- Home

- »

- Animal Health

- »

-

U.S. Veterinary 3D Printing Market Size & Share Report 2030GVR Report cover

![U.S. Veterinary 3D Printing Market Size, Share & Trends Report]()

U.S. Veterinary 3D Printing Market (2024 - 2030) Size, Share & Trends Analysis Report By Animal Type (Dogs, Cats), By Application (Therapeutic, Others), By Material, By Products, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-280-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Veterinary 3D Printing Market Trends

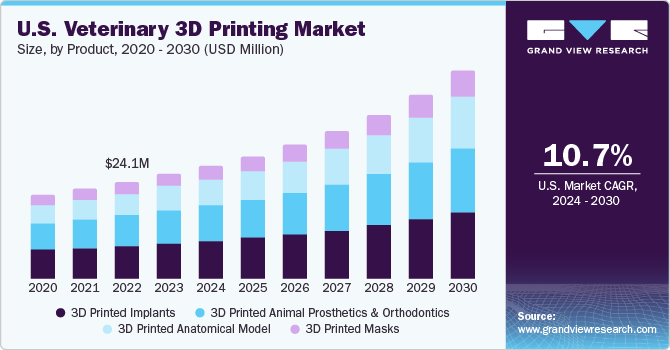

The U.S. veterinary 3D printing market size was estimated at USD 26.23 million in 2023 and is projected to grow at a CAGR of 10.68% from 2024 to 2030. The market is primarily driven by the increasing need for surgical planning and training, increasing customization and personalization, and simulation of model-based surgeries. Similar to human healthcare, veterinary medicine is increasingly recognizing the value of customization in treatment plans.

3D printing allows for the creation of patient-specific implants, prosthetics, and anatomical models, catering to individual animals' needs. Furthermore, continuous advancements in 3D printing technologies, such as improved printing speed, accuracy, and material capabilities, are driving the adoption of 3D printing products. These advancements allow for the creation of more complex and precise veterinary implants, prosthetics, and models.

Veterinary medicine is continually evolving with new treatments and emerging technologies. The customized solutions produced through 3D printing can lead to better treatment outcomes and faster recoveries for animals. Whether it's a custom orthopedic implant or a prosthetic limb, these solutions can significantly enhance the quality of life for veterinary patients. Furthermore, pre-surgical planning with 3D-printed models can streamline surgical procedures, reducing operating time and minimizing risks associated with anesthesia. This efficiency can be particularly critical in veterinary surgeries, where anesthesia risks are higher.

Currently, online 3D printing in the veterinary industry is largely utilized for research. For example, the technology enables surgeons to see a model of a damaged body part, such as a hip joint. This helps the physician in making early decisions before performing surgery. In addition, researchers take advantage of technology to enhance their understanding of veterinary care. According to Animal Wellness Magazine, a mechanical engineering doctorate candidate named Alexis Noel created a larger three-dimensional model of a cat's tongue to understand better the mechanics of the Velcro-like "spines" that distinguish the feline tongue.

3D printed models help understand complex surgical anatomy by allowing users to examine the spatial relationship of the key parts. It makes customized surgical planning easier by enabling doctors to modify and enhance the surgical plan based on the unique anatomy and pathology of each patient. Pre-contouring titanium plates for reconstruction and establishing osteotomy lines are two more surgical procedures that can be copied beforehand. Furthermore, a surgical guide and 3D printed model are also very helpful intraoperative guides and references. In addition, 3D printed models can enhance the education of veterinary residents and students as well as encourage better communication and understanding between pet owners and the diagnosis, course of treatment, and expected results associated with pet care.

