U.S. Surface Disinfectant Market Size, Share & Trends Analysis Report By Composition (Chemical, Biobased), By Form (Liquids, Sprays), By Application (Instruments, In-house Surfaces), By End Use, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-919-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Bulk Chemicals

Report Overview

The U.S. surface disinfectant market size was valued at USD 987.00 million in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 9.2% from 2020 to 2027. This growth can be attributed to the prevalence of healthcare-associated infections in the country, coupled with favorable government regulations concerning the usage of disinfectants for medical hygiene. Furthermore, the rising demand for green solutions, such as biobased products, continues to contribute to the market growth in the country. The surface disinfectant market in the U.S. can be segmented based on the composition, form, application, and end-use. Based on composition, the market is segmented into bio-based and chemical. The chemical segment is further divided into alcohols, phenols, peracetic acid, oxidizing agents, hydrogen peroxide, and quaternary ammonium compounds (QACs). The alcohol segment is expected to hold a prominent market share over the coming years. Moreover, increasing the utilization of alcohol on hard surfaces in laboratories and hospitals is anticipated to trigger segment growth.

The key applications of disinfectants comprise equipment/device or surface disinfection, which are envisioned for animal hygiene, human hygiene, and food & feed hygiene. Concerning the broad-scale shutdown of the manufacturing sites and the lockdown across the U.S., industrial applications of disinfectants in the food & beverage and other sectors are anticipated to contribute comparatively lesser in the market growth. However, the rising incidences of Hospital-Acquired Infections (HAIs) have contributed to the deployment of contamination control products, such as surface disinfectants, for numerous medical purposes.

Furthermore, the growing demand for meat and its by-products in the U.S. has pushed livestock farmers to implement farming practices, such as intensive farming. Livestock farming area is a high-disease prone location, which is anticipated to drive the demand for biobased products in the near future. Chemical disinfectants pose an impending threat to the living organisms and can enter the human body by means of ingestion, inhalation, and captivation through the skin. Such disinfectants cause irritation to the respiratory system, eyes, and skin. The aforementioned factors are expected to restrain the segment growth over the coming years.

Composition Insights

Chemicals segment accounted for the largest revenue share of over 90% in 2019. The segment will retain the dominant position during the forecast years due to the increasing consumption of quaternary ammonium compounds along with alcohols, owing to its effectiveness against fungi and vegetative bacteria. Chemical disinfectants are primarily classified into two types, namely non-oxidizing and oxidizing disinfectants.

The non-oxidizing products comprise alcohols, aldehydes, amphoteric phenolics, and Quaternary Ammonium Compounds (QACs). The disinfectants are generally segmented into three categories namely, low level (Phenolic, QAC), intermediate level (alcohols, hypochlorites, iodine, and iodophor), and high-level (hydrogen peroxide, glutaraldehyde, formaldehyde, ortho-phthalaldehyde, peracetic acid) disinfectants.

Chemical surface disinfectants are developed for large-scale industrial applications, such as hospital cleaners and household detergents. However, stringent government regulations related to the environment, human health, and toxicity of the chemical products, are expected to create huge opportunities for biobased products.

Key raw materials used to produce biobased products include vegetable oils, such as pine and castor oils. The prices of these raw materials have been volatile due to supply bottleneck and high demand from several end-use industries, such as food & beverage and healthcare, which can restrain its supply for manufacturing the surface disinfectants

Biobased products are anticipated to be potential alternatives to chemical products as they are biodegradable, non-toxic, and eco-friendly. The FDA approval to use biobased products in the formulations and commercialization of surface disinfectants is projected to create huge opportunities for the market participants over the forecast period.

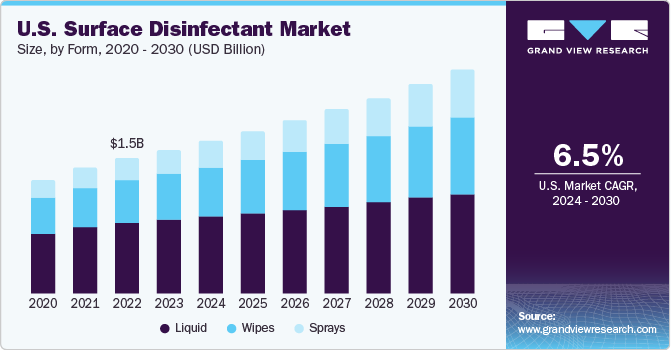

Form Insights

Liquids accounted for the largest revenue share of over 53% in 2019 and will expand further at a steady CAGR from 2020 to 2207, as they are strong, biocidal, or toxic antimicrobial chemicals that can be applied to contaminated surfaces. They are used for various applications, both household and industrial, including sealed marble countertops, sealed granite countertops, bathroom surfaces, exterior surfaces of appliances (such as toasters, stovetops, and microwaves), appliances with kitchen fixtures, enameled paint, glazed ceramic tile, stainless steel, windows, glass, vinyl, and plastic. Biobased products are predominantly utilized in the liquid form.

