- Home

- »

- Medical Devices

- »

-

U.S. Surgical Sealants And Adhesives Market, Industry Report, 2030GVR Report cover

![U.S. Surgical Sealants And Adhesives Market Size, Share & Trends Report]()

U.S. Surgical Sealants And Adhesives Market Size, Share & Trends Analysis Report By Product (Natural or Biological, Synthetic & Semi Synthetic), By Application (Central Nervous System Surgery, Cardiovascular Surgery, General surgery), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-225-2

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

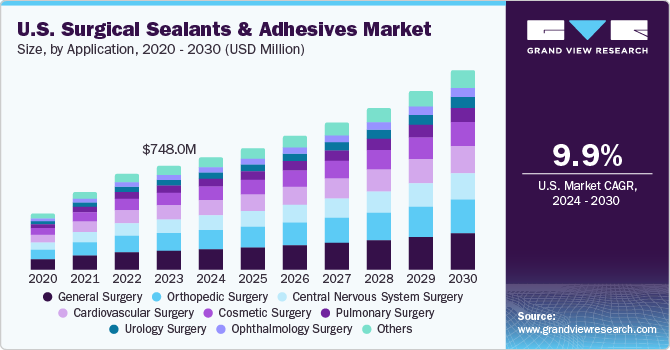

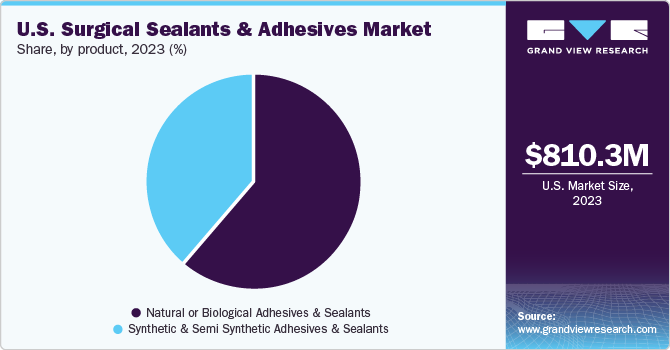

The U.S. surgical sealants and adhesives market size was valued at USD 810.3 million in 2023 and is anticipated to grow at a CAGR of 9.9% from 2024 to 2030. The market growth is significantly driven by increasing prevalence of chronic diseases and in turn the number of surgical procedures.

In 2023, U.S. accounted for a market share of over 32% in the global surgical sealants and adhesives market. Surgical procedures are generally accompanied by the risk of excessive bleeding, wound infection, or tissue damage. Surgical sealants minimize these issues due to their properties to seal the wound quickly and restrict the excessive blood loss during the surgical interventions, which in turn boost the demand for these products. A rapid surge in the number of surgeries, including cosmetic surgery and cardiac surgery, is expected to support the market expansion. According to an article published by the American Society of Plastic Surgeons in September 2023, around 26.2 million surgical, minimally invasive reconstructive, and cosmetic procedures were performed in the U.S. in 2022.

Advancements in anesthetic, surgical, intensive care techniques have led to an increase in the number of elderly people undergoing surgical procedures. Moreover, the manufacturers and industry participants are focusing on developing advanced products in the market. For instance, in January 2023, Grifols, a major plasma medicine company, revealed positive topline result from a phase 3b study of its fibrin sealant (FS) for treating bleeding in surgeries of pediatric patients. Such positive results from various studies and investigations undertaken by key market players are expected to bring novel products to the market.

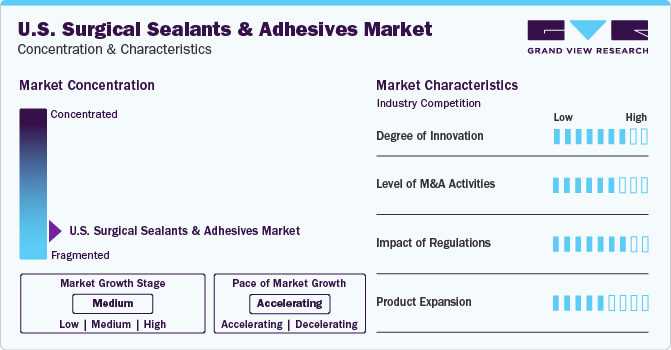

Market Characteristics & Concentration

The U.S. surgical sealants and adhesives industry is fragmented, which is marked by the presence of large number of companies competing for the market share. The industry is in its growth stage and will continue its trajectory in the coming 5-6 years.

U.S. surgical sealants and adhesives companies are focusing on continuous innovation to offer enhanced products. In addition, the regulatory bodies are also supporting innovative products by providing approvals for clinical trials and marketing. For instance, in December 2023, RevBio obtained authorization from the FDA to initiate the first-in-human (FIH) clinical trial for its bone adhesive, Tetranite, developed for cranial flap fixation. Tetranite is a synthetic, regenerative, self-setting, patented, osteoconductive, and injectable bone adhesive biomaterial.

The industry is characterized by a moderate level of merger and acquisition (M&A) activity. This is due to several factors, including the need to gain a competitive advantage in the industry and to consolidate in a rapidly growing industry. Major industry participants are acquiring firms operating across the industry. For instance, in May 2022, Ethicon acquired the GATT Technologies of Netherlands. With the help of this acquisition, Ethicon planned to use differentiated synthetic polymers to create hemostatic and sealant products.

The FDA and other authorities have established a regulatory framework to assure product safety, effectiveness, and quality standards. In addition, the regulatory bodies are also involved in clinical trials and marketing approval of surgical sealants and adhesives. In June 2023, the U.S. Food and Drug Administration (FDA) authorized the Pre-Market Approval (PMA) of LiquiBandFix8, a device that consists of a Cyanoacrylate adhesive and can be used in hernia surgery.

