- Home

- »

- Healthcare IT

- »

-

U.S. Surgical Instrument Tracking Systems Market, Industry Report, 2030GVR Report cover

![U.S. Surgical Instrument Tracking Systems Market Size, Share & Trends Report]()

U.S. Surgical Instrument Tracking Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Barcodes, RFID), By Product (Hardware, Software, Services), By End-use (Hospitals, Others), And Segment Forecasts

- Report ID: GVR-4-68040-271-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

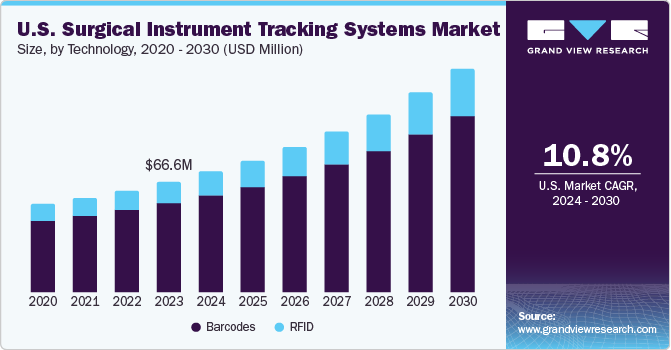

The U.S. surgical instrument tracking systems market size was estimated at USD 66.61 million in 2023 and is projected to grow at a CAGR of 10.8% from 2024 to 2030. The growing number of older people with chronic illnesses and the rise in surgical volume are the primary drivers of the country market's expansion. It is predicted that the increased prevalence of gynecological & orthopedic surgery, ulcerative colitis, and colorectal cancer surgery would propel market expansion in the U.S.

Market expansion is facilitated by high rates of surgical instrument misplacement and retention in the human body during surgical procedures. In 2021, the Radiological Society of North America (RSNA) reported that the market is increasing due to the estimated incidence of Retained Surgical Items (RSI), which is 1.32 events per 10,000 operations where surgery is required. All these factors would lead to the growth of the market.

The U.S. Food and Drug Administration's new unique device identity (UDI) tracking regulations can be implemented using surgical instrument monitoring systems, which enable the automatic identification of medical equipment, including tools. The need for technologies that enable compliance, such as surgical instrument monitoring systems, would increase with the growth of devices covered by UDI. This increase is due to the need to improve patient outcomes, comply with the FDA UDI program, automatically track vital equipment such as surgical instruments, and ensure that the proper tools are available in time for each surgical procedure. This government initiation leads to the growth of the market.

In addition, the market is impacted by factors such as the rising prevalence of chronic illnesses surgeries and significant investments made by the U.S. government to upgrade the healthcare system. For instance, in January 2022, data from Cedars-Sinai indicated that over 300,000 patients had successful coronary artery bypass graft surgery (CABG), also referred to as coronary bypass or bypass surgery, the most common cardiac surgery in the U.S. annually. This increases the need for surgical instruments in the U.S. market.

The monitoring and administration of surgical instruments have been made more accessible by the quick development of cutting-edge tracking technologies, including GPS, IoT, and RFID (Radio Frequency Identification). Furthermore, most healthcare providers now rely heavily on technology to ensure patient safety and high-quality care. For instance, in September 2018, hospitals started using automatic identifying technologies such as RFID to track medical devices and surgical tools, and there were 4,000 recorded occurrences of "retained surgery items" yearly in the U.S. All these significant factors are attributed to the market growth.

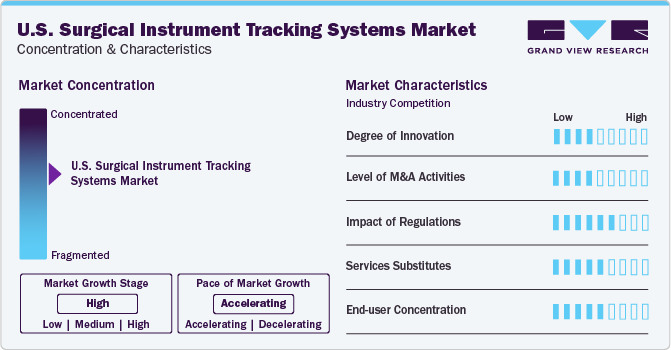

Market Concentration & Characteristics

The market growth stage is high, and the market growth is accelerating. The U.S. surgical instrument tracking systems industry is characterized by a high degree of innovation. The U.S. Food and Drug Administration (FDA) introduced the UDI system to effectively identify medical devices and instruments, one of the main reasons for this nation's dominance.

The industry is also characterized by mergers and acquisitions (M&A) activities owing to several factors, including the increasing adoption of surgical instrument tracking systems in hospitals, driven by the need to enhance surgical care safety and efficiency. For instance, in November 2019, Fortive Corporation announced the acquisition of Censis Technologies to expand the scope of its SaaS-based surgical instrument tracking and processing solutions for ambulatory surgery centers and hospital services' sterile processing departments.

