- Home

- »

- Medical Imaging

- »

-

U.S. Treatment Planning Systems And Advanced Image Processing Market, Industry Report, 2030GVR Report cover

![U.S. Treatment Planning Systems And Advanced Image Processing Market Size, Share & Trends Report]()

U.S. Treatment Planning Systems And Advanced Image Processing Market Size, Share & Trends Analysis Report By Component, By Technique, By Application (Adaptive Radiotherapy, Dose Accumulation), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-228-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

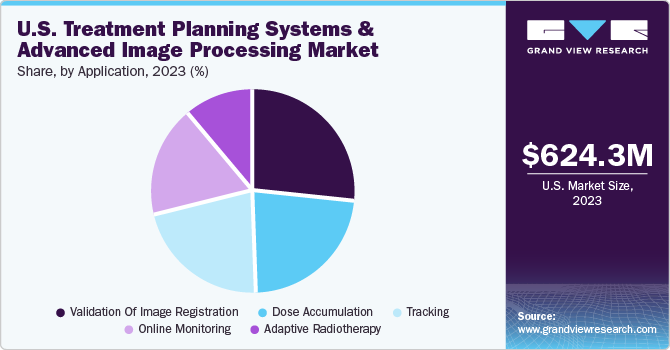

The U.S. treatment planning systems and advanced image processing market size was valued at USD 624.3 million in 2023 and is anticipated to grow at a CAGR of 8.70% from 2024 to 2030. The presence of cancer research institutes coupled with improved healthcare infrastructure is the major factor driving the market. The deployment of cancer treatment planning solutions is high in hospitals & cancer research institutes due to high prevalence of cancer and increase in healthcare expenditure budget.

U.S. accounted for 81.8% of the global treatment planning systems and advanced image processing market in 2023.The country is a competitive and leading market for novel cancer treatment solutions. In January 2022, the National Cancer Institute estimated that around 18.1 million people in the United States have survived cancer, which accounts for roughly 5.4% of the total population. According to projections, the number of individuals who have survived cancer is expected to reach 22.5 million by 2032, representing a 24.4% increase. The growing prevalence of cancer among various demographics and rising demand for advanced innovative treatment planning solutions & advanced imaging systems are some of the driving factors in the U.S. market.

The integration of AI/ML has led to significant enhancements in the diagnosis and imaging aspects of oncology care. Several healthcare professional societies and regulatory bodies have launched initiatives to encourage the adoption of AI/ML in various oncology processes, particularly in imaging, treatment planning, and delivery. For instance, the American College of Radiology established the Data Science Institute to foster collaboration among radiologists and public & private agencies and to facilitate the adoption & development of AI-based imaging solutions.

CancerLinQ was launched by the American Society of Clinical Oncology and the American Society for Radiation Oncology, while the Big Data to Knowledge initiative was established by the National Institute of Health. As the amount of cancer-related data continues to grow and the need for timely diagnosis and personalized treatment plans increases, the adoption of AI/ML in oncology has gained momentum.

The large geriatric population, increase in the incidence of lifestyle-induced diseases, and rise in the awareness about early diagnosis of chronic diseases increased the demand for medical imaging devices. Additionally, due to the increasing adoption of treatment planning systems in the region, rising prevalence of cancer, increasing number of players trying to gain higher revenue share, and consistent product innovations, the market is anticipated to grow at a substantial rate during the forecast period.

Market Characteristics & Concentration

The market is concentrated, with a few market players accounting for the majority of revenue share. Moreover, these players have strong market penetration and are preferred by customers due to the superior product quality. Primary customers of these software solutions are hospitals, specialty clinics, and oncology research centers.

This industry is dominated by participants involved in new product launches among several other strategic initiatives to maintain their position. Several players are launching various products and initiating product expansion. In May 2023, DOSIsoft made an announcement regarding their latest product innovation - ThinkQA Secondary Dose Check. The product is designed to offer fast, reliable, and independent 3D dose calculation for online adaptive workflows.

Several industry players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies. For instance, in September 2023, Varian Medical Systems, Inc. acquired Aspekt Solutions, a provider of medical physics, strategic consultation services, and dosimetry. This acquisition is anticipated to expand Varian's portfolio of Advanced Oncology Solutions (AOS) and enhance its capability to meet the increasing demand for tailored services and standardized care delivery.

The presence of numerous regulatory and governing bodies in the radiotherapy space is supporting the growing oncology treatment planning systems market. Government regulations are favoring the market growth. It is regulated by the FDA’s Center for Devices and Radiological Health (CDRH) in the US. Stringent regulations and lengthy product approval processes are some of the factors likely to impede market growth. Data security and confidentiality-related regulation may increase the regulatory burden on the companies and may lead to non-approval of certain systems.

Component Insights

Treatment planning software segment accounted for the largest share of 87.80% in 2023. These solutions offer a suite of tools for radiation therapy. The increasing availability of oncology radiotherapy treatment planning software solutions with added features, rising cases of cancer, and benefits of software solutions are key factors driving the growth & adoption of treatment planning software segment.

The advanced image processing software segment is expected to witness the fastest CAGR over the forecast period. Image processing software typically functions through image segmentation, image registration, and image visualization. Increasing demand for image processing solutions to enhance efficiency and reduce cost & time, coupled with the development & adoption of e-health infrastructure, is driving the growth of advanced image processing solutions. Increasing use of AI, funding, product launches, and R&D activities are expected to boost the segment’s growth.

