U.S. Small Molecule Innovator API CDMO Market Size, Share & Trends Analysis Report By Stage Type (Preclinical, Clinical, Commercial), By Service, By Customer Type, By Therapeutic Area, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-297-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

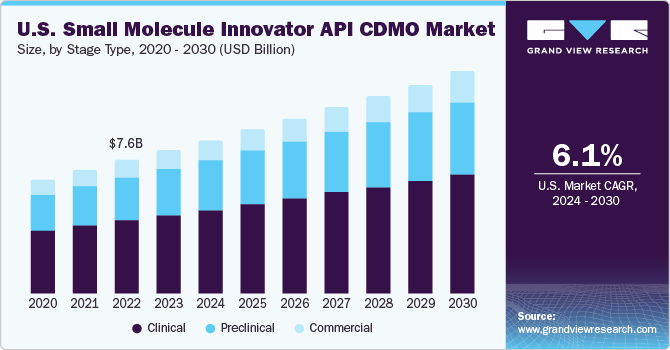

The U.S. small molecule innovator API CDMO market size was estimated at USD 8.80 billion in 2024 and is projected to grow at a CAGR of 6.0% from 2025 to 2030. Key growth drivers include rising outsourcing by pharmaceutical companies, demand for small-molecule drugs, and the number of clinical trials in the country. In addition, rising pharmaceutical R&D investment to expand the development of new small-molecule innovator APIs, increasing demand for novel therapies, and growing prevalence of cancer and age-related disorders are among the key factors driving the overall market growth.

The growing prevalence of rare diseases, the strong presence of well-established pharmaceutical companies, and the expansion of R&D and manufacturing facilities in the U.S. are some of the major factors expected to drive market growth over the forecast period. Moreover, the growing trend of drug discovery and emerging R&D activities are expected to boost market growth potential in the near future. For instance, in March 2023, Catalent, Inc. collaborated with Grunenthal for an oral dosage small molecule in Grunenthal’s pipeline. This collaboration strengthened the company’s operational capabilities in the U.S. market.

Small-molecule drugs continue to dominate the pharmaceutical drug development pipeline and approvals, thereby allowing several companies to prioritize the development of new small-molecule therapies to address a wide range of medical needs. As a result, there is a sustained demand for API CDMOs that can manufacture these active ingredients efficiently and cost-effectively, thereby accelerating industry demand. For instance, as per U.S. FDA data, in 2024, the U.S. FDA approved 50 novel drugs, representing a slight decline from the 55 approvals recorded in 2023. This represents the second-highest annual total in the past three decades. Among these, 31 were small molecules, accounting for 62% of the total approvals in 2024. Thus, an upsurge in the product pipeline & approvals is anticipated to bolster the overall market growth.

The pharmaceutical & biotechnology industries and CDMOs in the U.S. attract major investments owing to the increasing prevalence of cancer, cardiovascular diseases, respiratory diseases, infectious diseases, and several others is likely to create ample growth opportunities for CDMOs to develop new small-molecule innovator API drugs. Furthermore, several pharmaceutical companies and CDMOs are actively involved in mergers and acquisitions of small-scale companies to strengthen their service offerings, geographic presence, & operational capabilities. For instance, in March 2024, Bristol Myers Squibb acquired Karuna Therapeutics. This acquisition strengthened BMS’s Neuroscience Portfolio.

The growing R&D activities for small-molecule drugs have increased demand for contract development and manufacturing services, as pharmaceutical companies require specialized expertise, scalability, and cost efficiency. For instance, in September 2024, PCI Pharma Services, a prominent contract development and manufacturing organization, invested more than USD 365 million to expand its facilities in the U.S. and Europe. The initiative aims to enhance clinical trial supply management capabilities and large-scale commercial manufacturing. Through this investment, the company is focused on advanced drug delivery systems that improve treatment efficacy and patient convenience.

