U.S. Video-based Automatic Incident Detection Market Size, Share & Trends Analysis Report By Application (Road, Tunnels, Highways, Bridges), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-296-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

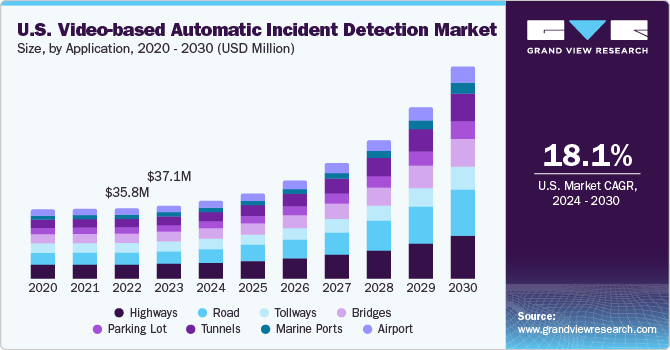

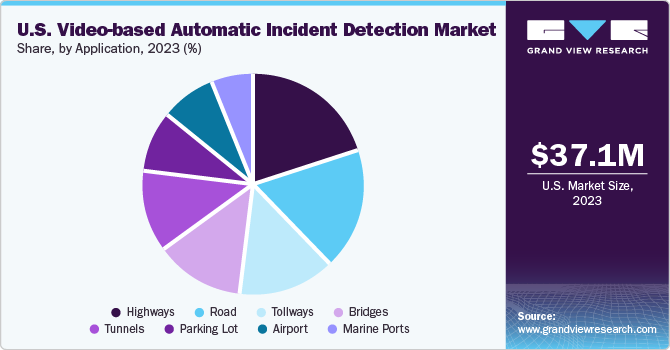

The U.S. video-based automatic incident detection market size was estimated at USD 37.1 million in 2023 and is expected to register a CAGR of 18.1% from 2024 to 2030. Traffic infractions, road accidents, and incidents occurring due to unpredictable risks cause harm to both human lives and wildlife, necessitating the implementation of video-based automatic incident detection solutions. These advanced systems can seamlessly capture, process, and deliver real-time incident data with unparalleled precision and reliability. Video-based automatic incident detection (AID) solutions empower traffic authorities and safety enforcement agencies to expedite decision-making processes and undertake prompt actions to minimize occurrences of unfortunate events.

Regulatory authorities and government agencies across the country are intensifying their efforts to encourage the implementation of technologically advanced transportation technologies that can minimize the risk of accidents, save lives, and create a hassle-free travel experience for commuters. For instance, in November 2023, the U.S. government launched the Advanced Transportation Technologies and Innovative Mobility Deployment (ATTIMD) Program. This initiative is set to allocate USD 60 million annually from 2021 to 2026 to support the deployment, installation, and utilization of cutting-edge technologies to improve the safety, efficiency, mobility, intermodal connectivity, and performance of transportation systems. Such initiatives are expected to create a positive atmosphere for transportation technologies, including video-based AID solutions.

The rising incidents of traffic rule violations, including over speeding, neglecting safety measures, wrong-way driving, and parking in restricted areas, are fueling the demand for advanced traffic management solutions. These solutions include speed enforcement cameras, sensors, video surveillance technologies, and dual audio systems, which are being widely deployed across roadways, airports, marine ports, highways, and parking areas. These technologies enable law enforcement agencies to oversee traffic operations remotely with a unified technology platform. Consequently, video-based automatic incident detection solutions significantly reduce the need for manual monitoring of daily traffic activities, thereby enhancing operational efficiency and reliability in identifying breaches, accidents, and unauthorized actions.