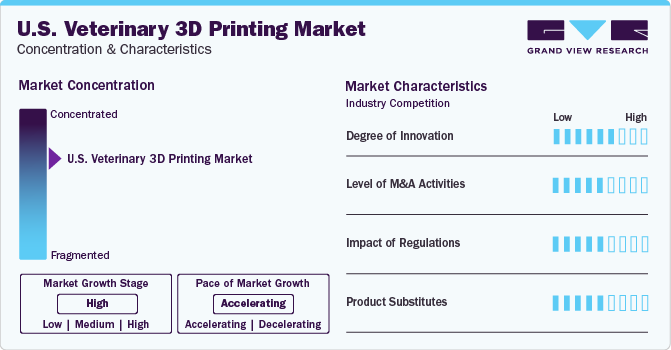

Market Concentration & Characteristics

The U.S. veterinary 3D printing industry exhibits a high market concentration. The market growth stage is high, with an accelerating pace. The development of new materials compatible with 3D printing has expanded the range of applications. From plastics to metals, ceramics, and even biomaterials, these advancements have widened the scope of what can be manufactured using 3D printing technology.

Moreover, the increasing pet ownership in the U.S. is fueling the demand for veterinary services, including surgical procedures. This trend is expected to continue as more people consider pets as part of their families, thus driving the demand for veterinary 3D printed implants or 3D printed animal prosthetics & orthodontics. According to the American Pet Products Association National Pet Owners Survey 2023-2024, around 66% of households owned a pet in the U.S. in 2023, which translates to approximately 86.9 million homes owning a pet. In addition, pet owners are becoming more aware of the importance of regular veterinary care for their animals’ health and well-being. This increased awareness translates into higher spending on veterinary services, including surgeries, which, in turn, boosts the market growth.

The market demonstrates a moderate degree of innovation, characterized by ongoing product launch, partnership and collaboration between market players, and supportive initiatives. For instance, In January 2022, Movora, the MedTech veterinary division of Vimian, established a facility in the U.S. through its new distribution center located in St. Augustine, Florida. This facility allows customers to order from all three Movora brands, KYON, BioMedtrix, and Veterinary Orthopedic Implants, through a single point of contact.

Within the market, there exists a low-to-moderate level of mergers and acquisitions activity, indicative of ongoing consolidation and strategic partnerships among industry players. For instance, In June 2023, Vimian acquired New Generation Devices to expand its offerings in veterinary orthopedic implants.

The market experiences a moderate impact of regulations. Regulatory bodies are increasingly recognizing the importance of 3D printing in veterinary medicine and are establishing guidelines to ensure the safety and efficacy of 3D-printed veterinary products.

The risk of substitutes is expected to be moderate. Tailoring implants to specific patient needs is becoming more common. If newer options allow for better customization, they might replace older, more standardized implants. The availability of biocompatible and sterilizable materials suitable for veterinary use has expanded, enabling the production of implants and devices that meet the necessary safety and regulatory standards.

Product Insights

The 3D printed implants segment dominated the market with a share of 33.90 % in 2023. This growth can be attributed to several key factors, including technological innovations, and several associated advantages of using 3D printed implants. Implants can be designed using biocompatible materials, reducing the risk of rejection or adverse reactions from the animal's body. This promotes better integration and reduces the likelihood of complications. Moreover, implants tend to be more durable than prostheses or masks, especially in cases where they need to withstand significant forces or wear over time. This durability ensures longer-lasting solutions for the animal's needs. Unlike prostheses or masks, implants typically require minimal maintenance once implanted. This reduces the need for frequent adjustments or replacements, leading to lower long-term costs and less inconvenience for the animal and its caregivers.

3D printed anatomical model is anticipated to grow at the fastest CAGR over the forecast period. According to the BRIEF RESEARCH REPORT article, published in February 2024, three-dimensional printed models are able to assist researchers to recognise the structural anatomic changes that occur in cases of temporomandibular joint ankylosis and pseudoankylosis, which cause closed jaw locking. It has been documented that its application in preoperative planning and intraoperative guidance enhances the predictability and success of these surgical operations, which can be highly complex, particularly when small animal patients are involved.