The surgical instrument tracking systems in the U.S. are also subject to increasing regulatory scrutiny. The Centers for Medicare and Medicaid Services (CMMS), who oversee favorable reimbursement policies and have organized procedures and frameworks for these devices, are another factor propelling the market expansion in the U.S. Until September 24, 2021, surgical instruments that are categorized as Class I devices must fully abide by these FDA guidelines. Later on, the date was adjusted to September 24, 2022. In addition, labelers are required to furnish the FDA's GUDID system (Global Unique Device Identification Database) with information on every device. This database functions as a catalog for device references.

The massive digitalization of the healthcare sector in the U.S. is driving the emergence of a wide range of services and substitutes in the country's surgical instrument tracking systems. A few services include radio frequency identification (RFID) technology, barcode scanning systems, internet of Things (IoT) devices, and cloud-based tracking platforms. The expansion of the global surgical instruments tracking systems market is propelled by the necessity to automatically monitor essential equipment, adhere to FDA Unique Device Identification (UDI) regulations, guarantee timely availability of appropriate tools for surgeries, and enhance patient outcomes, fueled further by rising surgical demands from sports injuries, accidents, and cardiovascular illnesses. For instance, in 2019, around 1.25 million total joint arthroplasty (TJA) surgeries, encompassing hip and knee replacements, were conducted, marking it as one of the most prevalent procedures in the U.S.

End-user concentration is a significant factor in the U.S. surgical instrument tracking systems industry since several end-user industries drive demand for this industry. The sector is characterized by a growing variety of well-established national businesses that create high-precision disposable and reusable surgical scalpels while attending to the particular needs of end users.

Technology Insights

The barcodes segment dominated the market and accounted for the largest revenue share in 2023. It is one of the most popular tracking technologies, and a big part of its high revenue share comes from the medical device industry adopting it progressively. In addition to their robust construction, 360° readability, affordable installation costs, and increasing use in surgical tool tracking systems, 2D barcodes such as data matrices and QR codes have become more prevalent in the industry.

The RFID segment is anticipated to register the fastest CAGR during the forecast period. Tracking surgical instruments with RFID in real-time avoids unnecessary equipment and the expenses related to wearing and sanitizing them. In North America, hospitals save USD 155,000 in each operating room based on two daily cases with 300 instruments supplied due to RFID in surgical tool monitoring systems.

Products Insights

The hardware segment accounted for the largest market share in 2023 and is expected to witness the fastest CAGR from 2024 to 2030. The services sector is expected to witness rapid growth during the forecast period. In addition, key players in the industry are fostering growth through collaborations, partnerships, and investments in innovative technologies, thereby propelling market expansion.

The industry is also expected to flourish due to the highly developed healthcare infrastructure and the quick uptake of innovative services and technology. For instance, in July 2020, Vizinex RFID announced the release of Flexible 6027 RFID tags and Flexible 6012, allowing flexible mounting options. Due to its adaptability, durability, and IP67 rating, both RFID tags are ideal for tracking various assets in interior settings. In addition, asset monitoring in workplaces, data centers, hospitals, and industries is made easy and affordable using RFID tags. Hardware adoption has been mostly driven by the significant demand for RFID technology, which provides real-time tracking and better accuracy. Furthermore, a significant factor in the hardware's leading market share is the requirement to install RFID readers and scanners in healthcare institutions and to retrofit current surgical equipment with RFID tags.

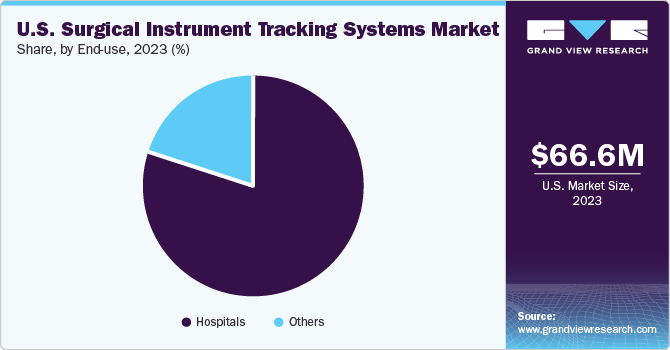

End-use Insights

The hospitals segment accounted for the largest market share in 2023 and is expected to witness the fastest CAGR from 2024 to 2030. Surgical instrument tracking is more critical since hospitals are places where people receive medical and surgical care. The rising healthcare costs and investments in new hospitals, alongside the expansion of existing ones, would lead to segment growth.

The market is expanding due to the rising incidence of hospital-acquired infections and surgical instrument misplacement. The Centers for Disease Control and Prevention (CDC), approximate that hospital-acquired infections (HAI) result in approximately 1.7 million illnesses yearly in the U.S. and lead to around 90,000 deaths. This drives the market's demand for solutions to minimize infections from contaminated equipment and improve inventory management. American organizations are known for offering top-notch, cutting-edge inventory management services.

