- Home

- »

- Medical Devices

- »

-

U.S. Transplantation Market Size, Industry Report, 2030GVR Report cover

![U.S. Transplantation Market Size, Share & Trends Report]()

U.S. Transplantation Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Tissue Products, Immunosuppressive Drugs), By Application (Organ Transplantation, Tissue Transplantation), By End-use (Hospitals, Transplant Centers), And Segment Forecasts

- Report ID: GVR-4-68040-277-6

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Transplantation Market Size & Trends

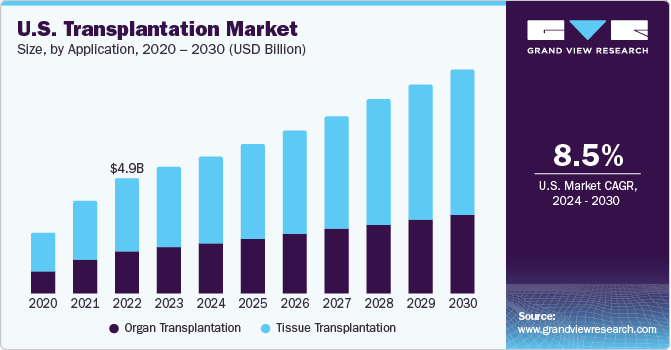

The U.S. transplantation market size was valued at USD 5.45 billion in 2023 and is expected to register a CAGR of 8.5% from 2024 to 2030. Increasing demand for novel products for tissue transplantation and organ transplantation to treat organ failure, is a significant factor driving the market growth. Tissue and organ transplantation is mainly performed for kidney, liver, heart, and lungs.

In 2023, U.S. accounted for over 33% in the global transplantation market. The increasing demand for organs for carrying out transplantation procedures can be linked to the growth in incidence of chronic diseases resulting in organ failures. For instance, conditions such as diabetes and hypertension are among the most common causes of end-stage renal disease, where dialysis or kidney transplant are the only options for treatment. According to the organdonor.gov as of Sept 2023, there were over 103,000 patients in the country awaiting organ transplantation, of which over 88,000 patients were waiting for kidney transplants. During the same time, there were over 46,000 organ transplants performed of which over 15,000 were kidney transplants.

The number of organ donors in the U.S. has increased significantly since the past decade. According to the U.S. Department of Health & Human Services, there is a 40% increase in the number of organ donors from 2011 to 2021. Growing demand for kidney transplantation is one of the major drivers of the market. Kidney transplantation witnessed an exponential growth from 16,186 transplants in 2011 to 23,401 transplants in 2021. Increase in aging population is also boosting the need for organ transplantation. Further, the number of organ transplants in the population older than 65 years is almost double when compared with 2011. These factors are projected to spur the demand for transplantation in the country.

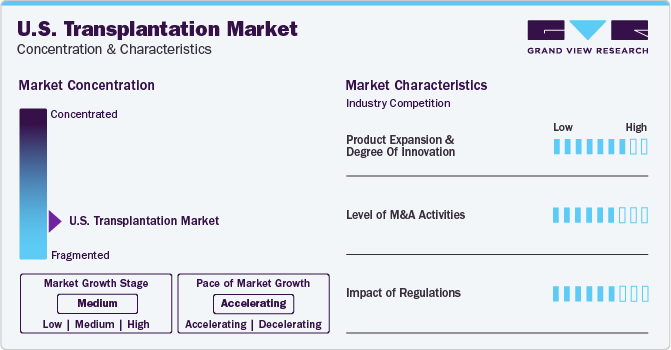

Market Concentration & Characteristics

The industry is at a growth stage and is growing at a CAGR of 8.5%. Rising regulatory approvals for autologous grafts, allografts, and other materials paired with the introduction of innovative products have led to increasing demand for transplantation treatment.

Increasing advancements in technologies have led to a paradigm shift in organ transplantation procedures and techniques, which is expected to propel the demand. Novel and enhanced transplantation solutions, including tissue products, surgical instruments, and tissue typing technology are also supplementing the demand. Further, increasing technological advancements in 3D bioprinting are boosting the adoption of organ transplantation. The demand for 3D bioprinting is surging as a result of the ongoing shortage of organ donors and the growing number of patients on the organ transplant waiting list.

The U.S. transplantation industry is characterized by a high level of M&A activities undertaken by leading players. This is due to factors including the increasing focus on enhancing companies' portfolio and the need to consolidate in a rapidly growing industry. Several players in the country are undertaking this strategy to strengthen their portfolio. For instance, in March 2022, Zimmer Biomet signed an agreement with Biocomposites to distribute genex bone graft substitute with its novel delivery options and mixing system.

The country witnesses an increased demand for innovative transplantation solutions for the treatment of organ failure. To manage such issues, the Health Resources and Services Administration (HRSA) department of the U.S. government introduced an initiative in March 2023, to release the data of transplant and new organ donors. This initiative is expected to enhance the transplantation network and help modernize organ procurement.

Product Insights

Tissue products held the largest market share of 58% in 2023. Tissue products that are used for transplantation consist of bone, skin, tendons, heart valves, corneas, ligaments, hematopoietic stem/progenitor, dura mater, cells derived from peripheral & cord blood, oocytes, and semen. Orthobiologics are used in cases of orthopedic injuries for speeding up the healing process and are used largely with transplantation products. Stryker Corporation is a leading company that manufactures orthobiologics and provides bone repair & soft tissue products. Tissue products such as skin, heart valves, ligaments, bone, corneas, tendons, cord blood, collagen, heart valves, and stem cells are also used in various transplantation procedures.

