U.S. Spatial Genomics & Transcriptomics Market Size, Share & Trends Analysis Report By Technology (Spatial Transcriptomics, Spatial Genomics), By Product (Consumables, Software), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-288-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

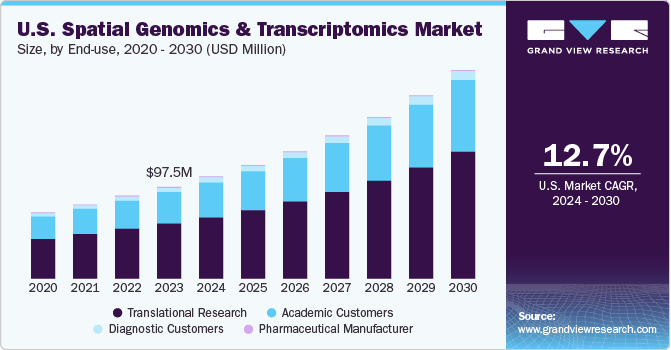

The U.S. spatial genomics & transcriptomics market size was valued at USD 97.5 million in 2023 and is projected to grow at a CAGR of 12.7% from 2024 to 2030. Market growth is driven by the increasing recognition of its potential as a cancer diagnostic tool and development of in situ sequencing technologies. Moreover, rapid advancements in genomics, spanning from human sequencing to tissue sequencing and single-cell sequencing, have led to the emergence of spatial genomic sequencing. These other factors are expected to boost market growth.

The U.S. spatial genomics & transcriptomics market accounted for a 38% share of the global spatial genomics & transcriptomics market in 2023. The market expansion is influenced by various key drivers, including the growing demand for personalized medicine, discovery of new biomarkers for diagnosis, and increased investments in research and development. The rise in chronic diseases, particularly cancer, leads to higher diagnosis rates and a greater need for advanced diagnostics. For instance, in 2022, the U.S. recorded 1,918,030 new cancer cases and 609,360 cancer-related deaths. Additionally, the increasing number of product launches and investments in innovative spatial genomics and transcriptomics technologies contribute to market growth.

Spatial genomics and transcriptomics include methods for analyzing DNA and RNA content and their spatial positioning. Microscopy techniques play a significant role in the spatial genomics market, including Fluorescence In Situ Hybridization (FISH), live DNA imaging, and chromosome conformation capture methods. Microscopy techniques are favored over sequencing methods in spatial genomics due to their effectiveness in visualizing spatial organization. While sequencing methods are primarily used for RNA studies, advancements in sequencing technologies are anticipated to drive growth in sequencing applications within spatial genomics. Such trends further propel market growth.

Market Concentration & Characteristics

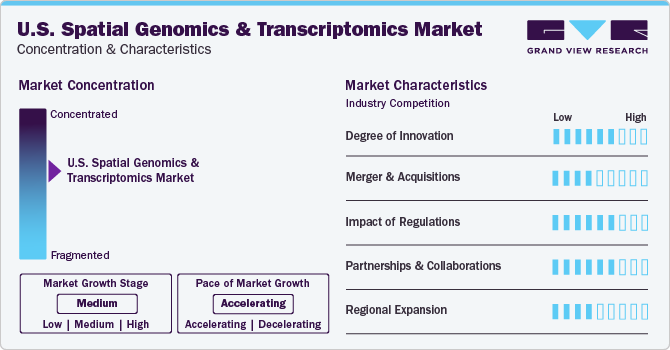

The U.S. spatial genomics and transcriptomics industry is moderately competitive due to factors such as the introduction of new products and slow adoption of technologies. Companies are striving to maintain a competitive edge by introducing innovative solutions. The increasing significance of genome mapping studies in biomedical research has led to competition among entities.

Introduction of innovative products in U.S. spatial genomics & transcriptomics enables companies to attract customers, increase revenue, and improve patient outcomes significantly. By developing advanced instruments, bioinformatics, and imaging tools, companies can set themselves apart in the industry, address changing patient requirements, and play a pivotal role in advancing personalized medicine.

The spatial genomics and transcriptomics market has witnessed significant activity in terms of mergers and acquisitions (M&A), with notable transactions impacting the industry landscape. This move enhances their capabilities, broadens product portfolios, and strategically improves their competencies. This industry is evolving rapidly, with a focus on integrating spatial transcriptomics with spatial epigenomics and exploring new technologies to advance research and diagnostics, indicating a dynamic and competitive environment.