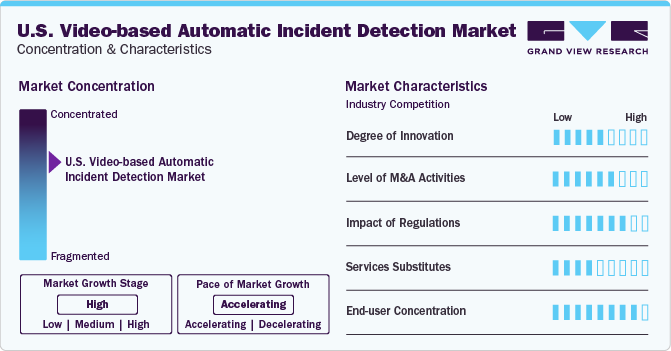

Market Concentration & Characteristics

The U.S. video-based automatic incident detection (AID) market growth is high, and the pace is accelerating. Integration of artificial intelligence (AI) and machine learning (ML) algorithms has significantly improved the capabilities of AID systems. These algorithms can analyze video feeds in real-time, identify patterns, and automatically detect various types of incidents, including accidents, vehicle breakdowns, and pedestrian crossings. ML models can also adapt and improve over time based on feedback and new data, leading to higher accuracy rates and fewer false positives.

Regulations governing data privacy and security, such as the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in the United States, impact the collection, processing, and storage of video data by AID systems. Compliance with these regulations is essential to protect the privacy rights of individuals and prevent unauthorized access or misuse of sensitive information.

Key players in the market include Axis Communications AB, Robert Bosch GmbH, Iteris, Inc., Q-Free ASA, and VIVOTEK Inc. These market players are aggressively pursuing strategic initiatives such as new product launches, R&D activities, and partnerships to retain and increase their market share. For instance, in January 2024, Axis Communications launched AXIS Radar Data Visualizer, an advanced analytics application that merges 180° radar detection with 180° panoramic multi-sensor imagery to help enhance situational awareness and significantly reduce false alarms. Ideal for overseeing vast open spaces, the application can precisely identify individuals up to 60 meters (200 feet) away and vehicles up to 85 meters (280 feet) away.

Application Insights

The highway segment dominated the market in 2023 and accounted for a revenue share of 20.3%. Rapidly growing highway infrastructure across the country, heightened regulatory pressures and government initiatives aimed at reducing road fatalities and improving traffic management are driving the adoption of video-based automatic incident detection (AID) systems across highways. Many states and cities in the U.S. are implementing stricter safety regulations and investing in ITS technologies as part of their road safety and infrastructure development programs.

The road segment is anticipated to witness a significant CAGR of 21.7% from 2024 to 2030. The constant rise in the number of vehicles on roads has led to an increase in traffic congestion and road accident incidences, necessitating more sophisticated traffic management and safety mechanisms. Video-based automatic incident detection systems for roads incorporate technologies such as wrong vehicle detection, stopped vehicle detection, pedestrian movement detection, abandoned objects on the road, and traffic flow monitoring.

Key U.S. Video-based Automatic Incident Detection Company Insights

The key industry participants include Robert Bosch GmbH; Teledyne FLIR LLC; Iteris, Inc.; and Sensys Networks, Inc.

-

Bosch provides integrated traffic management solutions that leverage video surveillance technology for incident detection and traffic monitoring. These solutions include intelligent traffic management systems, traffic signal controllers, and advanced analytics software for real-time data analysis.

-

Teledyne FLIR offers integrated solutions tailored to the transportation sector, including AID systems designed for highways, urban roads, tunnels, and bridges. These solutions combine thermal imaging cameras, video analytics software, and other sensors to provide comprehensive incident detection and monitoring capabilities.

Q-Free ASA, Dahua Technology Co., Ltd, and others are emerging players in the market.

-

Q-Free ASA develops advanced detection algorithms for video-based AID systems, aiming to improve the accuracy and efficiency of incident detection. These algorithms analyze video feeds from roadside cameras to identify anomalies such as accidents, vehicle breakdowns, debris on the road, or pedestrians in hazardous areas.

-

Dahua Technology offers a wide range of video surveillance products and solutions, including high-definition cameras, video management systems, and video analytics software. These solutions provide the foundation for Video-based AID systems by capturing real-time video footage of roadways, highways, and transportation infrastructure.

