- Home

- »

- Biotechnology

- »

-

U.S. Tissue Engineering Market Size, Industry Report, 2030GVR Report cover

![U.S. Tissue Engineering Market Size, Share & Trends Report]()

U.S. Tissue Engineering Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Cord Blood & Cell Banking, Cancer, Dental, Skin & Integumentary, Urology, Neurology), And Segment Forecasts

- Report ID: GVR-4-68040-244-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Tissue Engineering Market Trends

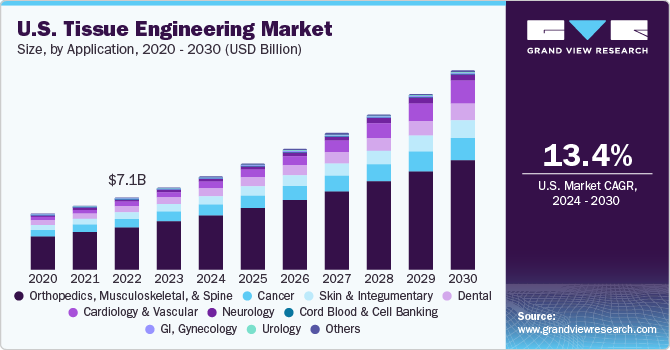

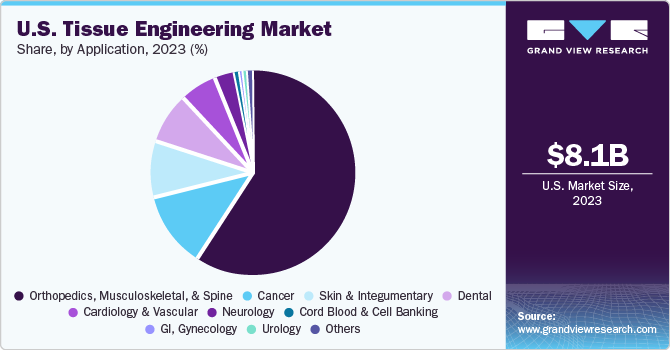

The U.S. tissue engineering market size was estimated at USD 8.1 billion in 2023 and is expected to grow at a CAGR of 13.4% from 2024 to 2030. The primary driver of this growth is the escalating demand for pioneering tissue engineering solutions that can treat chronic diseases and aid in the repair and regeneration of tissues. Furthermore, the progress in regenerative medicines, the increase in funding & investments for creating sophisticated tissue engineering products, and the mounting requirement for regenerative medicines are crucial contributors to this market’s expansion. In addition, the surge in research activities aimed at developing advanced solutions for tissue repair and reconstruction, coupled with the growing acceptance of novel cell therapies, adds to the optimistic future of this market.

U.S. accounted for over 47.8% of the global tissue engineering market in 2023. The escalating prevalence of chronic conditions, including cardiovascular diseases, diabetes, and orthopedic disorders, has fueled the need for tissue engineering solutions that can mend or substitute impaired tissues. According to a recent study by the American Health Association, approximately 133 million citizens, which is close to half of the population, are afflicted with a minimum of one chronic disease like hypertension, heart disease, or arthritis. This figure is projected to escalate to 170 million by the year 2030. Progress in 3D tissue engineering technology, including substituting embryonic cells with stem cells, developing organ-on-a-chip technology, and applying 3D bioprinters capable of effectively creating in vitro implants, is anticipated to boost growth.

The tissue engineering field has witnessed substantial advancements owing to the progress in biomaterials, 3D bioprinting, stem cell research, and gene editing methodologies, which have facilitated the creation of intricate and operational tissues. There is an increase in demand for regenerative medicine and tissue engineering clinical trials, which has led to the expansion of this market. There are currently 58 studies in progress for regenerative medicine and 63 ongoing studies for tissue engineering, as reported by the clinicaltrials.gov website. Despite this, the market's growth is hindered by ethical concerns related to stem cell research, tissue-engineered products, and product development.

Every year, around 18,000 new cases of traumatic spinal cord injury (tSCI) are reported in the United States, as per data provided by the National Spinal Cord Injury Statistical Center. The market growth is anticipated to increase in the predicted period due to chronic diseases, which are the primary causes of death and disability across the globe. The tissue regeneration technology is becoming increasingly popular due to its effective products and low rejection rates. Furthermore, there's a trend toward performing more regenerative treatments.

