- Home

- »

- Medical Devices

- »

-

U.S. Surgical Equipment Market Size, Industry Report, 2030GVR Report cover

![U.S. Surgical Equipment Market Size, Share & Trends Report]()

U.S. Surgical Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Surgical Sutures & Staplers, Handheld Surgical Devices), By Application (Neurosurgery, Plastic & Reconstructive Surgery), And Segment Forecasts

- Report ID: GVR-4-68040-276-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Surgical Equipment Market Trends

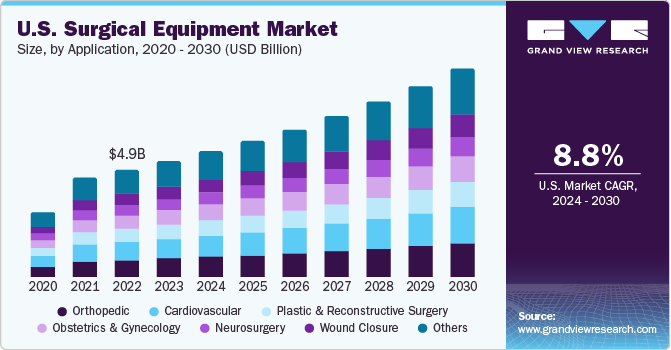

The U.S. surgical equipment market size was estimated at USD 5.53 billion in 2023 and is expected to expand at a CAGR 8.8 % from 2024 to 2030. Increasing prevalence of chronic diseases and a subsequent increase in the surgical procedures specifically minimally invasive surgeries is a key factor driving the growth of U.S. Surgical equipment market. The U.S. accounted for nearly 33% of the global surgical equipment market in 2023. Cancer has emerged as a significant healthcare challenge and a leading cause of death in the United States.

According to estimates from the American Cancer Society, there were 1,958,310 new cases of cancer and 609,820 cancer-related deaths in the U.S. in 2023. Chronic diseases represent a substantial burden in the U.S., accounting for over 75% of total healthcare expenditure. Consequently, the increasing prevalence of infectious and chronic diseases is expected to drive a significant demand for surgical instruments, thereby fueling market growth during the forecast period. Such high prevalence further contributes to the demand of surgical procedures thereby fueling the market growth.

The increasing number of minimally invasive surgeries has generated a significant demand for modern surgical tools and techniques. Leading companies are increasingly focusing on introducing technologically advanced surgical instruments. For instance, powered surgical instruments, including battery-powered and electric-powered devices, are gaining popularity among surgeons due to their ease of use and effectiveness.

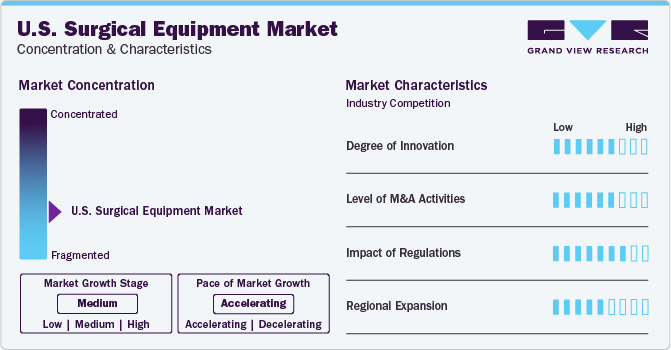

Market Concentration & Characteristics

The U.S. surgical equipment market is fragmented and is at a medium growth stage. This is likely due to high merger and acquisition activities, new product launches, regulatory approvals and regional expansion undertaken by industries in the market.

Companies are increasingly focusing on launching new products to maintain their leadership positions and strengthen their market presence. This strategic approach is vital for companies to stay competitive and adapt to changing market dynamics. By introducing innovative products, companies can attract customers, drive revenue growth, and enhance their brand reputation.

Companies are actively engaging in the acquisition of smaller companies to expand their market presence, enhance their capabilities, diversify their product portfolios, and strengthen their competencies. This strategic approach allows firms to leverage the strengths of acquired companies, tap into new markets, and drive growth effectively.

Regulatory bodies like the Food and Drug Administration (FDA) in the U.S. oversee regulations for medical devices, including surgical equipment. These authorities have established comprehensive frameworks and guidance documents to ensure the effectiveness, safety, and quality standards of medical products. Additionally, ongoing updates to regulations for surgical instruments are being implemented.

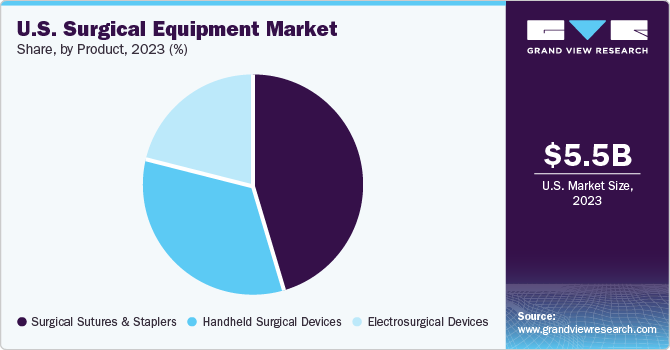

Product Insights

Based on the product, surgical sutures & staplers dominated the market with highest share of about 45% in 2023. Surgical sutures and staplers are used for wound closure post surgery. The applications of these equipment include less time requirement, reliable efficacy and safety associated with wound closure, and reduced risk of infection post surgery. Such applications boost the growth of the market. Moreover, few key companies operating in the U.S surgical equipment market aims to introduce innovative surgical sutures to serve better outcomes in patients thereby fueling the growth of the market. For instance, in December 2022, Stryker introduced the Citrefix Suture Anchor System, which incorporates the innovative citregen biomaterial. This advanced material is designed to promote bone regeneration and the natural healing process, enhancing the overall effectiveness of the system.

