- Home

- »

- Homecare & Decor

- »

-

U.S. Solo Travel Market Size & Trends, Industry Report, 2030GVR Report cover

![U.S. Solo Travel Market Size, Share & Trends Report]()

U.S. Solo Travel Market (2025 - 2030) Size, Share & Trends Analysis Report By Travel Type (Adventure & Extreme Travel, Eco Travel), By Traveler Type (Domestic, International), By Gender (Male, Female), By Age Group, By Booking Mode, And Segment Forecasts

- Report ID: GVR-4-68040-541-8

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Solo Travel Market Size & Trends

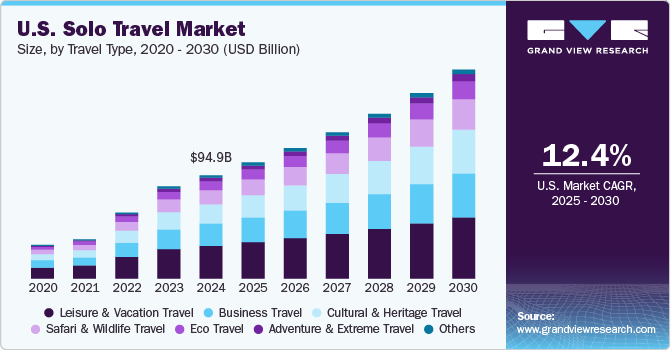

The U.S. solo travel market size was valued at USD 94.88 billion in 2024 and is expected to expand at a CAGR of 12.4% from 2025 to 2030. A combination of evolving traveler preferences and societal trends drives the market growth. Individuals seek personalized and flexible travel experiences, embracing the freedom and empowerment that solo travel offers. The growing prevalence of remote work has also encouraged people to explore new destinations while maintaining professional commitments.

Technological advancements have also played a significant role in enhancing the solo travel experience. The widespread availability of mobile applications for real-time navigation, accommodation booking, and transportation management has alleviated many of the challenges traditionally associated with independent travel. Furthermore, digital platforms provide comprehensive safety information, ensuring solo travelers can navigate unfamiliar environments with confidence. Social media further fuels this trend by enabling travelers to share their experiences, access peer recommendations, and build virtual communities, reducing the sense of isolation that can sometimes accompany solo journeys.

Economic factors have also contributed to the rise of solo travel, particularly among millennials and Gen Z, who are experiencing increased financial independence. Many travelers prioritize experiences over material possessions, directing their discretionary income toward personal exploration. Additionally, the growing adoption of remote and hybrid work models has provided greater flexibility in travel planning, allowing solo travelers to extend their trips without the constraints of traditional office-based employment. This has resulted in an uptick in “workcations” and extended solo travel experiences.

A rising emphasis on mental wellness and self-discovery has led travelers to prioritize solo journeys to rejuvenate and reflect. Advances in technology, such as user-friendly travel apps and platforms, have further facilitated U.S. solo travel by enhancing safety, connectivity, and convenience. In addition, the expanding range of tailored experiences, such as solo-friendly accommodations and guided tours, has significantly made solo travel more accessible and appealing. Furthermore, a 2024 American Express survey reveals that 57% of respondents prefer quick solo weekend getaways, with nearly a third favoring solo trips to new cities. This growing trend highlights the appeal of short, personal escapes that allow travelers to relax, recharge, and explore at their own pace.

In the U.S., a growing focus on mental wellness and self-discovery has encouraged travelers to embark on solo journeys to rejuvenate and reflect. Furthermore, technological advancements, including user-friendly travel apps and platforms, have greatly facilitated solo travel by improving safety, connectivity, and convenience. Additionally, the increasing availability of tailored experiences, such as solo-friendly accommodations and guided tours, has made solo travel more accessible and appealing within the U.S. market.

According to the 2024 Internova Index: North American Traveler Insights survey, international travel among U.S. travelers has grown by 22% in the past year, particularly in the premium and budget segments. Additionally, 25% of travelers plan to take more leisure trips in 2025, highlighting a strong desire for exploration and adventure. Luxury travelers are leading this trend, favoring destinations outside North America. The survey also found that 60% of travelers plan to use travel advisors, with even higher demand among those under 35. These experts are valued for their guidance and assistance, especially during travel disruptions like flight cancellations or itinerary adjustments.

