- Home

- »

- Medical Devices

- »

-

U.S. Tracheal Tube Introducers Market Size, Report, 2030GVR Report cover

![U.S. Tracheal Tube Introducers Market Size, Share & Trends Report]()

U.S. Tracheal Tube Introducers Market Size, Share & Trends Analysis Report By End Use (Hospitals And Clinics, Ambulatory Surgical Centers, Emergency Care Facilities/Urgent Care, Long-Term Facilities, Physician Offices) And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-487-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

U.S. Tracheal Tube Introducers Market Size & Trends

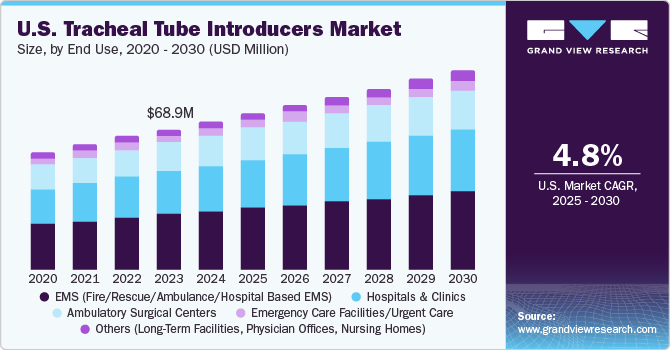

The U.S. tracheal tube introducers market size was valued at USD 72.91 million in 2024 and is anticipated to grow at a CAGR of 4.82% over the forecast period. The market is driven by the rising prevalence of respiratory disorders, increasing number of surgeries, and an aging population. As conditions such as Chronic Obstructive Pulmonary Disorders (COPD), asthma, neck tumors, and others become more common, the demand for tracheal tube introducers also increases.

The rising number of surgical procedures is a significant driver for the market. With the aging population and the increase in chronic diseases such as cardiovascular conditions, cancer, and obesity, there is a growing need for surgeries that require anesthesia and airway management. Many of these procedures, especially those in emergency, trauma, or complex surgical cases, involve tracheal tube introducers to ensure safe and effective intubation. For instance, the article published by the National Library of Medicine in April 2024 reported that one among nine individuals undergoes at least one surgery. This ratio increased with increasing age groups, especially in the 65 and above category.

In addition, data released by the Mass General Brigham Incorporated in August 2023 indicates that every year, over 900,000 cardiac surgeries are performed in the U.S. which includes operations such as coronary bypass. As a result, the significant number of patients undergoing cardiac surgeries and the increasing use of tracheal tube introducers in their treatment are expected to drive market growth in the coming years. The expansion of ambulatory surgical centers out, patient care facilities, and healthcare infrastructure across the U.S. is also contributing to the increased demand for airway management tools

The prevalence of respiratory diseases in the U.S., including chronic obstructive pulmonary disease (COPD), asthma, and pneumonia, is a primary driver for the tracheal tube introducers market. COPD and asthma affect millions of Americans, often leading to breathing difficulties that can require emergency interventions and intubation. These diseases are prevalent in older adults, smokers, and those with chronic health conditions, contributing to a consistent demand for airway management tools, including tracheal tube introducers. For instance, as per the data released by the U.S. FDA in October 2024, the percentage of students who smoke tobacco is more than 8.1%, which is nearly above 2.25 million in the U.S. This changing lifestyle is anticipated to increase the number of respiratory disorders and thus heighten the importance of reliable intubation equipment, as these devices help healthcare providers secure airways quickly, especially in patients with compromised breathing.

In addition, the aging population in the U.S. contributes to the tracheal tube introducers market, as older adults often require more frequent medical interventions, including surgeries and respiratory support. According to the data published by the National Council on Aging, Inc. in June 2024, 57.8 million adults aged over 65 lived in the U.S. in 2022. This number is projected to increase to 78.3 million by 2040. As people age, they are more prone to chronic health conditions such as cardiovascular disease, respiratory disorders, and other comorbidities that complicate airway management during medical procedures. This demographic shift increases the need for reliable intubation tools and consequently upsurges the demand for tracheal tube introducers, propelling market growth over the forecast period.

Market Characteristics

The market growth stage is low, and the pace of growth is accelerating. The tracheal tube introducers market is characterized by a high degree of growth due to the increasing prevalence of respiratory diseases, surgeries, and the need for airway intervention.

The market is experiencing moderate levels of innovation driven by advancements in product designing and novel material technologies. Continuous research and development efforts focus on enhancing device safety, precision, and patient outcomes. Innovations such as next-generation stylets, tracheal tube introducers that use advanced applications are addressing unmet needs, offering more effective treatment options for better airway intervention.

Regulatory bodies, such as the U.S. Food and Drug Administration (FDA), play a crucial role in shaping the market. Stricter requirements for clinical trials and post-market surveillance ensure patient safety and product efficacy but can also pose challenges for companies seeking approvals. While this regulatory landscape may slow time-to-market, it drives companies to innovate and develop products with higher safety standards, enhancing market credibility.

The market is experiencing a significant number of mergers and acquisitions (M&A) as companies seek to expand their product portfolios, leverage synergies, and enter new markets. Established players are acquiring smaller innovators to gain access to cutting-edge technologies, while strategic collaborations are emerging to enhance distribution networks. However, there have not been active acquisitions and mergers in recent years.

