- Home

- »

- Advanced Interior Materials

- »

-

U.S. Trench Shoring Equipment Market Size, Report, 2030GVR Report cover

![U.S. Trench Shoring Equipment Market Size, Share & Trends Report]()

U.S. Trench Shoring Equipment Market Size, Share & Trends Analysis Report By Type (Trench Shields, Hydraulic Shores), By Application (Pipeline Installation), By Region (Southwest), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-354-1

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

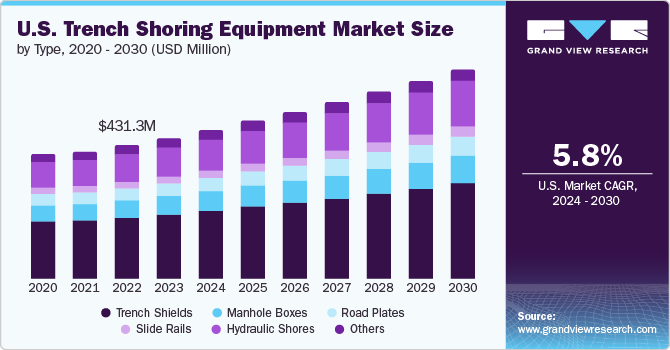

The U.S. trench shoring equipment market size was estimated at USD 455.6 million in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2030. The rising demand for trench shoring equipment in the U.S. can be attributed to the ongoing infrastructure development and renovation activities across the country. With an increased focus on enhancing public safety and complying with stringent safety regulations, construction companies are investing heavily in trench shoring equipment. This surge is driven by the need to prevent trench collapses, which are hazardous and can lead to significant project delays and financial losses. Moreover, the adoption of new technologies and advanced materials in the manufacturing of trench shoring equipment is improving its efficiency and reliability, further fueling the market growth.

As a result, the market is witnessing a significant uptick in demand, reflecting the broader trends of safety and innovation in the construction industry. Safety regulations mandate that construction sites implement measures to protect workers from hazards such as cave-ins, a significant risk in trenching operations. Trench shoring systems are specifically designed to prevent soil collapse and provide structural support to excavations, ensuring the safety of personnel working within them. These factors are expected to drive the market demand in the coming years. Moreover, the growing prominence of EVs in the U.S. is poised to bolster the market, driven by the need for extensive infrastructure development to support EV charging stations.

As cities and municipalities strive to meet the increasing demand for EV charging points, construction projects involving trenching and excavation become essential. These activities are necessary to lay underground utilities such as electrical conduits, cables, and foundations required to install and operate charging infrastructure. Trench shoring equipment is critical in these infrastructure projects to ensure workers' safety and excavations' structural integrity. With trench shoring systems, construction crews can safely dig and maintain trenches without risking collapse or other hazardous incidents. This compliance with safety regulations protects workers, minimizes project delays, and enhances overall operational efficiency.

Drivers, Opportunities & Restraints

The U.S. construction industry is currently experiencing robust growth, driven by factors, such as urbanization and infrastructure development. Construction is a significant contributor to the U.S. economy. According to The Associated General Contractors (AGC) of America, Inc., there were over 919,000 construction establishments in the country in the first quarter of 2023. The U.S. Census Bureau reported an approximate 10% increase in construction spending from 2023 to 2024. This growth has increased the demand for trench-shoring solutions across the country. Trench shoring is critical in ensuring the safety and efficiency of excavation and trenching activities. It involves using supportive systems, such as hydraulic shores, road plates, and trench boxes, to prevent soil cave-ins and provide a stable and safe environment for workers and equipment during underground construction.

Moreover, construction companies mitigate risks to workers and avoid potential legal liabilities and penalties associated with non-compliance, which can be highly expensive. For instance, in October 2022, The U.S. Department of Labor's Occupational Safety and Health Administration determined that R Construction Civil LLC, a construction company engaged in civil infrastructure and energy service-related construction, failed to comply with workplace safety procedures. The company allowed its workers to work in the absence of protective shoring. As a result, the company faced a proposed fine of USD 257,822. The U.S. Department of Labor's Occupational Safety and Health Administration publicizes such cases, incentivizing companies to comply with safety regulations to avoid bad publicity in the market and substantial expenses.

