U.S. Varicose Vein Treatment Devices Market Size, Share & Trends Analysis Report By Type (Endovenous Ablation, Sclerotherapy, Surgical Ligation/ Stripping), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-116-0

- Number of Report Pages: 75

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The U.S. varicose vein treatment device market size was estimated at USD 549.6 million in 2023 and is projected to grow at a CAGR of 5.5% from 2024 to 2030. The market is driven by several critical factors, including the increasing prevalence of varicose veins among the aging population, advancements in minimally invasive treatment technologies, rising awareness and acceptance of cosmetic procedures, and favorable reimbursement policies for vein treatments. According to Beth Israel Deaconess Medical Center, approximately 40 million Americans are affected by varicose veins, which appear swollen, twisted, and bluish veins visible under the skin, typically in the legs or pelvic region. These abnormal dilated blood vessels are common among the U.S. population.

The elderly population is particularly susceptible to developing varicose veins due to significant changes in the structure and function of veins as they age. Individuals over the age of 50 have a 50% chance of being affected by this condition. In addition, overweight persons and pregnant women are at a higher risk. Available treatment options include sclerotherapy, laser therapy, and radiofrequency ablation, with sclerotherapy commonly recommended as the first-line treatment for varicose, spider, and reticular veins.

Advancements in treatment technologies, such as endovenous laser ablation (EVLA) and radiofrequency ablation (RFA), made varicose vein treatments more effective and less invasive. These techniques use heat energy to collapse and seal damaged veins, reducing recovery times and minimizing the risk of complications. For instance, AngioDynamics' VenaCure EVLT is a minimally invasive endovenous laser treatment that provides a proven solution for addressing the root cause of varicose veins. It offers patients a rapid recovery and the ability to resume their normal daily activities quickly.

The increasing emphasis on patient-centered care in healthcare systems contributes to the preference for minimally invasive treatments. Patients are more informed and involved in their treatment decisions, seeking options that offer quicker recovery and less disruption to their lives. This trend aligns with the broader movement towards personalized medicine, where treatments are tailored to meet individual patient needs and preferences, further solidifying the role of minimally invasive procedures in the U.S. market.

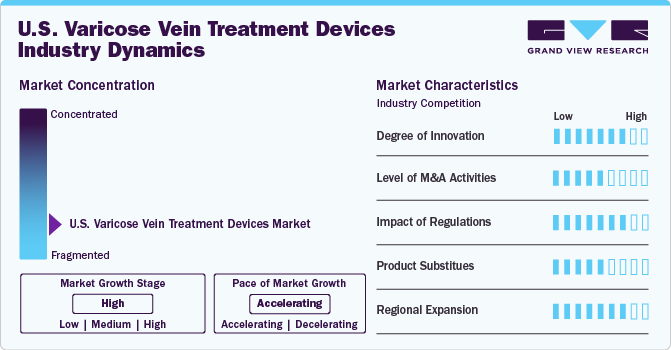

Market Concentration & Characteristics

Thedegree of innovation in the market is high, driven by advancements in minimally invasive technologies and patient-centric solutions. Recent innovations include the development of laser ablation devices and radiofrequency ablation systems, which significantly improve treatment efficacy and reduced patient recovery times. According to an article published by GE Healthcare in July 2023, traditional treatments for varicose veins are typically invasive. The standard approach involves a stripping procedure, where a vascular surgeon makes several incisions along the affected vein to remove it. This procedure can be painful and requires a lengthy recovery period.

Level of merger and acquisition (M&A) activities in the U.S. market is medium. The market saw significant consolidation as larger medical device companies sought to expand their product portfolios and gain competitive advantages through strategic acquisitions. M&A activities indicate a broader trend where established players seek to enhance their capabilities and market reach amid increasing competition from smaller firms specializing in niche products.

The impact of regulations on the U.S. market is assessed as high, given the stringent requirements set forth by regulatory bodies such as the FDA. These regulations ensure that devices meet safety and efficacy standards before being marketed. The approval process can be lengthy and costly, hindering rapid innovation and protecting patient safety. Recent changes in regulatory frameworks aimed at expediting approvals for breakthrough devices provided some relief; however, manufacturers must still navigate complex compliance landscapes.

The presence of product substitutes in the market is rated as medium. While traditional surgical method such as vein stripping is an option for patients with severe cases, there was a significant shift towards less invasive alternatives such as sclerotherapy and endovenous laser therapy (EVLT). These substitutes offer comparable outcomes with fewer complications and shorter recovery times, making those attractive options for patients and healthcare providers. For instance, in April 2022, THERACLION announced that 1,000 patients with varicose veins were treated using SONOVEIN, the only non-invasive ablation therapy device for this condition. This device offers an alternative to endovenous thermal ablation by allowing treatment without catheters, chemical injections, or incisions, thus leaving no scars and enabling procedures in non-sterile environments.

