- Home

- »

- Medical Devices

- »

-

U.S. Therapeutic Bed Market Size, Industry Report, 2030GVR Report cover

![U.S. Therapeutic Bed Market Size, Share & Trends Report]()

U.S. Therapeutic Bed Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Clinical Beds, Household Beds, Accessories), By Application (Acute Care Beds, Critical Care Beds, Long-term Beds) By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-229-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Therapeutic Bed Market Size & Trends

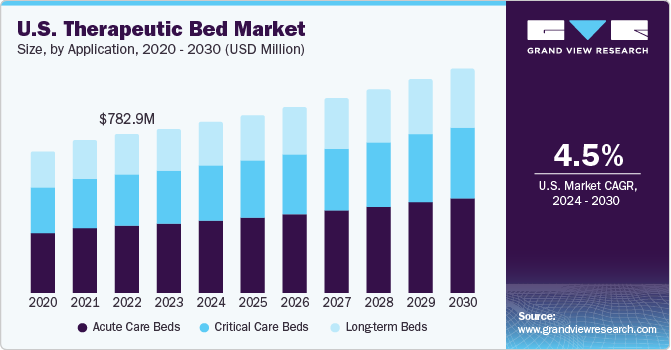

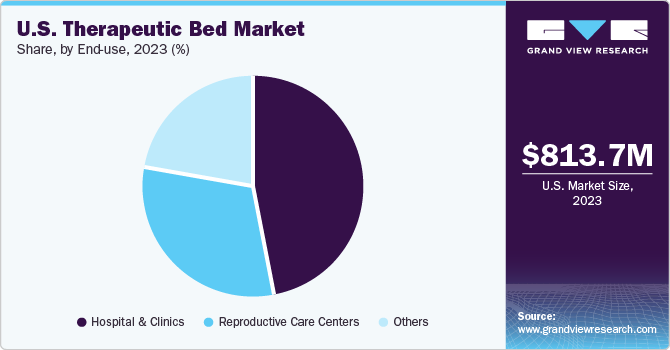

The U.S. therapeutic bed market size was estimated at USD 813.7 million in 2023 and is expected to grow at a CAGR of 4.5% from 2024 to 2030. The major driving factors contributing to the growth of this country include the increasing prevalence of chronic conditions, the growing popularity of home healthcare and rising improvement in public and private hospital infrastructure.

The U.S. accounted for nearly 18% of the global therapeutic beds market. The rising prevalence of chronic diseases, including urological disorders, cancer, cardiovascular issues, neurovascular diseases, and other long-term health conditions, is leading to a significant increase in hospital admissions. This surge in hospitalization rates is expected to drive market growth. Additionally, a substantial portion of the population faces a heightened risk of developing chronic diseases due to factors like high blood pressure, obesity, and smoking. According to the National Institute of Diabetes and Digestive and Kidney Diseases, Statistics, 42.7% of people are obese and 30.7 % of people are overweight in the U.S. Rising prevalence of obesity further contributes to increased demand for therapeutic beds as the obese population is more susceptible to chronic conditions requiring hospital admissions, thereby expected to drive the segment growth.

In addition, the growing geriatric population is one of the major driving factors fueling the growth of the market. As per America’s Health Rankings data released in 2022, approximately 58 million population were 65 years of age and above in the U.S., accounting for 17.3% population. This number is projected to grow by 22% by 2040. Thus, the rapidly rising geriatric population in the U.S. showcases significant opportunities in the therapeutic bed market.

Moreover, well-structured healthcare facilities and well established reimbursement coverages are likely to boost the growth of the market during forecast years. Governments and organizations are increasingly focusing on enhancing healthcare infrastructure, leading to a rise in demand for specialized healthcare services in developing economies, particularly for inpatient room care facilities. For instance, in July 2023, Alignment Health Plan announced its expansion in Pima and Santa Cruz countries through an agreement with Tuscom Medical Center. Such initiatives will likely increase the opportunities to boost market growth.

Market Concentration & Characteristics

The U.S. therapeutic bed industry is fragmented and is characterized by the presence of a large number of regional and global companies accounting for a fraction of the market. The market is expected to continue its growth trajectory in the coming 5-6 years.

Companies are increasingly focusing on launching new products to maintain their leadership positions and strengthen their market presence. This strategic approach is vital for companies to stay competitive and adapt to changing market dynamics. By introducing innovative products, companies can attract customers, drive revenue growth, and enhance their brand reputation.

Numerous companies are actively involved in acquiring smaller technologically advanced companies to expand their market positions. This strategic approach enables firms to enhance their capabilities, broaden their product portfolios, and improve their competencies. For instance, in November 2023, Bedding Industries of America announced a merger agreement with Saatva.

Regulations have the potential to impact industries in various ways, influencing both the demand and supply chain of products. The U.S. market for therapeutic beds is heavily regulated by the Food and Drug Administration (FDA). They classify therapeutic beds as Class I and II medical devices. These beds are designed to utilize mechanical methods like suction, snare, laser, or ultrasound technologies to address medical needs such as removing blood clots. This classification by the FDA is expected to drive market growth. Several companies strategically focus on regional expansion to serve a wide range of customers and capitalize on geographical market growth opportunities. This approach allows companies to strengthen their presence in different regions, adapt to local market needs, and enhance their market share by targeting diverse customer segments. Regional expansion strategies enable companies to leverage the potential for growth in specific geographic areas, ultimately contributing to their overall market success and sustainability.

Product Insights

Based on product, clinical beds dominated the market with a share of 49% in 2023. Major factors contributing to the growth of this segment include the high demand for clinical beds in the healthcare setting due to their portability, adjustable features, and support. These beds are designed to serve comfort and improve patients' outcomes during the course of treatment. In addition, the high prevalence of the geriatric population, and growing per capita investment in healthcare infrastructure by US government is expected to enhance demand in the forecast years.

