated at USD 18.79 billion in 2023 and is expected to reach USD 22.42 billion in 2024.

b. The global U.S. video streaming market is expected to grow at a compound annual growth rate of 19.8% from 2024 to 2030 to reach USD 66.41 billion by 2030.

b. Over-the-top (OTT) segment dominated the U.S. video streaming market with a share of 28.9% in 2019. This is attributable to the predominant advancement in IT infrastructure and expanding footfall of 5G have fared well for the market growth.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. U.S. Video Streaming Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.1.1. Technology advancements in machine learning and AI

3.3.1.2. Soaring Internet Penetration

3.3.2. Market Restraints Analysis

3.3.2.1. High Cost of Content Creation

3.3.3. Industry Opportunities

3.3.4. Industry Challenges

3.4. U.S. Video Streaming Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. U.S. Video Streaming Market: Streaming type Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. U.S. Video Streaming Market: Streaming type Movement Analysis, 2023 & 2030 (USD Billion)

4.3. Live Video Streaming

4.3.1. Live Video Streaming Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

4.4. Non-Linear Video Streaming

4.4.1. Non-Linear Video Streaming Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

Chapter 5. U.S. Video Streaming Market: Solution Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. U.S. Video Streaming Market: Solution Movement Analysis, 2023 & 2030 (USD Billion)

5.3. Internet Protocol TV

5.3.1. Internet Protocol TV Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

5.4. Over-the-Top (OTT)

5.4.1. Over-the-Top (OTT) Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

5.5. Pay TV

5.5.1. Pay TV Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

Chapter 6. U.S. Video Streaming Market: Platform Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. U.S. Video Streaming Market: Platform Movement Analysis, 2023 & 2030 (USD Billion)

6.3. Gaming Consoles

6.3.1. Gaming Consoles Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.4. Laptops & Desktops

6.4.1. Laptops & Desktops Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.5. Smartphones & Tablets

6.5.1. Smartphones & Tablets Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

6.6. Smart TV

6.6.1. Smart TV Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

Chapter 7. U.S. Video Streaming Market: Service Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. U.S. Video Streaming Market: Service Movement Analysis, 2023 & 2030 (USD Billion)

7.3. Consulting

7.3.1. Consulting Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

7.4. Managed Services

7.4.1. Managed Services Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

7.5. Training & Support

7.5.1. Training & Support Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

Chapter 8. U.S. Video Streaming Market: Revenue Model Estimates & Trend Analysis

8.1. Segment Dashboard

8.2. U.S. Video Streaming Market: Revenue Movement Analysis, 2023 & 2030 (USD Billion)

8.3. Advertising

8.3.1. Advertising Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

8.4. Rental

8.4.1. Rental Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

8.5. Subscription Based

8.5.1. Subscription Based Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

Chapter 9. U.S. Video Streaming Market: Deployment Type Estimates & Trend Analysis

