U.S. Super-resolution Microscopes Market Size, Share & Trends Analysis Report By Technology (STED, SIM, STORM, FPALM, PALM), By Application (Life Science, Nanotechnology, Material Science), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-275-3

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

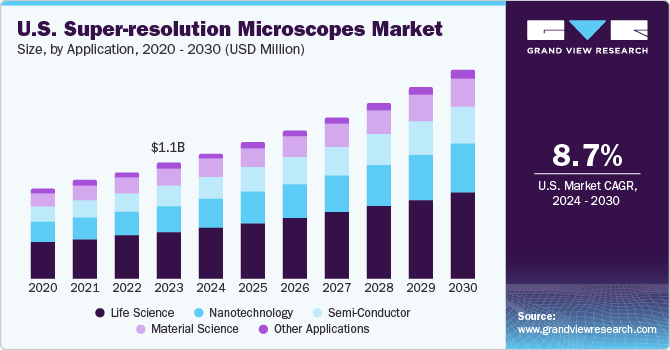

The U.S. super-resolution microscopes market size was valued at USD 1.07 billion in 2023 and is expected to grow at a CAGR of 8.7% from 2024 to 2030. Increasing demand for super-resolution microscopy in nanotechnology and wide application in life science industry mainly in microbiology, oncology for cancer cell proliferation, biomedical imaging, and drug discovery are the key reasons for the market growth.

In 2023, U.S. accounted for a market share of over 29.6% in the global super-resolution microscopes market. Major factors contributing to the growth of super-resolution microscopes market in this country include technological advancements and extensive research being carried out in different industries such as nanotechnology, life sciences, & semiconductor. Currently, medical research is being conducted for studying mechanisms of infectious diseases, viral structures, cancer cell proliferation mechanisms, and various pathways that need to be studied beyond the resolution of conventional microscopy. Super-resolution microscopy plays an important role in such cases.

As nanotechnology finds most of its application in semiconductors, material sciences, and life sciences, it helps government organizations and other corporate enterprises support R&D via funding. For instance, in 2021, the U.S. government announced a budget of USD 1.7 billion for the National Nanotechnology Initiative to support nanotechnology research. Thus, significant funding in nanotechnology is further expected to positively impact market growth.

Many research institutes in the country are also emphasizing the use of super-resolution microscopes over electron microscopes, to improve quality and results of research. The National Institute of Standards and Technology have come up with super-resolution chemical imaging-microscopy that enables studying various chemical processes before, after, and during the process, with viruses such as HIV at higher resolutions.

Market Concentration & Characteristics

Technological breakthroughs in diagnostic techniques, increasing government support, and corporate funding for microscopy are key factors driving the market growth. Technological advancements in diagnostic techniques, increasing government support, and corporate funding for microscopy are steering the product demand. The use of super-resolution microscopy in biological sciences is growing. Currently, nanoimaging and non-diffraction-limited optical methods are widening the scope of super-resolution microscopes. Advanced super-resolution microscopes allow for molecular analysis. The most recent application of microscopes is a cellular examination at the nanoscale level.

The U.S. super-resolution microscopes market is characterized by a high level of M&A activities undertaken by leading players. This is due to factors including the increasing focus on enhancing companies' portfolio and the need to consolidate in a rapidly growing market. Several players in the market are undertaking this strategy to strengthen their portfolio. For instance, in March 2022, Olympus Corporation partnered with Evorion Biotechnologies (evorion), a provider of cell analysis systems. The collaboration of CellCity System and CellCity Scout-AI software of Evorion as well as IXplore microscope systems and cellSens software of Olympus Corporation was aimed at making high-resolution live-cell analysis applications accessible.

The U.S. FDA is primarily responsible for devising regulations pertaining to super-resolution microscopes. Conventional equipment is classified as class I medical devices. For the distribution of new devices, a company is required to apply and obtain authorization in either of the three ways stated: premarket notification 510(k), Premarket Approval (PMA) application, or Humanitarian Device Exemption (HDE). In accordance with the ACA and Health Care and Education Affordability Reconciliation Act, the manufacturers are required to pay 2.3% excise tax on the sales of class I, II, and III medical devices in the U.S.

