- Home

- »

- Renewable Energy

- »

-

U.S. Solar Films Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Solar Films Market Size, Share & Trends Report]()

U.S. Solar Films Market Size, Share & Trends Analysis Report By Type (Frontsheet, Backsheet), By Polymer Type (Fluoropolymer, Non-fluoropolymer), By Thickness, By Film Type, By Application, By End-use, And Segment Forecasts 2023 - 2030

- Report ID: GVR-4-68040-142-2

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

U.S. Solar Films Market Size & Trends

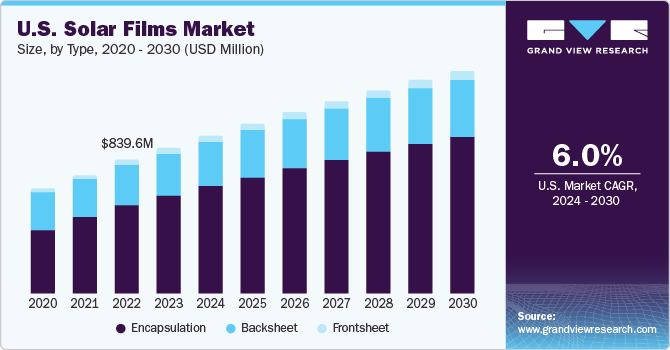

The U.S. solar films market size was estimated at USD 916.26 million in 2023 and is projected to register a CAGR of 6.0% from 2024 to 2030. Technology advancements in solar films are acting as a dynamic force for the expansion of the U.S. solar films market. Continuous improvements in the efficiency of materials and designs of solar films have significantly enhanced their energy-harvesting capabilities. High-efficiency solar films can capture a large portion of solar radiation and convert it into electricity with increased effectiveness. These advancements have led to significantly surged energy output from solar film installations, making them highly attractive to residential, commercial, and industrial consumers in the country. As solar films have become increasingly efficient at converting sunlight into usable energy, they are playing a pivotal role in driving the widespread adoption of solar energy solutions in the country.

Moreover, the integration of smart technology into solar films is reshaping the solar energy industry. These innovative films are equipped with sensors, controls, and connectivity features that enable real-time adjustments based on environmental conditions. Smart solar films can autonomously modulate their tint levels, as well as optimize the balance of natural light and heat entering buildings or vehicles. This not only enhances the comfort and convenience of users but also maximizes energy efficiency of solar panel, thereby reducing the requirement for manual intervention. The incorporation of smart technology aligns solar films with the broad trend of creating intelligent and energy-efficient environments. This makes them a preferable choice for consumers and businesses alike, thereby leading to the growth of the market in the U.S.

Market Concentration & Characteristics

The U.S. solar films market is consolidated in nature with key players in the market such as 3M, Cybrid, Dupont, and Saint-Gobain, among others. Companies are engaging in mergers & acquisitions, new product development, and technological advancement to increase their market presence in the U.S. solar films market.

The automotive industry has emerged as a significant contributor to the U.S. solar films market. Consumers are increasingly interested in features that enhance the comfort and energy efficiency of vehicles. Solar films in automotive applications not only improve interior comfort but also contribute to fuel efficiency by reducing the need for air conditioning. This segment's growth prospects are closely tied to the automotive industry's innovation and the integration of solar films into new vehicle designs.

Type Insights

Based on type, the U.S. Solar Films Market is segregated into Frontsheets, Backsheets, and Encapsulation. In terms of revenue, encapsulation segment accounted for the largest share of 67.3% in the global U.S. Solar Films Market in 2023. Encapsulation films play a critical role in protecting delicate solar cells from moisture, dust, and physical damage. Their ability to effectively seal and safeguard the solar modules ensures the long-term durability and reliability of solar installations, a crucial consideration for both consumers and commercial projects.

Moreover, encapsulation films contribute to the enhanced energy efficiency and performance of solar panels. By providing a protective layer that keeps environmental elements at bay, they help maintain the integrity of solar cells over time, preventing degradation and maximizing energy output. This increased efficiency translates to higher energy production and cost savings for solar panel owners, making encapsulation films a preferred choice in the U.S. market. In addition, the growing awareness of the importance of solar panel longevity and efficiency has driven the demand for high-quality encapsulation materials, further solidifying their dominant position in the U.S. market.

Furthermore, backsheet solar films accounted for second largest share in the U.S. market in 2023. Backsheets play a role in the overall structural integrity of solar film modules. They provide mechanical support and stability to the module, helping it withstand the rigors of installation and environmental conditions. Backsheets are engineered to resist UV radiation and thermal stress, ensuring that they remain durable and do not degrade over time. This durability is essential for the long-term performance and reliability of solar film installations.

Polymer Type Insights

The U.S. market is segmented into fluoropolymer and non-fluoropolymer. Fluoropolymer emerged as the largest segment market revenue share of 65.08% in 2023.The high transparency and excellent light transmission properties of fluoropolymers allow for efficient light capture by solar cells. This property enhances the overall efficiency of solar panels, leading to higher energy generation, which is a critical factor in the preference for fluoropolymer-based solar films. The longevity of these materials reduces maintenance costs and enhances the long-term performance of solar installations, making them a favored choice for both residential and commercial solar projects in the U.S.

