U.S. Value-based Healthcare Service Market Size, Share & Trends Analysis Report By Models (Pay For Performance, Patient-centered Medical Home), By Payer, By Providers Utilization Category, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-984-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

The U.S. value-based healthcare service market size was valued at USD 4.01 trillion in 2024 and is expected to grow at a CAGR of 7.4% from 2025 to 2030. Burgeoning pressure on the health system due to the constant increase in healthcare spending as a percentage of GDP and healthcare delivery costs are the key contributors to the rising penetration of value-based healthcare services in the industry. There is growing potential to implement a value-based healthcare system in the U.S. due to general areas of improvement such as the need for patient-centricity and uncoordinated treatment.

Factors such as the increasing prevalence of chronic illnesses, enhanced government initiatives, and a rising demand for more cohesive care delivery systems are anticipated to drive market growth throughout the forecast period. The rising prevalence of chronic diseases within the population highlights the necessity for value-based healthcare services to reduce unnecessary healthcare expenditures, thereby driving market growth. For instance, according to Control and Prevention (CDC) updates published in November 2023, approximately 136 million people are suffering with diabetic or prediabetic issues in the U.S. Moreover, as per the National Centre for Health Statistics, as of 2022, approximately 4.6% of adults in the U.S. have ever been diagnosed with COPD, emphysema, or chronic bronchitis. This statistic highlights the prevalence of these chronic respiratory conditions within the adult population.

A significant trend in healthcare is the growing emphasis on patient-centered care models. Initiatives such as patient-reported outcomes measures (PROMs) are becoming increasingly popular, enabling healthcare providers to customize treatments based on feedback and preferences from patients. For example, the Centers for Medicare & Medicaid Services (CMS) in the United States has played a key role in advancing value-based care through initiatives like the Medicare Shared Savings Program (MSSP) and the Hospital Readmissions Reduction Program (HRRP). These programs encourage healthcare providers to minimize readmissions and enhance the quality of care.

Furthermore, in February 2023, the Department of Health and Human Services (HHS) introduced several value-based initiatives aimed at supporting rural leaders and communities. These initiatives were developed primarily through the Centers for Medicare and Medicaid Services (CMS) and its Center for Medicare and Medicaid Innovation (CMMI). The goal is to help identify HHS value-based programs that are appropriate for rural participation. It is expected that these initiatives can enhance the implementation of integrated care models to effectively manage patient diseases, which in turn is likely to drive market growth.

Moreover, there is an increasing focus on population health management, where healthcare providers prioritize preventive care and the management of chronic diseases for specific groups of patients. A study published in Health Affairs indicates that value-based care models have led to a 5.6% decrease in hospitalizations and a 9% decline in emergency department visits, underscoring their effectiveness in enhancing patient outcomes.

Market Dynamics

The chart below illustrates the relationship between market concentration, market characteristics, and market participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including degree of innovation, industry competition, service substitutes, and impact of regulations, level of partnerships & collaborations activities, and geographic expansion. For instance, the U.S. Value-based healthcare service market is fragmented, with many small players entering the market and launching new services. The degree of innovation is medium, the level of partnerships & collaborations activities is medium, the impact of regulations on the market is high, and the regional expansion of the market is low.

The U.S. value-based healthcare services market is experiencing significant innovation as stakeholders push to improve patient outcomes while controlling costs. This shift from fee-for-service to value-based models has spurred advancements in data analytics, telehealth, and personalized medicine. Providers are increasingly integrating cutting-edge technologies such as artificial intelligence and machine learning to enhance predictive analytics, streamline care coordination, and drive preventive strategies. Furthermore, digital platforms are enabling greater patient engagement through real-time health tracking and decision-support tools. Partnerships between tech firms and healthcare providers are flourishing, fostering a collaborative environment that accelerates the development of customized, patient-centric solutions.

