U.S. Temperature Modulation Devices Market Size, Share & Trends Analysis Report By Product (Portable Blood/IV Warming Devices, Convective Patient Warming Systems, Conductive Patient Cooling Systems), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-310-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

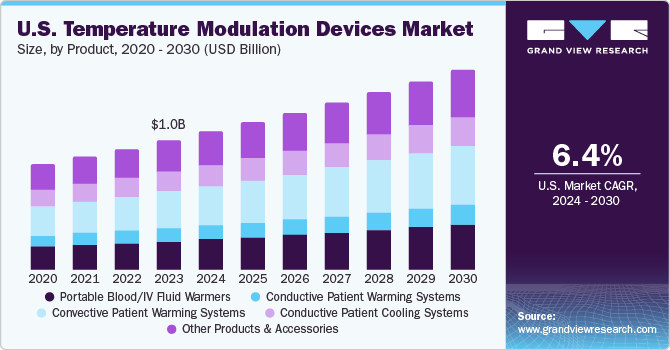

The U.S. temperature modulation devices market size was estimated at USD 1.04 billion in 2023 and is projected to grow at a CAGR of 6.4% from 2024 to 2030. This growth can be attributed to the rise in the number of surgical procedures, ambulatory surgery trends, advancements in technologies, and the increasing prevalence of cardiovascular and neurological disorders. According to the Centers for Disease Control and Prevention (CDC), cardiovascular disease claims one life every 33 seconds in the U.S. It also stated that in 2021, heart disease caused the death of approximately 695,000 people in the U.S., which accounts for one out of every five deaths.

The demand for patient temperature modulation devices in the U.S. has increased due to the rising number of surgical procedures. As medical technology advances, surgical procedures have become more complex and lengthy. Prolonged surgeries can lead to fluctuations in a patient’s body temperature, making temperature regulation essential. Patient temperature modulation devices help maintain normothermia throughout the procedure, reducing the risk of complications.

The increasing trend towards ambulatory or same-day surgeries necessitates efficient temperature management strategies, leading to market growth. Patient temperature modulation devices allow for precise body temperature control, promoting faster recovery and minimizing the risk of postoperative complications.

Technological advancements have led to the development of more sophisticated temperature modulation devices. These devices offer improved accuracy, efficiency, and user-friendly interfaces, making them more appealing to healthcare providers and patients. One such advancement is wearable temperature modulation devices that can be discreetly worn under clothing and provide continuous temperature regulation. For instance, in August 2023, AION Biosystems, Inc. announced FDA clearance for the iTempShield device, its skin wearable temperature monitoring device.

The increasing prevalence of cardiovascular and neurological disorders is one of the primary factors driving the market. Patients suffering from these conditions often require temperature modulation devices to manage their temperature and improve their outcomes. For example, hypothermia therapy is commonly used in the treatment of patients with cardiac arrest, traumatic brain injury, and stroke.

Furthermore, the growth in the usage of temperature regulation equipment in emergency departments (ED) and intensive care units (ICU) is projected to drive the growth of the market. Temperature modulation devices are crucial in ICUs and EDs, where patients often experience temperature fluctuations due to severe illnesses, surgeries, or injuries. By ensuring proper temperature regulation, these devices can improve patient outcomes, reduce the risk of complications, and decrease hospital stays, leading to increased demand.

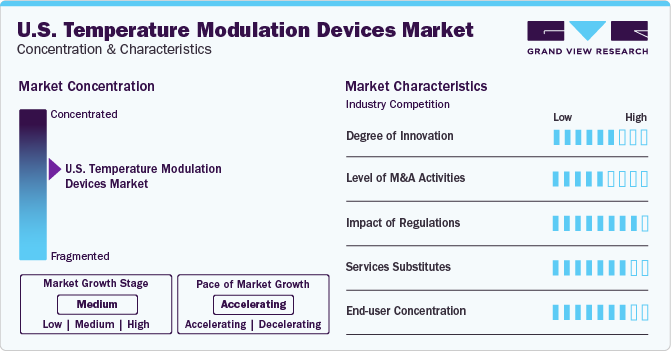

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The degree of innovation in temperature modulation devices has been significant in recent years. With advancements in technology, various devices are available that can control and monitor temperatures precisely. These devices range from simple thermostats to complex systems that use artificial intelligence and machine learning algorithms to optimize temperature settings. Some innovative temperature modulation devices include smart thermostats, wireless temperature sensors, and remote monitoring systems. As energy efficiency and environmental sustainability demand continues to grow, even more innovation is anticipated.

The U.S. temperature modulation devices market is also characterized by a medium level of merger and acquisition (M&A) activity by the players. This is due to various factors such as the increasing demand for temperature control devices, technological advancements, and the need for companies to expand their product portfolios and market reach. For instance, in January 2022, ICU Medical announced the successful completion of the acquisition of Smiths Medical.

The level of regulatory scrutiny for medical temperature modulation devices in the U.S. is high due to the potential risks associated with these devices and the need to ensure their safety and effectiveness for patient use. The FDA classifies medical temperature modulation devices under Class II, requiring premarket notification (510(k)) to demonstrate substantial equivalence to a legally marketed device or premarket approval (PMA) to establish their safety and effectiveness. Manufacturers must follow the FDA's Quality System Regulations to ensure their medical devices meet quality standards and function as intended. After approval, post-market surveillance activities are required to monitor the device's performance, report adverse events, and address any safety concerns during its lifecycle.

There are several product substitutes for medical temperature modulation devices. These include cooling pads, vests, blankets, and helmets. In addition, heating pads and warm blankets can be utilized to elevate body temperature when required.

End-user concentration is significantly high in the market. This is due to the diverse user base, widespread adoption, regulatory requirements, training programs, and technological advancements that promote accessibility and usability among a broad range of individuals in healthcare settings.