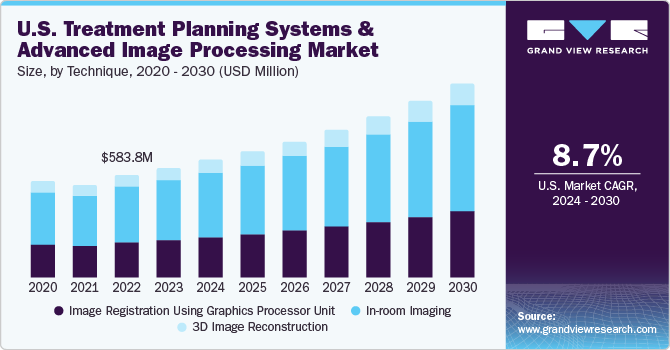

Technique Insights

In-room imaging segment accounted for the largest share of 55.12% in 2023. This technique is gaining popularity due to the emphasis on dosage volume reduction, normal tissue radiotherapy toxicity reduction, and improved precision treatment. Advancements in in-room imaging techniques have improved target localization, shortened treatment courses, reduced dosage toxicity, and improved tumor control.

The 3D image reconstruction segment is expected to witness the fastest CAGR over the forecast period. Healthcare infrastructure is rapidly advancing and incorporating innovative technologies, which is a driving factor for this segment. 3D image reconstruction processes emphasizes on image-based simulation to define tumor & critical structure volume for every individual patient. The increasing demand for accurate & precise oncology treatment practices to improve patient outcomes and tackle the high prevalence of cancer across the globe is driving the 3D image reconstruction segment.

Application Insights

Validation of image registration segment was identified as the largest revenue contributor with 27.10% share in 2023. Image registration plays a vital role in every stage of treatment planning that captures & forms image datasets. Although deformable image registration has gained popularity in recent years, there are no well-defined validation systems. These validation systems can be defined using anatomical landmark datasets and contours & deformation field analysis. These solutions would guide in dose mapping and accumulation.

Adaptive radiotherapy segment is expected to witness the fastest CAGR as this is an option that is commonly used for cancer of head, neck, and stomach. Increasing cancer incidences & associated mortality, rising number of cancer treatment facilities, and growing geriatric population are positively impacting the adoption of adaptive radiotherapy.

Key U.S. Treatment Planning Systems & Advanced Image Processing Company Insights

Some of the prominent U.S. treatment planning systems and advanced image processing market companies are RaySearch Laboratories; Varian Medical Systems; Accuray Inc.; Elekta; Brainlab, Prowess, Inc; DOSIsoft SA; MIM Software, Inc.; and Philips Healthcare. These players are adopting growth strategies such as innovative product launches, R&D investments, technological collaborations, and mergers & acquisitions to increase their foothold in the market.

Key U.S. Treatment Planning Systems And Advanced Image Processing Companies:

- Accuray Incorporated

- Elekta

- Philips Healthcare

- RaySearch Laboratories

- Varian Medical Systems

- Brainlab

- Prowess Inc.

- DOSIsoft SA

- ViewRay Inc.

- MIM Software Inc.

Recent Developments

-

MIM Software, Inc. obtained FDA approval for its latest version of AI auto-contouring solution, Contour ProtégéAI in May 2023. This updated version includes improved algorithms for Radiation Oncology segmentation, providing MIM Software customers with better results.

-

In May 2023, Brainlab AG unveiled the launch of ExacTrac Dynamic Surface, an addition to the ExacTrac Dynamic family of radiotherapy patient positioning and monitoring systems. This system is tailored to support SGRT

-

In June 2022, RaySearch Laboratories introduced the latest version of RayCare, the next-generation oncology information system. RayCare 6A comes with significant improvements across all major aspects of the product and includes enhanced connectivity with other hospital information systems to streamline the flow of data between systems

U.S. Treatment Planning Systems & Advanced Image Processing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 669 million

Revenue forecast in 2030

USD 1.10 billion

Growth rate

CAGR of 8.70% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

Segments covered

Component, technique, application

Country scope

U.S.

Key companies profiled

Accuray Incorporatd; Elekta; Koninklijke Philips NV; RaySearch Laboratories; Varian Medical Systems; Brainlab; Prowess, Inc.; DOSIsoft SA; Viewray, Inc.; MIM Software, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

U.S. Treatment Planning Systems And Advanced Image Processing Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. treatment planning systems and advanced image processing market report based on component, application, and technique:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Advanced Image Processing Software

-

Treatment Planning Software

-

Auto-contouring Software

-

Multi-modality Software

-

PET/CT Deformable Software

-

DICOM-RT Software

-

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

3D Image Reconstruction

-

In-room Imaging

-

Image Registration Using Graphics Processor Unit

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Adaptive Radiotherapy

-

Online Monitoring

-

Tracking

-

Dose Accumulation

-

Validation Of Image Registration

-

Frequently Asked Questions About This Report

b. The U.S. treatment planning systems and advanced image processing market size was estimated at USD 624.3 million in 2023 and is expected to reach USD 669.0 million in 2024.

b. The U.S. treatment planning systems and advanced image processing market is expected to grow at a compound annual growth rate of 8.47% from 2024 to 2030 to reach USD 1.10 billion by 2030.

b. The treatment planning software segment dominated the U.S. treatment planning systems and advanced image processing market with a share of 87.8% in 2023. This high segment share is attributable to the growing prevalence of cancer and increasing demand for accurate and advanced oncology therapy solutions.

b. Some key players operating in the U.S. treatment planning systems and advanced image processing market include Accuray Incorporatd; Elekta; Koninklijke Philips NV; RaySearch Laboratories; Varian Medical Systems; Brainlab; Prowess, Inc.; DOSIsoft SA; Viewray, Inc.; MIM Software, Inc.

b. Key factors that are driving the market growth include growing prevalence of cancer and increasing medical imaging procedures drive the demand for treatment planning systems which in turn is anticipated to drive the market growth over the forecast years.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."