- Home

- »

- Next Generation Technologies

- »

-

U.S. Smart Thermostat Market Size, Industry Report, 2030GVR Report cover

![U.S. Smart Thermostat Market Size, Share & Trends Report]()

U.S. Smart Thermostat Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Wi-Fi, ZigBee), By Product (Connected, Standalone, Learning), By End User, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-482-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Smart Thermostat Market Size & Trends

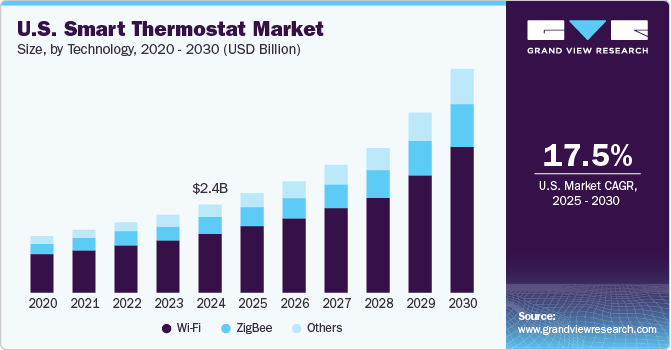

The U.S. smart thermostat market size was estimated at USD 2.36 billion in 2024 and is expected to grow at a CAGR of 17.5% from 2025 to 2030. The market growth is primarily driven by the increasing demand for energy-efficient solutions and the rising adoption of smart home technology. As energy costs rise, consumers and businesses alike are seeking ways to reduce energy consumption, making smart thermostats an appealing choice for their potential to optimize energy use and lower utility bills. Additionally, smart thermostats align with the growing trend of Internet of Things (IoT) devices, allowing users to seamlessly control and integrate multiple smart devices for enhanced comfort and convenience. The push for eco-friendly solutions and energy-conscious behavior also supports the market expansion.

Government initiatives promoting energy efficiency and sustainability are giving a significant boost to the U.S. smart thermostat market. Many governments around the world offer incentives, such as tax rebates and energy credits, for homeowners and businesses that adopt energy-saving technologies, including smart thermostats. For example, programs encouraging the use of smart thermostats to reduce peak energy demand and carbon emissions have been rolled out in U.S. These initiatives not only support environmental goals but also incentivize consumers to make energy-efficient choices, contributing to the rising sales of smart thermostats.

The U.S. market for smart thermostat presents several growth opportunities as demand rises across both residential and commercial sectors. The integration of smart thermostats in HVAC systems for optimized energy management is creating demand in commercial spaces like office buildings, retail establishments, and hospitals. As consumers become more interested in sustainable living, the market is further expanding with opportunities to integrate smart thermostats into smart home ecosystems and eco-friendly building projects, particularly in rapidly urbanizing regions.

Manufacturers in the U.S. smart thermostat market is focusing on strategic initiatives to drive growth, including product innovation, partnerships, and expansion into new regions. Many companies are investing in developing user-friendly interfaces and compatibility with popular smart home platforms like Amazon Alexa and Google Assistant. Additionally, manufacturers are expanding their presence in emerging markets and collaborating with energy providers to offer integrated energy management solutions. This focus on enhancing functionality and accessibility is aimed at capturing a wider consumer base, ultimately driving market growth as smart thermostats become a more accessible and appealing option for energy-conscious consumers.

Technological advancements are shaping the future of the market, with innovations in AI, machine learning, and IoT playing a crucial role. Modern smart thermostats can now learn user preferences and automatically adjust temperatures for maximum comfort and efficiency. Advanced sensors and data analytics allow these devices to monitor indoor and outdoor conditions, further optimizing energy usage. Additionally, smart thermostats now offer enhanced connectivity, making it easier for users to control their home environment remotely through mobile apps. These innovations not only improve the functionality of smart thermostats but also make them more effective at reducing energy consumption, supporting their growth and popularity in the market.

Technology Insights

The Wi-Fi segment held a substantial share of the U.S. smart thermostat market in 2024, driven by the high demand for reliable and user-friendly smart home solutions. Wi-Fi-enabled thermostats offer the convenience of remote control, allowing users to adjust temperature settings from anywhere via mobile devices. This feature has resonated well with consumers, especially in residential spaces, as it provides both energy savings and enhanced comfort. Additionally, Wi-Fi smart thermostats often integrate smoothly with other smart home devices, which further strengthens their popularity and market share as part of the connected home ecosystem.