Market Concentration & Characteristics

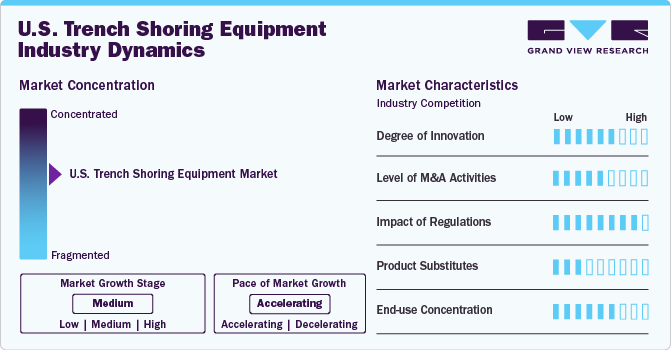

The industry growth stage is medium, and the pace is accelerating. The market is characterized by a high degree of innovation, which is attributable to the rapid technological advancements. Moreover, market players are adopting organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the market.

Regulations play a critical role in shaping the market, acting as both catalysts for growth and as defining parameters for operational conduct. Regulatory bodies, such as the OSHA, have established stringent guidelines that construction firms must adhere to when engaging in trenching and excavation activities to ensure worker safety and minimize the risk of trench collapses. These regulations mandate trench shoring equipment in various scenarios, making it a standard practice in the industry. This has led to a steady demand for trench shoring solutions as companies strive to comply with these rules to avoid hefty fines and safeguard their workforce.

Trench-shoring equipment ensures excavation sites' safety and structural integrity. Its primary end use involves providing temporary support for trenches to prevent collapses and safeguarding workers during the installation of utilities or pipelines or whenever deep excavation is required. This versatile equipment can be used in various scenarios, including construction, municipal infrastructure projects, and emergency responses where ground stability is compromised. By reinforcing trench walls, shoring equipment mitigates risks, enabling safe and efficient completion of construction and repair tasks.

The threat of substitutes for trench shoring equipment primarily arises from alternative excavation support methods, such as sloping, benching, and the use of trench boxes. Moreover, technological advancements leading to more sophisticated and safer excavation methodologies can pose a competitive challenge. In addition, the growing popularity and regulatory acceptance of ground improvement techniques and trenchless technology for utility installations may reduce dependence on traditional shoring equipment. However, the critical need for worker safety and regulatory compliance in trench operations sustains the demand for effective shoring solutions.

Type Insights

“The demand for manhole boxes type segment is expected to grow at a significant CAGR of 6.8% from 2024 to 2030 in terms of revenue”

The trench shields type segment held the largest share in 2023. The demand for trench shields is rising due to the increasing emphasis on site safety and the need to protect workers from cave-ins during excavation. Trench shields provide a safe working environment by preventing soil collapse and ensuring workers have enough time to complete their tasks without risk of injury or death.

The demand for the manhole boxes type segment is expected to grow at a significant CAGR in terms of revenue from 2024 to 2030. Manhole boxes are quickly assembled and installed without the need for an operative to enter the unsupported excavation, reducing the risk of accidents and injuries. They provide additional ground support, especially when installing pre-cast manhole rings, which helps to prevent soil collapse and ensures the stability of the trench.

