- Home

- »

- Animal Health

- »

-

U.S. Veterinary Equipment And Disposables Market, Industry Report 2030GVR Report cover

![U.S. Veterinary Equipment And Disposables Market Size, Share & Trends Report]()

U.S. Veterinary Equipment And Disposables Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Equipment & Accessories, Disposables/ Consumables), By Animal Type, By Usage, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-276-5

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

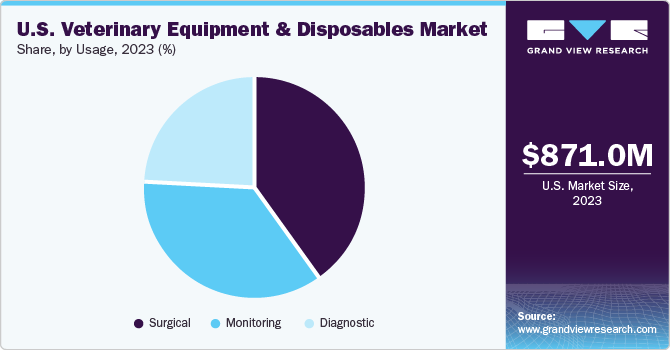

The U.S. veterinary equipment and disposables market size was valued at USD 871.0 million in 2023 and is projected to grow at a CAGR of 5.0% from 2024 to 2030. The market growth is attributed to its well-established veterinary healthcare infrastructure, increasing number of companion animals, growing animal healthcare expenditure, and focus on animal illnesses.

The U.S. accounted for nearly 40% of the global veterinary equipment and disposables market in 2023. The U.S. is witnessing a high demand for dog care due to the substantial number of pet dogs in the region. According to the American Pet Product Association, the U.S. invests a significant amount in dogs, among all companion animals. The region has witnessed a rise in veterinary healthcare expenditure, which is fueling market growth in the region. The presence of key market players, product innovations, the presence of several animal associations, and rising awareness about animal health are among the key factors contributing to market growth in the country.

Furthermore, increasing pet ownership and growing penetration of pet insurance in the country support market growth. Moreover, growing spending on pets and production animals accelerates market growth. The U.S. market is competitive, with the presence of many players. In January 2020, Midmark Corp. announced its “More” 2020 promotion. With this initiative, veterinarians and veterinary facilities can obtain cash back for selected veterinary equipment during the allotted time.

Market Concentration & Characteristics

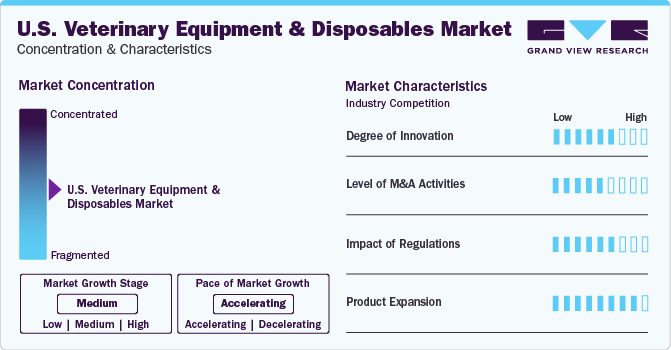

The veterinary equipment and disposables market is expected to witness moderate growth over the forecast period. The market is characterized by the presence of large number of public and private companies that keep intensifying the competitive rivalry.

The market is characterized by a high level of innovation as companies are majorly investing in R&D activities to improve existing products and introduce new ones. For instance, Bionet America, Inc. launched a wearable and wireless ECG sensor for vet clinics that monitor ECG, heart rate, and respiratory rate.

The market experiences a moderate to high level of M&A activity. Several key players are engaged in mergers, acquisitions, or strategic partnerships to expand their product portfolios and enhance their market presence. For instance, in July 2021, Covertrus, Inc. agreed to acquire VCP which is a global leader in animal health technology and services.

Regulatory factors in the market are not as stringent as in other industries such as pharmaceuticals. Regulation in this market is mainly focused on the governing of manufacturing, distribution, and use of veterinary products. Apart from this, the market witnesses supportive government initiatives & regulations for growth and advancements.

The market experiences high levels of product expansion owing to strategies such as R&D activities and several product launches. The growing prevalence of diseases such as respiratory muscle paralysis, drug toxicities, severe brain disease, or head trauma among animals and increasing R&D initiatives are driving the growth of veterinary ventilators market.

