- Home

- »

- Medical Devices

- »

-

U.S. Tumor Ablation Market Size, Industry Report, 2030GVR Report cover

![U.S. Tumor Ablation Market Size, Share & Trends Report]()

U.S. Tumor Ablation Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology, By Treatment (Surgical, Laparoscopic), By Application (Liver Cancer, Kidney Cancer), And Segment Forecasts

- Report ID: GVR-4-68040-241-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Tumor Ablation Market Size & Trends

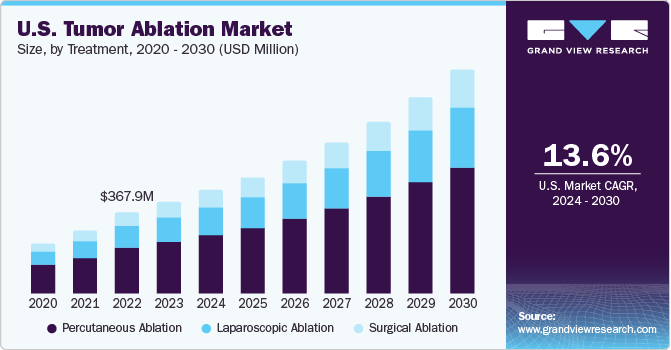

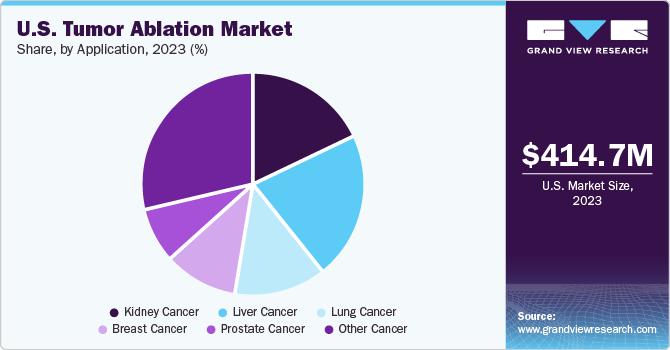

The U.S. tumor ablation market size was valued at USD 414.7 million in 2023 and is anticipated to grow at a CAGR of 13.6% from 2024 to 2030. Factors including high healthcare expenditure, rapid surge in incidence of cancer, and growing awareness about early disease diagnosis are significantly driving the market growth.

In 2023, U.S. accounted for a market share of over 25% in the global tumor ablation market. Major factors contributing to the market growth are government support for quality healthcare, high purchasing power, availability of reimbursement, and growing cancer cases in the U.S. The Patient Protection and Affordable Care Act (PPACA), also known as ObamaCare, promotes quality & affordability of health insurance and reduces the cost of healthcare for individuals & government. In addition, precision medicine initiatives are helping in formulating tailored strategies to target unique characteristics of diseases. Such government initiatives are helping improve the overall healthcare system, which is expected to boost the tumor ablation procedures market.

According to the American Cancer Society, in 2023, approximately 1,958,310 new cancer cases are expected to be diagnosed in the U.S. and approximately 609,820 patients are at high risk of death. Hence, various initiatives undertaken by the American Cancer Society to create awareness about cancer types are expected to drive the adoption of diagnostic and treatment procedures for these diseases. According to the National Cancer Institute, cancer mortality rates decreased by nearly 1.8% among men and 1.4% among women. Cancer survival rate has also improved over the past few years, reflecting the quality of healthcare in the U.S., which is expected to contribute to market growth. In addition, rising geriatric population and growing incidence of obesity have increased the risk of cancer, which is anticipated to fuel adoption of cancer treatment & diagnosis.

Market Characteristics & Concentration

The industry growth stage is high and pace of the growth depicts an accelerating trend. The U.S. tumor ablation industry is fragmented, which is marked by the presence of large number of companies competing for the market share. The industry is in high growth stage and will continue its trajectory in the upcoming 5-6 years.

Technological advancements in ablation devices have facilitated accuracy, portability, and cost-effectiveness, encouraging market players to constantly launch and improve advanced devices. Irreversible electroporation, cryoablation, high-intensity focused ultrasound (HIFU), and image-guided equipment are some of the major examples of technological advancements in the market. Alteration in existing technologies and introduction of novel ablation techniques make it possible to treat larger & more complex tumors in other organs. Furthermore, developments in intraprocedural imaging aim to increase treatment quality and minimize complications. Hence, advancements in intraprocedural imaging have improved treatment preparation and offer accurate analysis of the ablation zone during treatment.

The U.S. tumor ablation industry is characterized by a moderate level of M&A activities undertaken by key manufacturers. Numerous players in the country are collaborating with other relevant companies to strengthen their portfolio and expand their reach. For instance, in December 2022, Boston Scientific Corporation announced acquiring a majority stake, up to a maximum of 65% of shares, of Acotech, a manufacturer of products for different interventional procedures.

Favorable reimbursement policies are opportunistic for demand growth. Medicare and other insurers generally reimburse physicians based on fee schedules that are tied to Current Procedural Terminology (CPT) codes. CPT codes are published by the American Medical Association (AMA) and used to report medical procedures & services. Medicare repays hospitals for outpatient stays (including stays that do not span two midnights) under Ambulatory Payment Classification (APC) groups. It also consigns APC to procedures based on billed Healthcare Common Procedural Coding System (HCPCS/CPT) code.

Technology Insights

Radiofrequency tumor ablation accounted for the largest revenue share of 32.6% in 2023. This dominance is attributable to its advantages including efficiency and specificity in solid tumor ablation procedures for liver and kidney. Furthermore, radiofrequency ablation can be adopted to treat several tumors simultaneously, thus enhancing procedural efficiency with the help of different electrodes positioned at various sites. This is expected to surge the adoption rate of advanced tumor ablation solutions.