Wipes are the moistened pieces of cloth or plastic that frequently comes individually wrapped and folded for convenience. Surface disinfectant wipes are expected to witness significant growth in the coming years on account of their convenience, lesser probabilities of cross-contamination compared to the liquid form of the product, and zero water consumption. Wipes are widely used for disinfecting medical equipment in hospitals, particularly equipment with irregular exteriors, wherein the use of liquids and sprays is complicated.

Wipes are costlier than the other two product forms. Sprays are projected to record the fastest CAGR from 2020 to 2027 due to rising demand on account of the emergence of the COVID-19 pandemic in the U.S. The spray form of the product can be applied to a broader area in a short period, where wipes cannot be used. Surface disinfectants in a spray form are not applicable to small surface areas, such as medical devices and instruments.

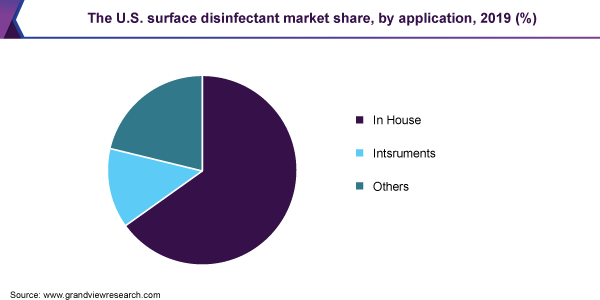

Application Insights

In-house surfaces application accounted for the largest revenue share of over 65% in 2019 and will grow further owing to the growing inclusion of surface disinfectants in several households, commercial, or industrial in-house surfaces. The Centers for Disease Control and Prevention (CDC) has laid down guidelines and recommendations for the cleaning and disinfection processes to be followed for in-house surfaces. The process of disinfecting in-house surfaces does not necessarily clean or kill all germs but lowers the risk of spreading infections and diseases caused by bacteria, fungi, or viruses. This factor is likely to fuel the growth of the market in the U.S.

The shoot up in product demand for regular cleaning and disinfecting in households, especially due to the COVID-19 pandemic situation, has further boosted the product sales in the market. The rising demand for surface disinfectants for equipment cleaning from medical professionals and consumers is likely to drive the demand for wipes and spray forms of the product. Increasing investments by the governments in R&D infrastructure and concerns regarding the dangers related to biohazards in laboratories have ramped the demand for surface disinfectants for disinfecting and cleaning laboratory equipment and instruments in medical facilities and industries, such as food processing and meat processing.

Other applications include outdoor disinfection and transportation among others. The product demand from these applications has increased in 2020 owing to the COVID-19 pandemic that has triggered the process of disinfection on nearly all surfaces, such as roads, PPE kits, etc. Chemical-based products are likely to dominate the market for other applications segment as these disinfectants are economical, easy to apply, and widely available.

End-use Insights

The industrial segment accounted for the largest revenue share of over 33% in 2019 owing to growing product applications for cleaning and disinfection of industrial equipment and surfaces. The food and meat processing industries are some of the key end-users. According to the Council of American States in Europe (CASE), food processing is one of the largest manufacturing industries of the U.S. that accounts for more than 10% of the countries shipments.

Growth in the production and expansion of industries in the U.S. is likely to drive the market in the near future. According to the Board of Governors of the Federal Reserve System, the industrial production and capacity utilization of the animal food processing industry in the U.S. grew from 102.9 to 134.9 units between 2016 and 2019. Meat processing includes poultry and livestock slaughter and is one of the prominent segments of the U.S. food and beverage industry, accounting for around 24% of its shipments in 2018. Regular disinfection and application of surface disinfectants in the animal processing industry is of key importance to the manufacturers to maintain final product quality, hygiene, and healthy manufacturing practices.

The commercial end-use segment includes applications in hotels, restaurants, cafeteria, bars, offices, and other commercial surfaces. The overall hotel industry of the U.S. is highly benefitted in the past years. However, the nationwide lockdown and temporary shutdown of office spaces due to the COVID-19 pandemic is expected to negatively influence the commercial end-use segment in 2020 and onwards. Furthermore, growing recognition of work-from-home benefits among the top commercial giants is likely to worsen the segment growth in the near future.

Key Companies & Market Share Insights

The competitive landscape of the market is moderately fragmented with the presence of multinationals striving to fulfill high demand from end-users. Key players are concentrating on using advanced technology and adopting new marketing strategies to strengthen their base to generate more revenue. Manufacturers are also focusing on optimizing and managing supply efficiency and ensuring their ability to compete with other players by increasing productivity, enhancing the operating efficiency, addressing the sourcing requirements, and reducing the lead time.