The rising healthcare costs and increased investment in new and existing hospitals would fuel the segment's rise. The American Hospital Association (AHA) data for 2023 indicates that there has been an increase in the country's operational hospital count from 5,534 in 2016 to 6,129 in 2023. Moreover, the AHA data also showed that approximately 34.01 million admissions occurred in U.S. hospitals in 2023. As a result, an increase in hospitals is anticipated to support the segment's growth.

Key U.S. Surgical Instrument Tracking Systems Company Insights

Some of the key players operating in the market include Vizinex (HID Global Corporation), Fortive, BD, and STERIS.

-

Vizinex (HID Global Corporation), a company specializing in developing radio-frequency identification (RFID) tags, caters to diverse asset-tracking needs. Their tags are employed in numerous applications such as long-range vehicle monitoring, frequent sterilization-requiring medical devices, and the oil industry's challenging conditions. The company's products are utilized for asset tracking, people monitoring, vehicle access control, medical samples management, and national ID card utilities. These RFID tags assist organizations in fulfilling their specific tracking demands efficiently and effectively.

-

Fortive is a diversified industrial technology company offering a wide range of field solutions, product realization, health, and sensor technologies. Focused on providing mission-critical products and services. The company offers services to various end markets, such as electronics, manufacturing, utilities, and medical.

Integra LifeSciences Corporation, Censis & Surglogs are some other market participants in the U.S. surgical instrument tracking systems market.

Key U.S. Surgical Instrument Tracking Systems Companies:

- Vizinex (HID Global Corporation)

- Fortive

- BD

- STERIS

- Integra LifeSciences Corporation

- Censis

- Surglogs

- Stryker

- Medtronic

- B. Braun SE

- Olymus Corporation

- Getinge

- 3M

- Medivators Inc.

Recent Developments

-

In January 2023, BD introduced a new robotic track system for its laboratory solution, the BD Kiestra microbiology. It speeds up results by eliminating manual effort and automating specimen processing. Processes are expedited, and cultural integrity is guaranteed by the track-based setup, which removes the need for human sorting and walking.

-

In May 2022, HID Global completed the acquisition of Vizinex RFID. This acquisition enhanced HID Global's already robust RFID tag offerings and further strengthened their presence and importance in key sectors, including healthcare and medicine.

-

In April 2022, Surglogs, the software platform, which helps healthcare organizations automate their regulatory compliance processes, introduced a new module called Sterile Processing Records that keeps track of sterilization loads for all healthcare facilities.

U.S. Surgical Instrument Tracking Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 72.51 million

Revenue forecast in 2030

USD 134.13 million

Growth rate

CAGR of 10.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, product, end-use

Country scope

U.S.

Key companies profiled

Vizinex (HID Global Corporation); Fortive; BD; STERIS; Integra LifeSciences Corporation; Censis; Surglogs; Stryker; Medtronic; B. Braun SE; Olymus Corporation; Getinge; 3M

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Surgical Instrument Tracking Systems Market Report Segmentation

This report forecasts revenue growth at country level and analyzes the latest industry trends in each sub-segment from 2018 to 2030. Grand View Research has segmented the U.S. surgical instrument tracking systems market report based on technology, product, and end-use:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Barcodes (by end-use)

-

Hospitals

-

Others

-

-

RFID (by end-use)

-

Hospitals

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. surgical instrument tracking systems market size was estimated at USD 66.61 million in 2023 and is expected to reach USD 72.51 million in 2024.

b. The U.S. surgical instrument tracking systems market is expected to grow at a compound annual growth rate (CAGR) of 10.8% from 2024 to 2030 to reach USD 134.13 million in 2024.

b. The barcodes segment held the largest market share of over 80.8% in 2023 owing to the rising chronic disorders & volume of surgeries. On the other hand, the RFID segment is expected to grow at the fastest CAGR over the forecast period. In addition to their robust construction, 360° readability, affordable installation costs, and increasing use in surgical tool tracking systems, 2D barcodes such as data matrices and QR codes have become more prevalent in the industry.

b. Some key players operating in the U.S. surgical instrument tracking systems market include Vizinex, Fortive Corporation, Becton Dickinson, HID global, Steris Plc, Key Surgical, Integra LifeSciences, TGX Medical Systems, Censis Technologies & Surglogs.

b. Key factors that are driving the market is impacted by factors such as the rising prevalence of chronic illnesses surgeries and significant investments made by the U.S. government to upgrade the healthcare system. For instance, in January 2022, data from Cedars-Sinai indicated that over 300,000 patients had successful coronary artery bypass graft surgery (CABG), also referred to as coronary bypass or bypass surgery, the most common cardiac surgery in the U.S. annually. This increases the need for surgical instruments in the U.S. market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.