U.S. Veterinary Point Of Care Diagnostics Market Size, Share & Trends Analysis Report By Product, By Animal Type, By Sample Type, By Indication, By Testing Category, By End-Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-227-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

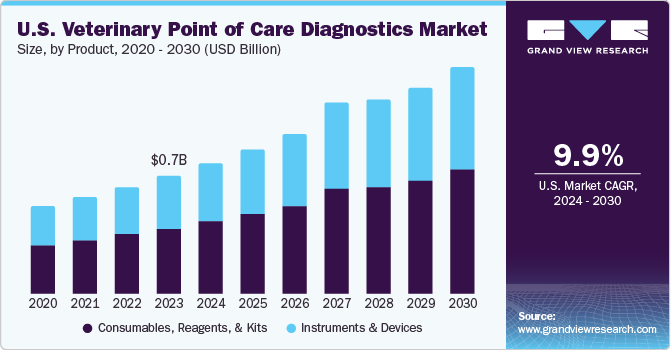

The U.S. veterinary point of care diagnostics market size was valued at USD 0.7 billion in 2023 and is estimated to grow at a CAGR of 9.9% from 2024 to 2030.The market's growth is predominantly fueled by a surge in spending on pet-related products and services, expanding number of pet owners, advancements in technology, and a strong demand for point-of-care diagnostics.

The rise in companion animal population is anticipated to drive demand for veterinary healthcare services and increase overall spending on pets. In U.S., the pet industry's expenditure surged to USD 123.6 billion in 2021, with pet owners spending around USD 34.3 billion on veterinary care and products. Veterinary surgeries, such as soft tissue, cardiovascular, ophthalmic, dental, and orthopedic surgeries, have become more common. The cost associated with surgeries, hospitalization, follow-up care, and medications are expected to fuel market growth and present new opportunities over the forecast period.

The Point-of-Care (POC) diagnostic technology provides immediate results and is clinically relevant information without the need for a core diagnostic laboratory. Therefore, they have the potential to reduce cost and time associated with veterinary diagnosis. The lateral flow technology applied in POC veterinary lateral flow devices and dipsticks has been used for decades in the diagnosis of infectious diseases among animals.

Moreover, the high number of veterinary patient visits, and developed veterinary healthcare infrastructure is further expected to fuel the market growth. Companies are investing in R&D to develop point-of-care diagnostic equipment. For instance, IDEXX developed SDMA test kits, which make use of AI for assessing kidney functions in cats and dogs. Zoetis has a pipeline of point-of-care diagnostics, which is expected to be launched in the coming years. Heska also launched a range of point-of-care diagnostic products to broaden its product portfolio.

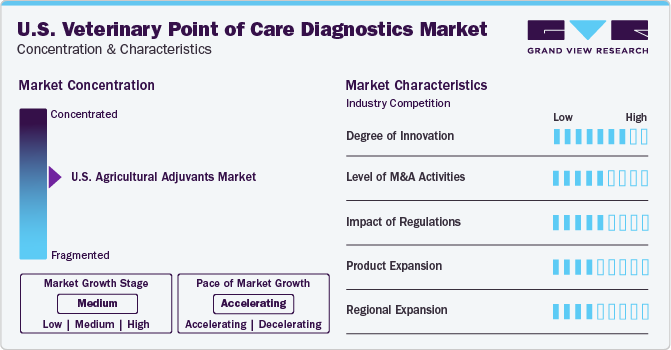

Market Concentration and Characteristics

The U.S. veterinary point of care diagnostics industry is moderately concentrated due to the presence of a few companies that hold higher shares operating in this industry.

Several research institutes and key companies are actively undertaking R&D activities to present innovative diagnostic testing and high efficacy for target consumers. For instance, in June 2023, Iowa State University's Veterinary Diagnostic Laboratory (VDL) introduced SmartChip, an innovative device. For this innovation, VDL received nearly USD 1.0 million grant from the U.S. Department of Agriculture's Animal and Plant Health Inspection Service (APHIS) to fund a project aiming to prepare for future disease outbreaks.

