U.S. Vascular Access Devices Market Size, Share & Trends Analysis Report By Product (Central Venous Catheters (CVC), Peripherally Inserted Central Catheter (PICCs)), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-493-3

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

U.S. Vascular Access Devices Market Trends

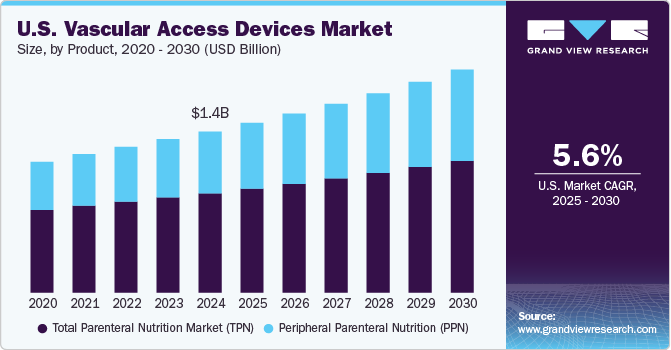

The U.S. vascular access devices market size was estimated at USD 1.40 billion in 2024 and is expected to grow at a CAGR of 5.6% from 2025 to 2030. The market growth is driven by the increasing prevalence of chronic diseases and the growing need for medical procedures that require vascular access. As healthcare providers continue to seek efficient solutions for delivering medications, fluids, and nutrients, the demand for innovative vascular access devices is expected to rise. Additionally, advancements in technology, such as the development of antimicrobial coatings and the integration of smart technologies in vascular access devices, contribute to enhancing patient safety and improving clinical outcomes.

The rising CVD cases in the U.S. are expected to fuel the market growth. According to the American Heart Association article published in January 2024, in the U.S., CVD results in about 2,552 deaths each day. CVD patients require long-term treatments involving medications and fluids, often administered through vascular access devices like central venous catheters (CVCs) and peripherally inserted central catheters (PICCs). This growing demand for cardiovascular care is a key driver for the market, as these devices play a critical role in managing CVD effectively

The growth of the U.S. vascular access devices industry is also driven by rising use of vascular access devices among pediatric patients. For instance, in January 2024, the Population Reference Bureau had projected that the American population aged 65 and over would expand from 58 million in 2022 to 82 million by 2050, reflecting a 47% increase. Additionally, it was anticipated that the share of the total population belonging to this age bracket would grow from 17% to 23%. Older adults are easily susceptible to infectious diseases and need hospital treatment by administering parenteral nutrition (PN), which helps maintain strength, energy, and hydration.

In addition, increased cancer cases and chemotherapy demand is anticipated to drive the growth of the market. According to the National Cancer Institute, in 2024, it is projected that approximately 2,001,140 new cancer cases will be diagnosed in the United States, with an estimated 611,720 individuals expected to die from the disease. Cancer treatment, particularly chemotherapy, plays a crucial role in managing the condition. According to a Health Cost Institute article published in March 2023, nearly 1 million people in the U.S. undergo chemotherapy each year. Most of these treatments are administered via infusion or injection, often requiring patients to visit a physician’s office or hospital outpatient department.

The widespread use of infusion therapies in cancer treatment underscores the critical role of vascular access devices, such as peripherally inserted central catheters (PICCs) and central venous catheters (CVCs), in delivering chemotherapy. This growing demand for oncology care is drives the North American vascular access devices market, as these devices are essential for ensuring safe, effective, and long-term access to the bloodstream for cancer patients undergoing treatment.

Market Concentration & Characteristics

The industry growth stage is medium, and the pace of the market growth is accelerating. This growth is driven by ongoing innovations and new developments within the medical devices industry, particularly in response to increasing demand for advanced and reliable vascular access solutions. Technological advancements, coupled with rising healthcare investments and the prevalence of chronic conditions requiring vascular access, are significantly contributing to the market’s expansion trajectory.

The degree of innovation in the market is moderate. This sector has seen technological advancements, particularly with the continuous innovations and new developments. For instance, in November 2023, BD unveiled the PIVO Pro, a revolutionary needle-free device for blood collection. The device stands out by being the first to work seamlessly with both integrated and long-term peripheral IV catheters, such as the Nexiva system, which now includes NearPort IV Access, following its approval by the FDA. Furthermore, technological advancements, such as improved catheter materials, antimicrobial coatings, and advanced ultrasound-guided insertion techniques are addressing infection risks and procedural challenges. However, the sector has not yet witnessed disruptive breakthroughs, and the focus remains on incremental improvements to existing devices.

The level of merger and acquisition (M&A) activities and partnerships within the U.S. market is high. Leading medical device companies are engaging in strategic alliances to expand their product portfolios, enhance research and development capabilities, and strengthen their market presence. Recent collaborations focus on integrating advanced technologies and improving distribution networks to cater to growing healthcare demands. For instance, in June 2023, Merit Medical Systems acquired AngioDynamics’ dialysis catheter portfolio, the BioSentry Biopsy Tract Sealant System, and the Surfacer Inside-Out Access Catheter System. These acquisitions aim to enhance Merit’s product offerings in dialysis, biopsy procedures, and vascular access, complementing its existing portfolio and strategic growth goals.

The impact of regulations on the U.S. vascular access devices market is high. Regulatory bodies such as U.S. Food and Drug Administration (FDA) impose stringent requirements to ensure safety, efficacy, and quality standards. Compliance with these regulations entails rigorous clinical testing, post-market surveillance, and adherence to evolving guidelines, significantly influencing product development timelines and market entry strategies.

The presence of product substitutes in the market is moderate. While alternative methods such as oral or subcutaneous drug delivery systems exist, they are not always suitable for patients requiring high-precision, long-term vascular access. Substitutes may pose a challenge in specific cases, but vascular access devices remain indispensable for critically ill patients and those undergoing complex medical treatments.

