U.S. Sperm Bank Market Size, Share & Trends Analysis Report By Donor Type (Known Donor, Anonymous Donor), By Service (Hospital Sperm Storage, Semen Analysis), By Fertilization Technique (Donor Insemination, In Vitro Fertilization), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-297-8

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Sperm Bank Market Size & Trends

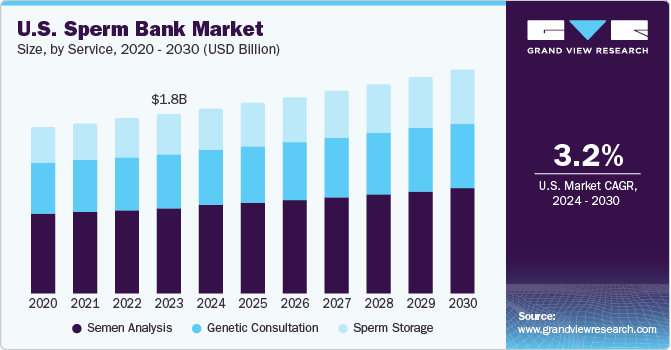

The U.S. sperm bank market size was estimated at USD 1.80 billion in 2023 and is projected to grow at a CAGR of 3.2% from 2024 to 2030. Innovations in cryopreservation techniques, the emergence of fertility tourism, increasing access to infertility treatment, and heightened risk of miscarriages are the key factors driving the market growth. According to March of Dimes, approximately 20 in 100 pregnancies end in miscarriage and following three consecutive miscarriages, the likelihood of experiencing another miscarriage increases to approximately 43%.

The demand for sperm bank services is projected to grow, as concerns about male infertility linked to abnormal and insufficient sperm volume, as well as ejaculatory issues, become more widespread. According to the American Association of Pregnancy, male infertility contributes around 50% of the overall infertility cases. Various factors, including illicit drug use, smoking, exposure to excessive alcohol consumption, hazardous substances, and genetic factors, can lead to male infertility. Consequently, the prevalence of both female and male infertility is on the rise, driving the need for infertility treatments such as donor insemination and IVF procedures. This increasing demand for infertility treatments is fueling the growth of the sperm bank market in the country.

A rise in funding and supportive government initiatives across various states in the U.S. is anticipated to boost the adoption of fertility treatments, thereby driving the demand for sperm banks. The U.S. government bodies and initiatives, including the Affordable Care Act (ACA), Health Resources and Services Administration (HRSA), and the Office on Women's Health (OWH), a part of the U.S. Department of Health and Human Services, are making efforts to improve maternal and child health including issues with miscarriage.

In response to the COVID-19 pandemic, scientific and professional fertility societies, such as the American Society of Reproductive Medicine (ASRM), issued guidelines for intended couples undergoing or expected to undergo treatments such as IVF. All guidelines issued by the society recommended the suspension of new fertility treatments, including intrauterine insemination, ovulation, and non-urgent gamete cryopreservation.

Market Concentration & Characteristics

The market growth stage is low, and the pace of growth is accelerating. The U.S. sperm bank market is characterized by a moderate degree of innovation owing to the advancements in cryopreservation techniques driven by factors such as desire and prospect to preserve fertility and social changes. For instance, in November 2023, Give Legacy, Inc., an at-home fertility clinic catering to individuals with sperm, announced an accomplishment: cryogenically preserving more than one trillion sperm. Addressing rising demand, the company inaugurated a new laboratory, solidifying its commitment to meeting growing needs.

The U.S. market for sperm banks is regulated by a combination of federal and state laws, guidelines, and industry standards for ensuring the safety and effectiveness of human cells, tissues, and cellular and tissue-based products, including sperm and monitor and reports on sperm bank practices and outcomes through the Assisted Reproductive Technology (ART) Program. The primary regulatory bodies include the Food and Drug Administration (FDA), the Centers for Disease Control and Prevention (CDC), and the American Association of Tissue Banks (AATB).

According to the American Society for Reproductive Medicine, FDA regulations for sperm donation stipulate requirements for both anonymous and known donors, including physical exams, questionnaires, medical history, and infectious disease testing. Anonymous donors must undergo a 6-month quarantine, while directed donors require over 35 days of quarantine with repeat testing. ASRM recommends psychoeducational and genetic screening for all donors and testing for recipients and their partners. Legal consultation is recommended due to potential state law variations.

The market growth is driven by a rise in awareness in the U.S. population. The rise in demand for U.S. sperm banks is also attributed to the growing need for infertility treatments for both males and females. These treatments, offered by sperm banks and IVF centers, yield favorable results, contributing to the increasing popularity of these services. For instance, as of March 2024, around 20 out of 50 states of U.S. have sperm banks.

Donor Type Insights

The known donor segment dominated the market with a share of 57.9% and is expected to grow at the fastest CAGR of 3.86% over the forecast period. A key factor driving growth in this segment is the choice of a close relative, such as a friend, family member, or even an acquaintance as a donor. The sperm bank facilitates the process, ensuring that all necessary medical tests and screening procedures are followed. This type of donation allows for a more personal connection between the donor and the recipient, but it also raises concerns about potential emotional and social complications in the future.

The anonymous donor segment is anticipated to register substantial growth from 2024 to 2030. This is due to maintaining privacy and avoiding potential complications in the future. Historically, most sperm donors in the U.S. have been anonymous, and the recipients have no access to identifying information about the donor. However, with the rise of openness and transparency in sperm bank practices, the demand for anonymous donors has decreased.