Product Insights

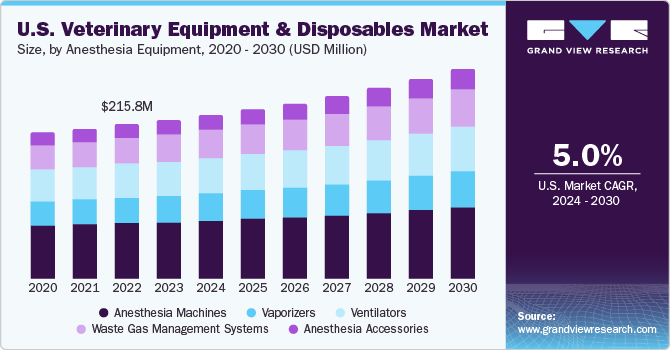

By product, equipment & accessories accounted for the largest revenue share of 65.19% of the market in 2023. Owing to the repetitive use of these products in surgical procedures. The accessories used with anesthesia equipment are laryngoscope handles & blades, induction chambers, carbon dioxide absorbent, and more, whereas, fluid management equipment can be divided into large-volume infusion pumps and syringe pumps. Thus, the segment is expected to grow owing to the rising adoption of anesthesia equipment in veterinary procedures.

The disposables/consumables segment is projected to witness the fastest-growing CAGR during the forecast period. Growing awareness regarding the severity of wounds in animals and common respiratory illnesses is expected to boost segment growth. Strong focus on ensuring the health & safety of pets, availability of pet insurance policies, and affordability of these consumables are among the key factors fueling segment market growth.

Animal Type Insights

By animal type, small animals accounted for the largest revenue share of 70.91% of the market in 2023. The rising small animal population and growing emphasis on pet care & wellness by pet owners are contributing to the growth of the segment. Growing awareness campaigns for animal rescue initiatives are boosting the revenue of the equipment market. The growing trend of keeping pets is anticipated to accelerate market growth. In the last 30 years, pet ownership has increased from 56% to 67% in all households and nearly 85 million households have a pet, according to American Pet Products Association. Thus, the aforementioned factors are expected to reinforce market growth.

The large animal segment is projected to witness the fastest growth during the forecast period. The growing demand for better treatment & diagnostics, increasing activities in animal husbandry, and growing awareness about their care are some of the key drivers for segment growth. A rise in disposable income and concerns about the protection of equines among owners are expected to boost demand for their care in the coming years.

Usage Insights

By usage, the surgical segment accounted for the largest revenue share of 40.14% of the market in 2023. These products include basic surgical instruments, instruments for carrying out cat castration, and other basic surgeries. The increasing number of surgical procedures on pets in developing countries is expected to drive market growth over the forecast period. The most common types of surgical procedures in pets include dental, cataract, hip dysplasia, spay or neuter, and wound repair. Moreover, rising demand for animal health insurance is expected to propel market growth. The insurance policy covers accident & illness and the cost of surgery & hospitalization. Thus, these factors support overall market growth.

The monitoring segment is projected to witness the fastest growth of CAGR during the forecast period. Novel technologies and advancements in veterinary equipment, such as wearables, can prove to be helpful for pet health monitoring. These monitoring systems play an important role in boosting the health of the animals. As the rate of animal hospitalizations and surgeries increases, monitoring animals’ health can provide useful insights into their condition. A substantial pet population and the significant presence of zoos in almost all nations are expected to propel segment growth.

End-use Insights

By end use, veterinary hospitals accounted for the largest revenue share of 44.08% of the market in 2023. The growth can be attributed to the availability of a wide range of treatment options in veterinary hospitals and clinics. Various government animal welfare organizations have issued guidelines for safety practices & standards to be implemented in hospitals, which has broadened the scope for segment growth over the past few years. Besides, this growth can be attributed to the high penetration of veterinary hospitals/clinics across the developed nations. An increasing number of veterinary surgeries further augments the growth of the segment.

The others segment is projected to witness considerable growth during the forecast period. This includes home and research institutes. Better critical care treatment options for small animals have raised demand for relevant research activities, which is expected to drive the segment over the forecast period. Functions governed by research institutes in relation to animal treatment are deployment, identification, and development of new treatment procedures for emerging or existing diseases in animals, which is further boosting market for veterinary equipment and disposables.