The regional expansion within the U.S. vascular access devices industry is high, driven by increased healthcare access, infrastructure advancements, and targeted investments in underserved areas. Efforts to address disparities in healthcare delivery and the adoption of advanced medical technologies are fuelling the penetration of vascular access devices across diverse regions in the U.S., enhancing overall market growth.

Product Insights

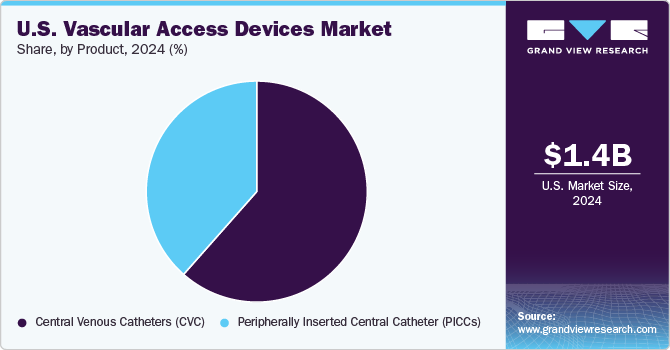

The Central Venous Catheters (CVC) segment dominated the U.S. vascular access devices industry and accounted for the largest share of over 61.52% in 2024. CVCs are also known as central lines, are long, flexible tubes inserted into a large vein that leads to the heart, typically placed in the neck (internal jugular vein), chest (subclavian or axillary vein), or groin (femoral vein). CVCs provide direct access to the central venous system, making them essential for administering medications, fluids, blood products, and nutrition over an extended period. Technologically advanced product offered by the manufacturers drives the growth of the market. For instance, Edges Medicare offers the C-Line Central Venous Catheter Kits, which feature multiple lumens available in single, double, triple, and quad configurations. The ergonomic design is flexible and contoured to minimize vessel trauma, while the radiopaque tips allow for easy confirmation of catheter placement.

The Peripherally Inserted Central Catheter (PICCs) segment is expected to grow at the fastest CAGR of 6.7% over the forecast period. Peripherally Inserted Central Catheters (PICCs) are long, thin, flexible tubes inserted into a peripheral vein in the arm, typically the basilic, brachial, or cephalic vein, and advanced through more prominent veins until the tip reaches a central vein near the heart, usually the superior vena cava. PICCs provide reliable and long-term intravenous access for administering medications, fluids, blood products, and parenteral nutrition.

Key U.S. Vascular Access Devices Company Insights

The U.S. vascular access devices market is highly competitive, with several major players competing for market share. Key players in the market include BD, Teleflex Incorporated, B. Braun SE, Angio Dynamics, and Smiths Medical (ICU Medical, Inc). These companies have established themselves as leaders in the industry, offering a wide range of products. In addition, several smaller companies are competing for a share of the market. For instance, in September 2022, Teleflex introduced a new Arrow Pressure Injectable Midline Catheters portfolio in the U.S. and Canada. These catheters are designed to address the line identification confusion that can arise while using the Arrowg+ard Blue Advance Midline and the traditional Arrow Midline, both of which come in single & double lumen options.

Key U.S. Vascular Access Devices Companies:

- BD

- Teleflex

- B Braun

- Medical Components, Inc

- Vygon SA

- Medtronic/Mozarc Medical

- Merit Medical/AngioDynamics

Recent Developments

-

In October 2024, Becton, Dickinson and Company (BD) introduced the BD EZI-O Intraosseous Vascular Access System, an advanced device providing rapid vascular access for critical care patients in emergency settings. Designed to address urgent medical needs, the system enables efficient medication and fluid delivery through bone marrow in seconds. The innovation aims to enhance care quality, particularly in challenging cases such as trauma, cardiac arrest, or shock.

-

In November 2023, BD unveiled the PIVO Pro, a revolutionary needle-free device for blood collection. The device stands out by being the first to work seamlessly with both integrated and long-term peripheral IV catheters, such as the Nexiva system, which now includes NearPort IV Access, following its approval by the FDA.

-

In April 2023, Medtronic and DaVita launched Mozarc Medical, a joint venture focused on advancing kidney care innovations. Mozarc aims to develop portable and home-based dialysis solutions, enhancing accessibility and flexibility for patients with chronic kidney disease. The initiative reflects both companies' commitment to transforming kidney health management through technology and patient-centered care.

U.S. Vascular Access Devices Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2025 |

USD 1.47 billion |

|

Revenue forecast in 2030 |

USD 1.93 billion |

|

Growth rate |

CAGR of 5.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product |

|

Country scope |

U.S. |

|

Key companies profiled |

BD; Teleflex; B Braun; Medical Components, Inc.; Vygon SA; Medtronic/Mozarc Medical; Merit Medical/AngioDynamics |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Vascular Access Devices Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. vascular access devices market report based on product:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Central Venous Catheters (CVC)

-

Tunneled CVC

-

Non-Tunneled CVC

-

-

Peripherally Inserted Central Catheter (PICCs)

-

Power Injected

-

Standard

-

-

Frequently Asked Questions About This Report

b. The U.S. vascular access devices market size was estimated at USD 1.40 billion in 2024 and is expected to reach USD 1.47 billion in 2025.

b. The U.S. vascular access devices market is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2030 to reach USD 1.93 billion by 2030.

b. The Central Venous Catheters (CVC) segment accounted for the largest market share of over 61.52% in 2024.

b. Key players in the market include BD, Teleflex Incorporated, B. Braun SE, Angio Dynamics, and Smiths Medical (ICU Medical, Inc).

b. The U.S. vascular access devices market is driven by the increasing prevalence of chronic diseases and the growing need for medical procedures that require vascular access.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."