U.S. Tablet Market Size & Trends

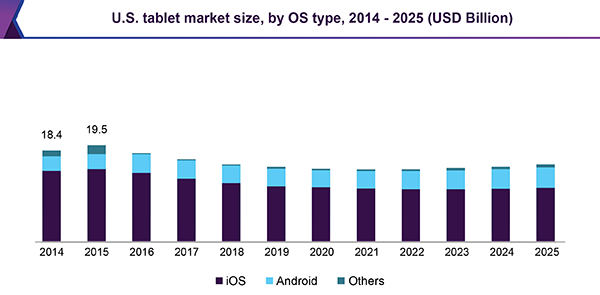

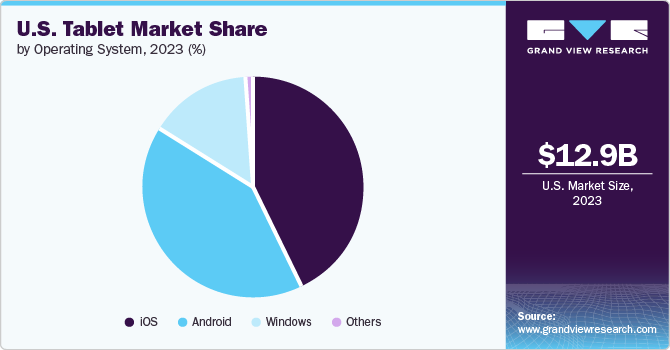

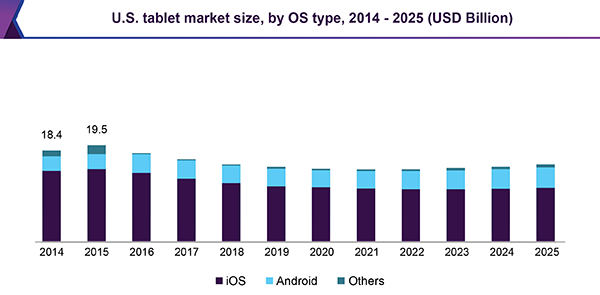

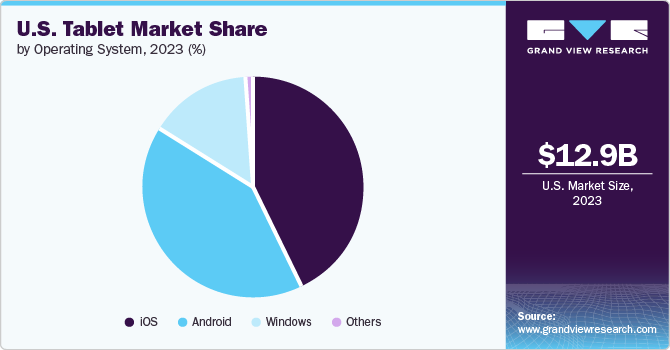

The U.S. tablet market size was valued at USD 12.86 billion in 2023 and is projected to grow at a CAGR of 1.5% from 2024 to 2030. Tablets offer high mobility with a user-friendly interface and are useful for personal and business use. It fulfills activities such as reading, entertainment, and communication. It is thus, a portable device that functions like a smartphone and a laptop. The tablet market in the U.S. is driven by customer adoption of remote work and learning solutions. The technological development stems from better performance and features, and media consumption. In addition, the penetration of high-speed internet and increased use of 5G technology is anticipated to drive the market growth.

Another important factor in the U.S. tablet market is the increasing integration of tablets with the Internet of Things (IoT). The tablets are used as control centers for home appliances following advances in the IoT. The users who demand better control and connectivity of their smart home devices are major end users of tablet devices. In addition, vendors are employing tablets in multiple IoT-related activities such as stock management, supply chain management, and field operations that are anticipated to drive market growth.

The expanding ecosystem of tablet-specific applications and software solutions encourages its use and adoption by tech-savvy users. A wide range of applications are developed for tablet-specific features, from business tools and educational apps to specialized software for industries such as healthcare, retail, and manufacturing. The application development leverages tablet features, and encourages the users, (whether individual or business) to invest in these devices. Therefore, the digital revolution across various industries has resulted in the high adoption of tablets, leading to continued growth in the U.S. tablet market.

Product Insights

The slate tab PC segment dominated with a 48.8% market share in 2023 due to their lightweight and sleek design, which appeals to both personal and professional users seeking portability and convenience. In addition, their affordability and wide range of options, from budget models to high-end devices, cater to diverse consumer needs. The continuous improvement in battery life, processor, and display quality of slate tablets enhances user experience and is anticipated to drive market growth.

Hybrid tab PC is expected to register a CAGR of 1.8% during the forecast period, driven by their versatility, combining the functionality of tablets and laptops in a single device. This versatility caters to the increasing demand for flexible devices that support remote work, online learning, and on-the-go productivity. Additionally, advancements in hardware and software, including improved processing power, longer battery life, and seamless operating systems, enhance the appeal of hybrid tab PCs. Furthermore, the trend towards digital transformation across various industries encourages the adoption of hybrid devices that offer the efficiency of a laptop with the portability of a tablet.