The market saw notable consolidations as larger operators sought to expand their reach and capabilities. For instance, in April 2023, CVS Health announced a partnership with Catholic Health, a prominent health system in New York, to enhance healthcare access and improve value-based care specifically for Medicare patients residing in Long Island. This collaboration aims to address the growing need for comprehensive healthcare services among the aging population in this region.

The impact of regulations on the industry is high, with strict guidelines influencing device development and deployment. Regulatory bodies, such as the Affordable Care Act (ACA) and various Medicare initiatives, have established guidelines that promote value-based care models. For instance, the Centers for Medicare & Medicaid Services (CMS) has implemented programs such as the Medicare Shared Savings Program (MSSP) and the Quality Payment Program (QPP), which reward providers for meeting specific quality metrics and improving patient outcomes. These regulations encourage healthcare organizations to adopt innovative care delivery models, such as Accountable Care Organizations (ACOs) and Patient-Centered Medical Homes (PCMHs).

The market has been experiencing significant regional expansion driven by a shift from volume-based care to value-based care models, prioritizing patient outcomes and cost efficiency. Regions with robust healthcare infrastructure, such as the Northeast and West Coast, have seen early adoption of value-based care models due to their advanced technological integration and established health systems that can support these changes. On the other hand, regions including the South and Midwest are gradually catching up as they recognize the potential for improved patient outcomes and reduced costs associated with value-based care.

Models Insights

On the basis of models, the patient-centred medical homes segment held the largest revenue share of 31.69% in 2024 and is expected to grow at a fastest CAGR over the forecast period. The ability of patient-centered medical home services to improve efficiency while providing medical assistance and reducing medical costs is one of the key factors influencing the market expansion. In addition, this market would have significant support, as healthcare providers at both the private and public levels restructure their operations to line with value-based reimbursement and patient-centered medical home care models. For instance, Pfizer has several patient-centered medical home models with which it collaborates on care management programs (PCMH).

The shared savings segment is expected to grow at the lucrative rate over the forecast period due to growing government initiatives aimed at introducing new models and programs. Moreover, the shared savings models offer numerous benefits, such as reducing unnecessary duplication of services and minimizing medical errors. The rising efforts to engage healthcare providers as Accountable Care Organizations (ACOs) are instrumental in enhancing the sustainability of the Medicare program while ensuring that Medicare patients receive high-quality care. For instance, in January 2023, the Centers for Medicare & Medicaid Services (CMS) introduced three innovative accountable care initiatives: the Medicare Shared Savings Program, the Community Health (ACO REACH) Model, and the Kidney Care Choices (KCC) Model along with the Accountable Care Organization Realizing Equity and Access Model. These initiatives are expected to provide improved quality of care to over 13.2 million Medicare beneficiaries in 2023. Consequently, such initiatives are likely to drive growth in this segment throughout the forecast period.

Payer Category Insights

On the basis of payer category, the medicare and medicare advantage segment held the largest revenue share of 48.48% in 2024 and is anticipated to grow at a fastest CAGR over the forecast period. Medicare is gradually shifting from fee-for-service compensation toward value-based models that promote cost-cutting and quality improvement, which is anticipated to drive market growth. The Medicare Advantage (MA) program, which enables Medicare beneficiaries to voluntarily join a commercial plan that provides health benefits, was established by the Balanced Budget Act (BBA) of 1997. In a related manner, the Centers for Medicare and Medicaid Services (CMS) and private insurers have enthusiastically endorsed several payment strategies for primary care doctors, specialists, and health systems in taking on financial risk for the individuals they treat.

