- Home

- »

- Medical Devices

- »

-

U.S. Specialty Medical Chairs Market, Industry Report, 2030GVR Report cover

![U.S. Specialty Medical Chairs Market Size, Share & Trends Report]()

U.S. Specialty Medical Chairs Market Size, Share & Trends Analysis Report By Product (Examination Chairs, Birthing Chairs, Blood Drawing Chairs, Rehabilitation Chairs, Treatment Chairs), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-271-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Specialty Medical Chairs Market Trends

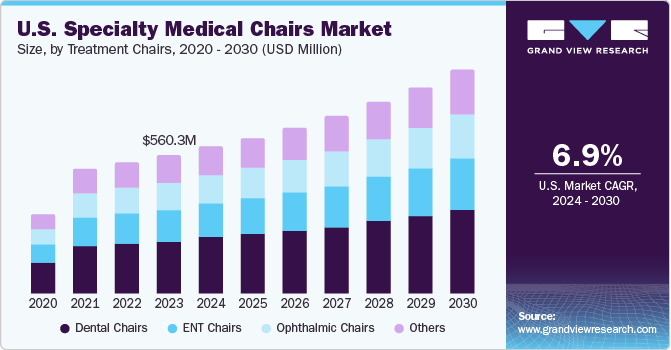

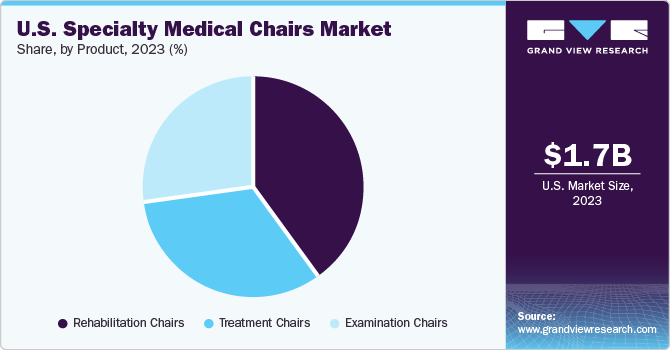

The U.S. specialty medical chairs market size was estimated at USD 1.70 billion in 2023 and is projected to grow at a CAGR of 6.9% from 2024 to 2030. To cater to the needs of the increasing elderly population, there is a higher demand for medical equipment and devices such as specialty medical chairs. Improvements in technology lead to the development of more advanced and comfortable medical chairs, catering to specific medical needs, and enhancing the overall patient experience. With an increasing number of people suffering from chronic conditions such as obesity, and neurological and orthopedic disorders, the demand for specialized medical chairs to support their needs has increased.

With an aging population and increasing sedentary lifestyle, the prevalence of orthopedic disorders such as osteoporosis, arthritis, and musculoskeletal injuries is on the rise. In recent years, there has been a growing trend towards minimally invasive orthopedic treatments, which often involve the use of orthopedic devices. This shift has led to an increased demand for devices such as orthopedic braces, implants, and prosthetics such as wheelchairs. This increasing incidence of orthopedic conditions creates a higher demand for orthopedic devices to manage pain, improve mobility, and support recovery. Many governments and insurance providers recognize the importance of medical chairs for the elderly and are implementing initiatives to make these products more accessible and affordable.

With the increasing population of elderly people, there is a surge in the demand for healthcare services and infrastructure to address the unique & evolving healthcare needs of the elderly. According to the WHO data, in 2022, one out of every six people worldwide will be 60 years or older by the year 2030. Moreover, the number of Americans aged 65 and older is projected to increase from 58 million in 2022 to 82 million by 2050. This, in turn, is estimated to propel the demand for specialty medical chairs over the forecast period.

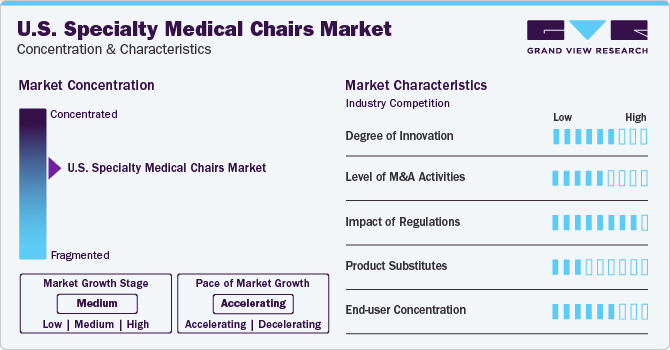

Market Concentration & Characteristics

The market is characterized by a moderate degree of innovation owing to the improving ergonomics driven by factors such as advancements in healthcare, the increasing aging population, and the growing need for these specialty chairs for the population suffering from orthopedic disorders are expected the boost the market growth.

The market is characterized by a high level of merger and acquisition (M&A) activity by the leading players. Government policies such as favorable reimbursement policies, are expected to boost the market for specialty medical chairs.

There are a limited number of direct product substitutes for the specialty medical chairs. However, there are a few technologies that can be used to achieve similar outcomes such as automation, advanced materials, and expert systems. Motorized seat elevation and reclining systems can be added to standard chairs to provide adjustable support for various medical conditions. These systems can help improve circulation, alleviate pain, and promote overall comfort. Moreover, vibration, massage therapy technologies and heating and cooling technologies can be integrated into chairs to provide therapeutic benefits for individuals with muscle pain, stiffness, or spasms.