The household therapeutic beds segment is anticipated to expand with the fastest CAGR from 2024 to 2030. Rising preference for convenience in long-term-care patients and the availability of good household beds contribute to market growth. The post-surgery acre following major surgeries in patients will likely increase the demand for household beds in the market.

Application Insights

Based on application, acute care therapeutic beds held the largest market share in 2023. The growth of this segment is driven by the rising number of hospital admissions due to chronic disease treatments and accidental cases. These acute care beds are utilized in general wards, pediatric, psychiatric, obstetric, and short-stay treatment wards of healthcare settings and clinics. These beds offer labor management during maternal delivery, help to manage patients with mental disorders, give comfort during injury or accidents, and provide support while performing surgeries. In addition, the need for good healthcare facilities such as maternity beds, ICU beds, and technologically advanced beds will likely boost the opportunities in this segment during forecast years.

The long-term care segment is projected to accelerate growth at the fastest CAGR from 2024 to 2030. The need for long-term assistance to patients with chronic disorders and immobility contributes to the growth of this segment. According to the CDC statistics, there are 12.1% of people have mobility disabilities in the U.S. Such disabilities will increase demand for long-term therapeutic beds with multifunction features which will significantly fuel the market growth.

End-use Insights

Based on end-use, hospitals, and clinics dominated the market with the largest share in 2023 owing to the increasing number of hospital admissions due to chronic disorders, infectious disease, and road accidents. Moreover, government reimbursement policies and well-structured hospital facilities in the U.S. further boost the segment's growth. In addition, hospitals and clinics are the primary points of contact for patients in need, offering various therapies, surgeries, and advanced technology-based treatments. Such attributes of this segment contribute to the growth of the market.

The other segment is projected to witness a growth at significant CAGR from 2024 to 2030. This segment is segmented into elderly care facilities, emergency care, home care settings, and nursing institutions. Increasing preference to homecare settings for post surgical recovery and increasing emergency care expected to boost the market growth.

Key U.S. Therapeutic Bed Market Company Insights

The major U.S. therapeutic bed companies include Baxter, Stryker, Invacare Corporation, and Medlien Industries, Inc. among others.

Leading companies in the U.S. therapeutic bed market always focus on developing and upgrading existing technologies to enhance patient outcomes and significantly increase surgical efficiency. Moreover, M&A activities undertaken by market players, innovative product launches and regional product expansion initiatives further leverage the growth of the market.

Key U.S. Therapeutic Bed Companies:

- Baxter

- Stryker

- Invacare Corporation

- Medline Industries, Inc.

- GF Health Products, Inc.

- Hard Manufacturing Company Inc.

- Gendron, Inc.

- Medical Depot.Inc. (Drive Devilbiss Healthcare)

- Lenz Therapeutics

- Graphite

Recent Developments

-

In January 2024, US Med-Equip announced partnership with Turn Medical to luanch automated prone therapy bed for critically ill respiratory patients. This would offer high efficient solutions to the hospitals and provide high standard patient care.

-

In June 2023, Baxter announced its novel next-generation ICU bed namely Progressa+ to support critical care patient needs in healthcare settings in the U.S. Progressa+ would provide the latest technology to serve pulmonary support, skin protection, and mobility features thereby helping hospital staff and patients

U.S. Therapeutic Bed Market Report Scope

Report Attribute

Details

Revenue Forecast in 2030

USD 1.11 billion

Growth rate

CAGR of 4.5% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use

Country scope

U.S.

Key companies profiled

Baxter; Stryker; Invacare Corporation; Medline Industries, Inc.; GF Health Products, Inc.; Hard Manufacturing Company Inc.; Gendron, Inc.; Medical Depot.Inc. (Drive Devilbiss Healthcare); Lenz Therapeutics;Graphite

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Therapeutic Bed Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. therapeutic bed market report based on, product, application, and end-use:

-

Product Outlook (Revenue USD Million; 2018 - 2030)

-

Clinical Beds

-

Regular Beds

-

ICU Beds

-

Pediatric Beds

-

Birthing Beds

-

Bariatric Beds

-

Low Air Loss Beds

-

Others

-

Household Beds

-

Accessories

-

-

Application Outlook (Revenue USD Million; 2018 - 2030)

-

Acute Care Beds

-

Critical Care Beds

-

Long-term Beds

-

-

End-Use (Revenue USD Million, 2018 - 2030)

-

Hospital & Clinics

-

Reproductive Care Centers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. therapeutic bed market size was estimated at USD 813.7 million in 2023 and is expected to reach USD 846.97 million in 2024.

b. The U.S. therapeutic bed market is expected to grow at a compound annual growth rate of 4.4% from 2024 to 2030 to reach USD 1.11 billion by 2030.

b. Clinical beds segment held the largest share of around 48.5% in 2023. High ICU admission rates, owing to an increase in the number of accidents, an ageing population, and outbreaks of life-threatening infectious diseases, are all driving to the segment's rise.

b. Some prominent players in the U.S. therapeutic bed market include Hill Rom, Inc. (Baxter); Stryker Corporation; Invacare Corporation; Medline Industries; Medical Depot.Inc.; GF Health Products, Inc.; Centromed Ltd.; Arjo; Amico Group of Companies; Bakare Beds Ltd.; Gendron, Inc.; Hard Manufacturing Company Inc.

b. Key drivers expected to contribute to market growth include rising geriatric population, increase in disease burden, high unmet medical needs in emerging & low-growth economies, and increase in public & private healthcare expenditure to improve the number of beds to patient ratio.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.