- Home

- »

- Medical Devices

- »

-

U.S. Sterilization Services Market Size, Industry Report, 2030GVR Report cover

![U.S. Sterilization Services Market Size, Share & Trends Report]()

U.S. Sterilization Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Contract Sterilization Services, Validation Sterilization Services), By Delivery Mode (Offsite, Onsite), And Segment Forecasts

- Report ID: GVR-2-68038-560-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Sterilization Services Market Trends

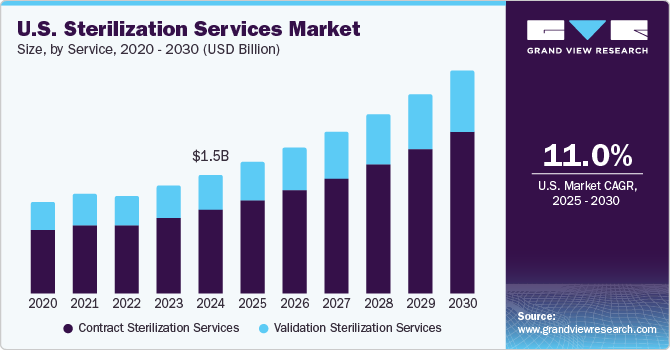

The U.S. sterilization services market size was estimated at USD 1.46 billion in 2024 and is expected to grow at a CAGR of 11.01% from 2025 to 2030. The rising surgical procedures, growing prevalence of hospital-acquired infections (HAIs), growing aging population, a rise in the incidence of chronic diseases, initiatives taken by government & regulatory bodies to ensure the adoption of essential sterilization standards in hospitals & research centers are driving market growth in the country, prompting healthcare facilities to adopt rigorous sterilization protocols to ensure patient safety and compliance with regulatory standards.

According to the Centers for Disease Control and Prevention (CDC), about 1 in 31 hospital patients in the U.S. has an HAI on any given day. Infections such as Clostridioides difficile (C. diff), methicillin-resistant Staphylococcus aureus (MRSA), and central line-associated bloodstream infections (CLABSIs) have led hospitals to adopt stricter sterilization protocols for surgical instruments, endoscopes, and reusable medical devices. The Centers for Disease Control and Prevention estimates that there are approximately 41,000 bloodstream infections each year in U.S. hospitals due to contaminated central lines. On 22 January 2024,an outbreak of three patients colonized with C. auris was reported at a long-term acute care hospital in King County. Subsequently, on January 26, 2024, a fourth patient colonized with C. auris was identified at a skilled nursing facility in Snohomish County. Additionally, one other patient with locally acquired C. auris colonization was reported in July 2023. Public Health is also aware of five other patients who developed C. auris colonization outside of Washington and have since received healthcare services within the state. Such incidents prompts the hospitals to overhaul its sterilization protocols and outsource services to ensure compliance with CDC guidelines in the U.S. As a result, the growing HAIs in the hospitals are driving the demand of sterilization services in the country.

Furthermore, as the number of surgeries continues to rise, healthcare facilities are under pressure to adopt stringent sterilization protocols to ensure patient safety and reduce the risk of infection. Some of the most common surgeries in the U.S. are cataract removal, join replacement, c-section, circumcision, broken bone repair, angioplasty and atherectomy, hysterectomy, and stent procedures. For instance, in the U.S., over 454,000 stent procedures are stent surgical procedures are performed. In addition, around 500,000 percutaneous coronary interventions are performed. Hence, the growing number of surgical procedures fuel the sterilization services market growth.

Regulatory agencies such as the FDA, the CDC, and the Environmental Protection Agency (EPA) implement strict sterilization and disinfection standards for medical devices, pharmaceuticals, and biologics. The Association for the Advancement of Medical Instrumentation (AAMI) has also set rigorous guidelines for healthcare providers to maintain sterility assurance levels. Non-compliance with these regulations can lead to severe penalties, product recalls, and reputational damage. In November 2024,The FDA issued a guidance "Transitional Enforcement Policy for Ethylene Oxide Sterilization Facility Changes for Class III Devices." This guidance establishes a transitional enforcement discretion policy for manufacturers of specific Class III devices in anticipation of changes in ethylene oxide (EtO) sterilization practices. It aims to prevent or mitigate potential disruptions or shortages in the medical device supply chain while sterilization facilities work to comply with new requirements set forth by the Environmental Protection Agency (EPA).

Technological advancements in sterilization techniques, such as ethylene oxide, steam sterilization, and hydrogen peroxide plasma, are also driving market growth. These innovations not only enhance the efficiency and effectiveness of the sterilization process but also expand its applications across various sectors, including pharmaceuticals and biotechnology.