The key companies operating in U.S. Veterinary POC diagnostics industry are undertaking multiple strategic initiatives, such as acquisitions to strengthen their product portfolios and offer diverse technologically advanced and innovative products to customers. For instance, in March 2023, Mars Incorporated announced the acquisition of Heska Corporation. This acquisition would enable the Science & Diagnostics division of Mars Petcare to expand its diagnostic offerings and broadly promote point-of-care veterinary diagnostics to the global pet healthcare community.

Several industry players are entering into partnerships & collaborations to be able to grow and innovate & improve their competitiveness by combining the expertise and efforts of different organizations. For instance, in October 2023, The U.S. Department of Agriculture (USDA) announced a new partnership between the National Bio and Agro-Defense Facility (NBAF) and the National Animal Health Laboratory Network (NAHLN). This collaboration would ensure that all laboratory networks in the country are prepared to counteract the risk posed by cross-border and newly arising illnesses, to safeguard the national agriculture and food production sectors.

The regulatory bodies such as the U.S. FDA and United States Pharmacopeia support the key companies with approvals, thereby fulfilling the industry demand and gaining new clients. Such regulatory support further enhances industry growth.

Product Insights

Based on product, consumables; reagents; & kits segment dominated with a share of 55.7% in 2023. This growth is attributed to increasing number of diagnostics for zoonotic infection, cancer, and multiple other chronic diseases. To address the rising demand for Point-of-Care (POC) testing, there has been a notable increase in the focus on ensuring a continuous and rising supply of consumables. For instance, in June 2023, IDEXX launched a veterinary diagnostic test, first from this player, named IDEXX Cystatin B for detecting kidney injury in dogs and cats.

Additionally, the instruments & devices segment is expected to witness growth at the fastest rate of 10.2% from 2024 to 2030. This segment’s growth is driven by rising veterinary product enhancement and surge in its demand. The demand for animal-derived food products is expected to drive the need for immunodiagnostic tests for animals over the forecast period. For instance, in March 2022, Volition entered into a significant supply and license agreement valued at USD 28.0 million with Heska Corporation. This agreement aimed to commercialize Heska's Nu. Q Vet Cancer Screening for canine cancer diagnostic and monitoring at point-of-care.

Animal Type Insights

Based on animal type, companion animals segment held the largest market share of 66.5% in 2023. This growth is attributed to high ownership of pets across the U.S. For instance, as per Pet Products Association statistics, approximately 66% of U.S. households, which accounts for approximately 86.9 million homes, currently own a pet. This surge in pet ownership further escalates the market growth over the forecast years.

The livestock animals’ segment is projected to grow with the fastest CAGR of 10.2% from 2024 to 2030. This growth is driven by rising zoonotic diseases and a rising number of livestock. A surge in veterinary practitioners is a major driver fueling the growth of the livestock animal market. According to the report published by Veterinary Medicine and Public Health at CDC, there are about 60,000 private practice veterinarians in the United States. Such a high number of vegetarian practices is likely to increase demand for U.S. veterinary point-of-care diagnostics over the forecast years.

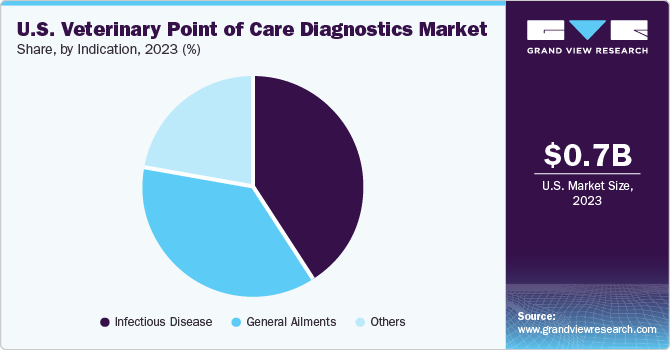

Indication Insights

Based on indication insights, infectious disease segment held the largest share of 41.0% in 2023. An increasing number of infectious diseases in livestock animals drives the segment. These infectious diseases include Q fever, brucellosis, tuberculosis, trichinellosis, and more. According to the United Nations Environment Programme and the International Livestock Research Institute, 75.0% of all emerging infectious diseases were reported as zoonotic in 2019. The increasing prevalence of foot and mouth disease in livestock animals is again a major factor responsible for market growth.