The Medicaid segment is expected to grow at the fastest CAGR over the forecast period. This growth is attributed to the increasing number of individuals qualifying for Medicaid, driven by economic challenges and expanded eligibility criteria under the Affordable Care Act (ACA), is creating a more extensive patient base that requires comprehensive healthcare services. As states continue to expand Medicaid programs, more low-income individuals gain access to essential health services, aligning with value-based care principles that emphasize quality over quantity. Moreover, there is a growing recognition of social determinants of health (SDOH) and their impact on patient outcomes. Medicaid programs are increasingly incorporating SDOH into their frameworks, focusing on holistic approaches that address medical needs and social factors such as housing, nutrition, and transportation. This shift encourages providers to adopt value-based care models that incentivize improved health outcomes rather than increased service utilization.

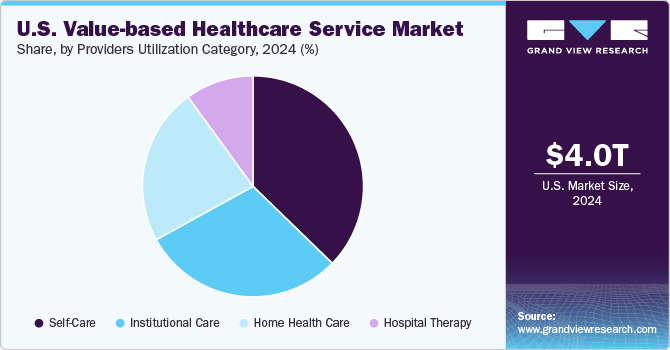

Providers Utilization Category Insights

On the basis of service, the self-care segment held the largest revenue share of 37.26% in 2024. Its dominance is due to increasing emphasis on patient-centered care, encouraging individuals to manage their health actively. This shift aligns with the principles of value-based care, where outcomes are prioritized over the volume of services provided. As patients become more empowered and informed about their health conditions, they are more likely to seek out self-care options, including telehealth services, mobile health applications, and wellness programs that promote preventive care. Moreover, the shift from fee-for-service models to value-based payment systems incentivizes healthcare providers to focus on preventive care and chronic disease management. Insurers increasingly recognize the importance of supporting self-care initiatives through coverage for digital health solutions and wellness programs.

The institutional care segment is expected to grow at the fastest CAGR over the forecast period. Its growth is attributed to the increasing technology, operational problems, rising consumer expectations, and new health conditions. As a result, there has been a continuous shift toward healthcare services that are value-based and patient-centered. Due to profitability, the number of patients treated, lower financial risk, value-based healthcare services are driven by a focus on establishing integrated practice units, which measure outcomes and cost at the patient level, bundle prices, geographic expansion, and information technology platforms.

Key U.S. Value-based Healthcare Service Company Insights

Some of the major companies in the market are Baker Tilly US, LLP; Deloitte; Siemens Medical Solutions USA, Inc.; Boston Consulting Group; and others. The strategies of key players to strengthen their market presence include new launches, partnership & collaborations, mergers & acquisitions, and geographical expansion. For instance, in September 2023, Walgreens Boots Alliance announced a strategic partnership with Pearl Health, a technology-driven healthcare organization focused on value-based care. This collaboration aims to enhance the delivery of healthcare services by leveraging Walgreens’ extensive network of pharmacies and Pearl Health’s innovative technology solutions.

Key U.S. Value-based Healthcare Service Companies:

- Baker Tilly US, LLP

- Deloitte

- Siemens Medical Solutions USA, Inc.

- Boston Consulting Group

- Change Healthcare

- Athena Healthcare

- Veritas Capital Fund Management, L.L.C.

- UnitedHealth Group.

- NXGN Management, LLC.

- McKesson Corporation

- Genpact

- Unlimited Technology Systems, LLC

- ForeSee Medical, Inc.

- Signify Health, Inc. (Sentara Healthcare)

- Curation Health

- Koninklijke Philips N.V.

- Humana

- The Commonwealth Fund.

- Stellar Health

- Privia Health

Recent Developments

-

In January 2024, Health Care Service Corporation (HCSC) entered into a definitive agreement to acquire The Cigna Group’s Medicare Advantage, Medicare Supplemental Benefits, Medicare Part D, and CareAllies businesses for approximately USD 3.3 billion. This acquisition is strategically significant as it allows HCSC to enhance its capabilities and expand its reach within the growing Medicare market.