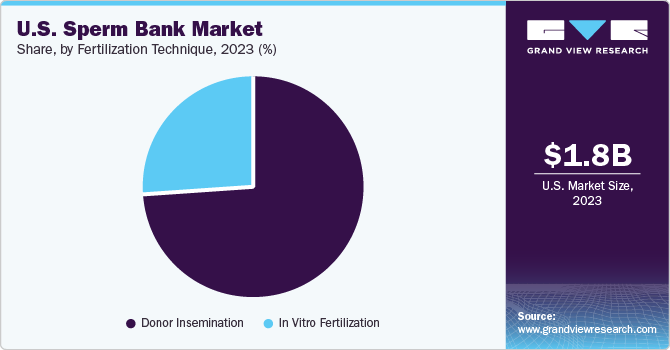

Fertilization Technique Insights

The donor insemination segment held the largest revenue share in 2023 owing to the technique's benefits and ease of use. Donor insemination, characterized by its relatively low cost and straightforward procedure, has garnered a substantial clientele, significantly contributing to the market's growth. It is often advised that individuals attempt at least three cycles of artificial insemination before considering more expensive In Vitro Fertilization (IVF) treatments. This recommendation highlights the cost-effective nature of donor insemination and its role in addressing infertility concerns for a broader range of patients.

The in vitro fertilization segment is projected to register the fastest CAGR during the forecast period. Growing awareness regarding the benefits of IVF procedures over insemination procedures is one of the crucial factors boosting the sperm bank market. The high cost of the procedure is also one of the key factors driving growth.

Service Insights

The semen analysis segment dominated the market with a share in 2023. Key factors driving this segment growth include advancements in semen analysis techniques, growing demand for assisted reproductive technologies, and increasing infertility rates. For instance, the Sperm Bank of California (TSBC) evaluates fertility using standards defined by the World Health Organization (WHO). Extensive semen analysis is necessary before any ART procedure, and basic screening is essential to keep sperm safe. The demand for sperm analysis is therefore the highest among all services.

The sperm storage segment is anticipated to register the fastest growth rate from 2024 to 2030. This is due to preservation for medical reasons and advancements in cryopreservation technique. Individuals are able to choose to store their sperm due to medical reasons, such as undergoing cancer treatment that could affect their fertility. In such cases, sperm storage serves to preserve their fertility and potential for biological parenthood.

Key U.S. Sperm Bank Company Insights

Some of the key companies operating in the U.S. sperm bank market include California Cryobank, Fairfax Cryobank, and The Sperm Bank of California.

-

California Cryobank is one of the largest and most established sperm banks in the U.S., offering a diverse range of donors and services.

-

Fairfax Cryobank is a leading sperm bank with a wide selection of donors and a focus on providing comprehensive donor information to help clients make informed choices.

Xytex Cryobank, Seattle Sperm Bank, and Cryos International Sperm Bank are some of the emerging market participants.

Key U.S. Sperm Bank Companies:

- California Cryobank

- Fairfax Cryobank

- The Sperm Bank of California

- Xytex Cryobank

- Seattle Sperm Bank

- Cryos International Sperm Bank

- Reproductive Biology Institute

- Midwest Sperm Bank

- Cryo-Cell International

- Northwest Sperm Bank

Recent Developments

-

In January 2024, Xytex, plans to debut FAMLINK BETA. This exclusive, by-invitation-only program is designed to cater to Xytex's valued clients who have successfully welcomed a child using a Xytex donor.

-

In August 2018, GI Partners successfully concluded the acquisition and merger of California Cryobank and Cord Blood Registry (CBR), resulting in the formation of the foremost organization in the stem cell storage and reproductive tissue services sectors.

U.S. Sperm Bank Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 2.25 billion |

|

Growth rate |

CAGR of 3.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Donor type, service, fertilization technique |

|

Country scope |

U.S. |

|

Key companies profiled |

California Cryobank; Fairfax Cryobank; The Sperm Bank of California; Xytex Cryobank; Seattle Sperm Bank; Cryos International Sperm Bank; Reproductive Biology Institute; Midwest Sperm Bank; Cryo-Cell International; Northwest Sperm Bank |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Sperm Bank Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. sperm bank market report based on donor type, service, and fertilization technique:

-

Donor Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Known Donor

-

Anonymous Donor

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sperm Storage

-

Semen Analysis

-

Genetic Consultation

-

-

Fertilization Technique Outlook (Revenue, USD Billion, 2018 - 2030)

-

Donor Insemination

-

In Vitro Fertilization

-

Frequently Asked Questions About This Report

b. The U.S. sperm bank market size was valued at USD 1.80 billion in 2023.

b. The U.S. sperm bank market is projected to grow at a compound annual growth rate (CAGR) of 3.2% from 2024 to 2030 to reach USD 2.25 billion by 2030.

b. The known donor segment dominated the market with a share of 57.9% and is expected to grow at the fastest CAGR of 3.86% over the forecast period. Key factors driving this segment growth include selecting a donor of choice, specifically a close relative, such as a friend, family member, or even an acquaintance.

b. Some of the key companies operating in the U.S. Sperm Bank Market include California Cryobank, Fairfax Cryobank, and The Sperm Bank of California.

b. Innovations in cryopreservation techniques, the emergence of fertility tourism, increasing access to infertility treatment, and an increase in the risk of miscarriages are the key factors driving the growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."