Non-fluoropolymer materials also play a significant role in the U.S. market, offering alternative solutions for various components of solar film modules. While fluoropolymers are known for their unique properties, non-fluoropolymer materials are chosen for their specific advantages, providing options that cater to different requirements in solar film technology.

Thickness Insights

Based on thickness, the U.S. Solar Films Market is segmented into less than 100 mm, 100 mm to 500 mm, and more than 500 mm. In terms of revenue, Less than 100 mm accounted for the largest share of 45.70% in 2023. In the U.S. market, the category of solar films with a thickness of less than 100 mm represents a crucial niche characterized by flexibility, adaptability, and ease of integration into various applications, both traditional and cutting-edge. As the demand for eco-friendly and energy-efficient technology solutions continues to grow, solar films with a thickness of less than 100 mm remain a critical enabler, driving innovation and sustainability across diverse sectors in the U.S.

More than 500 mm segment accounted for second largest share in the U.S. solar films market owing to the application in parabolic trough CSP systems. These systems employ curved mirrors or trough-shaped reflectors to concentrate sunlight onto a focal point, where it heats a heat-transfer fluid. The heated fluid is then used to produce steam, which drives a turbine to generate electricity. Solar films with thicknesses exceeding 500 mm play a critical role in enhancing the efficiency and reliability of utility-scale CSP projects, contributing significantly to the growth of renewable energy capacity and sustainable energy generation in the U.S.

Film Type Insights

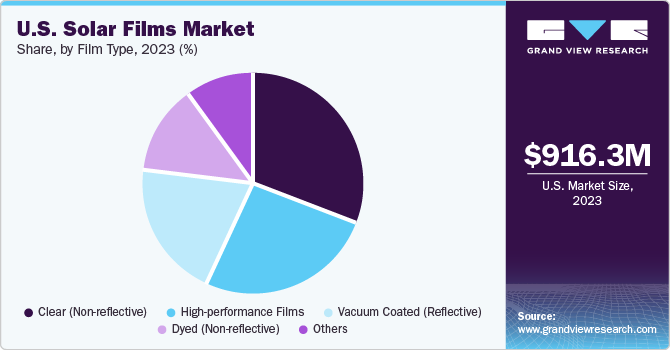

Based on Film Type, the U.S. Solar Films Market is segmented into clear (non-reflective), dyed (non-reflective), vacuum coated (reflective),high-performance Films, and others. In terms of revenue, clear (non-reflective) accounted for the largest share of 31.02% in 2023. The growth of this segment of the market is driven by the surging requirement for sustainable energy solutions in the country that seamlessly integrate with architectural designs of buildings and maximize natural light transmission. These films are designed to offer a transparent, inconspicuous, and visually appealing way to harness solar energy, making them suitable for use in a wide range of applications ranging from different architectural structures, residential units, commercial buildings, and public infrastructures to automobiles.

High-performance films registered the highest CAGR over a period of 2018 to 2030. The demand for high-performance solar films in the U.S. is growing, driven by increasing emphasis on energy efficiency and the need for green buildings. The high-performance films segment of the solar control window film market is expected to grow significantly, with advancements in nanotechnology and material science enabling the development of sophisticated and efficient films that selectively block infrared radiation and maintain optimal visible light transmission.

Application Insights

Based on Application, the U.S. market is segmented into Construction, Automotive, Marine, and Others. In terms of revenue, construction accounted for the largest share of 56.27% in 2023. The construction industry plays a pivotal role in the U.S. solar films market, where solar films find application in various construction-related scenarios, contributing to energy efficiency, sustainability, and improved building performance.In this context, solar films are instrumental in achieving compliance with energy efficiency regulations and sustainability certifications, such as LEED (Leadership in Energy and Environmental Design). Overall, the integration of solar films in construction aligns with the industry's commitment to sustainable building practices, energy conservation, and cost-effective solutions, driving their adoption across a wide range of building projects in the U.S.

The automotive accounted for the fastest growing segment having a CAGR of about 7.0% over the forecast period. Solar films offer benefits like UV protection, glare reduction, and energy efficiency inside vehicles, aligning well with the trends of sustainability and energy conservation. Advancements in solar film technologies, including smart and self-healing films, are contributing to the market growth, with consumers seeking personalized driving experiences and environmentally conscious solutions. Rising adoption of solar energy in automotive industry in the country is expected to further propel the growth of U.S. solar films market in near future.

End-use Insights

Based on end-use, the U.S. market is segmented into utility, residential, commercial, industrial, and military. In terms of revenue, commercial accounted for the largest share of 39.99% in 2023. The commercial sector has been increasingly focusing on sustainability and energy efficiency. Solar films offer an attractive solution for businesses looking to reduce their carbon footprint and energy costs simultaneously. Commercial buildings often have large surface areas that can be effectively covered with solar films, allowing for significant electricity generation on-site. This not only helps companies reduce their reliance on traditional grid power but also contributes to meeting sustainability goals and environmental regulations, which have become increasingly important for businesses in recent years.

