- Home

- »

- Consumer F&B

- »

-

U.S. Specialty Coffee Market Size, Industry Report, 2030GVR Report cover

![U.S. Specialty Coffee Market Size, Share & Trends Report]()

U.S. Specialty Coffee Market (2025 - 2030) Size, Share & Trends Analysis Report By Age Group (18-24 Years, 25-39 Years, 40-59 Years, Above 60), By Distribution Channel (Retail, Away From Home), And Segment Forecasts

- Report ID: GVR-4-68040-485-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Specialty Coffee Market Size & Trends

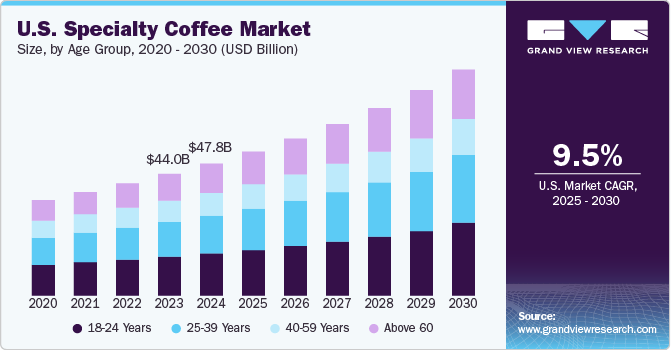

The U.S. specialty coffee market size was estimated at USD 47.8 billion in 2024 and is projected to grow at a CAGR of 9.5% from 2025 to 2030. The market growth can be attributed to evolving consumer preferences and an increasing appreciation for high-quality coffee. One of the key trends driving this market is the rising demand for artisanal and premium coffee products. As consumers become more sensitive in their coffee choices, they are gravitating towards specialty coffee that offers unique flavors, sourcing transparency, and sustainable production practices. This trend is often linked to the broader shifts in consumer habits favoring quality over quantity, allowing businesses that focus on specialty coffee to thrive in an increasingly competitive landscape.

The COVID-19 pandemic has catalyzed changes in consumer behavior that continue to impact the specialty coffee market. As coffee enthusiasts shifted to remote work and online shopping during lockdowns, there was a marked increase in home brewing equipment sales and coffee subscriptions across the U.S. This trend highlights a growing preference for convenience and personalization as consumers look for ways to replicate café experiences in their own homes.

The convenience factor also plays a significant role in the market growth. Consumers are demanding more flexible and convenient options for enjoying their non-alcoholic beverages, leading to a rise in ready-to-drink (RTD) cold brew and nitro coffee options. Furthermore, the increasing popularity of subscription services and online ordering platforms has streamlined the process of procuring specialty coffee, making it easily accessible to a wider audience. This convenience factor, coupled with the desire for high-quality coffee at home, has fueled the growth of at-home brewing equipment and specialty coffee subscriptions.

Consumers are increasingly aware of the ingredients in their food and beverages, leading to a preference for natural, organic, and low-sugar coffee options. Specialty coffee shops often cater to these preferences by offering dairy-free alternatives and sugar-free syrups and highlighting the natural antioxidants and health benefits of coffee. This trend towards conscious consumption aligns well with the specialty coffee demand, reinforcing its position as a healthier choice compared to mass-market options.

Specialty coffee shops are evolving beyond simple cafes into social hubs, offering a unique atmosphere and a platform for community connection. The rise of coffee-centric events, workshops, and educational experiences further engages consumers with the non-alcoholic beverages industry, fostering a deeper appreciation for the craft and artistry involved. This emphasis on the experience and fostering a sense of community around non-alcoholic beverages contributes to the growing demand for higher-quality, expertly crafted coffee within the U.S. market.

Technological advancements play a crucial role in shaping the trends within the U.S. market. The adoption of smart coffee machines, automated brewing systems, and innovative roasting techniques allows for greater control and precision in the coffee-making process, consistently delivering high-quality brews. Furthermore, the integration of mobile apps and digital platforms has simplified the ordering and purchasing experience for consumers, enabling seamless transactions and personalized recommendations. These technologies have not only streamlined operations for café and roasters but have also significantly enhanced the consumer experience, making specialty coffee more accessible and convenient.

Age Group Insights

Based on age group, the 18-24 years segment led the market with the largest revenue share of 31.9% in 2024. This demographic, often characterized by a strong social media presence and a desire for unique experiences, is drawn to the aesthetic appeal of specialty coffee shops. Moreover, the affordability and accessibility of specialty coffee options, such as cold brew and ready-to-drink variations, also contribute to the growing demand within this age group. In addition, the emphasis on sustainability and environmental consciousness among younger consumers drives them towards brands and roasters with transparent practices and eco-friendly initiatives.