The availability of product substitutes impacts the U.S. tracheal tube introducers market, with alternatives such as video laryngoscopes and optical styles providing competition. Moreover, advancements in imaging technologies and other non-invasive methods could reduce the need for invasive procedures such as tracheal tube introducers.

Industry players in the market are actively pursuing regional expansion to capitalize on emerging market opportunities. Growth is primarily driven by increasing healthcare investments, rising awareness of respiratory disorders, and improving access to advanced medical technologies. Companies are also establishing local manufacturing units and forging partnerships with regional distributors to navigate market-specific challenges and regulatory frameworks.

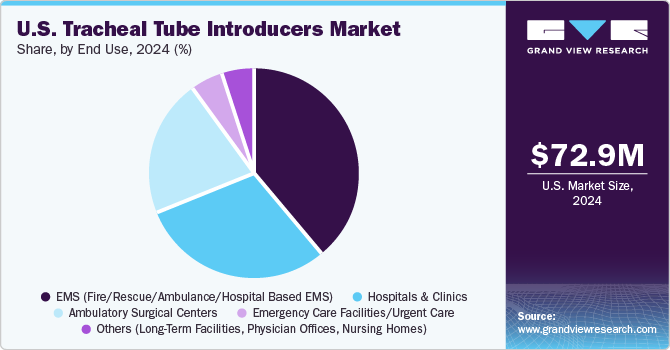

End Use Insights

The EMS segment held the largest market share of around 39.21% in 2024. There is an increasing need for rapid and reliable airway management in pre-hospital settings as these care settings encounter several emergency conditions. EMS providers, including fire departments, rescue teams, ambulance services, and hospital-based EMS, often face high-stakes scenarios where effective intubation is crucial for patient survival. Tracheal tube introducers quickly provide solutions to secure airways, especially in complex cases or in emergency environments where hospital access is challenging. The rising incidence of trauma cases, respiratory emergencies, and cardiac arrests in the U.S. emphasizes the need for specialized equipment that can ease the intubation process and increase the chances of a successful airway placement, making tracheal tube introducers an essential tool for EMS teams. For instance, as per the data mentioned in the American Association for the Surgery of Trauma, the U.S. accounts for 150,000 deaths annually attributed to trauma injuries, making it the fourth leading cause of death in the country. Such cases increase the demand for ambulances and emergency services to provide immediate airway interventions, thus contributing to the U.S. tracheal tube introducers market.

The hospitals and clinics segment is expected to grow at the highest CAGR of 4.91% during the forecast period. The U.S. has a rapidly developing healthcare infrastructure and hospitals equipped with the necessary emergency care products, including tracheal tube introducers. Hospitals have high requirements for such medical devices for critical care, emergency, and surgical settings. Tracheal tube introducers provide a valuable aid in achieving successful intubation, particularly for patients with challenging anatomy or in cases where conventional intubation methods may fail. In addition, the emphasis on patient safety and improved clinical outcomes further supports the adoption of advanced tracheal tube introducers in hospitals and clinics, thus supporting market growth in the coming years.

Key U.S. Tracheal Tube Introducers Company Insights

Key market players are focusing on growth strategies and market expansion. The U.S. market is witnessing several key trends impacting both established and new companies. Industry players are acquiring players providing tracheal tube introducers. Such strategic activities in the U.S. tracheal tube introducers market are anticipated to boost the market growth over the forecast period.

Key U.S. Tracheal Tube Introducers Companies:

- Intersurgical

- Flexicare (Group) Limited

- MEDLINE

- Dynarex Corporation

- Vygon SAS

Recent Developments

- In August 2022, Xponent Healthcare, Inc. acquired GreenField Medical Sourcing, Inc.’s Flex-Guide endotracheal tube introducer product line to expand its portfolio in airway management. Such acquisitions are anticipated to propel the market growth in the coming years.

U.S. Tracheal Tube Introducers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 76.83 million

Revenue forecast in 2030

USD 97.21 million

Growth Rate

CAGR of 4.82% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Country scope

U.S.

Report coverage

Revenue, competitive landscape, growth factors, and trends

Key companies profiled

Intersurgical, Flexicare (Group) Limited, MEDLINE, Dynarex Corporation, Vygon SAS,

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Tracheal Tube Introducers Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. tracheal tube introducers market report on the basis of end use:

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Ambulatory Surgical Centers

-

Emergency Care Facilities/Urgent Care

-

Others (Long-Term Facilities, Physician Offices, Nursing Homes)

-

EMS (Fire/Rescue/Ambulance/Hospital Based EMS)

-

Frequently Asked Questions About This Report

b. The U.S. tracheal tube introducers market size was estimated at USD 72.91 million in 2024 and is expected to reach USD 76.83 million in 2025.

b. The U.S. tracheal tube introducers market is expected to grow at a compound annual growth rate of 4.82% from 2025 to 2030 to reach USD 97.21 million by 2030.

b. The EMS (Fire/Rescue/Ambulance/Hospital Based EMS) segment dominated the U.S. tracheal tube introducers market and accounted for a revenue share of 39.21% in 2024.

b. Some key players operating in the U.S. tracheal tube introducers market include Intersurgical, Flexicare (Group) Limited, MEDLINE, Dynarex Corporation, and Vygon SAS.

b. The U.S. tracheal tube introducers market is driven by the rising prevalence of respiratory disorders, an increasing number of surgeries and an aging population.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."