Microwave ablation technology is projected to witness the fastest CAGR over the forecast period. Microwave ablation involves the use of electromagnetic waves for tumor destruction, with the device having a frequency of at least 900 MHz. It has various advantages over other techniques, in terms of effectiveness in destroying tumor cells. The advantages of microwave ablation technology include larger volume of tumor ablation, reduced pain, consistency in high temperature, lesser ablation time, and optimal heating of cystic mass. Such advantages are expected to boost the segment growth.

Treatment Insights

Percutaneous ablation segment accounted for the largest revenue share of 56.7% in 2023. Percutaneous tumor ablation, a minimally invasive medical therapy, eliminates the need for open surgery by treating tumors from outside of the body through the skin. This method makes use of different energy sources, such as heat or cold, to destroy or shrink tumor tissue. To precisely target the tumor, percutaneous ablation frequently employs image guidance methods such as ultrasound, CT scans, or MRI. The thermal ablation of localized solid tumors is currently feasible using a variety of percutaneous image-guided techniques.

The laparoscopic ablation segment is estimated to register the fastest CAGR over the forecast period. Laparoscopic ablation is a minimally invasive surgical procedure that uses heat or cold to kill tumors. Laparoscopic ablation, as compared to standard open surgery, involves making small incisions through which specialized instruments and a camera (laparoscope) are inserted to access the tumor and perform the procedure. This method has advantages such as less postoperative discomfort, shorter stays in hospital, and quick recovery times. It offers benefits such as less pain, shorter hospital stays, and faster recovery time compared to traditional surgery.

Application Insights

The liver cancer segment dominated the market in 2023 with a share of 21.4%. Liver cancer is considered the most common type of cancer. As per the American Cancer Society, there are about 41,210 new cases of liver cancer diagnosed in the U.S. in 2023 (27,980 in men and 13,230 in women). In total, 29,380 people are projected to die due to this illness (19,000 men and 10,380 women). Minimally invasive procedures, such as those involving the usage of a needle or probe, do not require a hospital stay. Hence, the adoption of these techniques is increasing.

Lung cancer segment has been anticipated to grow at a fastest rate during the forecast period. The growth is attributable to the increasing cases of lung cancer due to the surge in prevalence of smoking.

Key U.S. Tumor Ablation Company Insights

Key U.S. tumor ablation companies include Medtronic, Boston Scientific Corporation Johnson & Johnson Service Inc., and AngioDynamics. Manufacturers in the sector are emphasizing technological advancements for enhancing procedural outcomes. Such improvements are creating new growth opportunities in the industry. Furthermore, FDA approval of new products and several strategic initiatives by major players, such as mergers & acquisitions, are expected to contribute to market growth.

Key U.S. Tumor Ablation Companies:

- Medtronic plc.

- Boston Scientific Corporation

- Johnson & Johnson Service Inc. (Ethicon, Inc.)

- AngioDynamics

- Bioventus Inc. (Misonix Inc.)

- EDAP TMS

- Chongqing Haifu Medical Technology Co., Ltd

- Mermaid Medical

- HealthTronics, Inc.

- H.S. Hospital Service S.p.A

Recent Developments

-

In August 2023, Bioventus Inc. (Misonix Inc.) received U.S. FDA clearance for its neXus SonaStar Elite handpiece for various procedures, including removing malignant & benign spinal and brain tumors.

-

In March 2023, AngioDynamics entered a new partnership with Minimax Medical for the worldwide distribution of its product portfolio.

U.S. Tumor Ablation Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 414.7 million

Revenue forecast in 2030

USD 1.01 billion

Growth rate

CAGR of 13.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, product outlook

Segments covered

Technology, treatment, application

Country Scope

U.S.

Key companies profiled

Medtronic; Boston Scientific Corp.; Johnson & Johnson Service Inc. (Ethicon, Inc.); AngioDynamics; Bioventus Inc. (Misonix Inc.); EDAP TMS; Chongqing Haifu Medical Technology Co., Ltd.; Mermaid Medical; HealthTronics, Inc.; H.S. Hospital Service S.p.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Tumor Ablation Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. tumor ablation market report based on technology, treatment, and application:

-

Technology Outlook (Revenue in USD Million, 2018 - 2030)

-

Radiofrequency ablation

-

Microwave ablation

-

Cryoablation

-

Irreversible electroporation ablation

-

HIFU

-

Other ablation technologies

-

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical ablation

-

Laparoscopic ablation

-

Percutaneous ablation

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Kidney cancer

-

Liver cancer

-

Breast cancer

-

Lung cancer

-

Prostate cancer

-

Other cancer

-

Frequently Asked Questions About This Report

b. The U.S. tumor ablation market size was estimated at USD 414.7 million in 2023 and is expected to reach USD 468.3 million in 2024.

b. The U.S. tumor ablation market is expected to grow at a compound annual growth rate of 13.6% from 2024 to 2030 to reach USD 1.01 billion by 2030.

b. Radiofrequency ablation dominated the U.S. tumor ablation market with a share of 32.6% in 2023. This is attributable to government support for quality healthcare, availability of reimbursements, and the increasing prevalence of cancer.

b. Some key players operating in the U.S. tumor ablation market include Galil Medical Inc.; Misonix Inc.; HealthTronics; Angiodynamics (Covidien); Boston Scientific Corporation; Medtronic Plc.; SonaCare Medical; EDAP TMS S.A.; and Neuwave Medical Inc.

b. Key factors that are driving the U.S. tumor ablation market growth include the rising prevalence of cancer and the high demand for safer therapeutic options.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.