Material Insights

Based on material, the titanium segment held the largest market share in 2023. Titanium 3D implants offer several advantages over other implants in animals. Titanium is highly biocompatible, meaning it is well tolerated by the body without causing adverse reactions. Glass implants may cause irritation or inflammation in tissues due to their composition. Titanium implants can osseointegrate, meaning they can fuse directly with the surrounding bone tissue, promoting stability and long-term integration. This can lead to better outcomes in terms of implant success and longevity compared to glass implants, which may not integrate as effectively with bone. Moreover, titanium implants offer long-term stability and reliability, reducing the need for frequent replacements or revisions. This can lead to cost savings and improved overall outcomes for the animal.

Others are anticipated to grow at the fastest CAGR of 12.05% over the forecast period. According to Formlabs, BioMed White and Black Resins offer several benefits, including improved visualization. Medical practitioners use colored materials for surgical instruments that need to have more contrast against additional components, soft tissue, or surroundings during diagnostic and surgical planning. Black-and-white prints can help drug companies achieve efficient workflows by providing contrast between colored parts and powders or solids.

Application Insights

In terms of application, the therapeutic segment held the largest market share in 2023. The therapeutic segment is further sub-categorized into orthopedic and neurology subsegments. The rise in orthopedic diseases among animals indeed plays a significant role in propelling the growth of the market. Just like humans, animals suffer from various orthopedic conditions such as fractures, joint injuries, and skeletal abnormalities. For instance, according to Canine Arthritis Management 2024, osteoarthritis is the leading cause of chronic pain in dogs. Up to 35% of dogs of all ages may be affected, and it affects 80% of dogs older than eight years old. Surgical intervention is frequently necessary for these problems, and implants may be used to stabilize bones and promote recovery. Orthopedic surgery is one of the innovative treatment options that pet owners are increasingly preferring for their animals. This demand creates the need for novel solutions such as 3D-printed implants.

Animal Type Insights

Based on animal type, the dogs segment held the largest market share of 48.90% in 2023. Increasing dog ownership, growing awareness of pet healthcare, increasing humanization, and rising prevalence of chronic diseases in dogs are among the key drivers of the segment. Pet ownership has steadily increased in the U.S. over the years. Dogs are the most popular pets overall. Around 70% of U.S. households owned a pet as of 2022, with the number of U.S. households having a pet dog being 69 million. Moreover, according to an article published by The American Kennel Club, Inc. 2024, 20% of dogs will eventually develop joint problems that cause pain and may limit their mobility. The figures get significantly higher in dog breeds predisposed to certain joint disorders. Cruciate ligament injury is another orthopedic issue that is most common in dogs.

Cats segment is anticipated to grow at the fastest CAGR of 11.75 % over the forecast period. Cats are prone to obesity, and there has been increasing awareness of the frequency of obesity in domestic cats. The need for 3D printed solutions, such as implants, to manage feline obesity has grown as cat owners become more conscious of the health hazards involved. For example, 60% of cats in the United States are fatty or overweight, according to the Association for Pet Obesity Prevention Survey 2022.