In addition to these factors, outsourcing trends and technological advancements are also driving the growth of the market. Many healthcare facilities are opting to outsource sterilization services to specialized providers, allowing them to reduce costs and improve efficiency. Meanwhile, innovations in sterilization methods, such as ethylene oxide (EtO) and gamma radiation, are enhancing the effectiveness and efficiency of sterilization processes, attracting more users to the market.

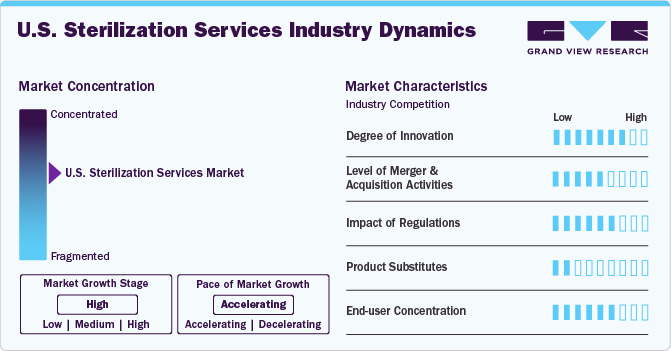

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The U.S. sterilization services industry is characterized by growth owing to the rising prevalence of HAIs and increasing investment in advanced sterilization equipment, such as ethylene oxide, gamma irradiation, and steam sterilization systems, to ensure efficient and effective sterilization processes.

Industry players and researchers are concentrating on integration of advanced sterilization technologies, such as low-temperature plasma and ultraviolet (UV) light sterilization. These methods not only ensure effective microbial elimination but also cater to a wider range of sensitive medical devices, expanding the scope of sterilization services.Moreover, there is a growing emphasis on sustainability in sterilization practices. Many providers are exploring eco-friendly sterilization methods and sustainable services to reduce environmental impact. For instance, Prince Sterilization Services offers environmentally friendly and sustainable sterilization services that primarily cater to the pharmaceutical, biotechnology, compounding pharmacy, and medical device industries.

Governed primarily by entities such as the Food and Drug Administration (FDA) and the Centers for Disease Control and Prevention (CDC), these regulations aim to ensure the safety and efficacy of sterilization processes to protect patient health. Regulations require sterilization facilities to adhere to stringent quality control measures, which minimizes the risk of cross-contamination and hospital-acquired infections (HAIs). Compliance with these standards drives companies to invest in advanced technologies and practices, fostering innovation within the industry.

The U.S. sterilization services industry has witnessed significant activity in mergers and acquisitions (M&A) over recent years, reflecting the industry's growth and transformation. The increasing emphasis on healthcare quality and patient safety has driven demand for advanced sterilization services, making this sector an attractive target for investors and larger healthcare companies. For instance, in April 2019, Fortive Corporation announced the successful completion of its acquisition of the Advanced Sterilization Products (ASP) business from Ethicon, Inc., a subsidiary of Johnson & Johnson, for an estimated USD 2.7 billion in cash.

The U.S. market for sterilization services is consolidated and dominated by large companies that offer sterilization services. Notable players in this market include STERIS, Andersen Sterilizers, and ASP (Fortive).

Service Insights

Contract services dominated the market and accounted for a share of 70.6% in 2024. Hospitals and manufacturers are leveraging contract sterilization services to optimize efficiency and ensure compliance with stringent standards. By outsourcing, they can alleviate equipment and staff maintenance burdens, while also gaining access to advanced technologies without significant capital expenditure. This approach enables healthcare providers to effectively meet their operational needs while reducing costs.Contract sterilization services typically offer operational cost savings for manufacturers by eliminating the need for them to invest in their own sterilization facilities and equipment. This allows companies to allocate resources more effectively and maintain focus on their core competencies. In addition, these services also provide flexibility in capacity that allows businesses to scale operations up or down based on demand without the financial burden of fixed investments in facilities.

Validation sterilization services are expected to grow significantly over the forecast period. The healthcare industry is driven by stringent regulations and a heightened emphasis on preventing hospital-acquired infections, necessitating the validation of sterilization processes to ensure the sterility of medical devices. As medical technology advances, the development of complex devices demands specialized sterilization techniques and validation procedures to guarantee their safety and efficacy.

Delivery Mode Insights

Offsite sterilization services accounted for the largest market revenue share of 68.2% in 2024, driven by cost analysis and the convenience of outsourcing. Providers employ skilled staff and adhere to high standards, ensuring compliance with state regulations. By minimizing costs and time, these services have created demand, making them an attractive option for hospitals seeking efficient and effective sterilization solutions.

Onsite sterilization services are projected to grow significantly at a CAGR of 8.9% over the forecast period. On-site sterilization enables facilities to rapidly process equipment, minimizing downtime and ensuring instruments are readily available for procedures. This is particularly crucial for emergency surgeries or situations where equipment is not readily accessible from the central sterile processing department. For hospitals with limited storage capacity, on-site sterilization is a practical solution, eliminating the need to store large quantities of sterilized equipment.