Many key companies have very diverse product portfolios. These companies have established recognized brands, such as Polyquart, Tinogard, and Laevergy by BASF SE and PERACLEAN by Evonik Industries AG, which have a prominent presence in the market. A majority of the players are engaged in forwarding integration to gain a competitive edge in the market. For instance, Evonik Industries AG manufactures peracetic acid and hydrogen peroxide, as well as utilizes these products to produce surface disinfectants for the pharmaceutical and medical industries.

With the spike in demand for disinfectant sprays and wipes from the medical and pharmaceutical sectors, quaternary ammonium compounds have observed high demand in the country. In spite of the plants operating well in the country, manufacturers are struggling with unprecedented demand and recurrent problems in procuring raw materials in bulk. In April 2020, Max Lauwiner, the Head of the Global Operations for Lonza Specialty Ingredients, confirmed that the company’s plant in Illinois, which is responsible for the production of quaternary ammonium compounds, is functioning at full capacity utilization, in spite of recurrent suspensions in raw material supply due to container availability, freight capacity, and logistics restrictions. Some of the prominent players in the U.S. surface disinfectant market include:

-

BASF SE

-

Evonik Industries AG

-

The 3M Company

-

Kimberly-Clark Corporation

-

Ecolab Inc.

-

The Procter & Gamble Company (P&G)

-

Reckitt Benckiser Group plc

-

The Clorox Company

-

Medline Industries, Inc.

-

Whiteley Corporation

-

Lonza Group Ltd.

-

S. C. Johnson & Son, Inc.

The U.S. Surface Disinfectant Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2020 |

USD 1.1 billion |

|

Market volume in 2020 |

9,77,294.32 kilotons |

|

Revenue forecast in 2027 |

USD 1.9 billion |

|

Volume forecast in 2027 |

15,82,014.09 kilotons |

|

Growth Rate |

CAGR of 9.2% from 2020 to 2027 |

|

Base year for estimation |

2019 |

|

Historical data |

2016 - 2018 |

|

Forecast period |

2020 - 2027 |

|

Quantitative Units |

Volume in kilotons, revenue in USD million and CAGR from 2020 to 2027 |

|

Report coverage |

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Composition, form, application, end-use |

|

Country scope |

The U.S. |

|

Key companies profiled |

BASF SE; Evonik Industries AG; The 3M Company; Kimberly-Clark Corp.; Ecolab Inc.; The Procter & Gamble Company (P&G); Reckitt Benckiser Group plc.; The Clorox Company; Medline Industries, Inc.; Whiteley Corp.; Lonza Group Ltd.; S. C. Johnson & Son, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this report, Grand View Research has segmented the U.S. surface disinfectant market report on the basis of composition, form, application, and end-use:

-

Composition Outlook (Volume, Kilotons; Revenue, USD Million; 2016 - 2027)

-

Chemical

-

Alcohols

-

Ammonium Compounds

-

Oxidizing agents

-

Phenolics

-

Aldehydes

-

Others

-

-

Biobased

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million; 2016 - 2027)

-

Liquids

-

Chemical

-

Biobased

-

-

Wipes

-

Chemical

-

Biobased

-

-

Sprays

-

Chemical

-

Biobased

-

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2016 - 2027)

-

In-house Surfaces

-

Chemical

-

Biobased

-

-

Instruments

-

Chemical

-

Biobased

-

-

Others

-

Chemical

-

Biobased

-

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million; 2016 - 2027)

-

Hospitals

-

Chemical

-

Biobased

-

-

Laboratories

-

Chemical

-

Biobased

-

-

Households

-

Chemical

-

Biobased

-

-

Industrial

-

Chemical

-

Biobased

-

-

Commercial

-

Chemical

-

Biobased

-

-

Frequently Asked Questions About This Report

b. The U.S. surface disinfectant market size was estimated at USD 987.0 million in 2019 and is expected to reach USD 1,120.3 million in 2020.

b. The U.S. surface disinfectant market is expected to grow at a compound annual growth rate of 9.2% from 2020 to 2027 to reach USD 1,992.6 million by 2027.

b. Alcohols and oxidizing agents together dominated the U.S. surface disinfectant market with a volume share of 80% in 2019. This is attributable to the rising usage of chemical-based surface disinfectant across large scale industrial applications.

b. Some key players operating in the U.S. surface disinfectant market include BASF SE, Evonik Industries AG, The 3M Company, Kimberly-Clark Corporation, Ecolab Inc, The Procter & Gamble Company (P&G), Reckitt Benckiser Group plc, The Clorox Company, Medline Industries, Inc. Whiteley Corporation, Lonza Group Ltd. S.C. Johnson & Son, Inc.

b. Key factors that are driving the market growth include increasing Commercial end-use of the surface disinfectants include application in hotels, restaurants, cafeteria, bars, offices, and other commercial spaces coupled with to growing application of surface disinfectant for cleaning and disinfection of industrial equipment and surfaces.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."