U.S. Supply Chain Security Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Security Type, By Enterprise Size, By Vertical, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-252-3

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. Supply Chain Security Market Trends

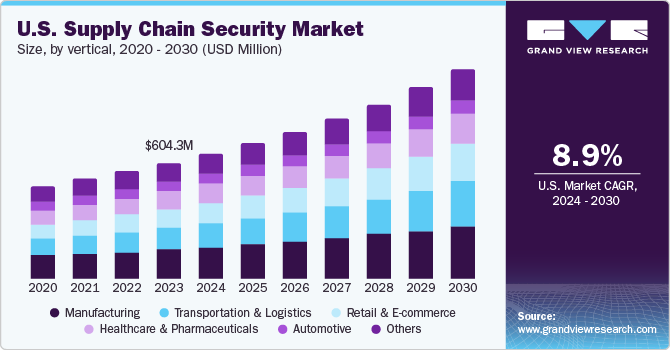

The U.S. supply chain security market size was valued at USD 604.3 million in 2023 and is projected to grow at a CAGR of 8.9% from 2024 to 2030. The U.S. accounted for 25.7% of the global supply chain security market. The growth of the U.S. supply chain security industry can be attributed to the increasing possibilities of cyber threats across various industries. In recent years, disruptive and emerging technologies in the manufacturing, retail, healthcare, and oil & gas sectors have provided new capabilities, facilitated automation, and improved working conditions. As a result, considering the U.S. threat landscape, the market is witnessing growth in supply chain security due to the emergence of new exploits, malware, and vulnerabilities.

The demand for supply chain security solutions is expected to increase due to the increased volume of business data across U.S. industries. Furthermore, the increase in data is compelling businesses to adopt analytics solutions for converting raw data into actionable insights. Moreover, the need for better strategic decision-making, inventory cost reduction, maximizing profitability, and helping companies improve their market position is expected to drive the growth of supply chain security solutions.

In addition, the data locality & protection security solution enables business entities to manage and secure data, which is stored, used, exchanged and worked in compliance with U.S. government and industry standards in domestic operations. Data protection has become a major challenge in the digital age, where data is a significant asset for any firm. With the large volume of data in databases, safeguarding it is critical to preventing economic harm are the key factors expected to drive the demand for data locality & protection security solutions in the U.S. supply chain.

Furthermore, In the U.S., various SMEs and large enterprises have increased the adoption of security solutions to avoid system breaches and help protect the process more efficiently and securely to overcome any rapid disruption, such as any cyberattack. In addition, various large enterprises are investing significantly in adopting technologies such as the Internet of Things (IoT), blockchain, and Artificial Intelligence (AI) to enhance the transparency of supply chain activities. The demand for security services is increasing due to tech innovations, which include forecasting, risk planning, customer & supplier management, and warehouse & logistics management.

Supply chain security solutions are helping in shipping cargo to enhance the security of the supply chain, logistics, and transport systems. However, the market has several complexities, including IT infrastructures, continually evolving technologies, mergers & acquisitions, and changing regulatory environments. This creates fragmented technology silos and makes it difficult for enterprises to optimize end-to-end value streams. The supply chain security market has its own limitations, such as addressing unforeseen threats like cyberattacks, natural disasters, hijacks, and pirate attacks, which can hamper the growth of the market.

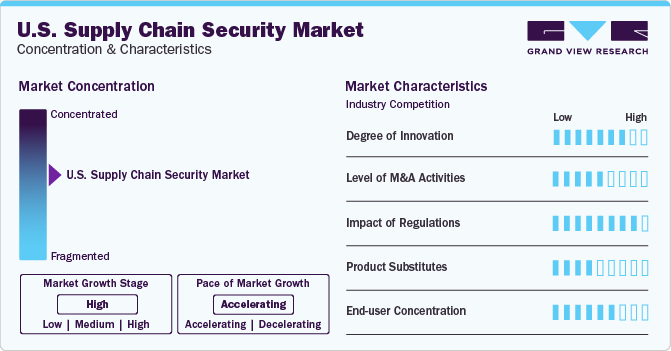

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The U.S. supply chain security market is relatively concentrated. In the near future raising, concerns about cybersecurity and technological advancements, such as integration of artificial intelligence (AI) and machine learning (ML) for threat detection, anomaly detection, and automated response systems, counter and eliminate the possibilities of cyber threats, which is likely to create ample opportunities for market growth in the U.S. supply chain security market.

The U.S. supply chain security solutions are adopted across various SMEs and large industries, especially IT, telecommunication, manufacturing, pharmaceuticals, and healthcare, to ensure a supply chain network without disruptions. The U.S. market has the presence of multiple security service providers, such as IBM Corporation, Oracle Corporation, Cisco Systems Inc., and others.

There is a significant potential for innovation in the supply chain security market in the U.S., where organizations can access security services & solutions within minimum budget allocation. American companies always prefer to enhance their supply chain efficiency to outperform competitors. The focus on a sustainable supply chain network can increase security measures in the supply chain network, allowing businesses to be more agile and flexible and better manage market demands.