Application Insights

“The demand for transport infrastructure application segment is expected to grow at a significant CAGR of 6.8% from 2024 to 2030 in terms of revenue”

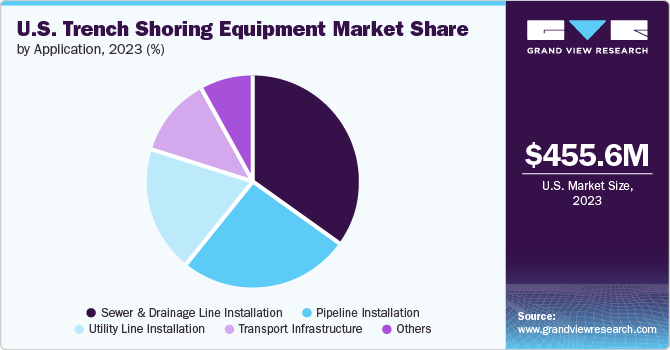

The sewer & drainage line installation segment held the largest share in 2023. Trench shoring equipment plays a crucial role in ensuring worker safety during sewer and drainage line installation projects. The equipment is designed to support the sidewalls of trenches and prevent cave-ins, which can be particularly challenging in sewer and drainage line installations due to the depth and length of the trenches. For instance, trench shields are commonly used in sewer and waterline repair projects, allowing workers to access the trench safely and efficiently.

The demand for the transport infrastructure application segment is expected to grow at a significant CAGR from 2024 to 2030 in terms of revenue. Trench shoring equipment is crucial in the construction and maintenance of transport infrastructure, ensuring the stability and safety of excavations for projects such as roadways, railways, and bridges. Trench shoring prevents collapses and provides a secure working environment to workers during the installation of underground utilities like drainage systems, sewers, and communication lines beneath roads and rail tracks.

Country Insights

“In the U.S., Southeast dominated the market in 2023 and it accounted for 25.3% market share in 2023”

The southeast region dominated the market in 2023. The increasing installation of natural gas pipelines in the region is driving the demand for trench-shoring equipment due to the region's rising focus on energy infrastructure development. The construction of natural gas pipelines requires extensive excavation, wherein trench-shoring equipment is critical to prevent soil collapse and ensure the safety of workers. In addition, stringent regulatory standards emphasize the implementation of protective measures, further propelling the demand for trench shoring equipment. As a result, growing natural gas pipeline installation activities in the Southeast U.S. are driving the need for reliable and effective trench-shoring solutions.

Stringent regulations in the Southwest U.S. region are crucial in driving the demand for trench-shoring equipment. For example, in Texas, state regulations require implementing safety measures to ensure worker well-being and compliance. One such state regulation is Section 756.022 of the Health and Safety Code in Texas, which mandates trench excavation exceeding the depth of five feet to include the trench safety system for trench excavation safety protection. As a result, construction projects, especially those involving excavation activities, are mandated to use trench shoring equipment to maintain a secure working environment.

Key U.S. Trench Shoring Equipment Company Insights

Some of the key players operating in the market include Trench Shoring Company, Speed Shore Corporation, and Pacific Shoring among others.

-

Trench Shoring Company has a presence in eleven locations in the U.S., which include, Compton, Banning, Bakersfield, Corona, Fullerton, Fresno, Lake Forest, Moorpark, San Diego, San Leandro, and Las Vegas, Nevada. The company has been developing products to meet the unique needs of contractors that focus on public works projects. It provides the construction industry with modern shoring equipment and trench plates. The company has its own Trench Shoring University training team, through which it provides online and in-person instructor-led training to individuals

-

Pacific Shoring offers a full line of aluminum and steel trench safety equipment. The company has a robust network of dealers that allows its products to penetrate the U.S., Canada, and Australia markets. The company has been continuously enhancing its product line by focusing on minimized lead times and introducing innovative products across the trench shoring industry. The company's shoring assemblies are manufactured in Santa Rosa, California & Pasadena, and Texas. It operates at three locations in the U.S., including Graham, North Carolina; Houston, Texas; and Santa Rosa, California. In addition, the company has been developing a strong distributor network, which gave it an added advantage to sell and ship its shoring products across 50 states of the U.S. and Canada

Pinnacle Manufacturing, TrenchTech Inc., Kundel Industries Inc., CONQUIP, are some of the emerging market participants in the U.S. trench shoring equipment market.