Presently, ongoing pre-clinical studies are concentrating on using tissue-engineered vascular grafts for cardiovascular surgeries and treatments. In addition, tissue-engineered bladders have demonstrated successful implantation outside the patient market for tissue engineering is expected to grow, driven by increased government funding for medical and academic research. For instance, in January 2023, Sartorius, a supplier of biopharmaceutical equipment, acquired a 10% stake in BICO, a company at the forefront of 3D bioprinting. This USD 49.91 million investment is part of a broader collaboration between the two companies. Their joint research and development efforts will focus on developing digital solutions for cell line development workflows. Stem cell treatments hold considerable importance for treating various medical conditions, which has led to substantial investment in research and clinical application. The swift advancements in stem cell research have improved the management of diseases. As a result, with the rising incidence of cancer, diabetes, and other chronic diseases, the emphasis on stem cell research has grown.

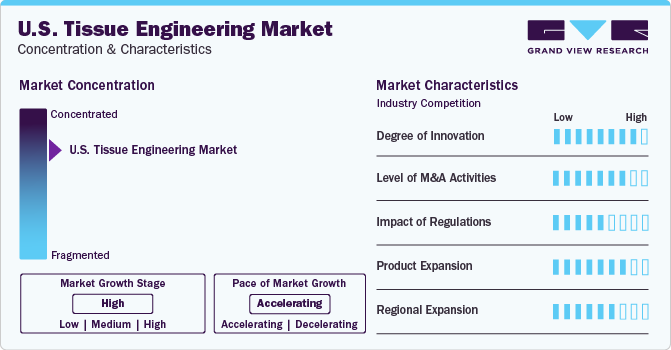

Market Characteristics & Concentration

The U.S. tissue engineering industry is characterized by a high degree of concentration, with key players dominating the industry. Major companies like AbbVie (Allergan), Becton Dickinson and Company, and B. Braun, Integra LifeSciences Corporation are prominent in this industry. This consolidation is driven by strategic initiatives such as research collaborations, partnerships, mergers, and acquisitions to gain a competitive edge. The presence of numerous industry players contributes to the competitive landscape of the tissue engineering industry.

The tissue engineering industry exhibits high innovation, with continuous advancements reshaping the industry. Technological progress, artificial intelligence (AI) and machine learning (ML) integration and expanding applications beyond traditional medical fields contribute to a dynamic landscape. Market players are concentrating on creating groundbreaking technologies and broadening their range of products to cater to changing requirements. This emphasis on innovation underscores the industry's commitment to revolutionizing healthcare through regenerative therapies and cutting-edge solutions.

The tissue engineering industry experiences significant mergers and acquisitions as companies seek growth opportunities and strategic partnerships. For instance, in March 2024, Siemens acquired Varian to address personalized diagnosis needs. Major companies holding industry shares are extending their capabilities through mergers and acquisitions, reflecting the industry's focus on inorganic growth strategies. These activities signal a trend toward collaboration and expansion within the tissue engineering sector.

Regulations on medical devices have a substantial impact on tissue engineering manufacturers in the U.S. These regulations ensure product safety, efficacy, and quality standards, influencing manufacturing processes and industry entry requirements. Compliance with stringent regulatory requirements is crucial for tissue engineering companies to navigate the complex landscape of healthcare regulations in the U.S., ensuring that products meet established standards for patient safety and effectiveness.

The tissue engineering industry is primarily experiencing product expansion, focusing on developing innovative solutions and expanding product portfolios to meet evolving demands. Companies are introducing new products such as synthetic materials, biologically derived materials, and decellularized scaffolds, catering to various medical specialties like orthopedics, cardiology, dermatology, neurology, and urology. This product-centric approach underscores the industry's commitment to advancing regenerative therapies through novel technologies.

Companies in the industry are expanding across different parts of the U.S. to leverage regional strengths in healthcare infrastructure, research institutions, and funding opportunities. North America dominates the industry due to its well-established healthcare infrastructure and significant investments in R&D. Companies are strategically positioning themselves in regions like North America and Europe, where there is a conducive environment for research collaborations, clinical trials, and innovation partnerships. This geographic diversification allows companies to tap into diverse resources for growth and development.

Application Insights

Orthopedics, musculoskeletal, & spine dominated the market and held the largest revenue share of 59.5% in 2023. The rise in musculoskeletal disorders has led to the growth of tissue engineering as a vital treatment method for orthopedic surgeons. This approach manages various disorders, from meniscal deficits in young athletes to osteochondral abnormalities in the glenohumeral joint. The market is expected to grow due to market players' adoption of various growth strategies and the launch of new products. For instance, in October 2022, LifeNet Health showcased its advanced allograft biologics for fusion at the North American Spine Society (NASS) 2022 Annual Meeting in Chicago. This included ViviGen MIS, the first viable cellular allograft delivery device for minimally invasive surgery.