Region expansion within the U.S. market is high, with companies actively seeking to penetrate underserved markets across various states such as California, Texas, and Florida. The growing awareness about venous diseases and an aging population prompted manufacturers to expand their distribution networks beyond metropolitan areas into rural regions where access to specialized care can be limited.

Type Insights

The injection sclerotherapy segment accounted for the largest revenue share of 68.91% in 2023 due to its widespread adoption and effectiveness in treating varicose veins. Injection sclerotherapy involves injecting a sclerosant (a substance that causes thrombosis and fibrosis of the vein) directly into the affected vein, leading to its reabsorption and resolution. According to an article published in Cureus in January 2024, sclerotherapy, a crucial treatment for varicose veins, is broadly analyzed, encompassing liquid and foam techniques. Foam sclerotherapy stands out for its enhanced efficacy. The study offers an in-depth comparison of these modalities, underscoring variations in technical success, recurrence rates, and cost-effectiveness.

The endovenous ablation emerged as the fastest-growing segment. This growth can be attributed to the increasing prevalence of varicose veins among the aging population, necessitating effective and minimally invasive treatment options. Endovenous ablation techniques, including radiofrequency ablation (RFA) and laser ablation (EVLA), offer significant advantages over traditional surgical methods including vein stripping, reduced recovery times, lower complication rates, and improved patient comfort. According to the National Library of Medicine, radiofrequency ablation is a minimally invasive, image-guided procedure conducted in outpatient settings using local anesthesia. It requires a performing operator, a nursing assistant, and a trained ultrasound technician.

Key U.S. Varicose Vein Treatment Devices Company Insights

The U.S. market is characterized by a competitive landscape dominated by several key players with significant market shares across various segments, including endovenous laser therapy, radiofrequency ablation, and sclerotherapy products, for instance, Medtronic's VenaSeal closure system for superficial vein therapies.

Key U.S. Varicose Vein Treatment Devices Companies:

- Medtronic

- AngioDynamics

- Candela Corporation

- Lumenis Be Ltd.

- biolitec Holding GmbH & Co KG

- Eufoton s.r.l.

- Energist

- Quanta System

Recent Developments

-

In June 2023, Theraclion received FDA clearance to initiate a pivotal clinical trial in the U.S. and Europe. The multicenter study, named VEINRESET, will evaluate the Sonovein device for treating primary insufficiency of great saphenous veins at four centers.

-

In April 2022, Ra Medical Systems, Inc. announced that the U.S. Patent and Trademark Office granted a patent for liquid-filled laser ablation with expanded distal optical windows.

U.S. Varicose Vein Treatment Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 576.0 million |

|

Revenue Forecast in 2030 |

USD 795.1 million |

|

Growth Rate |

CAGR of 5.5% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

August 2024 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type |

|

Key companies profiled |

Medtronic; AngioDynamics; Candela Corporation; Lumenis Be Ltd.; biolitec Holding GmbH & Co KG; Eufoton s.r.l.; Energist; Quanta System |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Varicose Vein Treatment Devices Market Report Segmentation

This report forecasts revenue growth in the U.S. and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. varicose vein treatment devices market report based on type:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Endovenous Ablation

-

Endovenous Laser Therapy

-

Radiofrequency Ablation

-

-

Sclerotherapy

-

Surgical Ligation/Stripping

-

Frequently Asked Questions About This Report

b. The U.S. varicose vein treatment devices market size was estimated at USD 549.6 million in 2023 and is expected to reach USD 576.0 million in 2024.

b. The U.S. varicose vein treatment devices market is expected to grow at a compound annual growth rate of 5.5% from 2024 to 2030 to reach USD 795.1 million by 2030.

b. Sclerotherapy dominated the type segment of the U.S. varicose vein treatment devices market in 2023. This is attributable to the easier accessibility, efficiency to treat varicose veins, and favorable reimbursement scenario.

b. Some key players operating in the U.S. varicose vein treatment devices market are Medtronic plc; AngioDynamics, Inc.; Syneron Medical Ltd.; Lumenis Ltd.; Biolitec AG; Eufoton srl; Energist Group; Quanta Systems S.p.A.; and Teleflex, Inc.

b. Key factors that are driving the market growth include the growth in investments by the manufacturers to introduce innovative products and an increase in the prevalence of varicose veins coupled with the growing geriatric population.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."