Product Insights

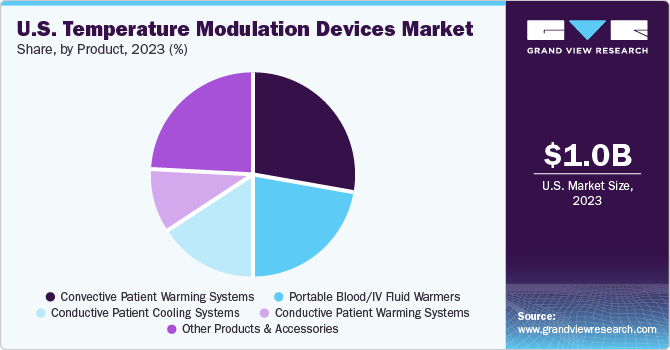

The convective patient warming systems segment dominated the market and accounted for a revenue share of 27.9% in 2023. The segment is projected to grow at the fastest CAGR from 2024 to 2030. This high percentage can be attributed to the growing number of surgical procedures, the rising prevalence of hypothermia, and advancements in technologies. For instance, In April 2023, Baxter unveiled multiple products at AORN 2023, including the commercial launch of the new conductive Baxter Patient Warming system developed to assist in achieving and maintaining patient normothermia.

These products improve patient outcomes, including reduced post-operative infections, faster recovery times, and shorter hospital stays. The increasing focus on improving patient outcomes and reducing healthcare costs is driving the adoption of these systems. In addition, rising demand from emergency centers and remote clinics is also anticipated to propel the demand for temperature control systems.

The portable blood/IV fluid warmers sector is projected to grow at a significant CAGR from 2024 to 2030. The rising incidence of trauma, emergency medical situations, prehospital care requirements, and technological advancements are significant factors driving the segment’s growth. Furthermore, the rising trend of home healthcare services and the need for efficient, portable medical devices have contributed to the growth.

These devices enable medical professionals to provide high-quality care in non-clinical settings, reducing hospital readmissions and improving patient outcomes. For instance, in June 2023, QinFlow Inc. and Life-Assist announced the completion of their integration of a distribution partnership for the Warrior line of portable blood and IV fluid warming devices. This new partnership aims to improve emergency care professionals' access to critical equipment across the U.S.

Key U.S. Temperature Modulation Devices Company Insights

Some key companies operating in the U.S. market include 3M; Belmont Medical Technologies; ZOLL Medical Corporation, Inc.; and Gentherm Medical

-

3M Company is a major player in the temperature modulation devices market. It is among the most popular manufacturers of patient temperature modulation devices with a known brand in every product segment, such as 3M Bear Hugger and 3M Ranger.

-

Belmont Medical Technologies specializes in fluid management and critical care solutions, including temperature modulation devices. Their products such as the CritiCool System aid in maintaining patient normothermia.

GE Healthcare; BD; and The Surgical Company are some emerging participants in the U.S. market.

-

GE Healthcare is a global leader in healthcare technology, including temperature management solutions. The company offers products such as the CritiCool System for precise temperature control in critical care settings.

-

BD is a global medical technology company that specializes in medication management, patient safety, and clinical information systems. BD’s offerings in the temperature modulation devices market include products for temperature management during surgeries and other medical procedures. Its portfolio includes Arctic Sun Temperature Management System.

Key U.S. Temperature Modulation Devices Companies:

- 3M

- Belmont Medical Technologies

- GE Healthcare

- BD

- ICU Medical

- The Surgical Company

- Stryker

- Gentherm

- ZOLL Medical Corporation

Recent Developments

-

In January 2024, SourceMark announced its expanded partnership with Gentherm and became the only U.S. supplier offering all three patient warming modalities - resistive, convective, and conductive.

-

In June 2023, ICU Medical announced the availability of a blood and fluid warming device, the Level 1 H-1200 Fast Flow Fluid Warmer, which enables quick infusion of warm fluids and offers additional protection with an integrated air detector and clamp.

-

In June 2023, Draeger, Inc. unveiled a new product called Babyroo TN300, an FDA-cleared open warmer that offers supportive lung protection and temperature stability for newborns from birth until they are discharged from the hospital.

U.S. Temperature Modulation Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.10 billion |

|

Revenue forecast in 2030 |

USD 1.60 billion |

|

Growth rate |

CAGR of 6.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product |

|

Key companies profiled |

3M; Belmont Medical Technologies; GE Healthcare; BD; ICU Medical; The Surgical Company; Stryker; Gentherm; ZOLL Medical Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Temperature Modulation Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. temperature modulation devices market report based on product:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Portable Blood/IV Fluid Warmers

-

Conductive Patient Warming Systems

-

Convective Patient Warming Systems

-

Conductive Patient Cooling Systems

-

Other Products & Accessories

-

Frequently Asked Questions About This Report

b. The U.S. temperature modulation devices market size was valued at USD 1.04 billion in 2023 and is expected to reach USD 1.10 billion in 2024.

b. The U.S. temperature modulation devices market is projected to grow at a compound annual growth rate (CAGR) of 6.4% from 2024 to 2030 to reach USD 1.60 billion by 2030.

b. Convective patient warming systems dominated the market and accounted for a share of around 27% in 2023, owing to the growing number of surgical procedures, rising prevalence of hypothermia, and advancements in technology.

b. Some of the key companies operating in the U.S. temperature modulation devices market include 3M; Belmont Medical Technologies; ZOLL Medical Corporation, Inc.; and Gentherm Medical.

b. The U.S. temperature modulation devices market growth can be attributed to the rise in surgical procedures, ambulatory surgery trends, technological advancements, and the increasing prevalence of cardiovascular and neurological disorders.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."