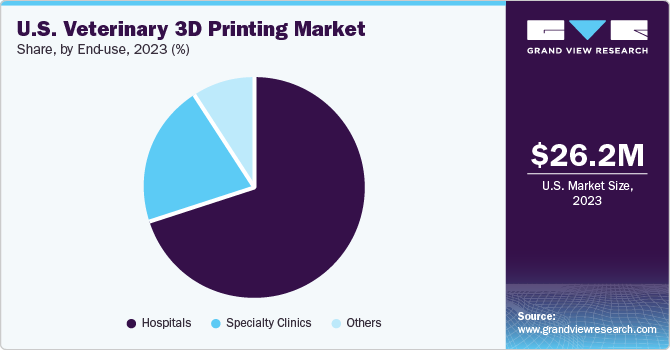

End-use Insights

In terms of end-use, hospitals held the largest revenue share of 70.01% in 2023. As more pet owners seek advanced medical care for their furry companions, the demand for innovative veterinary treatments, including 3D implants, has increased. Hospitals equipped with specialized veterinary services and advanced medical technologies are often at the forefront of adopting these innovative solutions. Hospitals serve as hubs for pet owners seeking medical assistance for their animals. By offering 3D implant procedures, these hospitals raise awareness among pet owners about the availability and benefits of such advanced treatments. Moreover, hospitals provide platforms for training veterinary professionals in the use of advanced medical technologies, including 3D printing and implantation techniques. This educational aspect further drives the adoption of 3D implants.

Specialty clinics are anticipated to grow at the fastest CAGR over the forecast period. Specialty clinics typically have veterinarians with expertise in specific areas such as orthopedics, neurology, or oncology. These veterinarians are more likely to recommend and perform advanced procedures like 3D implant surgeries. Specialty clinics are more likely to have access to advanced equipment, including 3D printers and imaging technologies, necessary for designing and producing high-quality implants.

Key U.S. Veterinary 3D Printing Company Insights

The market for Veterinary 3D Printing in the U.S. is characterized by high competitive rivalry among existing players. Existing players are enhancing their product portfolios with technologically advanced products and are widening their geographic reach by acquiring small & local players. These market players undertake several strategic initiatives to boost their market presence and share, including partnerships & collaborations, mergers & acquisitions, facility expansion, and product launches.

Key U.S. Veterinary 3D Printing Companies:

- 3D Systems Corporation

- Movora (Vimian)

- WhiteClouds

- Med Dimensions

- Vet 3D

- M3D ILAB Ltd

- 3D Pets (DiveDesign)

- CABIOMEDE Vet

- Wimba

- Novus Life Sciences.

Recent Developments

-

In December 2022, Vimian's Movora reported the successful completion of one of the first orthopedic procedures in dogs and horses using 3D-printed implants.

U.S. Veterinary 3D Printing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 28.19 million

Revenue forecast in 2030

USD 51.83 million

Growth Rate

CAGR of 10.68% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Products, animal type, material, application, end-use, country

Country (State) scope

California; Florida; Texas; Washington; Colorado; Others

Key companies profiled

3D Systems Corporation; Movora (Vimian); WhiteClouds; Med Dimensions; Vet 3D; M3D ILAB Ltd; 3D Pets (DiveDesign), CABIOMEDE Vet, Wimba,Novus Life Sciences

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Veterinary 3D Printing Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. veterinary 3D printing market report based on products, animal type, material, application, and end-use.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

3D Printed Implants

-

3D Printed Animal Prosthetics & Orthodontics

-

3D Printed Anatomical Model

-

3D Printed Masks

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Horses

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutic

-

Orthopedic

-

Neurology

-

-

Others

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Titanium

-

Ceramic

-

Others

-

Plastics

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

California

-

Florida

-

Texas

-

Colorado

-

Washington

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. veterinary 3D printing market size was estimated at USD 26.23 million in 2023 and is expected to reach USD 28.19 million in 2024.

b. The U.S. veterinary 3D printing market is expected to grow at a compound annual growth rate of 10.68% from 2024 to 2030 to reach USD 51.83 million by 2030

b. On the basis of product, the 3D printed implants segment dominated the market with a share of 33.90 % in 2023. This growth can be attributed to several key factors, including technological innovations, and several associated advantages of using 3D printed implants.

b. Some key players operating in the U.S. veterinary 3D printing market include 3D Systems Corporation, Movora (Vimian), WhiteClouds, Med Dimensions, Vet 3D, M3D ILAB Ltd, 3D Pets (DiveDesign), CABIOMEDE Vet, Wimba, Novus Life Sciences.

b. Key factors that are driving the market growth include increasing need for surgical planning and training, increasing customization and personalization, and simulation of model-based surgeries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.