Key U.S. Sterilization Services Company Insights

STERIS, ASP (Fortive), Sterigenics U.S., LLC - A Sotera Health company, E-BEAM Services, Inc, and Andersen Sterilizers are some of the major players in the U.S. sterilization services industry. These companies are expanding their service portfolios in this sector and acquiring smaller firms to strengthen their competitive edge in the rapidly growing industry. Moreover, industry players are launching advanced products to meet the increasing demand.

Key U.S. Sterilization Services Companies:

- STERIS

- ASP (Fortive)

- Andersen Sterilizers

- Prince Sterilization Services, LLC

- Midwest Sterilization Corporation

- E-BEAM Services, Inc

- Sterigenics U.S., LLC - A Sotera Health company

- VPT Rad, Inc.

- Infinity Laboratories

Recent Developments

-

In November 2024, Vance Street Capital, a private equity firm based in Los Angeles, announced a partnership with the management team of Prince Sterilization Services to assist in the Company's ongoing expansion. This strategic alliance aims to bolster Prince Sterilization Services' growth within the pharmaceutical and medical device sterilization markets.

-

In August 2024, Advanced Sterilization Products (ASP), a Fortive division, received FDA clearance for the ULTRA GI Cycle, a hydrogen peroxide gas plasma sterilization method for duodenoscopes, aiming to enhance patient safety in healthcare settings.

-

In July 2024, STERIS announced the establishment of a new ethylene oxide (EO) processing facility in Singapore through a strategic collaboration with TOMOE SHOKAI CO., Ltd (“TOMOE”). This new EO facility will enhance the STERIS network, which already includes a comprehensive range of services such as electron beam, gamma, X-ray, and microbiological testing, available in locations like Kuala Ketil, Kulim, Port Klang, and Rawang in Malaysia; Chonburi in Thailand; and Suzhou in China.

-

In October 2023, Advanced Sterilization Products (ASP), a Fortive company, expanded its Sterilization Monitoring (SM) portfolio with new steam monitoring products. These additions enhance sterility assurance and improve efficiency, helping sterile processing departments achieve greater confidence in sterilization results.

-

In October 2023, E-BEAM Services, Inc. completed a significant facility expansion in Lebanon, Ohio, adding 52,000 square feet of cutting-edge technology to support the company's continued growth and increased demand for sterilization and crosslinking services.

U.S. Sterilization Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.61 billion

Revenue forecast in 2030

USD 2.71 billion

Growth rate

CAGR of 11.01% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, delivery mode

Country scope

U.S.

Key companies profiled

STERIS; ASP (Fortive), Andersen Sterilizers; Prince Sterilization Services, LLC; Midwest Sterilization Corporation; E-BEAM Services, Inc; Sterigenics U.S., LLC - A Sotera Health company; VPT Rad, Inc.;Infinity Laboratories

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Sterilization Services Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. sterilization services market report based on service, and delivery mode:

-

Service Outlook (Revenue, USD Million; 2018 - 2030)

-

Contract Sterilization Services

-

Validation Sterilization Services

-

-

Delivery Mode Outlook (Revenue, USD Million; 2018 - 2030)

-

Offsite

-

Onsite

-

Frequently Asked Questions About This Report

b. The U.S. sterilization services market was estimated at USD 1.46 billion in 2024 and is expected to reach USD 1.61 billion in 2025.

b. The U.S. sterilization services market is expected to grow at a compound annual growth rate of 11.01% from 2025 to 2030 to reach USD 2.71 billion by 2030.

b. Contract sterilization services segment dominated the U.S. sterilization services market with a share of 70.6% in 2024. Contract sterilization services typically offer operational cost savings for manufacturers by eliminating the need for them to invest in their own sterilization facilities and equipment. This allows companies to allocate resources more effectively and maintain focus on their core competencies. In addition, contract sterilization services also provide flexibility in capacity that allows businesses to scale operations up or down based on demand without the financial burden of fixed investments in facilities.

b. Some key players operating in the U.S. sterilization services market include STERIS, ASP (Fortive), Andersen Sterilizers, Prince Sterilization Services, LLC, Midwest Sterilization Corporation, E-BEAM Services, Inc, Sterigenics U.S., LLC – A Sotera Health company, VPT Rad, Inc.,and Infinity Laboratories.

b. Key factors that are driving the market growth include an increasing number of surgical procedures, rising prevalence of HAIs, growing aging population, a rise in the incidence of chronic diseases, initiatives taken by government & regulatory bodies to ensure the adoption of essential sterilization standards in hospitals & research centers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.