Product Insights

The natural/biological sealants and adhesives segment accounted for the largest share of 61.5% in 2023. The dominance of this segment is attributable to the increasing applications of various natural or biological sealants in medical practice. Fibrin sealants have effective applications in thoracic, cardiovascular, orthopedic, neuro, and reconstructive surgeries. Furthermore, fibrin has received approval from the FDA to be used under all three groups, including sealants, hemostats, and adhesives. Thus, such approvals boost the demand for fibrin products, which is expected to propel the segment growth over the forecast period.

The synthetic & semi-synthetic adhesives & sealants segment is projected to garner the fastest CAGR over the forecast period. The growth of the segment can be attributed to the increasing demand for cyanoacrylates owing to their high-speed drying rate. Furthermore, the strong mechanical strength and ease of adhesion are anticipated to boost the adoption of cyanoacrylates in surgical practices.

Application Insights

The general surgery segment accounted for the largest market share of 17.1% in 2023. This is primarily due to the high volume of surgeries conducted annually. According to the article published by the National Library of Medicine in January 2022, about 530,000 general thoracic surgeries are performed every year in the U.S. In addition, the availability of several certified general surgeons is expected to boost the segment growth.

The cosmetic surgery segment is anticipated to register the fastest CAGR over the forecast period. This is due to the increasing number of cosmetic procedures and the presence of numerous surgical sealants and adhesives that can be used in cosmetic surgeries. In addition, surgical adhesives are more beneficial in cosmetic procedures than other alternatives such as stitches. According to an article published by SpecialChem in January 2022, skin grafts using cyanoacrylate adhesives can heal with much less scarring than those with stitches. Such exceptional benefits associated with the market products are anticipated to propel the segment growth.

Key U.S. Surgical Sealants And Adhesives Company Insights

Key surgical sealants and adhesives companies in the U.S. include Johnson & Johnson, Integra Life Sciences Corporation, Baxter, and Medtronic PLC. The competitive scenario in the market is driven by both established players and new entrants, with market expansion, partnerships, innovative product launches being key strategies. Companies are focusing on developing advanced products that provide superior performance and patient comfort. In addition, the increasing investments are influencing the development of advanced products.

Key U.S. Surgical Sealants And Adhesives Companies:

- Johnson & Johnson (Ethicon)

- Artivion, Inc (CryoLife, Inc.)

- C.R. Bard, Inc. (BD)

- Medtronic

- B. Braun SE

- Mallinckrodt

- Cardinal Health

- Baxter

- Integra Life Sciences Corporation

- Stryker

Recent Developments

-

In November 2023, Ethicon, a Johnson & Johnson's MedTech division, announced the launch of Ethizia, a hemostatic sealing patch, for stopping disruptive bleeding in surgeries.

-

In November 2023, Pramand LLC introduced the CraniSeal Dural Sealant System in the U.S. market. This system provides watertight closure and is used in cranial surgery.

-

In May 2023, Sealonix, Inc. announced that it had closed USD 20 million Series A financing to produce sealant products for orthopedic as well as abdominopelvic procedures.

-

In March 2023, Animus Surgical introduced a new transparent, biodegradable, non-toxic hydrogel wound sealant for application on open wounds.

-

In March 2023, Scientists from Terasaki Institute for Biomedical Innovation (TIBI) developed injectable biomaterial with considerably improved stretchability, toughness, and adhesive strength.

U.S. Surgical Sealants And Adhesives Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.57 billion

Growth Rate

CAGR of 9.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

U.S.

Key companies profiled

Johnson & Johnson (Ethicon); Artivion, Inc (CryoLife, Inc.); C.R. Bard, Inc. (BD); Medtronic; B. Braun SE; Mallinckrodt; Cardinal Health; Baxter; Integra Life Sciences Corporation; Stryker

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Surgical Sealants And Adhesives Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. surgical sealants and adhesives market report based on product and application:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural or Biological Adhesives and Sealants

-

Fibrin Sealants

-

Collagen Based Adhesives

-

Gelatin Based Adhesives

-

Synthetic and Semi Synthetic Adhesives and Sealants

-

Cyanoacrylates

-

Polymeric Hydrogels

-

Urethane Based Adhesives

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Central Nervous System Surgery

-

Cardiovascular Surgery

-

General Surgery

-

Orthopedic Surgery

-

Cosmetic Surgery

-

Pulmonary Surgery

-

Urology Surgery

-

Ophthalmology Surgery

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. surgical sealants and adhesives market size was estimated at USD 810.30 million in 2023 and is expected to reach USD 880.82 million in 2024.

b. The U.S. surgical sealants and adhesives market is expected to grow at a compound annual growth rate of 9.9% from 2024 to 2030 to reach USD 1.57 billion by 2030.

b. Based on product, natural/biological adhesives & sealants dominated the U.S. surgical sealants and adhesives market with a share of 61.5% in 2023. The dominance of this segment is attributable to the increasing applications of various natural or biological sealants in medical practice

b. Some key players operating in the U.S. surgical sealants and adhesives market include Johnson & Johnson (Ethicon), Artivion, Inc (CryoLife, Inc.), C.R. Bard, Inc. (BD), Medtronic, B. Braun SE, Mallinckrodt, Cardinal Health, Baxter, Integra LifeSciences Corporation, Stryker

b. Key factors that are driving the U.S. surgical sealants and adhesives market growth include rise in the number of surgical procedures being performed and technological advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."