Collaboration and partnerships play a pivotal role in the U.S. spatial genomics and transcriptomics industry, fostering innovation, driving research advancements, and enhancing the development of cutting-edge technologies. These collaborations often involve key companies in the field, including academic institutions, research centers, biotech companies, and pharmaceutical firms.

These key strategies are employed by companies to enhance their market presence and cater to evolving demands. Companies are focusing on expanding their product portfolios to meet the increasing demand for spatial genomics and transcriptomics applications in translational research, drug discovery, and diagnostics.

Product Insights

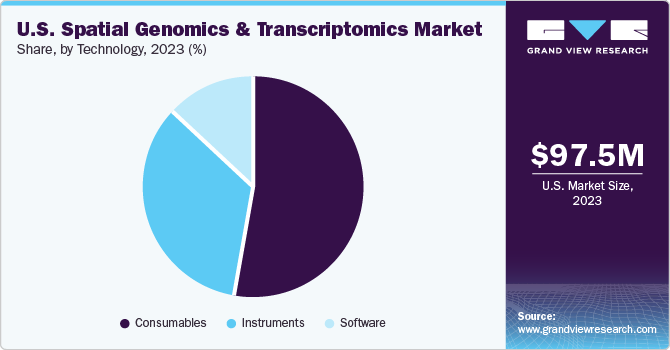

Consumables product segment held the largest share of 53% in 2023. The extensive product adoption, escalated utilization of reagents & kits, broad product accessibility, and regular procurement of consumables essential for operating various analyzers driving the market growth. Moreover, the introduction of new instruments necessitates the development of the required consumables to support their functionality. Such trends in this segment are likely to fuel market growth in the forecast period.

Software segment is projected to grow at the largest CAGR from 2024 to 2030. The increasing number of ongoing genomic research studies contributes to the demand for robust software solutions to visualize, interpret, and manage data generated after spatial studies of DNA and RNA molecules. Furthermore, companies are collaborating to enhance their service offerings by leveraging partnerships with other organizations, leading to market expansion. For instance, in October 2022, 10X Genomic and Oxford Nanopore Technologies partnered to announce single-cell and spatial full-length isoform transcript sequencing. This aims to simplify the sequencing of full-length transcripts in single reads by utilizing Oxford Nanopore's PromethION devices and consumables, combined with 10x Genomics' sample preparation methods.

Technology Insights

Spatial transcriptomics segment dominated the market with a share of 79% in 2023 and is expected to experience growth at the fastest CAGR in the forecast period. The growing demand for nucleic acid sequencing of biological samples or single cells is a key driver for this segment growth. Additionally, the widespread applications of this segment, such as developing spatial maps of complex tissues, immune profiling, identifying drug targets, and optimizing computational biology, contribute to its high demand, thereby boosting market growth.

Spatial genomics segment is anticipated to witness a growth at significant CAGR from 2024 to 2030. The advancements in genome editing tools such as the CRISPR/Cas9 system have facilitated spatial genomics adoption, driving market growth. Moreover, the potential of spatial genetics/transcriptomics analysis has increased investments in the innovation of new products in the healthcare sector which is further propelling growth opportunities in the market.

End-use Insights

Translational research segment accounted for 60% of revenue share in 2023. The segment’s dominance can be attributed to the increasing adoption of spatial genomics to translate real-time tissue responses to an external agent. Spatial genomics plays an important role in translational research, especially in cell mapping and neuroscience. Moreover, several companies are focusing on sustainable product launches, fulfilling unmet translational research needs, and offering opportunities for segment growth. For instance, in 2022, The 10x Genomics launched Visium Cyt Assist to enhance sample preparation and introduced a comprehensive whole transcriptome and 31-plex protein assay. This advancement enables researchers to analyze both protein and RNA within a single tissue section while also incorporating H&E/IF staining to assess tissue morphology.

Academic customer segment is expected to witness growth at a CAGR of 12% over the forecast period owing to increasing preference for spatial genomic analysis by academic research institutions. This technology is valuable for academic researchers studying the morphological characteristics of cells in genetically linked diseases such as cancer, diabetes, Alzheimer's, and more. These kinds of applications of spatial genomics and transcriptomics are expected to enhance market growth.

Key U.S. Spatial Genomics & Transcriptomics Company Insights

The dominant companies in the U.S. spatial genomics & transcriptomics market include 10X Genomics, Illumina, Inc., and Dovetail Genomics among others.