-

Pinnacle Manufacturing provides portable storage tanks, vertical storage tanks, trench shoring equipment, poly storage tanks, trash containers, and pool tanks. The company has four divisions, namely, Pinnacle West, Pinnacle Parts, Pinnacle Trench Shoring, and Pinnacle East. The company specializes in steel trench shields for the underground utilities market. The trench shields are designed and certified by a registered professional engineer to meet and exceed the OSHA standards 1926 Sub Part P-excavations. The company has been developing products with high quality through continuous improvement and development. The company has two manufacturing facilities with over 3,50,00 square feet of indoor manufacturing space

-

TrenchTech, Inc. offers a wide array of trenching solutions and it provides top-quality, innovative products for both rent and purchase. All equipment meets or exceeds OSHA standards and comes with the manufacturer’s tabulated data, certified by a registered professional engineer. In addition, the company offers custom engineering and special operations services, as well as safety and equipment training. The company has its own Safety University where it gives classroom training and hands-on demonstration

Key U.S. Trench Shoring Equipment Companies:

- Trench Shoring Company

- TrenchTech, Inc.

- Speed Shore Corporation

- Pinnacle Manufacturing, LLC

- Pacific Shoring

- ESC Group

- CONQUIP

- Arcosa, Inc.

- Kundel Industries Inc.

- Cerda Industries

Recent Developments

-

In April 2024, Pacific Shoring acquired EZE Shore, Ltd., a UK-based company. In the European market, EZE Shore, Ltd. was known for introducing a robust, lightweight, completely composite trench shoring system for trench depths up to eight feet. Pacific Shoring also acquired the current patent rights in the U.S. and Europe as part of this new transaction. This acquisition is anticipated to help the company develop new products and position itself as an innovator in the market

-

In July 2023, ESC Group launched its latest trench shoring equipment product line that offers aluminum sheet piles and trench shields. Furthermore, the company's product portfolio has been increased by the introduction of ABX Series - an aluminum trench shield (known as trench box) developed by its core engineering team. This new product launch helped the company diversify its trench-shoring product offering in the U.S.

U.S. Trench Shoring Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 481.7 million

Revenue forecast in 2030

USD 677.0 million

Growth rate

CAGR of 5.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, and region

Region scope

Southwest; West; Midwest; Southeast; Northeast

Key companies profiled

Trench Shoring Company; TrenchTech, Inc.; Speed Shore Corp.; Pinnacle Manufacturing, LLC; Pacific Shoring; ESC Group; CONQUIP; Arcosa, Inc.; Kundel Industries Inc.; Cerda Industries

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Trench Shoring Equipment Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. trench shoring equipment market report on the basis of type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Trench Shields

-

Manhole Boxes

-

Road Plates

-

Slide Rails

-

Hydraulic Shores

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Sewer and Drainage Line Installation

-

Pipeline Installation

-

Utility Line Installation

-

Transport Infrastructure

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Southwest

-

West

-

Midwest

-

Southeast

-

Northeast

-

Frequently Asked Questions About This Report

b. The U.S. trench shoring equipment market size was estimated at USD 455.6 million in 2023 and is expected to reach USD 481.7 million in 2024

b. The U.S. trench shoring equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 677.0 million by 2030.

b. Southeast region dominated the market in 2023. The increasing installation of natural gas pipelines in the Southeast U.S. region is driving the demand for trench shoring equipment due to the region's rising focus on energy infrastructure development. The construction of natural gas pipelines requires extensive excavation, wherein the use of trench shoring equipment is critical to prevent soil collapse and ensure the safety of workers.

b. Some of the key players operating in the U.S. trench shoring equipment market include Trench Shoring Company, TrenchTech, Inc., Speed Shore Corporation, Pinnacle Manufacturing, LLC, Pacific Shoring, ESC Group, CONQUIP, Arcosa, Inc., Kundel Industries Inc., Cerda Industries among others.

b. The rising demand for trench shoring equipment in the U.S. can be attributed to the extensive infrastructure development and renovation activities taking place across the country. With an increased focus on enhancing public safety and complying with stringent safety regulations, construction companies are investing heavily in trench shoring equipment.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."