The immunosuppressive drugs segment is projected to register the fastest growth during the forecast period. This is attributable to the increasing usage of these drugs to prevent post-transplant rejection of organ or tissue. There are two types of immunosuppressive drugs - induction drugs and maintenance drugs. Induction drugs are powerful antirejection drugs that are used particularly at the time of transplantation. Maintenance drugs on the other hand are antirejection medicines that are used for longer duration of time.

Application Insights

Tissue transplantation dominated the market with a share of 58% in 2023. The replacement of skin, bones, cornea, tendons, nerves, heart valves, and veins are among the most commonly performed tissue transplant procedures. The increasing number of accident and burn cases is expected to propel the demand for tissue transplantation.

The organ transplantation segment is expected to exhibit the fastest growth rate during the forecast period. Major factors driving the growth of organ transplantation include increasing cases of loss of blood, serious trauma, drug abuse, sepsis, and other acute diseases. The most commonly transplanted organs include kidney, heart, lungs, and liver. Some of the factor contributing to the growth of organ transplantation are lifestyle disorders, such as alcohol consumption, unhealthy dietary habits, and lack of exercise.

End-use Insights

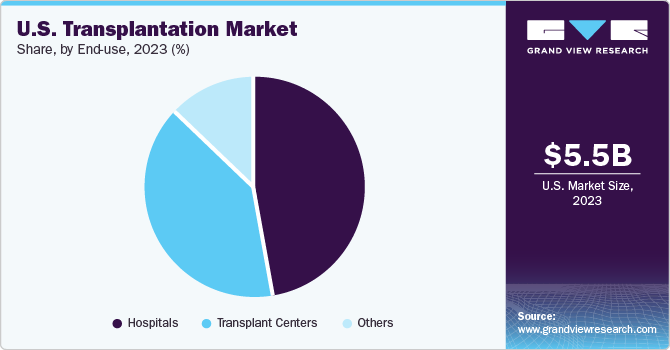

The hospitals segment held the largest revenue share of 47.4% in 2023. High number of organ transplants are conducted at hospitals as they are the primary treatment center. Hospitals keep a track of organ receivers that are on the waiting list and intimate them about the availability of an organ. Hospitals ensure HLA matching of receiver with the donor to avoid the risk of transplant rejection. Since majority of the hospitals have well-defined databases to check for the availability of organs, large number of transplant procedures are performed in such settings.

The transplant centers segment is expected to exhibit the fastest CAGR during the forecast period. Transplantation centers offer transplantation programs and consist of specialty surgeons, anesthesiologists, nurse coordinators, financial coordinators, primary care physicians, and dieticians for monitoring the procedure to avoid negative outcomes. Such centers also raise awareness about organ transplantation to encourage organ donation. According to the National Kidney Center, there are about 244 kidney transplant centers in the U.S. These centers are attracting high demand because they cater exclusively to organ transplantation.

Key U.S. Transplantation Company Insights

The industry is moderately fragmented with a majority of mid and small-sized companies. Some of the leading transplantation companiesin the U.S. include Medtronic, Zimmer Biomet, and Stryker Corporation among others. These companies are involved in launching novel productsby partereninring with research laboratories & universities, , and regional expansion to gain maximum revenue share in the industry.

Key U.S. Transplantation Companies:

- Abbvie, Inc

- Arthrex, Inc.

- Zimmer Biomet

- Medtronic

- Novartis AG

- Stryker Corporation

- 21st Century Medicine

- BiolifeSolutions, Inc

- Teva Pharmaceuticals

- Veloxis Pharmaceutical

Recent Developments

-

In May 2022, Medtronic plc partnered with DaVita, Inc. to form a novel, independent kidney care-focused medical device company NewCo to enhance the overall outcomes and patient treatment.

-

In February 2022, Veloxis Pharmaceuticals, Inc. announced that VEL-101 immunosuppressive agent received fast track designation by the U.S FDA. VEL-101 is an investigational novel maintenance immunosuppressive agent purposed for prophylaxis of renal allograft rejection for kidney transplant in patients.

U.S. Transplantation Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 9.63 billion

Growth rate

CAGR of 8.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use

Country scope

U.S.

Key companies profiled

AbbVie, Inc.; Arthrex, Inc.; Zimmer Biomet; Medtronic; Novartis AG; Stryker Corporation; 21st Century Medicine; BioLifeSolutions, Inc; Teva Pharmaceuticals; Veloxis Pharmaceuticals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Transplantation Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. transplantation market based on product, application, and end-use:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tissue Products

-

Immunosuppressive Drugs

-

Preservation Solution

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Organ Transplantation

-

Tissue Transplantation

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Transplant Centers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. transplantation market size was estimated at USD 5.45 billion in 2023 and is expected to reach USD 5.91 billion in 2024.

b. The U.S. transplantation market is expected to grow at a compound annual growth rate of 8.5% from 2024 to 2030 to reach USD 9.63 billion by 2030.

b. Tissue products segment dominated the product segment with a share of 39.0% in 2023. This is attributable to high demand and usage of tissue products.

b. Some key players operating in the U.S. transplantation market include AbbVie, Inc.; Arthrex, Inc.; Zimmer Biomet; Medtronic; Novartis AG; Stryker; 21st Century Medicine; BioLifeSolutions, Inc; Teva Pharmaceuticals; and Veloxis Pharmaceuticals.

b. Key factors that are driving the U.S. transplantation market growth include an increase in the incidence of acute diseases, the introduction of technologically advanced products, and an increasing number of tissue banks.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.