9.1. Segment Dashboard

9.2. U.S. Video Streaming Market: Deployment Type Movement Analysis, 2023 & 2030 (USD Billion)

9.3. Cloud

9.3.1. Cloud Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

9.4. On-Premises

9.4.1. On-Premises Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

Chapter 10. U.S. Video Streaming Market: User Estimates & Trend Analysis

10.1. Segment Dashboard

10.2. U.S. Video Streaming Market: User Movement Analysis, 2023 & 2030 (USD Billion)

10.3. Enterprise

10.3.1. Enterprise Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Billion)

10.4. Consumer

10.4.1. Consumer Market Revenue Estimates and Forecasts, 2017 - 2030 (

Chapter 11. Competitive Landscape

11.1. Recent Developments & Impact Analysis by Key Market Participants

11.2. Company Categorization

11.3. Company Market Positioning

11.4. Company Market Share Analysis

11.5. Company Heat Map Analysis

11.6. Strategy Mapping

11.6.1. Expansion

11.6.2. Mergers & Acquisition

11.6.3. Partnerships & Collaborations

11.6.4. New Product Launches

11.6.5. Research And Development

11.7. Company Profiles

11.7.1. Amazon Web Services, Inc.

11.7.1.1. Participant’s Overview

11.7.1.2. Financial Performance

11.7.1.3. Product Benchmarking

11.7.1.4. Recent Developments

11.7.2. Apple Inc.

11.7.2.1. Participant’s Overview

11.7.2.2. Financial Performance

11.7.2.3. Product Benchmarking

11.7.2.4. Recent Developments

11.7.3. Cisco Systems, Inc.

11.7.3.1. Participant’s Overview

11.7.3.2. Financial Performance

11.7.3.3. Product Benchmarking

11.7.3.4. Recent Developments

11.7.4. Google LLC

11.7.4.1. Participant’s Overview

11.7.4.2. Financial Performance

11.7.4.3. Product Benchmarking

11.7.4.4. Recent Developments

11.7.5. Kaltura, Inc.

11.7.5.1. Participant’s Overview

11.7.5.2. Financial Performance

11.7.5.3. Product Benchmarking

11.7.5.4. Recent Developments

11.7.6. Netflix, Inc.

11.7.6.1. Participant’s Overview

11.7.6.2. Financial Performance

11.7.6.3. Product Benchmarking

11.7.6.4. Recent Developments

11.7.7. International Business Machine Corporation (IBM Cloud Video)

11.7.7.1. Participant’s Overview

11.7.7.2. Financial Performance

11.7.7.3. Product Benchmarking

11.7.7.4. Recent Developments

11.7.8. Wowza Media Systems, LLC

11.7.8.1. Participant’s Overview

11.7.8.2. Financial Performance

11.7.8.3. Product Benchmarking

11.7.8.4. Recent Developments

11.7.9. Hulu, LLC (Walt Disney)

11.7.9.1. Participant’s Overview

11.7.9.2. Financial Performance

11.7.9.3. Product Benchmarking

11.7.9.4. Recent Developments

List of Tables

Table 1 U.S. Video Streaming market by streaming type, 2017 - 2030 (USD Million)

Table 2 U.S. Video Streaming market by solution, 2017 - 2030 (USD Million)

Table 3 U.S. Video Streaming market by platform, 2017 - 2030 (USD Million)

Table 4 U.S. Video Streaming market by service, 2017 - 2030 (USD Million)

Table 5 U.S. Video Streaming market by revenue model, 2017 - 2030 (USD Million)

Table 6 U.S. Video Streaming market by deployment type, 2017 - 2030 (USD Million)

Table 7 U.S. Video Streaming market by user, 2017 - 2030 (USD Million)

Table 8 U.S. Video Streaming market by country, 2017 - 2030 (USD Million)

Table 9 Key companies launching new products/services

Table 10 Key companies engaged in mergers & acquisition

Table 11 Key companies engaged in Research & development

Table 12 Key Companies engaged in expansion

List of Figures

Fig. 1 U.S. Video Streaming Market segmentation

Fig. 2 Market research process

Fig. 3 Information procurement

Fig. 4 Primary research pattern

Fig. 5 Market research approaches

Fig. 6 Market formulation & validation

Fig. 7 U.S. Video Streaming market snapshot

Fig. 8 U.S. Video Streaming market segment snapshot

Fig. 9 U.S. Video Streaming market competitive landscape snapshot

Fig. 10 Market driver impact analysis

Fig. 11 Market restraint impact analysis

Fig. 12 U.S. Video Streaming Market, streaming type outlook key takeaways (USD Million)

Fig. 13 U.S. Video Streaming Market: streaming type movement analysis 2023 & 2030 (USD Million)

Fig. 14 Live Video Streaming market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 15 Non-Linear Video Streaming (Video on Demand) market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 16 U.S. Video Streaming Market: solution outlook key takeaways (USD Million)

Fig. 17 U.S. Video Streaming Market: solution movement analysis 2023 & 2030 (USD Million)

Fig. 18 Internet Protocol TV market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 19 Over-the-Top (OTT) market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 20 Pay TV market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 21 U.S. Video Streaming Market: platform outlook key takeaways (USD Million)

Fig. 22 U.S. Video Streaming Market: platform movement analysis 2023 & 2030 (USD Million)

Fig. 23 Gaming Consoles market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 24 Laptops & Desktops market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 25 Smartphones & Tablets market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 26 Smart TV market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 27 U.S. Video Streaming Market: service outlook key takeaways (USD Million)

Fig. 28 U.S. Video Streaming Market: service movement analysis 2023 & 2030 (USD Million)

Fig. 29 Consulting market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 30 Managed Services market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 31 Training & Support market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 32 U.S. Video Streaming Market: revenue model outlook key takeaways (USD Million)

Fig. 33 U.S. Video Streaming Market: revenue model movement analysis 2023 & 2030 (USD Million)

Fig. 34 Advertising market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 35 Rental market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 36 Subscription market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 37 U.S. Video Streaming Market: deployment type outlook key takeaways (USD Million)

Fig. 38 U.S. Video Streaming Market: deployment type movement analysis 2023 & 2030 (USD Million)

Fig. 39 Cloud market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 40 On-Premises market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 41 U.S. Video Streaming Market: User outlook key takeaways (USD Million)

Fig. 42 U.S. Video Streaming Market: User movement analysis 2023 & 2030 (USD Million)

Fig. 43 Enterprise market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 44 Consumer market revenue estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 45 Regional marketplace: Key takeaways

Fig. 46 U.S. Video Streaming Market: Regional outlook, 2023 & 2030 (USD Million)

Fig. 47 U.S. Video Streaming market estimates and forecasts, 2017 - 2030 (USD Million)

Fig. 48 Strategy framework

Fig. 49 Company Categorization

Market Segmentation

- U.S. Video Streaming Market, Streaming Type Outlook (Revenue, USD Billion, 2017 - 2030)

- Live Video Streaming

- Non-Linear Video Streaming (Video on Demand)

- U.S. Video Streaming Market, Solution Outlook (Revenue, USD Billion, 2017 - 2030)

- Internet Protocol TV

- Over-the-Top (OTT)