The 25-39 years segment is expected to grow at the fastest CAGR of 10.3% from 2025 to 2030, fueled by a combination of established routines and evolving appetites. This demographic utilizes specialty coffee as a means of enhancing productivity and incorporating a sense of indulgence into their daily routines. The convenience and accessibility of specialty coffee options, including subscription services and online ordering, contribute to its growing appeal within this busy lifestyle. Furthermore, this age group places increasing emphasis on the quality and health benefits associated with specialty coffee, recognizing the potential for antioxidants and improved focus. They are increasingly drawn to the unique flavor profiles and regional origins offered by specialty coffee roasters.

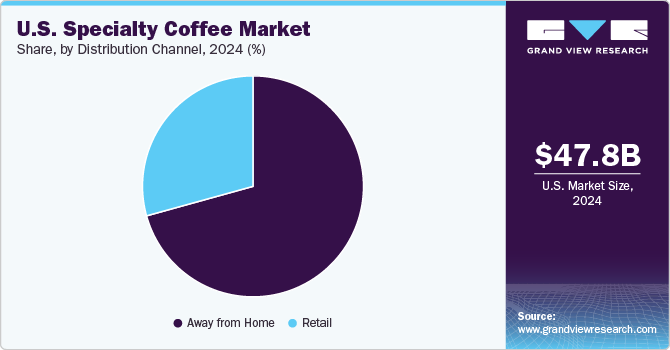

Distribution Channel Insights

Based on distribution channel, the away-from-home segment led the market with the largest revenue share of 70.7% in 2024,driven by the growing popularity of non-alcoholic beverages as a social beverage and the increasing demand for premium coffee experiences. Consumers are increasingly seeking out unique coffee offerings, including cold brew, nitro coffee, and innovative flavor combinations. Moreover, the desire for convenient and readily accessible specialty coffee options in diverse settings, from traditional coffee shops to quick-service restaurants and even workplaces, contributes significantly to the segment's growth. Besides, the focus on creating a unique and engaging atmosphere within cafes, offering Wi-Fi, comfortable seating, and engaging events, also enhances consumer appeal and drives repeat visits.

The retail segment is expected to grow at the fastest CAGR of 9.7% from 2025 to 2030, fueled by the increasing convenience and accessibility of high-quality coffee options. Consumers are increasingly seeking out premium coffee products for at-home consumption, driven by a growing appreciation for specialty coffee and a desire to recreate café-quality experiences at their convenience. This trend is supported by the expansion of grocery store coffee products, with a wider variety of single-origin beans, gourmet blends, and innovative brewing formats like ready-to-drink cold brews and coffee pods. Moreover, the growth of e-commerce and online platforms is significantly impacting the retail landscape for specialty coffee. Consumers are increasingly buying coffee beans, brewing equipment, and single-serve pods online, driven by convenience, wider product selection, and the availability of specialized information and reviews.

Regional Insights

The West region dominated the U.S. specialty coffee market with the largest revenue share of 25.8% in 2024, influenced majorly by a culture that embraces artisanal craftsmanship and innovation. Cities such as Seattle, Portland, and San Francisco are at the forefront of the specialty coffee movement, often leading the way in terms of new brewing methods, single-origin beans, and sustainability practices. This region is characterized by a strong emphasis on quality, with consumers showing a preference for ethically sourced coffee and a willingness to pay a premium for unique flavor profiles. In addition to traditional coffee shops, a growing number of roasters and micro-roasters are emerging, with many focusing on direct trade relationships with farmers to ensure high-quality production and sustainable practices.

The Southeast U.S. specialty coffee market is expected to grow at the fastest CAGR of 10.3% from 2025 to 2030, driven largely by an evolving café culture and a burgeoning appreciation for high-quality brews. Cities like Atlanta, Charleston, and Nashville are witnessing a proliferation of specialty coffee shops that emphasize community engagement alongside their offerings. Local cafés often serve as social hubs, where consumers value experiences that go beyond just coffee, including live music and community events. The Southeast market exhibits a strong trend towards blended drinks, with seasonal flavors and unique presentations capturing the attention of consumers, particularly younger demographics.