Consumer Survey & Insights

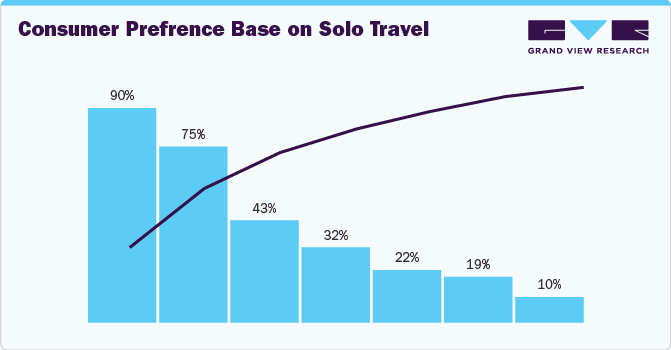

Solo travel has experienced significant growth, with 11% of the overall travel market comprising single travelers. In 2023, 83 million Americans are considering a solo trip, reflecting post-pandemic trends. Women dominate this segment, with 84% of solo travelers being female, and 72% of women in the U.S. have taken a solo vacation. Notably, female solo travelers aged 65 and older increased from 4% in 2019 to 18% in 2022. Social acceptance of solo travel has risen, as seen in a 42% increase in solo traveler bookings over the last two years. Additionally, the hashtag #solotravel has garnered over 5.2 million posts.

The industry continues to grow steadily, with companies increasingly catering to this niche since 2009 by reducing single supplement fees. According to the 2024 Solo Traveler Reader Survey, which had 2,400 respondents, over 80% were women, primarily Americans aged 55 and older with university or graduate degrees. Notably, 22% of respondents took two trips in the past year, while 43% took three or more. For 2025, 32% plan to visit Europe, while 19% remain undecided. Key factors influencing travel decisions include price (77%), safety (76%), and weather (58%). Additionally, 75% prefer trips lasting two weeks or longer, with 90% favoring escorted tours.

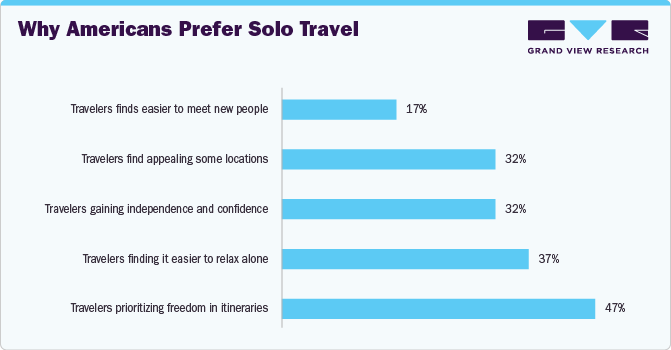

Research from YouGov RealTime indicates that solo travel appeals to many Americans, with 57% expressing interest in solo trips to another U.S. city and 66% having traveled alone or considering it. The primary motivation for solo travel is the desire for freedom in planning itineraries without external input (47%). Additionally, 37% believe traveling alone offers greater opportunities to relax and unwind. For some, solo travel boosts self-confidence or meets new people, making it a unique and personal experience.

Travel Type Insights

Solo leisure & vacation travel accounted for a revenue share of 32.0% in 2024, driven by the desire for relaxation, cultural exploration, and personal enrichment. Many tourism and hospitality companies in the U.S. offer tailored packages, solo-friendly accommodations, and group tours for independent travelers, making leisure travel more appealing and convenient. The rise of remote work and flexible schedules has enabled more people to travel on their own terms, leading to longer and more frequent leisure trips.

In 2021, a survey revealed that 21% of Americans planned to take a solo trip. Vacation was the leading reason for travel, with 87% of respondents prioritizing leisure trips. Business travel followed at 52%, while 42% aimed to visit family and friends. Additionally, nearly a third (32%) intended to take trips that had been postponed due to COVID-19, reflecting the impact of the pandemic on travel plans.

Demand for solo adventure and extreme travel is expected to grow at a CAGR of 14.4% from 2025 to 2030. Many solo travelers seek adventure travel as a way to step outside their comfort zones, embrace new challenges, and gain a sense of accomplishment. Unlike traditional leisure vacations, adventure travel offers thrilling activities such as hiking, trekking, scuba diving, and wildlife exploration, making it an appealing choice for those looking to combine travel with personal growth and excitement. The rise in interest can be attributed to younger generations, particularly millennials and Gen Z, who value experiential travel and prioritize activities that offer both adventure and cultural enrichment.

Traveler Type Insights

Domestic solo travelers accounted for a revenue share of over 65% in 2024. Many individuals embark on solo journeys within their countries to experience new cultures, landscapes, and activities at their own pace. Unlike group travel, solo travel allows for a more personalized and flexible itinerary, allowing travelers to explore destinations based on their interests and schedules. For instance, a study in February 2025, found that 41% of solo travelers in the U.S. choose domestic destinations for their first solo trip, with mountain regions (18.26%) and major cities like New York (14.19%) being the most popular. The main reasons for traveling alone include the desire for independence (74%) and flexible scheduling (63%). First-time solo trips usually last 7 to 10 days, with budgets ranging from USD 1,000 to USD 2,000.

