- Home

- »

- Medical Devices

- »

-

U.S. Sternal Closure Systems Market, Industry Report, 2030GVR Report cover

![U.S. Sternal Closure Systems Market Size, Share & Trends Report]()

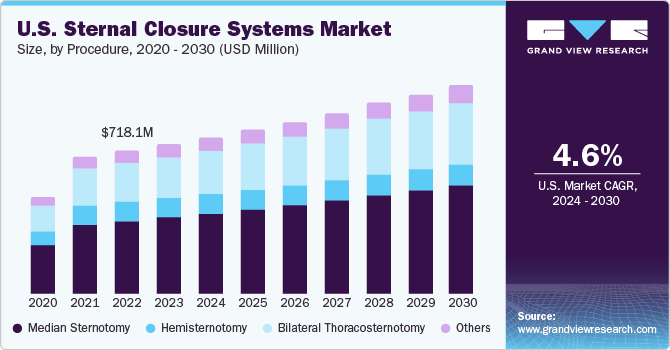

U.S. Sternal Closure Systems Market Size, Share & Trends Analysis Report By Product (Closure Devices, Bone Cement), By Procedure (Median Sternotomy, Hemisternotomy, Bilateral Thoracosternotomy) By Material Type, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-235-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Sternal Closure Systems Market Trends

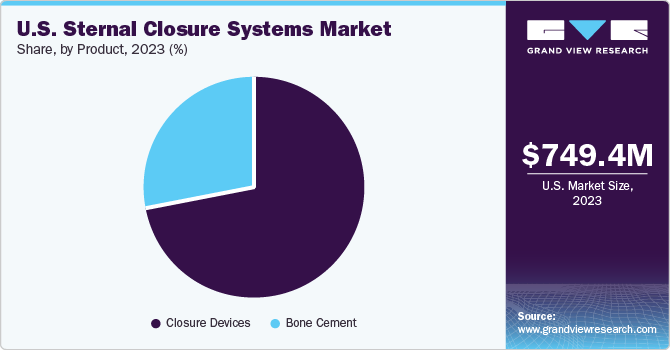

The U.S. sternal closure systems market size was estimated at USD 749.4 million in 2023 and is expected to grow at a CAGR of 4.60% from 2024 to 2030. Potential factors contributing to the growth of this region include increasing incidences of cardiothoracic surgeries, a surge in geriatric populations, growing R&D activities and innovative product launches. Furthermore, several regulatory approvals for innovative product launches is driving the market.

The U.S. sternal closure system market growth is attributed to sedentary lifestyle, poor nutrition, and lack of physical activity which further lead to chronic diseases such as cancer, diabetes, obesity, and cardiovascular diseases. According to the National Institute of Diabetes and Digestive and Kidney Diseases Statistics, 42.7% people are obese and 30.7% people are overweight in the U.S. Rising prevalence of obesity further contributes to increased demand for median sternotomy procedures, thereby expected to drive the segment growth.

In addition, the growing geriatric population is one of the major factors fueling the market growth. As per American health Rankings data, approximately 17.3% of people are of age 65 and above in the U.S. and this number will increase to 22% by 2040. Thus, the rapidly rising geriatric population showcases significant opportunities in the sternal closure system.

Moreover, well-structured healthcare facilities and favorable reimbursement coverages are likely to boost the market growth over the forecast period. Advancements in surgical technologies and invasive cardiac surgeries have led to a growing need for specialized sternal closure systems that offer stability, reduced trauma, and enhanced patient outcomes.