STED microscopy helps study material science and cell biology at a nanoscale, making a detailed study of structural & functional relationship possible, which was difficult with diffraction-limited microscopy. With recent advances like live-cell microscopy or spectral multiplexing, fluorescence-based investigation of components & nanoscale material is possible. Recent upgradation in two-photon excitation stimulated emission depletion (2PE-STED), which uses both pulse approaches and continuous wave, offers benefits like simplifying synchronization, lower input power, and simple optical scheme. Such developments are creating new growth avenues for the market.

Leading players in the market, such as Danaher (parent company for Leica Microsystem) and Applied Precision (GE Healthcare), are headquartered in the U.S., with manufacturing site present at different locations. Many companies from European and Asian countries are also focusing on expanding their business reach in the U.S. For instance, in March 2022, Olympus Corporation inaugurated its Olympus Discovery Center at the University of Maryland (UMD). The center equips bioengineering researchers with high-performance microscopy systems, enabling analysis of living tissue to encourage study of cellular and subcellular events.

Technology Insights

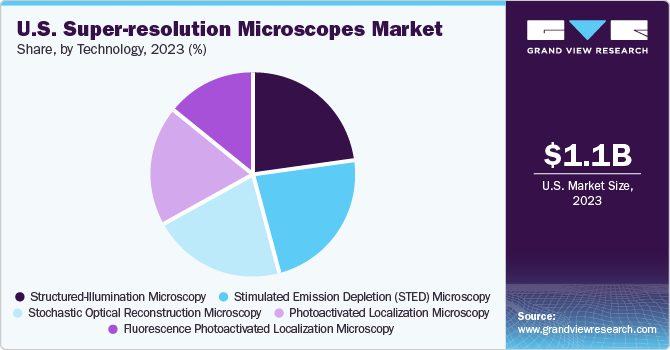

Stimulated Emission Depletion (STED) microscopy technology accounted for the largest market share of 22.7% in 2023 due to its ability to deliver diffraction-unlimited images, with no need for further computational processing. The application of fast-beam scanners has established STED microscopy as one of the quickest super-resolution imaging techniques available as it does not require data processing after the acquisition. STED-FCS (Fluorescence Correlation Spectroscopy) has applications in single-molecule studies on membranes, where it gives data for lipid membrane diffusion.

The STORM technology is expected to garner the fastest CAGR during the forecast period. This can be attributed to the technological advancements, collaborations between various industry players, and research funded by government organizations. STROM microscopes can be used in conjunction with AX/AR confocal microscopes. In May 2021, Nikon Corporation announced the debut of the AX and AX R confocal microscopes. These new microscopes have a newly rebuilt scan head with 8K*8K resolution, ultra-fast resonant scanning, and the biggest 25mm field of view in the world.

Application Insights

The life science segment held the highest market share of 41.0% in 2023. This can be attributed to the increasing applications of super-resolution microscopy in the field of R&D and diagnostics. For instance, in the field of neuroscience, the adoption of fluorescence imaging techniques and specialized probes have provided insights into the cellular structures of neurons. Such data is being used for investigations of neurodegenerative and autoimmune disorders. The growing applicability of super-resolution microscopes in diagnostics is anticipated to drive market growth.

The nanotechnology segment is expected to grow at the fastest CAGR during the forecast period owing to increasing application in visualization of interaction of nanomaterials with biological entities at high resolution. In addition, the government is supporting nanotechnology research and key players are coming up with nanotechnology-based products driving the market. For Instance, in 2021, the U.S. government announced 1.7 billion in funding for nanotechnology research.