The others segment, which includes innovative connectivity options like Zigbee, Z-Wave, and Bluetooth, is witnessing significant growth. These alternative technologies are often preferred for their low power consumption and enhanced security, making them appeal for specific applications such as multi-family homes and commercial buildings. Furthermore, these technologies often support mesh networking, which allows for greater connectivity across devices in large or complex spaces. As the demand for smart solutions expands beyond the traditional home environment, these alternative technologies continue to grow, meeting the needs of diverse settings.

Product Insights

The connected segment commands a considerable market share in 2024, benefiting from a growing consumer interest in IoT-enabled devices. Connected smart thermostats, whether controlled through Wi-Fi or other connectivity options, offer seamless control through mobile applications, voice assistants, and automated schedules. This high level of integration appeals to consumers looking for streamlined, energy-efficient ways to manage indoor temperatures. With increasing smart home adoption and the rising awareness of energy savings, connected smart thermostats remain a top choice, holding a large portion of the market share.

The learning segment witness significant growth in the forthcoming years, driven by advancements in technology and increasing consumer demand for energy-efficient solutions. Learning thermostats are equipped with artificial intelligence and machine learning capabilities that automatically adjust heating and cooling settings based on user behavior and environmental factors. Thus, this adaptability enhances user convenience and offers significant energy savings, a major appeal for environmentally conscious consumers and households looking to reduce utility costs.

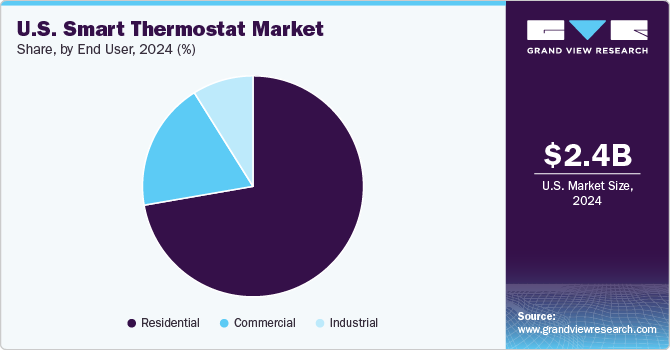

End User Insights

The residential segment occupied a significant market share in 2024, largely due to the increasing popularity of smart homes and energy-efficient devices among homeowners. Residential consumers are increasingly adopting smart thermostats to reduce their energy bills and contribute to a more sustainable lifestyle. These devices' easy integration with other smart home solutions, coupled with their ability to offer customized and automated temperature control, has made them particularly appealing for residential use. With rising consumer awareness about smart energy solutions, the residential segment is likely to maintain its leading position in the market.

The commercial segment is witnessing substantial growth, fueled by rising energy costs and the need for better energy management in commercial spaces. Businesses are investing in smart thermostats to monitor and control heating, ventilation, and air conditioning (HVAC) systems across multiple locations or large areas, helping reduce operational expenses. Furthermore, smart thermostats help businesses achieve sustainability goals by minimizing energy waste, which aligns well with the increasing push for green building standards. As companies seek to enhance both efficiency and environmental compliance, the commercial segment continues to expand robustly.

Country Insights

The U.S. smart thermostat industry, influenced by the country's strong technological advancement, well-established IoT ecosystem, and increasing consumer interest in smart home automation. American consumers are generally early adopters of new technology, which fuels the rapid integration of smart thermostats in homes and businesses. Environmental awareness and energy-saving incentives from both federal and state governments also encourage widespread adoption. Furthermore, the growing integration of smart thermostats with voice assistants and other IoT devices has made them an appealing choice in American households, which is driving the market growth.

Key U.S. Smart Thermostat Company Insights

Some of the key players operating in the market include Honeywell, Google Nest, and Ecobee. Honeywell enjoys a strong position in the industry owing to its broad portfolio of products and strong distribution networks.