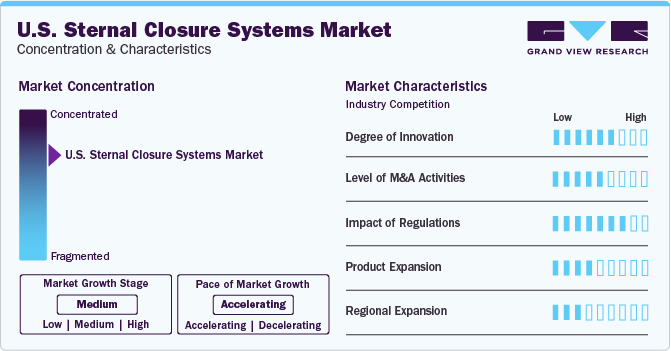

Market Characteristics & Concentration

The U.S. sternal closure market is highly concentrated due to the presence of a few large-scale industries holding higher market shares in the market. The market growth is moderate at an accelerating pace.

.Industry players are increasingly focusing on launching new products to maintain their leadership positions and strengthen their presence. This strategic approach is vital for companies to stay competitive and adapt to changing market dynamics. By introducing innovative products, companies can attract customers, drive revenue growth, and enhance their brand reputation.

Numerous industry players are actively involved in acquiring smaller companies to expand their positions. This strategic approach enables firms to enhance their capabilities, broaden their product portfolios, and improve their competencies. For instance, in January 2024, Orthofix Medical Inc. announced their merger of equals with SeaSpine Holdings Corporation following approval from each company's stockholders. This merger would aism to lead the way in the spine and orthopedics industry.

Regulations have the potential to impact industries in various ways, influencing both the demand and supply chain of products. The U.S. market for sternal closure systems is heavily regulated by the Food and Drug Administration (FDA), which establishes stringent standards for surgical safety and efficacy. This regulatory environment has created a highly competitive market where companies invest significantly in research and development to introduce new devices to the industry. Several industries are strategically focusing on regional expansion to serve a wide range of customers and capitalize on geographical market growth opportunities. This approach allows companies to strengthen their presence in different regions, adapt to local market needs, and enhance their market share by targeting diverse customer segments. Regional expansion strategies enable companies to leverage the potential for growth in specific geographic areas, ultimately contributing to their overall market success and sustainability. For instance, in February 2022 has made an investment in CircumFix Solutions, a startup based in Tennessee, USA, that has developed an innovative sternal closure device aimed at enhancing patient recovery post open chest surgery.

Procedure Insights

Based on procedure, medial sternotomy held the largest market share with 51.0% in 2023. The median sternotomy procedure provides convenient access to heart, lungs, and surrounding structures during heart valve replacement surgery and coronary artery bypass surgery. This technique is known for reducing postoperative infections and complications, leading to a growing demand in the global market for sternal closure systems. The growing geriatric population, which is susceptible to chronic cardiovascular diseases, is anticipated to fuel the demand for median sternotomy procedures. The increasing elderly population, which is more prone to chronic cardiovascular conditions, is expected to drive the demand for median sternotomy procedures.

The bilateral thoracosternotomy segment is anticipated to expand at the fastest CAGR from 2024 to 2030. Bilateral thoracosternotomy, also known as the clamshell incision, is a potential alternative for lung transplantation and is best suited for end-stage pulmonary diseases such as Chronic Obstructive Pulmonary Disease (COPD), cystic fibrosis, and emphysema. The growing demand for lung transplantation procedures, due to the rising prevalence of these conditions, is expected to drive market growth.

Material Type Insights

Based on material type, stainless steel accounted for the largest market share of about 27.0% in 2023, owing to the availability of abundant raw material suppliers and the economic feasibility and affordability. This material offers benefits such as cost-effectiveness, durability, and ease of manufacturing, driving its demand in the market for sternal closure systems. Several companies are focusing on new product launches which further boost the growth.

The titanium segment is projected to witness growth at the fastest CAGR from 2024 to 2030. The growing demand is driven by their corrosion resistance, ability to effectively join human bones, biocompatibility, and non-ferromagnetic property, which allows patients with titanium implants to be safely examined under magnetic resonance imaging (MRI) scans. Additionally, the high efficacy, non-toxic nature of implants, and stability of titanium products contribute to their growing popularity in the sternal closure systems market.