U.S. Tariff Impact & Strategic Opportunity Analysis

The imposition of U.S. tariffs on pharmaceutical imports particularly from key manufacturing economies such as China and India has significantly impacted the U.S. small molecule innovator API CDMO market. These tariffs have increased the cost of raw materials and intermediates, disrupting established supply chains and pushing U.S. based innovators to seek alternative sourcing strategies. As a result, domestic CDMOs are expected to witness a surge in demand, driven by biopharma companies reshoring API production to reduce geopolitical and cost-related risks.

This shifting trade landscape is also creating opportunities for U.S. CDMOs to capture greater market share by offering localized, tariff-free production. The market is witnessing increased investments in infrastructure expansion and capacity upgrades to meet growing demand. Moreover, innovators are prioritizing CDMOs with advanced capabilities in process development and regulatory compliance to accelerate timelines and mitigate tariff-related delays. While tariffs pose short-term cost challenges, they are also accelerating long-term structural shifts that favor U.S.-based API development and manufacturing service providers. This realignment supports domestic supply chain resilience, enhances reshoring initiatives, and strengthens the U.S. position in global pharmaceutical manufacturing.

Technological Advancements

The U.S. small molecule innovator API CDMO market is witnessing significant transformation driven by constant technological innovations, increasing complexity in drug development, heightened regulatory expectations, and a rising demand for accelerated time-to-market. Several CDMOs are increasingly adopting AI to enhance drug development efficiency. AI applications range from accelerating clinical trial processes to improving drug safety reporting and medical imaging analysis. For instance, AI can assist in early cancer detection by identifying abnormalities in X-rays that human eyes might overlook.

The industry is increasingly adopting digital technologies under the Pharma 4.0 initiative to enhance productivity and better address patient needs. This transformation aims to streamline drug development processes, improve cost-efficiency, and foster a more patient-centric approach, while maintaining stringent quality and regulatory compliance standards. Further, continuous manufacturing is gaining momentum, offering streamlined production with real-time monitoring and control of Critical Process Parameters (CPPs), aligned with Quality by Design (QbD) principles. CDMOs are utilizing Process Analytical Technology (PAT), multivariate data analysis (MVDA), and spectroscopic tools such as Near-Infrared (NIR) and Raman spectroscopy for enhanced process control and quality assurance.

High-throughput screening (HTS), including advanced assay formats, accelerates drug discovery and formulation optimization. Imaging techniques like NIR and Raman Chemical Imaging, paired with chemometrics, provide spatially resolved material insights. In analytical development, mass spectrometry (MS), including HRMS, tandem MS, and hyphenated techniques such as LC-MS, GC-MS, is pivotal for structural characterization, impurity profiling, and pharmacokinetics.

NMR spectroscopy across high-field, multi-nuclear, solid-state, and DNP-enabled variants offers deep structural insights, while hyphenated NMR platforms improve data productivity. Meanwhile, X-ray crystallography, boosted by synchrotron sources, serial techniques, and in situ methods, supports polymorph analysis and structure-based drug design. Collectively, these innovations enhance process efficiency, regulatory compliance, and the scientific consistency of API development in the U.S. small molecule innovator API CDMO industry.

Pricing Analysis

The small molecule innovator API CDMO market utilizes a variety of pricing models, each model customized to cater to specific project needs and client engagement levels. Fixed pricing is commonly used for projects widely used, especially for defined, short-term, or early-stage projects. This model offers predictability for sponsors while aligning compensation with progress for service providers. Value-based pricing is gaining popularity in high-impact areas like oncology or personalized medicine, where compensation is based on the outcome or perceived value of the service. Subscription or retainer models are increasingly adopted for long-term partnerships, giving sponsors recurring access to services or dedicated teams across multiple studies.

Market Concentration & Characteristics

The small molecule innovator API services market is experiencing rapid innovation and constant evolution to meet the growing demands for innovation, efficiency, and regulatory compliance. Significant advancements in lead optimization, formulation development, and process optimization have led to enhanced sensitivity and specificity of small molecules. For instance, integration of High-Throughput Screening (HTS) platforms to identify promising drug candidates, while continuous manufacturing systems streamline production processes, reducing variability and enhancing efficiency.