The cardiology and vascular sector is predicted to experience the fastest CAGR of 25.0% during the forecast period. This segment's quick growth is attributed to the urgent requirement for innovative solutions in cardiac care. The field of tissue engineering has the potential to create cardiac grafts and regenerate tissues without causing adverse effects such as immunogenicity. The use of advanced biomaterials, such as synthetic polymers, like polyglycolic acid and polylactic acid, in cardiac tissue engineering has significantly contributed to this growth. These advancements enable the development of functional and viable engineered tissues, addressing challenges in cardiac care and driving the rapid expansion of tissue-engineered products in cardiology.

Key U.S. Tissue Engineering Company Insights

The U.S. tissue engineering market is characterized by intense competition, with numerous manufacturers taking up different initiatives for most of the market. To maintain and grow their international footprint, these market players resort to key business tactics such as launching new products, gaining approvals, making strategic acquisitions, and fostering continuous innovation. A case in point is the extension of the research collaboration between BioMed X and AbbVie in January 2023, as announced by the independent German biomedical research entity. Based in the U.S., this renewed research alliance will concentrate on immunology and tissue engineering, following an initial collaborative project on Alzheimer’s disease at the BioMed X Institute in Heidelberg, Germany.

Key U.S. tissue engineering Companies:

- Zimmer Biomet Holdings, Inc.

- AbbVie (Allergan)

- Becton Dickinson and Company

- B. Braun

- Integra LifeSciences Corporation

- Organogenesis Holdings Inc.

- Medtronic

- ACell, Inc.

- Athersys, Inc.

- Tissue Regenix Group plc

- Stryker Corporation

- RTI Surgical, Inc.

- ReproCell, Inc.

- Baxter International, Inc.

Recent Developments

-

In November 2023, Medtronic launched the Symplicity Spyral renal denervation system. This signifies a groundbreaking advancement in hypertension treatment. FDA approval of this innovative medical device offers a novel approach to managing high blood pressure, providing a significant opportunity for growth and innovation within the healthcare technology sector.

-

In August 2023, AbbVie merged with Allergan in Japan after a global acquisition. This strategic move aimed to leverage Allergan's expertise and resources, enhancing AbbVie's position in regenerative medicine and tissue engineering solutions and fostering innovation and market growth.

-

In June 2023, BD opened a new research and development facility in Blackrock, Dublin. It announced an additional investment to expand its manufacturing facility in Enniscorthy, Wexford, to enhance its presence in Ireland's growing tissue engineering industry. This strategic move aims to leverage Ireland's supportive environment for R&D, fostering innovation and growth in this sector.

U.S. Tissue Engineering Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 19.4 billion

Growth rate

CAGR of 13.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application

Country scope

U.S.

Key companies profiled

Zimmer Biomet Holdings, Inc.; AbbVie (Allergan); Becton Dickinson and Company; B. Braun; Integra LifeSciences Corporation; Organogenesis Holdings Inc.; Medtronic; ACell, Inc.; Athersys, Inc.; Tissue Regenix Group plc; Stryker Corporation; RTI Surgical, Inc.; ReproCell, Inc.; Baxter International, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Tissue Engineering Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. tissue engineering market based on application:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cord Blood & Cell Banking

-

Cancer

-

GI, Gynecology

-

Dental

-

Skin & Integumentary

-

Urology

-

Orthopedics, Musculoskeletal, & Spine

-

Neurology

-

Cardiology & Vascular

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. tissue engineering market size was estimated at USD 8.1 billion in 2023.

b. The U.S. tissue engineering market is expected to grow at a compound annual growth rate (CAGR) of 13.4% from 2024 to 2030 to reach around USD 19.4 billion by 2030.

b. Orthopedics, musculoskeletal, & spine dominated the market and held the largest revenue share of 59.5% in 2023.

b. Some prominent players in the U.S. tissue engineering market include Zimmer Biomet Holdings, Inc.; AbbVie (Allergan); Becton Dickinson and Company; B. Braun; Integra LifeSciences Corporation; Organogenesis Holdings Inc.; Medtronic; ACell, Inc.; Athersys, Inc.; Tissue Regenix Group plc; Stryker Corporation; RTI Surgical, Inc.; ReproCell, Inc.; Baxter International, Inc.

b. The primary driver of this growth is the escalating demand for pioneering tissue engineering solutions that can treat chronic diseases and aid in the repair and regeneration of tissues.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.