Product Insights

Based on type, the closure devices dominated with the highest share of 72.0% in 2023 and is expected to grow at the fastest CAGR over the forecast period. This growth is attributed to reduced post-surgical complications and quick recovery outcomes provided by closure devices. Moreover, technological advancement, high mergers and acquisitions, and innovative product launches drive the market growth. For instance, in November 2023, Orthofix Medical Inc. announced the launch of WaveForm L which is a lateral lumbar interbody system. This system specializes in lateral lumbar interbody fusion (LLIF) procedures to offer strength and stability.

The bone cement segment is projected to expans at a significant CAGR from 2024 to 2030 owing rising number of median sternotomy and prevalence of cardiovascular disorders in the U.S. Bone cement combined with wires has emerged as an alternative to traditional sternal closure methods. Companies in the market are prioritizing strategic partnerships and funding initiatives to enhance research and development capabilities, thereby expanding their product offerings.

Key U.S. Sternal Closure Systems Company Insights

The key companies include Zimmer Biomet, DePuy Synthes and KLS Martin Group, Orthofix Holdings Inc, GE Healthcare, and A&E Medical Corporation.

Leading companies in the U.S. Sternal closure systems market are always focusing on developing and upgrading existing technologies to enhance patient outcomes and significantly increase surgical efficiency. Moreover, M&A activities undertaken by market players, innovative product launches and regional product expansion initiatives further leverage the growth of the market.

Key U.S. Sternal Closure Systems Companies:

- DePuy Synthes

- Zimmer Biomet Holdings, LLC

- KLS Martin Group

- Stryker

- Johnson & Johnson,

- Orthofix Holdings Inc

- GE Healthcare

- A&E Medical Corporation

- Acute Innovations

- Abyrx, Inc

- Kinamed Incorporated

Recent Developments

-

In January 2023, Able Medical Devices introduced looped wire sutures for closing a patient’s chest after open-heart surgery. These sutures offer more robust sternal closure compared to traditional wire sutures and double the surface area of single wires.

-

In February 2022, Evonik invested in US-based startup Circumfix for a novel sternal closure device to offer rapid patient recovery after open-chest surgery.

U.S. Sternal Closure Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 782.5 million

Revenue Forecast in 2030

USD 1.02 billion

Growth rate

CAGR of 4.60% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, procedure, material-type

Country scope

U.S.

Key companies profiled

DePuy Synthes; Zimmer Biomet Holdings, LLC; KLS Martin Group; Stryker; Johnson & Johnson,Orthofix Holdings Inc; GE Healthcare; A&E Medical Corporation; Acute Innovations; Abyrx, Inc; Kinamed Incorporated

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Staernal Closure System Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. sternal closure systems market report based on product, procedure, and material type:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Closure Devices

-

Sternal Closure Wires

-

Sternal Closure Plates and Screws

-

Sternal Closure Clips

-

Sternal Closure Cables

-

-

Bone Cement

-

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Median Sternotomy

-

Hemisternotomy

-

Bilateral Thoracosternotomy

-

Others

-

-

Material Outlook (Revenue, USD Million, (2018 - 2030)

-

Titanium

-

Polyether Ether Ketone (PEEK)

-

Stainless Steel

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. sternal closure systems market size was estimated at USD 749.4 million in 2023 and is expected to reach USD 782.5 million in 2024.

b. The U.S. sternal closure systems market is expected to grow at a compound annual growth rate of 4.6% from 2024 to 2030 to reach USD 1.02 billion by 2030.

b. Based on type, the closure devices segment held the largest market share with 72.4% in 2023 owing its wide benefits and advantages as compared to bone cement.

b. Some key players operating in the U.S. sternal closure systems market include Depuy Synthes, Zimmer Biomet, KLS Martin Group, Orthofix Holdings, Inc., A&E Medical Corporation, Jace Medical, LLC, Acute Innovations, Abyrx, Inc., Kinamed Incorporated.

b. Key factors that are driving the U.S. sternal closure systems market growth include an increase in the number of surgical procedures and technological advancements in sternotomy techniques.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."