- Home

- »

- Communications Infrastructure

- »

-

U.S. Social Commerce Market Size & Share Report, 2030GVR Report cover

![U.S. Social Commerce Market Size, Share & Trends Report]()

U.S. Social Commerce Market (2023 - 2030) Size, Share & Trends Analysis Report By Business Model (B2C, B2B, C2C), By Product Type (Apparel, Accessories, Home Products), By Platform/Sales Channel, And Segment Forecasts

- Report ID: GVR-4-68040-094-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

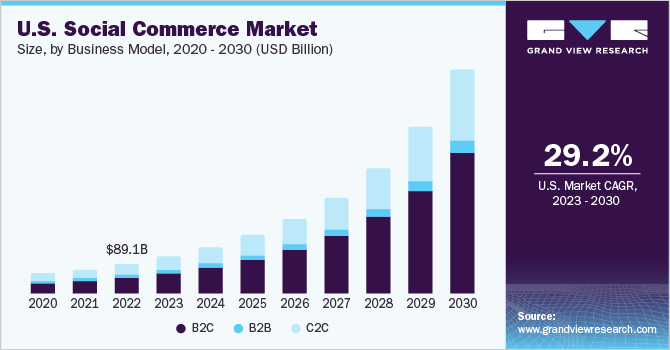

The U.S. social commerce market size was valued at USD 89.11 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 29.2% from 2023 to 2030. This growth is attributed to fuel the average time consumed on social media platforms during the pandemic and the greater convenience for buyers to purchase products. Moreover, an increasing number of active buyers on various social media platforms such as Facebook, Twitter, Inc., Reddit, and Taobao.com is also anticipated to drive the growth of the U.S. social commerce industry over the forecast period.

Users are now spending more time on social media because of the crisis. As a result, the merchants expanded their spending on advertising, allowing them to reach out to additional clients, businesses, and product categories. For instance, Facebook, one of the top social commerce platforms, reported that its adverts in the United States reached 179.7 million users. Additionally, it is expected that the growing practice of live-streaming purchases, also known as video-based shopping, would create expansion chances for the social commerce sector in the United States. The U.S. social commerce market’s growth may be constrained by consumers' growing worries about the acquisition and potential use of their data by social media platforms.

Many companies are utilizing social commerce to serve current and potential new clients. People in the United States spend more time on social media platforms; studies indicate that the average person probably spends over two hours daily, which is one of the elements causing this trend. In the United States, users spend an average of 25.6 hours monthly on the TikTok platform, followed by YouTube and Facebook. Due to their ability to make purchases more participatory than traditional e-commerce platforms, these networks serve as effective marketing tools, fueling a steady rise in online purchasing through social media platforms.

Over a long time, social media companies have adjusted to meet shifting customer needs. Over the past ten years, progressive developments have moved away from text-based updates and towards graphic information. Social media sites like Facebook, Instagram, and Snapchat have promoted this visual material, paving the door for social commerce. Short-video platforms like TikTok furthered the "content is the champion" trend, which improved the prospects for the U.S. social commerce sector.

Platforms for social commerce are drawing companies of all sizes because they offer a way to create individualized client journeys through social interactions. Social media served as a venue for users to browse before purchasing on e-commerce sites like Amazon.com and Walmart for a considerable amount of time. However, social media platforms increasingly enable businesses to create client communities, bonds, and trust. By enabling the seamless integration of e-commerce items, visual-first platforms like Instagram and Pinterest have been instrumental in bringing about this transition. This is anticipated to boost the growth of the market over the forecast period.

Business Model Insights

The B2C segment accounted for a market share of 54.7% in 2022. The need for B2C social commerce, which refers to using social media platforms to execute e-commerce transactions directly with consumers, has been increasing recently. Social networking sites have developed into powerful platforms for connecting with customers, promoting brands, and generating revenue for companies. Businesses can reach a huge audience owing to the growing consumer usage of social media platforms. With millions, if not billions, of active users, platforms like Facebook, Instagram, Pinterest, and TikTok are desirable markets for B2C trade.

The C2C segment is expected to grow at a CAGR of 27.3% during the forecast period. Consumers buying and selling goods or services directly to or from other consumers using social media platforms is called C2C (Consumer-to-Consumer) social commerce. Users of social media platforms can interact and connect with people outside their social networks. The reach is increased when purchasing or selling goods because of this increased connectedness. Users can reach a wider audience, boosting their chances of finding customers or sellers interested in their products.

Product Type Insights

The personal & beauty care segment accounted for a market share of 24.3% in 2022. The personal and beauty care sector has seen substantial growth in social commerce, as people use social media platforms to buy and sell cosmetics, personal care items, and beauty-related services. In the personal and beauty care sector, influencers are quite important. They have amassed sizable fan bases on social networking sites and frequently offer product recommendations, reviews, and instructions. Influencer marketing enables firms to connect with a highly engaged audience, increasing product exposure and sales.