Companies are actively expanding their business presence through various strategies, including the acquisition of small or emerging companies, partnerships, and regional expansion to sustain their market dominance. This approach allows companies to strengthen their market position by integrating new businesses and leveraging their strengths to enhance their competitive edge on a scale.

Key U.S. Spatial Genomics & Transcriptomics Companies:

- NanoString Technologies, Inc.

- S2 Genomics, Inc.

- Illumina, Inc.

- Dovetail Genomics

- 10x Genomics

- Seven Bridges Genomics

- Readcoor, Inc

- Bio-Techne

- Advanced Cell Diagnostics (ACD)

Recent Developments

-

In March 2024, 10x Genomics, Inc. launched its Visium HD Spatial Gene Expression product, allowing researchers to analyze the entire transcriptome from FFPE tissue sections at a single cell-scale resolution. This innovative assay provides a comprehensive understanding of gene expression patterns within tissues, offering researchers a powerful tool to explore cellular biology in detail.

-

In March 2024, Johns Hopkins biomedical engineers invented an innovative computational technique to accurately align ST data across various samples, resolutions, and technologies, empowering researchers to delve deeper into cellular biology. This novel method, known as STalign, enhances their capacity to effectively compare spatial single-cell data, facilitating comprehensive insights into cellular organization and function.

U.S. Spatial Genomics & Transcriptomics Market Report Scope

|

Report Attribute |

Details |

|

Revenue Forecast in 2030 |

USD 222.2 million |

|

Growth rate |

CAGR of 12.7% from 2024 to 2030 |

|

Actual data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, technology, end-use |

|

Country scope |

U.S. |

|

Key companies profiled |

NanoString Technologies, Inc.; S2 Genomics, Inc.; Illumina, Inc.; Dovetail Genomics; 10x Genomics; Seven Bridges Genomics; Readcoor, Inc; Bio-Techne; Advanced Cell Diagnostics (ACD) |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Spatial Genomics & Transcriptomics Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. Spatial Genomics & Transcriptomics market report based on product, technology, and end-use:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

By Mode

-

Automated

-

Semi-automated

-

Manual

-

-

By Type

-

Sequencing Platforms

-

IHC

-

Microscopy

-

Flow Cytometry

-

Mass Spectrometry

-

Others

-

-

-

Consumables

-

Software

-

Bioinformatics Tools

-

Imaging Tools

-

Storage and Management Databases

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Spatial Transcriptomics

-

Sequencing-Based Methods

-

Laser Capture Microdissection (LCM)

-

FFPE Tissue Samples

-

Others

-

-

Transcriptome In-Vivo Analysis (TIVA)

-

In Situ Sequencing

-

Microtomy Sequencing

-

-

IHC

-

Microscopy-based RNA Imaging Techniques

-

Single Molecule RNA Fluorescence In-Situ Hybridization (smFISH)

-

Padlock Probes/ Rolling Circle Amplification

-

Branched DNA Probes

-

-

-

Spatial Genomics

-

FISH

-

Microscopy-based Live DNA Imaging

-

Genome Perturbation Tools

-

Massively-Parallel Sequencing

-

Biochemical Techniques

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Translational Research

-

Academic Customers

-

Diagnostic Customers

-

Pharmaceutical Manufacturer

-

Frequently Asked Questions About This Report

b. The U.S. spatial genomics & transcriptomics market size was estimated at USD 97.5 million in 2023 and is expected to reach USD 108.5 million in 2024.

b. The U.S. spatial genomics & transcriptomics market is expected to grow at a compound annual growth rate of 12.7% from 2024 to 2030 to reach USD 222.2 million by 2030.

b. The spatial transcriptomics segment dominated the U.S. spatial genomics & transcriptomics market with a share of 79.24% in 2023. This is attributable to the rising adoption of transcriptomics technologies in research and development activities for drug discovery and development.

b. Some key players operating in the U.S. spatial genomics & transcriptomics market include Natera Inc.; 10x Genomics; Dovetail Genomics; Illumina, Inc.; S2 Genomics, Inc.; NanoString Technologies, Inc.; Seven Bridges Genomics; Horizon Discovery Group plc; Bio-Techne

b. Key factors that are driving the market growth include the rising demand for transcriptomics and genomics technologies for the development of clinical therapeutics for disorders such as neurodegenerative disorders and cancer.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."