Key U.S. Video-based Automatic Incident Detection Companies:

- Axis Communications AB

- Dahua Technology Co., Ltd

- EFKON GmbH

- Hangzhou Hikvision Digital Technology Co., Ltd.

- IntelliVision

- Iteris, Inc.

- Miovision Technologies Incorporated

- Omnibond Systems, LLC.

- Q-Free ASA

- Robert Bosch GmbH

- Sensys Networks, Inc. (Citilog)

- Teledyne FLIR LLC

- TRAFICON

- Vaaaninfra.com

- Videonetics

- VIVOTEK Inc.

Recent Developments

-

In February 2024, Axis Communications AB announced the launch of AXIS Q1808-LE, a powerful bullet camera with greater image quality in 4K and ultra-high light sensitivity. A deep learning processing unit allows the advanced camera to collect and analyze data on the edge easily. Integration of AXIS Q1808-LE and AXIS Object Analytics can facilitate the identification and categorization of moving objects.

-

In January 2024, VIVOTEK Inc. announced a strategic partnership with Vaxtor Technologies, a provider of license plate recognition and vehicle identification software. The partnership brought together Vaxtor Technologies’ specialized knowledge in license plate recognition software and VIVOTEK Inc.’s expertise in surveillance technology, specifically emphasizing their collaboration on the newest series of LPR cameras.

-

In October 2023, Iteris, Inc. announced a new contract worth USD 1.2 million from the City of Yorba Linda in the U.S. state of California for ITS upgrade and traffic signal synchronization projects. The contract envisaged the company installing conduit, signal timing synchronization, and fiber optic communications systems and providing TMC improvements, system construction, and integration support.

U.S. Video-based Automatic Incident Detection Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 39.5 million |

|

Revenue forecast in 2030 |

USD 107.2 million |

|

Growth rate |

CAGR of 18.1% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Application |

|

Country scope |

U.S. |

|

Key companies profiled |

Axis Communications AB; Dahua Technology Co., Ltd; EFKON GmbH; Hangzhou Hikvision Digital Technology Co., Ltd.; IntelliVision; Iteris, Inc.; Miovision Technologies Incorporated; Omnibond Systems, LLC.; Q-Free ASA; Robert Bosch GmbH; Sensys Networks, Inc. (Citilog); Teledyne FLIR LLC; TRAFICON; Vaaaninfra.com; Videonetics; VIVOTEK Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Video-based Automatic Incident Detection Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. video-based automatic incident detection market based on application:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Road

-

Parking Lot

-

Highways

-

Tunnels

-

Bridges

-

Tollways

-

Marine Ports

-

Airport

-

Frequently Asked Questions About This Report

b. The U.S. video-based automatic incident detection market size was estimated at USD 37.1 million in 2023 and is expected to reach USD 39.5 million in 2024.

b. The U.S. video-based automatic incident detection market is expected to grow at a compound annual growth rate of 18.1% from 2024 to 2030 to reach USD 107.2 million by 2030.

b. The highway segment dominated the video-based AID market in 2023 and accounted for a revenue share of 20.3%. Rapidly growing highway infrastructure across the country, heightened regulatory pressures and government initiatives aimed at reducing road fatalities and improving traffic management are driving the adoption of video-based AID systems across highways.

b. The key industry participants include Axis Communications AB, Dahua Technology Co., Ltd, EFKON GmbH , Hangzhou Hikvision Digital Technology Co., Ltd., IntelliVision, Iteris, Inc., Miovision Technologies Incorporated, Omnibond Systems, LLC., Q-Free ASA, Robert Bosch GmbH, Sensys Networks, Inc. (Citilog), Teledyne FLIR LLC, TRAFICON, Vaaaninfra.com, Videonetics, VIVOTEK Inc.

b. The rising incidents of traffic rule violations, including overspeeding, neglecting safety measures, wrong-way driving, and parking in restricted areas, are fueling the demand for advanced traffic management solutions. These solutions include speed enforcement cameras, sensors, video surveillance technologies, and dual audio systems, which are being widely deployed across roadways, airports, marine ports, highways, and parking areas.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."