U.S. Thermal Spray Coatings Market Size, Share & Trends Analysis Report By Material (Metal, Ceramics, Abradable), By Technology (Plasma Spray, HVOF), By Application, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-312-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

U.S. Thermal Spray Coatings Market Trends

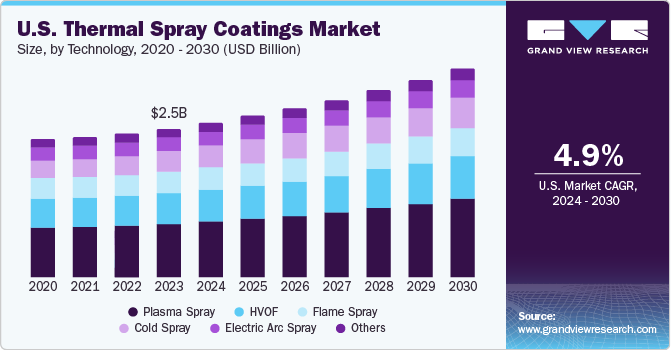

The U.S. thermal spray coatings market size was estimated at USD 2.5 billion in 2023 and is anticipated to grow at a CAGR of 4.9% from 2024 to 2030. This expansion is driven by several key factors, including increasing demand for performance-enhanced components in critical industries like aerospace and automotive, growing adoption of thermal spray coatings in medical devices for improved wear resistance and longevity, and ongoing advancements in material science.

The U.S. thermal spray coatings market accounted for a share of 23.6% of the global thermal spray coatings market revenue in 2023. Stringent environmental regulations, such as those stated by the EPA, can limit the application of alternative technologies like chrome plating, a process well-established for its generation of carcinogenic by-products. This creates a market opportunity for thermal spray coatings as a more sustainable alternative. For instance, regulations like the Restriction of Hazardous Substances (RoHS) in the U.S. restrict certain hazardous materials in products, pushing manufacturers towards thermal spray coatings that can achieve similar functionalities with less restricted materials.

Material Insights

The ceramics segment accounted for the largest revenue share of 32.1% in 2023. Ceramic coatings are known for their exceptional hardness, wear resistance, and thermal insulation properties. They find extensive applications in gas turbines, aerospace components, and industrial machinery. The projected growth for ceramics is robust, driven by increased demand from sectors, such as power generation, automotive, and medical devices. As industries seek improved performance and durability, ceramics remain a key choice for thermal spray coatings.

Abradables is another noteworthy segment, with a predicted CAGR of 5.4% from 2024 to 2030. These coatings are designed to be sacrificial, allowing them to wear away gradually during operation. They are commonly used in compressor seals, creating a tight seal while minimizing wear on adjacent components. The aerospace industry, in particular, benefits from abradables due to their ability to reduce clearance gaps and enhance engine efficiency.

Technology Insights

The plasma spray segment dominated the market with a revenue share of 36.4% in 2023. This well-established technology is a versatile workhorse, offering a mature solution for various applications. It excels in wear and corrosion protection, thermal insulation, and surface modification. Plasma spray's popularity is attributed to its ability to deposit a wide range of materials with precise control over the coating's properties, thereby making it a dependable choice across numerous industries.

Cold spray is expected to be the fastest-growing segment from 2024 to 2030. This innovative technology offers distinct advantages, including minimal heating of the substrate, reduced oxidation, and the ability to deposit materials that are sensitive to high temperatures. These attributes make cold spray an attractive option for applications in automobile, aerospace, and even the biomedical field. As research and development continue, cold spray is poised for further growth and wider adoption in the U.S. thermal spray coatings market.