International solo traveler is set to grow at a CAGR of 13.9% from 2025 to 2030. Modern travelers increasingly seek personalized experiences that align with their individual preferences, making solo travel an appealing choice. The pandemic has also fostered a sense of independence and comfort with solitude, encouraging more individuals to explore alone. Additionally, the rise of digital nomads, single professionals, and retirees has boosted demand for solo travel. Millennials and Gen Z travelers, in particular, prioritize self-discovery, adventure, and wellness, leading to a surge in extended solo trips. Advancements in travel infrastructure, such as single-occupancy accommodations and guided solo tours, further cater to solo travelers' unique needs. Moreover, an increasing emphasis on mental well-being and self-care drives many individuals to embark on solo journeys for personal growth and transformative experiences.

Gender Insights

Female solo travelers accounted for a revenue share of 66.0% in 2024. More women prioritize travel to escape routine stress, recharge mentally, and find balance. Solo travel offers a unique form of self-care, allowing women to disconnect from daily responsibilities, embrace mindfulness, and engage in activities that promote relaxation and personal happiness. This shift in mindset has led to a surge in solo female travelers seeking destinations that encourage wellness, nature immersion, and cultural enrichment, reinforcing the trend as a growing segment in the travel industry. For instance, in April 2024, Insight Vacations launched women-only tours led by female travel directors and local experts, offering unique and immersive experiences. These tours focus on fostering connections among women travelers while highlighting female artisans, entrepreneurs, and cultural contributors.

The male solo travelers segment is expected to grow at a CAGR of 13.3% from 2025 to 2030. Men are drawn to physically and mentally challenging activities such as mountaineering, wilderness survival, off-road biking, and scuba diving. These experiences provide an adrenaline rush and a sense of accomplishment and resilience. Solo travel, in particular, allows men to push their limits without external influences, enabling them to test their endurance and self-sufficiency. With the rise of remote work, freelancing, and digital nomad lifestyles, more men have the flexibility to travel while maintaining their careers. Many professionals are choosing to integrate travel into their work schedules, either by extending business trips for leisure exploration or by working from different U.S. locations or worldwide.

Age Group Insights

Solo travelers aged between 25 and 40 in 2024 accounted for 46.3% of the overall U.S. solo travel market. Many individuals in this age group in the U.S. have established their careers and enjoy a stable income, allowing them to allocate discretionary spending toward travel. Personal development and self-exploration are significant motivators for solo travel among this demographic. People in their late 20s to 30s often go through transformative life phases, such as career changes, personal growth journeys, or even major life decisions. Traveling alone provides an opportunity for self-reflection, increased confidence, and personal growth.

Solo travelers aged between 18 and 24 are expected to grow at a CAGR of 13.8% from 2025 to 2030. This growth is driven by younger travelers’ strong desire for self-discovery, adventure, and authentic cultural experiences. This age group values independence and flexibility, making solo travel an ideal choice for exploring the world on their own terms. Additionally, increased accessibility to budget-friendly travel options and digital tools for planning and safety have further empowered this generation to embrace solo journeys. Social media has played a significant role in normalizing and promoting solo travel among young people. Platforms such as Instagram, TikTok, and YouTube are filled with content creators and influencers who share their solo travel experiences, showcasing the excitement and freedom of exploring the world alone. These platforms not only serve as a source of inspiration but also as a means of reassurance, providing insights into destinations, travel safety tips, and firsthand experiences from other solo travelers.

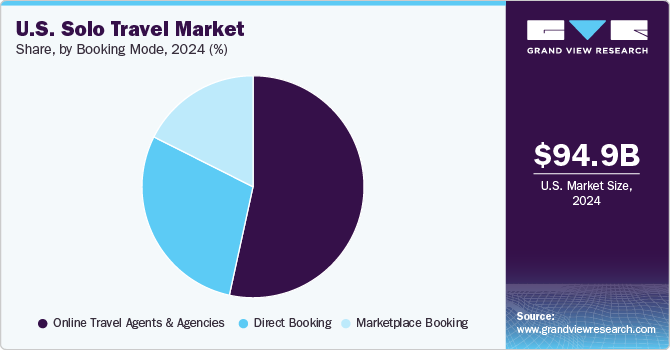

Booking Mode Insights

Bookings through online travel agents and agencies (OTAs) held a revenue share of 53.4% of the U.S. solo travel industry in 2024 due to their convenience, comprehensive inventory, and seamless digital experience. Furthermore, advancements in digital technology have made OTAs more accessible and user-friendly, contributing to their growing popularity among solo travelers. Mobile applications, AI-driven recommendations, and real-time booking updates provide a seamless travel planning experience. Many OTAs also integrate features such as itinerary management, travel insurance, and visa assistance, catering to the diverse needs of solo adventurers. For instance, in May 2024, Kayak launched a set of AI-powered tools to simplify travel planning. One of the key features, "PriceCheck," allows users to upload flight itinerary screenshots, enabling the platform to compare prices across multiple sites for the best deal.