Key U.S. Super-resolution Microscopes Company Insights

Applied Precision (GE Healthcare), Danaher Corporation, and Bruker Corporation are some of the key U.S. super-resolution microscopes companies operating in the U.S. market. Collaboration is one of the ongoing trends in this market. For instance, the collaborations of JEOL with Nikon and Carl Zeiss with Seiko in the past years have enhanced the super-resolution microscopes-related product competitiveness, with increased sales and established new markets. Collaborations have typically taken place in the production phase and are expected to surge in other fields, such as development and engineering. Technological knowledge in mechatronics, software, analog electronics, and physics is fundamental to the viability of most companies.

Key U.S. Super-resolution Microscopes Companies:

- ZEISS

- Applied Precision (GE Healthcare)

- Nikon Corporation

- Olympus Corporation

- Leica Microsystems (Danaher Corporation)

- Bruker Corporation

- Hitachi High Technologies

Recent Developments

-

In April 2022, Bruker Corporation acquired Optimal Industrial Automation and Technologies, a leader in pharma & biopharma Process Analytical Technology (PAT), automation of pharma manufacturing, and Quality Assurance (QA) software & systems integration. The acquisition strengthened Bruker’s software & solutions for biologics, small molecules, and new drug modalities.

-

In March 2022, Bruker Corporation launched Ultima Investigator Plus— an innovative modular platform. The platform is an addition to Ultima line of multiphoton microscopes focused on deep tissue fluorescence imaging.

-

In February 2022, Olympus Corporation inaugurated its new facility, Olympus Discovery Center, at Texas A&M University. The center planned to contribute to human disease research by providing researchers access to FVMPE-RS gantry multiphoton microscope for high-resolution deep tissue imaging, FLUOVIEW FV3000RS inverted confocal microscope for high-speed live cell imaging, and VS120 virtual slide scanner for automatic & optimized whole slide scanning.

-

In January 2022, Zeiss Group launched an integrated solution—In Situ Lab, for its Field Emission Scanning Electron Microscopes (FE-SEM). The solution was aimed at enabling researchers to analyze materials such as alloys, metals, plastics, polymers, ceramics, and composites under tension & heat.

U.S. Super-resolution Microscopes Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.16 billion |

|

Revenue forecast in 2030 |

USD 1.92 billion |

|

Growth Rate |

CAGR of 8.7% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, application |

|

Country scope |

U.S. |

|

Key companies profiled |

ZEISS; Nikon Corporation; Olympus Corporation; Leica Microsystems (Danaher Corporation); Hitachi High Technologies; Applied Precision (GE Healthcare); Bruker Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Super-resolution Microscopes Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. super-resolution microscopes market report based on technology and application:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Stimulated Emission Depletion (STED) Microscopy

-

Structured-Illumination Microscopy (SIM)

-

Stochastic Optical Reconstruction Microscopy (STORM)

-

Fluorescence Photoactivated Localization Microscopy (FPALM)

-

Photoactivated Localization Microscopy (PALM)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Nanotechnology

-

Life Science

-

Material Science

-

Semi-Conductor

-

Other Applications

-

Frequently Asked Questions About This Report

b. The U.S. super-resolution microscopes market size was estimated at USD 1.07 billion in 2023 and is expected to reach USD 1.16 billion in 2024.

b. The U.S. super-resolution microscopes market is expected to grow at a compound annual growth rate of 8.7% from 2024 to 2030 to reach USD 1.92 billion by 2030.

b. The life science segment dominated the U.S. super-resolution microscopes market with a share of 40.96% in 2023. This can be attributed to the increasing applications of super-resolution microscopy in the field of research & development and diagnostics.

b. Some key players operating in the U.S. super-resolution microscopes market include ZEISS; Nikon Corporation; Olympus Corporation; Leica Microsystems (Danaher Corporation); Hitachi High Technologies; Applied Precision (GE Healthcare); and Bruker Corporation.

b. Key factors that are driving the U.S. super-resolution microscopes market growth include increasing applications in the life science industry, technological advancements, and a growing focus on nanotechnology.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."