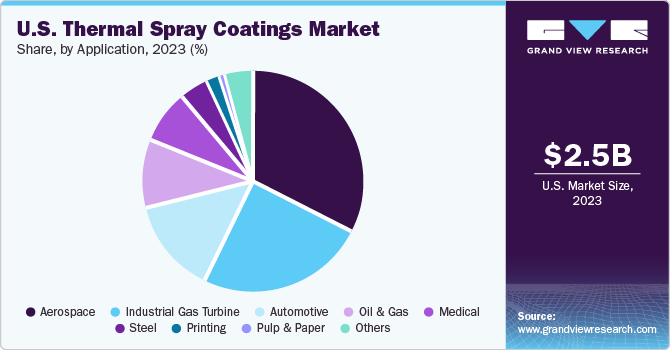

Application Insights

The aerospace segment dominated the market with a share of 33.2% in 2023. Thermal spray coatings play a vital role in the aerospace sector as they help enhance performance, improve wear resistance, and protect against extreme temperatures. These coatings benefit aircraft engines, turbine blades, and components exposed to high-velocity environments. As air travel continues to grow, the demand for thermal spray coatings in the aerospace sector is expected to increase in the coming years.

The oil and gas segment is projected to experience the fastest CAGR of 6.0% from 2024 to 2030. Thermal spray coatings find extensive use in this sector for protecting equipment exposed to harsh conditions, such as corrosion, erosion, and high temperatures. Pipelines, valves, drilling tools, and offshore platforms benefit from these coatings, extending their lifespan and reducing maintenance costs. As the energy industry seeks efficiency and durability, the adoption of thermal spray coatings in oil and gas applications continues to rise.

Key U.S. Thermal Spray Coatings Company Insights

Some of the key players operating in the market include OC Oerlikon Management AG, Bodycote PLC, and Praxair S.T. Technologies Inc.:

-

OC Oerlikon is a leading provider of thermal spray solutions, offering a wide range of coating materials and technologies. Its expertise spans various industries, including aerospace, automotive, and energy. With a strong focus on research and innovation, Oerlikon continues to drive advancements in thermal spray coatings

-

Praxair S.T. Technologies Inc. (now part of Linde PLC): Praxair S.T. Technologies specializes in high-performance coatings for critical applications. Its portfolio includes plasma spray, HVOF (high-velocity oxy-fuel), and cold spray coatings

Key U.S. Thermal Spray Coatings Companies:

- OC Oerlikon Management AG

- Praxair S.T. Technologies Inc.

- Chromalloy Gas Turbine LLC

- Kennametal Inc.

- TOCALO Co. Ltd.

- APS Materials Inc.

- ASB Industries Inc.

- Bodycote PLC

- Eurocoating SpA

- FM Industries Inc.

Recent Developments

-

In January 2024, Flame Spray North America invested USD 2.5 million to expand Laurens County operations, adding advanced thermal spray coating tech for industrial gas turbines and upgrading existing facilities

-

In April 2024, Hardide Coatings introduced the inaugural offering in its new line of pre-coated, performance-enhanced components. This initial product focuses on a 4-inch JP-5000 copper nozzle designed for high-velocity oxy-fuel (HVOF) thermal spray coating applications

-

In August 2023, Firestable Insulation Company introduced a closed-cell spray foam insulation to the building insulation market. This patented product boasts direct code compliance, functioning as an NFPA-275 thermal barrier that adheres to the International Building Code (IBC) immediately upon application. This eliminates the need for a separate thermal barrier installation, streamlining the building process

U.S. Thermal Spray Coatings Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 3.5 billion |

|

Growth rate |

CAGR of 4.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, trends |

|

Segments covered |

Material, technology, application |

|

Key companies profiled |

OC Oerlikon Management AG; Praxair S.T. Technologies Inc.; Chromalloy Gas Turbine LLC; Kennametal Inc.; TOCALO Co. Ltd.; APS Materials Inc.; ASB Industries Inc.; Bodycote PLC; Eurocoating SpA; FM Industries Inc. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Thermal Spray Coatings Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. thermal spray coatings market report based on material, technology, and application:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metals

-

Ceramics

-

Intermetallics

-

Polymers

-

Carbides

-

Abradables

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Cold Spray

-

Flame Spray

-

Plasma Spray

-

HVOF

-

Electric Arc Spray

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace

-

Industrial Gas Turbine

-

Automotive

-

Medical

-

Printing

-

Oil & Gas

-

Steel

-

Pulp & Paper

-

Others

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."