- Pay TV

- U.S. Video Streaming Market, Platform Outlook (Revenue, USD Billion, 2017 - 2030)

- Gaming Consoles

- Laptops & Desktops

- Smartphones & Tablets

- Smart TV

- U.S. Video Streaming Market, Service Outlook (Revenue, USD Billion, 2017 - 2030)

- Consulting

- Managed Services

- Training & Support

- U.S. Video Streaming Market, Revenue Model Outlook (Revenue, USD Billion, 2017 - 2030)

- Advertising

- Rental

- Subscription

- U.S. Video Streaming Market, Deployment Type Outlook (Revenue, USD Billion, 2017 - 2030)

- Cloud

- On-Premises

- U.S. Video Streaming Market, User Outlook (Revenue, USD Billion, 2017 - 2030)

- Enterprise

- Corporate Communications

- Knowledge Sharing & Collaborations

- Marketing & Client Engagement

- Training & Development

- Consumer

- Real-Time Entertainment

- Web Browsing & Advertising

- Gaming

- Social Networking

- E-Learning

Report content

Qualitative Analysis

- Industry overview

- Industry trends

- Market drivers and restraints

- Market size

- Growth prospects

- Porter’s analysis

- PESTEL analysis

- Key market opportunities prioritized

- Competitive landscape

- Company overview

- Financial performance

- Product benchmarking

- Latest strategic developments

Quantitative Analysis

- Market size, estimates, and forecast from 2017 to 2030

- Market estimates and forecast for product segments up to 2030

- Regional market size and forecast for product segments up to 2030

- Market estimates and forecast for application segments up to 2030

- Regional market size and forecast for application segments up to 2030

- Company financial performance

Research Methodology

Grand View Research employs a comprehensive and iterative research methodology focused on minimizing deviance to provide the most accurate estimates and forecasts possible. The company utilizes a combination of bottom-up and top-down approaches for segmenting and estimating quantitative aspects of the market. In Addition, a recurring theme prevalent across all our research reports is data triangulation which looks market from three different perspectives. Critical elements of the methodology employed for all our studies include:

Preliminary data mining

Raw market data is obtained and collated on a broad front. Data is continuously filtered to ensure that only validated and authenticated sources are considered. In addition, data is also mined from a host of reports in our repository, as well as a number of reputed paid databases. For a comprehensive understanding of the market, it is essential to understand the complete value chain, and to facilitate this; we collect data from raw material suppliers, distributors as well as buyers.

Technical issues and trends are obtained from surveys, technical symposia, and trade journals. Technical data is also gathered from an intellectual property perspective, focusing on white space and freedom of movement. Industry dynamics with respect to drivers, restraints, and pricing trends are also gathered. As a result, the material developed contains a wide range of original data that is then further cross-validated and authenticated with published sources.

Statistical model

Our market estimates and forecasts are derived through simulation models. A unique model is created customized for each study. Gathered information for market dynamics, technology landscape, application development, and pricing trends are fed into the model and analyzed simultaneously. These factors are studied on a comparative basis, and their impact over the forecast period is quantified with the help of correlation, regression, and time series analysis. Market forecasting is performed via a combination of economic tools, technological analysis, industry experience, and domain expertise.

Econometric models are generally used for short-term forecasting, while technological market models are used for long-term forecasting. These are based on an amalgamation of the technology landscape, regulatory frameworks, economic outlook, and business principles. A bottom-up approach to market estimation is preferred, with key regional markets analyzed as separate entities and integration of data to obtain global estimates. This is critical for a deep understanding of the industry as well as ensuring minimal errors. Some of the parameters considered for forecasting include:

• Market drivers and restraints, along with their current and expected impact

• Raw material scenario and supply v/s price trends

• Regulatory scenario and expected developments

• Current capacity and expected capacity additions up to 2030

We assign weights to these parameters and quantify their market impact using weighted average analysis, to derive an expected market growth rate.

Primary validation

This is the final step in estimating and forecasting for our reports. Exhaustive primary interviews are conducted, on face to face as well as over the phone to validate our findings and assumptions used to obtain them. Interviewees are approached from leading companies across the value chain including suppliers, technology providers, domain experts, and buyers to ensure a holistic and unbiased picture of the market. These interviews are conducted across the globe, with language barriers overcome with the aid of local staff and interpreters. Primary interviews not only help in data validation but also provide critical insights into the market, current business scenario, and future expectations and enhance the quality of our reports. All our estimates and forecast are verified through exhaustive primary research with Key Industry Participants (KIPs) which typically include:

• Market-leading companies

• Raw material suppliers

• Product distributors

• Buyers

The key objectives of primary research are as follows:

• To validate our data in terms of accuracy and acceptability

• To gain an insight into the current market and future expectations

Data Collection Matrix

|

Perspective |

Primary research |

Secondary research |

|

Supply-side |

|

|

|

Demand-side |

|

|

Industry Analysis Matrix

|

Qualitative analysis |

Quantitative analysis |

|

|

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."