The apparel segment is expected to grow at a CAGR of 31.6% during the forecast period. In recent years, the purchasing and selling of apparel goods through social media platforms have grown significantly in garment social commerce. The product category of apparel is very visually appealing, and social media platforms offer the perfect setting for presenting apparel, accessories, and current trends. Users can generate visually appealing material on websites like Instagram and Pinterest, such as lookbooks, style tips, and outfit inspiration, which can increase engagement and purchases.

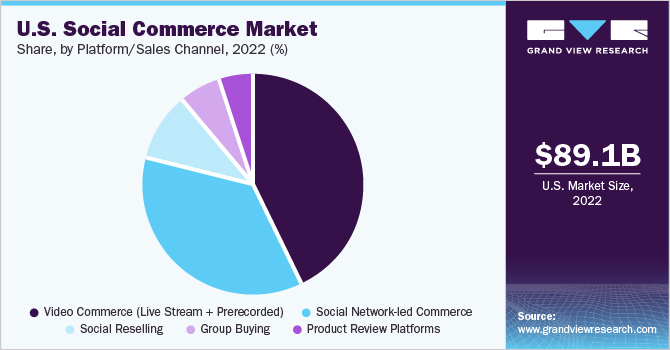

Platform/Sales Channel Insights

The video commerce (live stream + prerecorded) segment had the highest market share of 43.3% in 2022. In recent years, there has been an increase in demand for video commerce, including live streaming and prerecorded videos used for social commerce. This type of social commerce blends the effectiveness of video content with online buying to give customers an interesting and interactive shopping experience.

Real-time communication between buyers and sellers is possible through live-streaming video commerce. Viewers can query dealers or hosts for more information, and they will promptly receive a response. This live conversation simulates the in-store buying experience, where customers may converse with salespeople and receive tailored advice, increasing their trust and confidence in their purchase choice.

The social network-led commerce segment is anticipated to grow at the highest CAGR of 29.4% over the forecast period. Integrating e-commerce features into social media platforms, called social network-led commerce or social commerce, enables users to find, investigate, and buy goods and services directly through the social network.

Mobile devices are the primary means of accessing social media networks, consistent with the rising use of smartphones for online shopping. Social network-led commerce takes advantage of social media's focus on mobile devices, enabling consumers to make purchases anytime, anywhere, and straight from their mobile devices. This accessibility and convenience facilitate the expansion of social commerce.

Key Companies & Market Share Insights

For instance, in April 2021, Broadcom Inc. collaborated with Google Cloud to encourage innovation and improve the integration of cloud Product Types across the company's major software businesses. The collaboration envisages the company distributing its enterprise and security operations software on Google Cloud for enterprises to implement DevOps, Broadcom security, and other Business Models on Google Cloud's trusted global infrastructure. Some prominent players in the U.S. social commerce market include:

-

Depop

-

Etsy, Inc.

-

Meta Platforms, Inc.

-

Pinduoduo Inc.

-

Pinterest, Inc.

-

Poshmark

-

Roposo

-

Shopify

-

Snap, Inc.

-

Taobao

-

TikTok (Douyin)

-

Twitter, Inc.

-

WeChat (Weixin)

U.S. Social Commerce Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 659.41 billion

Growth rate

CAGR of 29.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Business model, product type, platform/sales channel

Key companies profiled

Depop; Etsy, Inc.; Meta Platforms, Inc.; Pinduoduo Inc.; Pinterest, Inc.; Poshmark; Roposo; Shopify; Snap, Inc.; Taobao; TikTok (Douyin); Twitter, Inc.; WeChat (Weixin).

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Social Commerce Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. social commerce market report based on business model, product type, and platform/sales channel:

-

Business Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

B2C

-

B2B

-

C2C

-

-

Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Personal & Beauty Care

-

Apparel

-

Accessories

-

Home Products

-

Health Supplements

-

Food & Beverage

-

Others

-

-

Platform/Sales Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Video Commerce (Live stream + Prerecorded)

-

Social Network-led Commerce

-

Social Reselling

-

Group Buying

-

Product Review Platforms

-

Frequently Asked Questions About This Report

b. The U.S. social commerce market size was estimated at USD 89.11 billion in 2022 and is expected to reach USD 109.98 billion by 2023.

b. The U.S. social commerce market is expected to grow at a compound annual growth rate of 31.6% from 2023 to 2030 to reach USD 659.41 billion by 2030.

b. The B2C segment dominated theU.S. social commerce market with a share of 54.7% in 2022. This is attributable to the social networking sites developed into powerful platforms for connecting with customers, promoting brands, and generating revenue for companies

b. Some key players operating in the U.S. social commerce market include Depop, Etsy, Inc., Meta Platforms, Inc., Pinduoduo Inc., Pinterest, Inc., Poshmark, Roposo, Shopify, Snap, Inc., Taobao, TikTok (Douyin), Twitter, Inc., and WeChat (Weixin).

b. This growth is attributed to fuel the average time consumed on social media platforms during the pandemic and greater convenience for buyers to purchase products. Moreover, an increasing number of active buyers on various social media platforms such as Facebook, Twitter, Inc., Reddit, and Taobao.com is also anticipated to drive the U.S. Social Commerce market over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.