However, rapid digitalization has become a threat to data privacy, and security service providers are emphasizing eliminating data breach possibilities and securing data. With the growing complexity of the U.S. market concerning the supply chain network, minor interruptions hinder the market growth, and end users face the consequences. Therefore, supply chain security is a top priority for U.S. businesses to meet market demand.

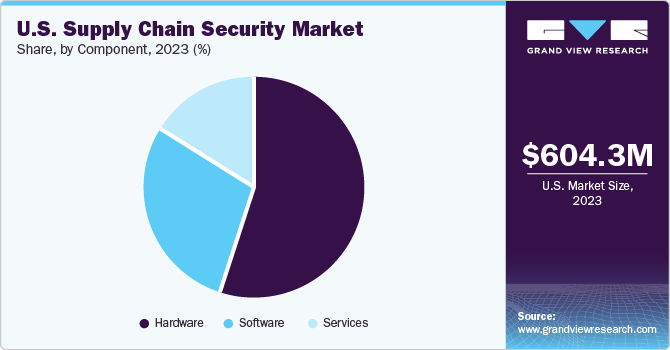

Component Insights

Hardware segment dominated the market and accounted for the highest revenue share of 55.0% in 2023. The hardware providers develop security infrastructure to carry out smooth supply chain operations. With the increasing number of cybercrimes from anonymous networks, Internet Service Providers (ISP) and large and small & medium-sized businesses are deploying next-generation security hardware, such as encrypted USB flash drives, as Intrusion Prevention Systems (IPS). Hardware assists organizations in upgrading their IT security by enabling real-time monitoring of threats and preventing threats from entering computing systems. As a result, hardware component demand in the U.S. supply chain security market is growing.

Services segment is anticipated to witness fastest CAGR of 9.9% from 2024 to 2030 in the U.S. Supply Chain Security Market. The rising number of suitable supply chain security software is propelling the adoption of supply chain security services across several U.S. industries. The services help companies manage many resources, massive data volumes, and network connectivity across billions of devices; they can be a potential target for cybercriminals. During the forecast period, several U.S. organizations subscribe to cybersecurity services to build a robust security structure and mitigate cyberattacks in supply chains.

Security Type Insights

Data locality & protection segment led the market and accounted highest revenue share of 42.9% in 2023. Large enterprises are investing in IT infrastructure such as data locality and protection to reduce cyber threats and reduce dependency on third-party service providers. An increase in databases associated with supply chain activities has increased the complexity of securing the data sets across healthcare and financial, among other sectors. The data locality & protection security solution enables businesses to manage and secure data, which is stored, used, exchanged, and managed in compliance with government and industry standards of the regions in which they operate. As a result, the data locality & protection segment has a significant market share in the U.S. supply chain security market.

Data Visibility & Governance segment is anticipated to witness a significant CAGR of 10.2% from 2024 to 2030 in the U.S. supply chain security market. Data governance is critical in supply chain security as it ensures the dependability, consistency, and security of the data utilized in the analysis. Effective data governance allows firms to address common supply chain security obstacles such as data inaccuracy, data silos, and regulatory issues while maximizing the benefit of analytics-driven decision-making.

Enterprise Size Insights

Large enterprises segment led the market and accounted for the highest global revenue share of 53.1% in 2023. Large enterprises in U.S. are increasingly adopting supply chain security solutions to enhance security compliance, increase efficiency, reduce operating expenses and downtime, and accelerate time-to-market. Moreover, supply chain security services enables large businesses to streamline their business operations. Thus, the market is expected to be in high over the forecast period due to the growing number of large firms in the U.S.

Small and Medium Sized Enterprises (SMEs) segment is anticipated to witness significant CAGR of 9.5% from 2024 to 2030 in the U.S. supply chain security market. SMEs are more vulnerable to cyberattacks owing to their low degree of security due to funding constraints.Furthermore, the rising availability of cloud-based Supply Chain Analytics (SCA) solutions has raised their demand among small & medium-sized businesses owing to several benefits, including quicker implementation windows, effective and efficient use of IT resources, quick deployment, and enhanced mobility and flexibility. Thus, supply chain security market is witnessing demand among SMEs is poised to grow significantly over the forecast period.

Vertical Insights

Manufacturing segment accounted for the largest market revenue share of 25.5% in 2023. Manufacturing companies in the U.S. have always been pioneers in adopting the latest technological innovations to stay ahead in the market. They use cutting-edge automation, AI, and hyper-connected network communications to improve their operations. However, these advancements also make them vulnerable to cyber threats. Attackers can exploit business operations, including supply chain. Therefore, manufacturing organizations address these challenges by increasing focus on supply chain security in their business operations.

Retail & e-commerce segment is expected to register the fastest CAGR of 10.9% during the forecast period. Retail organizations now have access to more consumer data across a wide range of digital platforms prone to cyber threats where attackers can target sensitive data. Similarly, e-commerce companies in the U.S. are proactively seeking security solutions to protect against data breaches, fraud, theft, phishing attacks, brand impersonation, brandjacking, cybersquatting, Distributed Denial-of-Service (DDOS) assaults, and trademark infringement in supply chain networks. As a result, this segment is driving the growth of the U.S. supply chain security market.