The general ailments segment is projected to expand with the fastest CAGR of 10.1% from 2024 to 2030. This growth is likely to be driven by increasing awareness of veterinary health among the population. Moreover, a few key companies are focusing on innovative diagnostics for general ailments in livestock which in turn fuels market growth. For instance, in March 2023, PDX Biotech LLC. Announced the launch of a rapid test to diagnose periodontal disease in dogs. This includes OraStripdx, that features user-friendly test strip which changes color based on concentration of thiols in the patient’s oral fluid. Following this innovative test, the company won Purina's 2023 Innovation award in Pet Care.

Sample Type Insights

Based on sample type, blood, plasma and serum segment accounted for the largest share of about 40.0% in 2023. This growth is driven by increasing testing for zoonotic diseases and general ailments for safety of veterinary health. Moreover, affordability, quick results analysis, and high efficiency are likely to boost the growth. According to Kirkwood Animal Hospital in the U.S., routine blood tests are advised as a crucial component of a companion animal overall health program. These tests play a significant role in identifying issues before they manifest visibly, allowing for timely intervention to address them.

The urine segment is anticipated to witness growth with the fastest CAGR over the forecast period. The growth is fueled by the multiple applications provided by urinalysis. Urinalysis applications include cost-effectiveness, easy accessibility, and provide biochemical data. These tests are generally preferred for detecting kidney dysfunction in animals.

Testing Category Insights

In animal health diagnostics, parasitology has emerged as the leading testing category, accounting for the largest share of approximately 18.0% in 2023. This growth can be attributed to the increasing preference for parasitological testing of animals. Parasitological tests are used to diagnose both internal and external parasites in animals. Internal parasitology tests are commonly performed by examining feces for parasite eggs, with roundworm, whipworm, hookworm, Giardia, and coccidia being the most frequently diagnosed internal parasites, as per the Companion Animal Parasite Council (CAPC).

Recently, Zoetis introduced Vetscan Imagyst™, a diagnostic platform that uses image recognition technology, algorithms, and cloud-based artificial intelligence (AI) to offer accurate testing results in various fields, including blood smear analysis, AI fecal testing, and digital cytology image transfer. The technology aims to enhance the efficiency and accuracy of diagnostic tests performed in veterinary clinics, enabling quicker and more precise diagnoses.

On the other hand, bacteriology is expected to witness the fastest CAGR from 2024 to 2030, mainly due to the higher prevalence of bacterial diseases in animals. The emergence of bacterial infections in companion animals is growing, as per an NIH review published in 2022. Additionally, various researchers are focusing on developing diagnostic tests for bacterial zoonosis, which is likely to boost the growth of the market. For example, in April 2023, Cornell University College of Veterinary Medicine announced a novel test to detect Brucella canis, a zoonotic disease that can spread to people through contact with infected dogs.

End-use Insights

In 2023, the veterinary hospitals & clinics segment accounted for the largest share with 54.0%, owing to the growing number of animal patients visiting these medical facilities for treatment and diagnosis, as well as the increasing demand for animal diagnostic testing in detecting infectious diseases in both small and large animals.

Government funding to veterinary hospitals and clinics is also a major factor driving the market forward. Furthermore, the home care settings segment is expected to grow fastest, with a CAGR of 10.5% over the forecast period. Pet owners and other end consumers benefit greatly from advanced veterinary diagnostics, such as in-house analyzers and point-of-care services, which offer convenience and rapid results.

Key U.S. Veterinary Point Of Care Diagnostics Company Insights

The key companies operating in the U.S. veterinary point of care diagnostics include IDEXX, Zoetis, NeuroLogica Corp., and Heska Corporation, Phibro Animal Health Corporation, BioPredic International among others.

There is intense competition between key companies that are actively engaged in a high degree of innovation, the impact of regulations, mergers and acquisitions, and regional expansion.

Key U.S. Veterinary Point Of Care Diagnostics Companies:

- Zoetis Inc.

- IDEXX

- Thermo Fisher Scientific Inc.