Operating System Insights

The iOS segment dominated in 2023 with a market share of 42.6%. This is attributed to Apple's brand name and loyal customers who trust Apple's product quality and reliability. In addition, iOS tablets seamlessly integrate with other Apple products such as iPhones, Macs, and iCloud, improving user experience and promoting repeat purchases. Furthermore, continuous innovation in hardware and software, such as introducing powerful M1 and M2 chips in iPads, ensures superior performance, attracting professional and non-professional users looking for high-performance tablets.

The Android segment is projected to grow at a CAGR of 1.5% over the forecast period. This is due to Android’s large portfolio of competitively priced products that target consumers at different levels. Android offers an open platform that encourages development and provides freedom of choice for manufacturers and users. Furthermore, synchronization of Android tablets with the relevant Google service and apps improves the device’s utility for personal and business use.

Screen Resolution Insights

The 768 x 1024 segment held a significant market share in 2023 due to its affordability and sufficient resolution for common tasks such as reading, web browsing, and prolonged screen time. This setting is popular in educational and regular tablets appealing to a broad range of users who prioritize functionality over high-end specifications. Legacy systems and budget-friendly tablets follow this resolution setting to cater to normal buyers and meet their regular computing needs.

The 800 x 1280 segment is projected to grow at a CAGR of 6.4% over the forecast period in the U.S. tablet market, driven by its enhanced visual quality that offers a better viewing experience for multimedia content, gaming, and productivity tasks. In addition, this setting strikes a balance between performance and cost, appealing to customers looking for high-quality displays at a premium price. Furthermore, the increasing use of tablets for remote learning and the adoption of hybrid work models is anticipated to drive the segment growth.

Distribution Channel Insights

The online segment dominated the market in 2023 for its convenience and wide selection, letting customers compare models, read reviews, and make informed purchases from home. In addition, competitive pricing and frequent promotions by online retailers attract several buyers looking for the best deals. Furthermore, the availability of next-day delivery and hassle-free return policies enhance the online shopping experience, making it a preferred choice for tablet buyers.

The offline segment is projected to grow at a CAGR of 0.4% over the forecast period. The steady growth is due to consumer preference for hands-on experience before purchasing, allowing them to assess the device's look, feel, and performance. Additionally, offline stores offer personalized customer service, which can be particularly appealing to buyers with specific needs. The product availability can be immediate from stores to the users, further contributing to the steady growth of offline tablet sales.

Key U.S. Tablet Company Insights

Some key companies in the U.S. tablet market include Apple, Samsung, TCL, Microsoft, Lenovo, and others. Vendors in the market are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are undertaking several strategic initiatives, such as mergers, acquisitions, and partnerships.

-

Apple is known for its innovative electronics and software products. It designs, manufactures, and distributes products such as iPhone, iPad, Mac computers, Apple Watch, and Apple TV. The company also offers the creation of several operating systems including iOS and macOS, and services such as Apple App Store, Apple Music, and iCloud.

-

Lenovo is a global technology company, known for designing, manufacturing, and selling a wide range of consumer electronics, personal computers, and enterprise solutions. It consists of a wide range of products including laptops, desktops, tablets, smartphones, and smart home devices. Lenovo also offers data center solutions, including servers, storage, and networking products that cater to individual customers and businesses.

Key U.S. Tablet Companies:

- Apple

- Amazon

- Samsung

- TCL

- Microsoft

- Alcatel

- Google

- Motorola

- Asus

- Lenovo

Recent Developments

-

In May 2024, Apple unveiled several new accessibility solutions for specially-abled users. It has added new features in its latest version of iPad that captures eye movements of the user. Through this feature, it allows specially-abled users to navigate the screen seamlessly. Additionally, Apple incorporated a new feature of Assistive Access, which simply predefines and categorizes all the options for the users belonging to the cognitively impaired category.

-

In March 2024, Samsung launched the Galaxy Tab S6 Lite (2024), with enhanced capabilities and innovative features for professional entertainment purposes. It comes with the advanced S Pen that ensures high accuracy and has a 10.4-inch display, with 14 hours of video playback. It has a slim design and is compatible with other Galaxy products.

U.S. Tablet Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 12.90 billion

|

|

Revenue forecast in 2030

|

USD 14.08 billion

|

|

Growth Rate

|

CAGR of 1.5% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Report updated

|

September 2024

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, OS, screen resolution, distribution channel

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

Apple; Amazon; Samsung; TCL; Microsoft; Alcatel; Google; Motorola; Asus; Lenovo

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Tablet Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. tablet market report based on product, operating system, screen resolution, and distribution channel.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hybrid Tab PC

-

Slate Tab PC

-

Others

-

Operating System Outlook (Revenue, USD Million, 2018 - 2030)

-

iOS

-

Android

-

Windows

-

Others

-

Screen Resolution Outlook (Revenue, USD Million, 2018 - 2030)

-

768 x 1024

-

800 x 1280

-

1280 x 800

-

834 x 1112

-

962 x 601

-

Others

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)