-

In December 2023, Startup Guidehealth acquired Arcadia’s value-based care division. This acquisition is significant as it positions Guidehealth to enhance its capabilities in the healthcare sector, particularly in value-based care, which focuses on improving patient outcomes while controlling costs. Value-based care models incentivize healthcare providers to deliver high-quality services rather than volume, aligning financial incentives with patient health outcomes.

U.S. Value-based Healthcare Service Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 4.31 trillion |

|

Revenue forecast in 2030 |

USD 6.16 trillion |

|

Growth Rate |

CAGR of 7.4% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast data |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million/Billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Models, payer category, providers utilization category |

|

Key companies profiled |

Baker Tilly US, LLP; Deloitte; Siemens Medical Solutions USA, Inc.; Boston Consulting Group; Change Healthcare; Athena Healthcare; Veritas Capital Fund Management, L.L.C.; UnitedHealth Group.; NXGN Management, LLC.; McKesson Corporation; Genpact; Unlimited Technology Systems, LLC; ForeSee Medical, Inc.; Signify Health, Inc. (Sentara Healthcare); Curation Health; Koninklijke Philips N.V.; Humana; The Commonwealth Fund.; Stellar Health; Privia Health. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Value-based Healthcare Service Market Report Segmentation

This report forecasts revenue growth, country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. value-based healthcare service market report based on models, payers category, and providers utilization category.

-

Models Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pay for performance

-

Patient-centred

-

medical home"

-

Shared savings

-

Shared risk

-

Bundled payment

-

Capitation models

-

-

Payer Category Outlook (Revenue, USD Billion, 2018 - 2030)

-

Medicare and Medicare Advantage

-

Medicaid

-

Commercial

-

-

Providers Utilization Category Outlook (Revenue, USD Billion, 2018 - 2030)

-

Home Health Care

-

Frontloading Skilled Nursing Visits

-

Specialized Frontloading Therapy Visits

-

-

Institutional Care

-

Self-Care

-

Hospital Therapy

-

InPatient

-

Outpatient

-

-

Frequently Asked Questions About This Report

b. U.S. value-based healthcare service market size was estimated at USD 4.01 trillion in 2024 and is expected to reach USD 4.31 trillion in 2025.

b. U.S. value-based healthcare service market is expected to grow at a compound annual growth rate of 7.41% from 2025 to 2030 to reach USD 6,16 trillion by 2030.

b. Patient-centred medical home dominated the Models segment of the U.S. value-based healthcare service market with a share of 31.69% in 2024. The ability of patient-centered medical home services to improve efficiency while providing medical assistance and reducing medical costs is one of the key factors influencing the market expansion.

b. Some key players operating in the U.S. value-based healthcare service market include Baker Tilly US, LLP; Deloitte; Siemens Medical Solutions USA, Inc.; Boston Consulting Group; Change Healthcare; Athena Healthcare; Veritas Capital Fund Management, L.L.C.; UnitedHealth Group; NXGN Management, LLC.; McKesson Corporation; Genpact; Unlimited Technology Systems, LLC; ForeSee Medical, Inc.; Signify Health, Inc. (Sentara Healthcare); Curation Health; Koninklijke Philips N.V.

b. Key factors that are driving the market growth include improved chronic health condition patient management, the higher incidence of chronic non-communicable diseases, the rising demand for more integrated care delivery models, the demand for informed shared decision-making, personalized experiences, and choice among patients, as well as rising organizational restructuring efforts and rising government initiatives.

b. The COVID-19 pandemic has eventually accelerated the deployment of value-based healthcare service models, causing the launch of care delivery to more virtual models due to the declared necessity to focus efforts on patient activation and facilitate treatment of chronic, elective, and non-communicable illness situations.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."