-

Honeywell Home, a brand of Resideo Technologies, Inc., is a prominent market player, known for its reliable and energy-efficient home automation solutions. Honeywell Home’s offerings, such as the T10 Pro and T10+ Smart Thermostats, are ENERGY STAR certified and feature RedLINK 3.0 technology, enabling control over multiple indoor air quality systems. With a strong reputation in comfort, security, and energy management, Honeywell Home continues to innovate, integrating smart home technologies that provide convenience and sustainability for residential and light commercial users.

-

Johnson Controls is a leading provider of advanced building and energy management solutions, with a growing presence in the U.S. smart thermostat market. The company’s smart thermostats, including models within its GLAS range, leverage cutting-edge IoT technology and artificial intelligence to provide adaptive climate control and improved energy efficiency. Johnson Controls focuses on sustainable solutions that align with global green building initiatives, offering U.S. Smart Thermostat products that support both residential and commercial applications with enhanced connectivity, remote management, and compatibility with broader building automation systems.

Key U.S. Smart Thermostat Companies:

- Control4

- ecobee

- Emerson

- Google Nest

- Honeywell Home

- Johnson Controls

- Lux Products Corporation

- Resideo Technologies, Inc.

- Netatmo SA

- Siemens

- Vine Connected Corporation

Recent Developments

-

In February 2024, Carrier has introduced the Smart Thermostat, a cost-effective, connected 24V thermostat aimed for residential new construction builders and homeowners.

-

In April 2023, Resideo Technologies, Inc., a leading provider of home comfort and safety solutions, launched the Honeywell Home T10+ Smart Thermostat Kits. An upgrade to the popular ENERGY STAR certified Honeywell Home T10 Pro, the T10+ now includes RedLINK 3.0, allowing for simultaneous control of three types of indoor air quality (IAQ) equipment.

-

In May 2022, Ecobee has introduced its Smart Thermostat Premium and Smart Thermostat Enhanced, which elevate the Smart Thermostat category by enhancing comfort, home health, and security. Made with premium materials and advanced engineering, these models maintain ecobee’s reputation for energy savings while adding new features for sophisticated home climate control.

U.S. Smart Thermostat Market Report Scope

Report Attribute

Details

Market size in 2025

USD 2.68 billion

Revenue forecast in 2030

USD 6.00 billion

Growth rate

CAGR of 17.5% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, product, end user

Key companies profiled

Google Nest; Honeywell Home; ecobee; Emerson; Johnson Controls; Control4; Vine Connected Corporation; Resideo Technologies, Inc.; Netatmo SA; Tado GmbH; Siemens; Lux Products Corporation

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Smart Thermostat Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. Smart Thermostat market report based on technology, product, and end user:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Wi-Fi

-

ZigBee

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Connected

-

Standalone

-

Learning

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Frequently Asked Questions About This Report

b. The U.S. smart thermostat market size was estimated at USD 2.36 million in 2024 and is expected to reach USD 2.68 billion in 2025.

b. The U.S. smart thermostat market is expected to grow at a compound annual growth rate of 17.5% from 2025 to 2030 to reach USD 6.00 billion by 2030.

b. The Wi-Fi segment holds a substantial share in the U.S. smart thermostat market, driven by the high demand for reliable and user-friendly smart home solutions. Wi-Fi-enabled thermostats offer the convenience of remote control, allowing users to adjust temperature settings from anywhere via mobile devices. This feature has resonated well with consumers, especially in residential spaces, as it provides both energy savings and enhanced comfort.

b. Some of the key players operating in the Smart Glasses include Control4, ecobee, Emerson, Google Nest, Honeywell Home, Johnson Controls, Lux Products Corporation, Resideo Technologies, Inc., Netatmo SA, Siemens, and Vine Connected Corporation.

b. The growth of the U.S. smart thermostat market is driven primarily by the increasing demand for energy-efficient solutions and the rising adoption of smart home technology. As energy costs rise, consumers and businesses alike are seeking ways to reduce energy consumption, making smart thermostats an appealing choice for their potential to optimize energy use and lower utility bills. Additionally, smart thermostats align with the growing trend of IoT (Internet of Things) devices, allowing users to seamlessly control and integrate multiple smart devices for enhanced comfort and convenience. The push for eco-friendly solutions and energy-conscious behavior also supports the expansion of the U.S. Smart Thermostat market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.