- Heska Corp

- Phibro Animal Health Corporation

- Blair Milling and Elevator Co., Inc.

- NeuroLogica Corp

- NEOGEN Corporation

- Marshfield Labs

- ProtaTek International, Inc.

- Texas A&M Veterinary Medical Diagnostic Laboratory

- VCA, Inc

- University of Minnesota

Recent Developments

-

In October 2023, Zomedica Corp. announced the collaboration with the acquisition of Qorvo Biotechnologies LLC. (QBT) Under this acquisition, the company would get full access to the TRUFORMA platform including the instrument, software, and several important veterinary diagnostic assays developed by QBT.

-

In January 2023, SKT Telecom announced a strategic partnership with Vetology Innovations and signed a contract with Vieworks, an X-ray medical imaging device manufacturer. This partnership would integrate SKT's AI technologies and Vetology’s expertise in the veterinary domain. Moreover, the contract with Vieworks would supply X-ray detectors and medical devices to other companies.

-

In June 2023, Esaote North America, Inc. announced a new veterinary MyLab TM X90VET ultrasound system along with intelligent proprietary Augmented Insights TM Technology. This new veterinary system is designed to provide veterinary care with high-precision imaging and diagnosis.

-

In July 2022, Merck KGaA's Life Science business received funding support amounting to USD 123.7 million from the U.S. Department of Defense and the U.S. Department of Health and Human Services to produce lateral flow membranes crucial for Point-of-Care (POC) tests for both humans and animals.

-

In April 2022, Zoetis launched an AI blood smear diagnostic tool for Vetscan Imagyst. This is a multi-purpose platform that leverages artificial intelligence for image analysis. The platform is used for AI digital cytology and fecal analysis for cats and dogs.

U.S. Veterinary Point Of Care Diagnostics Market Report Scope

|

Report Attribute |

Details |

|

The market size value in 2024 |

USD 1.0 billion |

|

The revenue forecast for 2030 |

USD 1.8 billion |

|

Growth Rate |

CAGR of 10.7% from 2024 to 2030 |

|

Actual estimates |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Billion & CAGR from 2024 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Product, animal type, sample type, indication, testing category, end-use |

|

Country Scope |

U.S. |

|

Key companies profiled |

Zoetis Inc.; IDEXX; Thermo Fisher Scientific Inc.; Heska Corp; Phibro Animal Health Corporation. Blair Milling and Elevator Co., Inc.; NeuroLogica Corp; NEOGEN Corporation; Marshfield Labs; ProtaTek International, Inc.; Texas A&M Veterinary Medical Diagnostic Laboratory; VCA, Inc; University of Minnesota |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Veterinary Point of Care Diagnostics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. intravenous infusion pump market based on product, animal type, sample type, indication, testing category, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables, Reagents, & Kits

-

Instruments & Devices

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

Livestock Animals

-

Cattle

-

Swine

-

Poultry

-

-

-

Sample Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood/Plasma/Serum

-

Urine

-

Fecal

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Infectious Disease

-

General Ailments

-

Others

-

-

Testing Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Hematology

-

Diagnostic Imaging

-

Bacteriology

-

Virology

-

Cytology

-

Clinical Chemistry

-

Parasitology

-

Serology

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Home Care Settings

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. veterinary point of care diagnostics market size was estimated at USD 0.7 billion in 2023 and is expected to reach USD 1.0 billion in 2024

b. The U.S. veterinary point of care diagnostics market is expected to grow at a compound annual growth rate of 9.9% from 2024 to 2030 to reach USD 1.8 billion by 2030.

b. Based on sample type, the blood/plasma/serum segment held the largest share of about 40% in 2023. This growth is driven by the increasing testing for zoonotic diseases and general ailments for the safety of veterinary health.

b. Some key players operating in the U.S. veterinary point of care diagnostics market include IDEXX, Zoetis, NeuroLogica Corp., and Heska Corporation, Phibro Animal Health Corporation, BioPredic International among others.

b. Key factors that are driving the market growth include surge in spending on pet-related products and services, the expanding number of pet owners, advancements in technology, anda strong demand for point-of-care diagnostics.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."