Key U.S. Veterinary Equipment And Disposables Company Insights

Covetrus, Medtronic, Avante Animal Health, and Midmark Corporation are some of the key veterinary equipment and disposables companies in the U.S. These companies are adopting several growth strategies such as product launches, M&A activities, collaborations, and more to gain a stronger foothold in the market.

The market is witnessing strong competition owing to the presence of both large and small-sized companies in the region. Manufacturers are focusing on developing innovative features such as advanced programming capabilities, wireless connectivity, and integration with electronic medical records.

Key U.S. Veterinary Equipment And Disposables Companies:

- Covetrus

- Medtronic

- B. Braun Vet Care GmbH

- Avante Animal Health

- Shenzhen Mindray Animal Medical Technology Co., LTD.

- Midmark Corporation

- Vetland Medical Sales & Services, LLC

- Masimo

- Dispomed Ltd

- Nonin

Recent Developments

-

In January 2024, Hill’s Pet Nutrition announced the launch of new products and enhancements to its therapeutic pet food line, Hill's Prescription Diet such as hydrolyzed soy canine, multicare low-fat canine, gastrointestinal biome stress feline, and multicare stress feline new wet flavors.

-

In November 2023, Hygiena announced that it was awarded the prestigious AOAC RI Performance Tested MethodsSM (PTM) Certification for the entire product testing workflow for its Innovate RapiScreen Dairy and Beverage Kits

-

In December 2023, Chewy announced the launch of its pet health practices under the brand name Chewy Vet Care. It is expected to be inaugurated in early 2024 in South Florida along with several other launches throughout the year

U.S. Veterinary Equipment And Disposables Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 903.5 million

Revenue forecast in 2030

USD 1.20 billion

Growth rate

CAGR of 5.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, usage, animal type, end-use

Country scope

U.S.

Key companies profiled

Covetrus; Medtronic; B. Braun Vet Care GmbH; Avante Animal Health; Shenzhen Mindray Animal Medical Technology Co., LTD.; Midmark Corporation; Vetland Medical Sales & Services, LLC; Masimo; Dispomed Ltd; Nonin

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Veterinary Equipment And Disposables Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. veterinary equipment and disposables market report based on product, animal type, usage, and end-use:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Animals

-

Dogs

-

Cats

-

Other Small Animals

-

-

Large Animals

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment & Accessories

-

Anesthesia Equipment

-

Anesthesia Machines

-

Vaporizers

-

Ventilators

-

Waste Gas Management Systems

-

Anesthesia Accessories

-

-

Veterinary Telemetry Systems

-

Patient Monitors

-

Patient Monitoring Accessories

-

-

Oxygen Concentrator & Accessories

-

Fluid Management Equipment

-

Large-Volume Infusion Pumps

-

Syringe Pumps

-

-

Temperature Management Equipment

-

Patient Warming Systems

-

Fluid Warmers

-

-

-

Disposables/ Consumables

-

Airway Management Consumables

-

Other Consumables

-

-

-

Usage Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical

-

Diagnostic

-

Monitoring

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals

-

Veterinary Clinics

-

Laboratories

-

Others

-

Frequently Asked Questions About This Report

b. The global U.S. veterinary equipment & disposables market size was estimated at USD 871.0 million in 2023 and is expected to reach USD 903.5 million in 2024.

b. The U.S. veterinary equipment & disposables market is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach USD 1.20 billion by 2030.

b. By product, equipment & accessories accounted for the largest revenue share of 65.19% of the U.S. veterinary equipment & disposables market in 2023. Owing to the repetitive use of these products in surgical procedures. The accessories used with anesthesia equipment are laryngoscope handles & blades, induction chambers, carbon dioxide absorbent, and more.

b. Some key players operating in the U.S. veterinary equipment & disposables market include Covetrus; Medtronic; B. Braun Vet Care GmbH; Avante Animal Health; Shenzhen Mindray Animal Medical Technology Co., LTD.; Midmark Corporation; Vetland Medical Sales & Services, LLC; Masimo; Dispomed Ltd and Nonin.

b. Key factors that are driving the market growth include well-established veterinary healthcare infrastructure, increasing number of companion animals, growing animal healthcare expenditure, and focus on animal illnesses.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.