Key Companies & Market Share Insights

The market has seen significant growth over recent years, propelled by a blend of innovation and competitive strategies among key players. Major companies such as Starbucks, Newberry Coffee Roaster, Peet’s Coffee Inc., The J.M. Smucker Company, Inspire Brands, and Keurig Green Mountain Inc. dominate the landscape, yet a plethora of smaller boutique brands have carved out their niche by focusing on artisanal quality and unique flavor profiles. Starbucks, for instance, has consistently pushed the envelope with new product launches that cater to evolving consumer preferences, including plant-based options and seasonal beverages. In addition to product innovation, Starbucks has heavily invested in R&D to enhance sustainability in sourcing beans and improving brewing methods.

Mergers and acquisitions have further reshaped the competitive landscape of the specialty coffee sector, with companies seeking to expand their footprint and diversify their offerings. The acquisition of smaller brands by larger corporations not only broadens the product line but also allows for the sharing of resources and expertise in areas such as supply chain management and sustainability practices. Moreover, companies are continually exploring expansion opportunities into untapped markets, both domestically and internationally, driven by the growing demand for premium coffee experiences. This dynamic environment signifies that the market remains ripe for innovation and growth as companies seek to capture and maintain consumer interest in a competitive arena.

Key U.S. Specialty Coffee Companies:

- Starbucks Coffee Company

- The J.M. Smucker Company

- Inspire Brands

- Keurig Green Mountain Inc.

- Eight O’Clock Coffee Company

- F. Gaviña & Sons, Inc.

- Intelligentsia

- Sextant Coffee Roasters

- Newberry Coffee Roaster

- Peet’s Coffee Inc.

Recent Developments

-

In December 2023, WithMe, Inc. partnered with Atomic Coffee Roasters to introduce the SipWithMe Bean-to-Cup coffee amenity in multifamily properties across Boston. This collaboration aims to drive demand for specialty coffee in the U.S. by offering premium, convenient coffee solutions directly within residential communities. The partnership leverages Atomic Coffee's expertise and WithMe's technology to enhance the resident experience and capitalize on the growing preference for high-quality, on-demand coffee.

-

In March 2021, JDE Peet’s and J.M. Smucker entered into a strategic partnership to strengthen their positions in the coffee industry. This collaboration aims to leverage JDE Peet’s global expertise in coffee with J.M. Smucker’s strong U.S. distribution network, enhancing market reach and operational efficiencies. The partnership is set to drive innovation, expand product offerings, and capitalize on growing consumer demand for high-quality coffee products

U.S. Specialty Coffee Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 52.1 billion

Revenue forecast in 2030

USD 81.8 billion

Growth rate

CAGR of 9.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion,and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Age group, distribution channel

Regional scope

Northeast; Southwest; West; Southeast; and Midwest

Key companies profiled

Starbucks Coffee Company: F. Gaviña & Sons, Inc.; Intelligentsia; Sextant Coffee Roasters; Newberry Coffee Roaster; Eight O’Clock Coffee Company; Keurig Green Mountain Inc.; Peet’s Coffee Inc.; The J.M. Smucker Company; Inspire Brands

Customization scope

Free Report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

U.S. Specialty Coffee Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. specialty coffee market report based on age group, distribution channel, and region:

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

18-24 Years

-

25-39 Years

-

40-59 Years

-

Above 60

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

Coffee Shops and Cafes

-

Hotels and Restaurants

-

Others

-

-

Away from Home

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Northeast

-

Southwest

-

West

-

Southeast

-

Midwest

-

Frequently Asked Questions About This Report

b. The U.S. specialty coffee market size was estimated at USD 47.8 billion in 2024 and is expected to reach USD 52.1 billion in 2025.

b. The U.S. specialty coffee market is expected to grow at a compound annual growth rate of 9.5% from 2025 to 2030, reaching USD 81.8 billion by 2030.

b. The West U.S. specialty coffee market captured a revenue share of over 25.8%, influenced majorly by a culture that embraces artisanal craftsmanship and innovation. Cities such as Seattle, Portland, and San Francisco are at the forefront of the specialty coffee movement, often leading the way in terms of new brewing methods, single-origin beans, and sustainability practices.

b. Some key players operating in the U.S. specialty coffee market include Starbucks Coffee Company, The J.M. Smucker Company, Inspire Brands, Keurig Green Mountain Inc., Eight O’Clock Coffee Company, F. Gaviña & Sons, Inc., Intelligentsia, Sextant Coffee Roasters, Newberry Coffee Roaster, and Peet’s Coffee Inc.

b. Key factors driving the market growth include the increasing popularity of subscription services and online ordering platforms, which have streamlined the process of procuring specialty coffee and made it easily accessible to a wider audience.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.