Residential segment is expected to grow at significant rate owing to the high adoption of solar energy in residential properties in U.S. Moreover, financial incentives, including federal tax credits and state-level incentives, have made solar film installations more affordable for homeowners. These incentives encourage residential property owners to invest in solar films, not only to reduce their energy bills but also to contribute to a greener and more sustainable energy future. As solar film technology continues to advance, residential applications are expected to play a significant role in expanding the adoption of solar films across the U.S.

Key U.S. Solar Films Company Insights

The U.S. market is fragmented with the presence of various key players. Major players compete based on production capacity expansions, product portfolio developments, and methods to implement new technologies in the manufacturing of solar films. The key players engaged in U.S. solar films market are 3M, Honeywell International Inc., Johnson Window Films Inc., Mitsubishi Polyester Films, and Jolywood, among others.

-

In October 2023, Endurans Solar is a manufacturing company based in the U.S. The company announced an expansion of its production capacity at its U.S. backsheet manufacturing facility in Nashua, New Hampshire. The exact capacity increase remains undisclosed.

-

In May 2023, First Solar, Inc. has acquired one of the European perovskite technology leaders, Evolar AB, for approximately $38 million upfront, with an additional $42 million contingent on future technical milestones.

-

In May 2023, DuPont launched frontsheet materials with the brand name Tedlar at the 2023 SNEC International Photovoltaic Power Generation and Smart Energy Exhibition.

Key U.S. Solar Films Companies:

- 3M

- Honeywell International Inc.

- Johnson Window Films Inc.

- Mitsubishi Polyester Films

- Jolywood

- Dupont

- Garware Suncontrol Film

- Solar Control Films Inc.

- Polytronix Inc

- DUNMORE

U.S. Solar Films Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 990.93 million

Revenue forecast in 2030

USD 1,404.52 million

Growth rate

CAGR of 6.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in million square meter, revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, polymer type, thickness, film type, application, end-use

Country Scope

U.S.

Key companies profiled

3M; Agfa-Gevaert N.V.; COVEME s.p.a.; Cybrid Technologies Inc.; DUNMORE; Dupont; Eastman Chemical Company; Garware Suncontrol Film; Honeywell International Inc.; Johnson Window Films Inc.; Jolywood; Krempel GmbH; Lintec Corporation; Madico, Inc.; Mitsubishi Polyester Films; Polytronix Inc; Purlfrost Ltd; Saint Gobain; Solar Control Films Inc.; Targray; Thermolite, LLC; Toray Industries, Inc.; Airtech Advanced Materials Group; HEXIS S.A.S.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Solar Films Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. Solar Films Market report based on type, polymer type, thickness, film type, application, and end-use:

-

Type Outlook (Volume, Million Square Meter; Revenue, USD Million, 2018 - 2030)

-

Frontsheet

-

Backsheet

-

Encapsulation

-

-

Polymer Type Outlook (Volume, Million Square Meter; Revenue, USD Million, 2018 - 2030)

-

Fluoropolymer

-

Non-fluoropolymer

-

-

Thickness Outlook (Volume, Million Square Meter; Revenue, USD Million, 2018 - 2030)

-

Less than 100 mm

-

100 mm to 500 mm

-

More than 500 mm

-

-

Film Type Outlook (Volume, Million Square Meter; Revenue, USD Million, 2018 - 2030)

-

Clear (Non-reflective)

-

Dyed (Non-reflective)

-

Vacuum coated (Reflective)

-

High-performance Films

-

Others

-

-

Application Outlook (Volume, Million Square Meter; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Automotive

-

Marine

-

Others

-

-

End-use Outlook (Volume, Million Square Meter; Revenue, USD Million, 2018 - 2030)

-

Utility

-

Residential

-

Commercial

-

Industrial

-

Military

-

Frequently Asked Questions About This Report

b. .The U.S. solar films market size was estimated at USD 916.26 million in 2023 and is expected to reach USD 990.93 million in 2023.

b. .The U.S. solar films market is expected to grow at a compound annual growth rate of 6.0% from 2024 to 2030 to reach USD 1,404.52 million by 2030.

b. Fluoropolymer dominated the U.S. solar films market with a share of more than 65.08% in 2023. This is due to its exceptional durability and resistance to environmental factors, making it ideal for solar panel applications in demanding outdoor conditions.

b. .Some key players operating in the U.S. solar films market include 3M Company (U.S.), Eastman Chemical Company (U.S.), Saint-Gobain (France), and Toray Industries, Inc. (Japan).

b. .Key factors that are driving the U.S. solar films market growth include technology advancements in solar films, the presence of federal and state incentives, along with tax credits, and increased adoption of solar photovoltaic (PV) systems in residential and commercial applications.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."