Key U.S. Supply Chain Security Company Insights

Some of the prominent participants operating in the market include IBM Corporation, Oracle Corporation and others.

-

IBM Corporation specializes in providing technological solutions and supply chain security. The company caters to multiple sectors and industries, such as electronics, aerospace & defense, automotive, energy & utilities, healthcare, life science, and electronics. It operates its businesses through five segments, namely Cloud & Cognitive Software, Global Business Services, Global Technology Services, Systems, and Global Financing.

-

Oracle Corporation is a global information technology services and solutions company that holds expertise in databases and relational servers, application development, decision support tools, and enterprise business applications. The company operates through three business segments, namely cloud and license, hardware, and services. Its solutions are powered by Artificial Intelligence (AI), consumer-market design elements, and collaboration tools.

ORBCOMM, Monnit Corporation, and others are some of the emerging companies operating in the U.S. supply chain security market

-

ORBCOMM provides industrial internet and Machine-to-Machine (M2M) communications network, hardware, and solutions. The networks offered by the company include cellular, satellite, and dual mode. The hardware offered by the company include devices, modems, sensors & antennas, and routers. The solutions offered by the company include web applications and enterprise IoT toolkits. The company offers services to sectors and industries such as industrial, transportation, government, and maritime.

-

Monnit Corporation is a technology company that specializes in developing and deploying innovative IoT solutions. The company provides a wide range of wireless sensors and monitoring devices that enable seamless data collection, analysis, and reporting. These sensors cover diverse parameters, such as temperature, humidity, motion, water presence, and door/window access, enabling organizations to efficiently manage and monitor their assets, environments, and processes in real-time.

Key U.S. Supply Chain Security Companies:

- Altana AI

- Cisco Systems Inc.

- Cold Chain Technologies

- Dickson, Inc.

- Emerson Electric Co.

- FourKites

- IBM Corporation

- McAfee Corporation

- Monnit Corporation

- Oracle Corporation

- ORBCOMM

- Roambee

- SafeTraces

- Sensitech Inc.

- Tive

Recent Developments

-

In January 2024, In January 2024, FourKites and Zebra Technologies collaborated for integration of cutting-edge technology such as Workcloud Task Management and Workcloud Scheduling applications to optimize labor management and task execution and to engage frontline workers effectively.

-

In November 2023, Tive announced partnership with Vector Global Logistics, the global leader in real-time, end-to-end shipment visibility solutions. This collaboration yielded astonishing results such as enhancing supply chain visibility and efficiency.

-

In November 2023, Roambee, the global real-time supply chain visibility and intelligence provider, announced a joint venture with Central Soft, a renowned Japanese software and services company. This collaboration marks the beginning of a groundbreaking digital transformation in APAC to embrace the latest technological advancements in supply chain artificial intelligence (AI) & sensor-driven visibility to enhance business operations.

-

In August 2023, u-blox, a worldwide provider of advanced positioning and wireless communication technology and services, partnered with ORBCOMM to develop solutions for converging terrestrial and satellite IoT communications markets.

U.S. Supply Chain Security Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 652.0 million |

|

Revenue forecast in 2030 |

USD 1,087.7 million |

|

Growth rate |

CAGR of 8.9% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, security type, enterprise size, vertical |

|

Country scope |

U.S. |

|

Key companies profiled |

Altana AI; Cisco Systems Inc.; Cold Chain Technologies; Dickson, Inc.; Emerson Electric Co.; FourKites; IBM Corporation; McAfee Corporation; Monnit Corporation; Oracle Corporation; ORBCOMM; Roambee; SafeTraces; Sensitech Inc.; Tive |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Supply Chain Security Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. supply chain security market report based on component, security type, enterprise size, and vertical.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Security Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Data Locality & Protection

-

Data Visibility & Governance

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium-enterprise (SME)

-

Large Enterprise

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare & Pharmaceuticals

-

Retail & E-commerce

-

Automotive

-

Transportation and Logistics

-

Manufacturing

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. supply chain security market size was estimated at USD 604.3 million 2023 and is expected to reach USD 652.0 million in 2024

b. The U.S. supply chain security market is expected to grow at a compound annual growth rate of 8.9% from 2024 to 2030 to reach USD 1,087.7 million in 2030.

b. Hardware segment dominated the market and accounted for the highest revenue share of 55.0% in 2023. The hardware providers develop security infrastructure to carry out smooth supply chain operations.

b. Some key players operating in the U.S. supply chain security market are Altana AI; Cisco Systems Inc.; Cold Chain Technologies; Dickson, Inc.; Emerson Electric Co.; FourKites; IBM Corporation; McAfee Corporation; Monnit Corporation; Oracle Corporation; ORBCOMM; Roambee; SafeTraces; and Sensitech Inc.; Tive among others.

b. The growth of the U.S. supply chain security market can be attributed to the increasing possibilities of cyber threats across various industries. In recent years, disruptive and emerging technologies in the manufacturing, retail, healthcare, and oil & gas sectors have provided new capabilities, facilitated automation, and improved working conditions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."