The electrosurgical segment is expected to witness a growth at the fastest CAGR of 9.4% during the forecast years owing to rising demand of these products by the Ambulatory Surgical Centres (ASCs) and clinics.

Application Insights

Based on the applications, the others segment dominated the market with largest share in 2023. The other segment is further segmented into general surgery, dental surgery, and microvascular surgery. More than 1.2 million general surgeries such as cholecystectomies are performed annually and considered to be a common procedure. Dental surgeries, including root canals, are also frequent and expected to drive segment growth. For instance, as per the American Association of Endodontists (AAE), Approximately 25 million root canal procedures are done yearly in the U.S., with an average of 41,000 root canals daily, indicating a substantial demand for surgical instruments in dental procedures.

The platsic and reconstructive surgery segment is anticipated to escalate the growth at fastest CAGR of 10.7 % during the forecast years owing to rising preference of these surgeries to enhance appearance in individuals. As per article released by the American Society of Plastic Surgeons in 2023, approximately 26.2 million surgical, minimally invasive reconstructive, and cosmetic procedures were conducted in the U.S. in 2022. This marked a 19% increase in cosmetic surgery procedures, which is a significant factor driving market growth

Key U.S. Surgical Equipment Company Insights

The key companies operating in the markey include Johnson & Johnson, Stryker, Boston Scientific, Inc, Zimmer Biomet Holdings, Inc and Becton, Dickinson and Company among others.

Leading companies in the U.S. Surgical equipment market are always focusing on developing and upgrading existing technologies to enhance patient outcomes and significantly increase surgical efficiency. Moreover, M&A activities undertaken by market players, innovative product launches and regional product expansion initiatives further leverage the growth of the market.

Key U.S. Surgical Equipment Companies:

- Johnson & Johnson

- Stryker

- Boston Scientific, Inc

- Hospira

- Integra LifeSciences

- Zimmer Biomet Holdings, Inc

- Becton, Dickinson and Company

- CooperSurgical, Inc

- Thompson Surgical Instruments, Inc

- Arthrex, Inc.

- Aspen Surgical

Recent Developments

-

In December 2023, the US-based Popular Equipment Finance announced the acquisition of a Quantum Surgical-manufactured Epione robot. The Epione robotic system is specialized for the early treatment of inoperable tumors especially in the abdomen (liver, kidney, and pancreas). This acquisition aims to accelerate the Epione adoption and efficient patient outcomes across the US.

-

In June 2023, STERIS plc announced the acquisition agreement with Becton, Dickinson, and Company for about USD 540 million. Under this acquisition, the acquiring company would buy surgical instrumentation, laparoscopic instrumentation, and sterilization facilities of Becton, Dickinson, and Company to further strengthen, complement, and expand STERIS’s product offerings within our Healthcare segment.

-

In April 2022, Carl Zeiss Meditec acquired Kogent Surgical, LLC, and Katalyst Surgical, LLC to enhance its position as a comprehensive solution provider in the global medical device market. This strategic move would contribute to recurring revenue and strengthen the company’s position as a comprehensive solution provider in the medical device industry.

U.S. Surgical Equipment Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 9.14 billion

Growth rate

CAGR of 8.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

U.S.

Key companies profiled

Johnson & Johnson; Stryker; Boston Scientific. Inc; Hospira; Integra LifeSciences; Zimmer Biomet Holdings, Inc; Becton, Dickinson, and Company; CooperSurgical, Inc;

Thompson Surgical Instruments, Inc; Arthrex, Inc.; Aspen Surgical

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Surgical Equipment Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. surgical equipment market report based on product, and application:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical Sutures & Staplers

-

Handheld Surgical Devices

-

Forceps & Spatulas

-

Retractors

-

Dilators

-

Graspers

-

Auxiliary Instruments

-

Cutter Instruments

-

Others

-

-

Electrosurgical Devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Neurosurgery

-

Plastic & Reconstructive Surgery

-

Wound Closure

-

Obstetrics & Gynecology

-

Cardiovascular

-

Orthopedic

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. surgical equipment market size was estimated at USD 5.53 billion in 2023 and is expected to reach USD 5,728.46 million in 2024.

b. The U.S. surgical equipment market is expected to grow at a compound annual growth rate of 8.8% from 2024 to 2030 to reach USD 9.14 billion by 2030.

b. Based on product, surgical sutures & staplers dominated the U.S. surgical equipment market with a share of 44.5% in 2023 due to large usage in wound closure procedures.

b. Some key players operating in the U.S. surgical equipment market include Zimmer Biomet Holdings, Inc.; Becton, Dickinson and Company; B. Braun Melsungen AG; Smith & Nephew plc; Stryker Corporation; Aspen Surgical Products, Inc.; Ethicon, Inc.; Medtronic; and Alcon Laboratories, Inc.

b. Key factors that are driving the U.S. surgical equipment market growth include the Increasing prevalence of chronic diseases, growing geriatric population base, rise in the number of surgical procedures, and introduction of technologically advanced products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.