End-user concentration is a significant factor in specialty medical chairs market since several end-user industries drive demand for these devices to provide adequate support, comfort, and pain relief. The market is characterized by the increase in the number of people with back issues, such as scoliosis or spinal stenosis, who may need specialized chairs to maintain proper posture and alleviate pain.

Product Insights

Rehabilitation chairs dominated the market and accounted for a share of 40.1% in 2023. These chairs are designed to be customizable and adaptable to meet the specific needs of individual users. They are engineered to provide optimal comfort and support to users during their recovery process. They often include features such as adjustable backrests, headrests, and footrests, which can help alleviate pain and discomfort while promoting proper posture and alignment. They can be adjusted for various parameters such as height, angle, and support, allowing them to cater to a wide range of users with different medical requirements.

Rehabilitation chairs offer numerous medical benefits, including improved circulation, reduced muscle tension, and better respiratory function. For instance, in May 2022, Sunrise Medical launched new power wheelchairs with rehab style seating systems which alleviates weight capacity concerns and with the provision of a relaxed sitting position. Moreover, they can help prevent complications such as pressure ulcers and contractures, which are common among individuals with limited mobility. Compared to other medical equipment, rehabilitation chairs can be a cost-effective solution for users who require long-term support during their recovery process.

Treatment chairs are expected to register the fastest CAGR during the forecast period. These chairs are a necessary part of any procedure such as surgery. The major advantage imparted by these chairs is that they help patients accomplish a comfortable posture while sitting that provides the doctors with unlimited access to numerous parts of a patient’s body. This equipment helps increase safety for both patients & healthcare practitioners and improves patient relaxation. Hence, the increase in advantages of treatment chairs is anticipated to boost market growth.

Key U.S. Specialty Medical Chairs Company Insights

Some of the key companies operating in the U.S. specialty medical chairs market include Dentsply Sirona; Fresenius Medical Care AG & Co. KGaA, Planmeca Oy, Inc.; and Danaher.

-

Dentsply Sirona, a global manufacturer of dental and medical equipment, offers a range of specialty medical chairs under various brand names such as Belmont, SiroChair, Prophix, Inteus.

-

Danaher is a global science and technology innovator that operates through various platforms, including its Danaher Business Systems (DBS) and Danaher Product Platforms (DPP).

A-dec Inc, Winco Mfg. LLC, Medcor are some of the other market participants in the U.S. specialty medical chairs market.

Key U.S. Specialty Medical Chairs Companies:

- A-dec, Inc.

- ActiveAid, Inc.

- DentalEZ, Inc.

- Fresenius Medical Care AG & Co. KGaA

- Topcon Corp.

- Midmark Corp.

- Danaher (KaVo Dental GmbH)

- Dentsply Sirona

- Planmeca Oy

- Hill Laboratories Company

Recent Developments

-

In August 2023, Nakanishi Inc. acquired DCI International, LLC, the U.S. fastest-growing dental equipment manufacturer. This was done in the aim to expand and serve the customers better in the U.S. market.

-

In April 2023, Stryker launched the Xpedition powered stair chair. This launch increased comfort and security for both the patient and the first responder team.

-

In August 2022, Sunrise Medical launched RGK wheelchairs in North America. This launch was a made to order manual chair that combined design with advanced materials.

U.S. Specialty Medical Chairs Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.80 billion

Revenue forecast in 2030

USD 2.68 billion

Growth rate

CAGR of 6.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product

Country scope

U.S.

Key companies profiled

A-dec, Inc.; ActiveAid, Inc.; DentalEZ, Inc.; Fresenius Medical Care AG & Co. KGaA; Topcon Corp.; Midmark Corp.; Danaher (KaVo Dental GmbH); Dentsply Sirona; Planmeca Oy; Hill Laboratories Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Specialty Medical Chairs Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. specialty medical chairs market report based on product:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Examination Chairs

-

Birthing Chairs

-

Cardiac Chairs

-

Blood Drawing Chairs

-

Dialysis Chairs

-

Mammography Chairs

-

-

Rehabilitation Chairs

-

Pediatric Chairs

-

Bariatric Chairs

-

Geriatric Chairs

-

Others

-

-

Treatment Chairs

-

Ophthalmic Chairs

-

ENT Chairs

-

Dental Chairs

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. specialty medical chairs market size was valued at USD 1.70 billion in 2023 and is expected to reach USD 1.80 billion in 2024.

b. The U.S. specialty medical chairs market is projected to grow at a compound annual growth rate (CAGR) of 6.9% from 2024 to 2030 to reach USD 2.68 billion in 2024.

b. The rehabilitation chairs dominated the market and accounted for a share of 40.1% in 2023. These chairs are designed to be customizable and adaptable to meet the specific needs of individual users. They are engineered to provide optimal comfort and support to users during their recovery process.

b. Some of the key companies operating in the U.S. specialty medical chairs market include Dentsply Sirona; Fresenius Medical Care AG & Co. KGaA, Planmeca Oy, Inc.; and Danaher.

b. Improvements in technology lead to the development of more advanced and comfortable medical chairs, catering to specific medical needs, and enhancing the overall patient experience. With an increasing number of people suffering from chronic conditions such as obesity, neurological and orthopedic disorders, the demand for specialized medical chairs to support their needs has increased.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."