Solo travel bookings through marketplace booking is expected to grow at a CAGR of 12.2% from 2025 to 2030. Marketplace booking platforms such as Airbnb, Booking.com, and Expedia streamline the process by aggregating multiple options in one place. This allows travelers to compare prices, availability, and reviews instantly, enabling informed decision-making. For solo travelers who prioritize efficiency and autonomy, this level of accessibility makes marketplace booking the preferred choice over conventional methods.

Key U.S. Solo Travel Company Insights

The U.S. solo travel market is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some prominent companies in this market are Intrepid Travel, G Adventures, Austin Adventures, Contiki Holidays Limited, and others.

-

Contiki Holidays Limited is a travel company specializing in group adventures for young travelers aged 18 to 35 years. Operating across six continents, Contiki offers curated trips that focus on social experiences, cultural immersion, and hassle-free travel by managing accommodations, transport, and activities. Contiki provides a community-driven experience with no single supplements by pairing individuals with same-gender roommates. Those preferring privacy can opt for a solo room upgrade.

-

Austin Adventures is a travel company specializing in small-group adventure experiences. With decades of expertise, the company offers guided trips focused on outdoor activities such as hiking, biking, and multisport adventures in destinations worldwide. In 2021, Austin Adventures merged with Active Adventures, expanding its reach and enhancing its portfolio of immersive travel experiences. The company provides a welcoming environment by offering the option to share accommodation with a same-gender traveler, eliminatingextra costs.

Key U.S. Solo Travel Companies:

- Intrepid Travel

- G Adventures

- Austin Adventures

- Contiki Holidays Limited

- Solos Holidays Ltd.

- EF Education First Ltd. (EF Go Ahead Tours)

- WeRoad

- Trafalgar

- Booking Holdings Inc.

- Airbnb Inc.

Recent Developments

-

In January 2025, Intrepid Travel introduced a unique six-day culinary tour in partnership with the Melbourne Food and Wine Festival (MFWF), set to take place from March 20 to 25, 2025. Led by food expert Lyndey Milan, the experience includes exclusive dining events such as MFWF’s World’s Longest Lunch, a gourmet journey on The Q Train, and a special spirits and cheese pairing session.

U.S. Solo Travel Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 106.45 billion

Revenue forecast in 2030

USD 191.69 billion

Growth Rate (Revenue)

CAGR of 12.4% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Travel type, traveler type, gender, age group, booking mode

Country scope

U.S.

Key companies profiled

Intrepid Travel; G Adventures; Austin Adventures; Contiki Holidays Limited; Solos Holidays Ltd.; EF Education First Ltd. (EF Go Ahead Tours); WeRoad; Trafalgar; Booking Holdings Inc.; and Airbnb Inc.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Solo Travel Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. solo travel market report based on travel type, traveler type, gender, age group, and booking mode:

-

Travel Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Leisure & Vacation Travel

-

Adventure and Extreme Travel

-

Safari and Wildlife Travel

-

Cultural & Heritage Travel

-

Eco Travel

-

Business Travel

-

Others

-

-

Traveler Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Domestic

-

International

-

-

Gender Outlook (Revenue, USD Billion, 2018 - 2030)

-

Male

-

Female

-

-

Age Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

18-24 Years

-

25-40 Years

-

41-56 Years

-

57 Years and Above

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct Booking

-

Online Travel Agents and Agencies (OTAs)

-

Marketplace Booking

-

Frequently Asked Questions About This Report

b. The U.S. solo travel market was estimated at USD 94.88 billion in 2024 and is expected to reach USD 106.45 billion in 2025.

b. The U.S. solo travel market is expected to grow at a compound annual growth rate of 12.4% from 2025 to 2030, reaching USD 191.69 billion by 2030.

b. The U.S. solo travel market accounted for a share of about 73% in the overall U.S. solo travel market. This is due to the growing focus on mental wellness and self-discovery, which has encouraged travelers to embark on solo journeys to rejuvenate and reflect.

b. Key players in the U.S. solo travel market are Intrepid Travel, G Adventures, Austin Adventures, Contiki Holidays Limited, Solos Holidays Ltd., EF Education First Ltd. (EF Go Ahead Tours), WeRoad, Trafalgar, Booking Holdings Inc., Airbnb Inc.

b. Key factors that are driving the U.S. solo travel market growth include growing prevalence of remote work has also encouraged people to explore new destinations while maintaining professional commitments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.