The U.S. small molecule innovator API CDMO market is witnessing a moderate degree of M&A activities. Strategic acquisitions to broaden service offerings such as large molecule bioanalysis, cell & gene therapy testing, and immunogenicity assays. For instance, in March 2024, Pace Analytical Services announced the acquisition of Lebanon, a laboratory facility in New Jersey from Curia. The acquisition aimed to support emerging drug development partners by providing rapid and expert development and commercial analytical laboratory services across the biopharma industry.

Continuous regulatory reforms are highly impacting the U.S. small molecule innovator API CDMO market by establishing stringent quality standards, approval processes, and manufacturing practices. Compliance with stringent U.S. FDA and cGMP guidelines to enhance product safety, efficacy, and market access, driving market demand. Regulatory complexities, such as intellectual property protection and environmental requirements, influence pharmaceutical companies to outsource development and manufacturing activities. While compliance costs may increase, they also foster innovation, create high barriers to entry, and offer opportunities for CDMOs with robust regulatory capabilities to secure long-term contracts with pharmaceutical innovators.

The U.S. small molecule innovator API CDMO market is characterized by increased demand for high-potency API (HPAPI) capabilities, regulatory-compliant cGMP facilities, and integrated development-to-commercialization services. CDMOs are expanding service portfolios through capacity additions, specialized containment settings, and continuous manufacturing technologies. Moreover, growing biotech pipelines, accelerated FDA pathways, and reshoring trends are driving service localization and innovation-focused partnerships, strengthening the U.S. as a key hub for small molecule innovator API development.

There is a strong presence of key market players in the U.S. These players are undertaking several strategies such as collaborations, partnerships, and acquisitions to broaden their geographical presence and enhance operational capabilities in the U.S. For instance, in October 2023, Cambrex Corporation concluded a USD 38 million-capacity expansion of its small molecule API manufacturing facility in North Carolina. This expansion resulted in a twofold increase in the facility’s manufacturing capacity. The facility included innovative analytical & chemical development laboratories, two additional clinical manufacturing suites, and the establishment of a small-scale commercial manufacturing operation featuring three work centers and 2,000 L reactors. Such strategic initiatives aimed to improve service offerings, accelerate time-to-market, and gain a competitive edge in the rapidly evolving small molecule innovator API services market.

Stage Type Insights

The clinical segment is further sub-segmented into Phase I, Phase II, and Phase III. The clinical segment dominated the market, accounting for 54.68% revenue share in 2024. The segment growth is driven by the growing small molecule product pipeline and the launch of novel drugs. For instance, Lonza stated that, small molecules represent the largest single drug class in the clinical phase, accounting for more than 50% of clinical pipelines. Furthermore, rapid advancements in structure-based design, prediction, imaging, Artificial Intelligence (AI), automation, and machine learning have become major enablers for small molecule-led optimization to increase speed and enhance success rates in pharmaceutical companies.

In clinical segment, the Phase III trials dominated the market in 2024. The segment growth is owing to increasing number of late-stage pipeline candidates and the rising outsourcing of complex API manufacturing by pharmaceutical firms. As clinical success rates improve, innovators rely on CDMOs with scalable capabilities, regulatory expertise, and rapid turnaround to meet commercialization timelines. Rising R&D investment and demand for accelerated cost-efficient development pathways for novel small molecule therapeutics are boosting segmental demand.

The commercial segment is anticipated to witness the fastest CAGR over the forecast period. The increasing demand for new small molecule innovator API in the pharmaceutical industry is driving commercial CDMOs to expand their capabilities, which is expected to boost the market. CDMOs help pharmaceutical companies comply with current Good Manufacturing Practices (cGMPs) and have capabilities that allow seamless scaling up of manufacturing from laboratory to commercial production, benefiting pharmaceutical/biotechnological manufacturers and consequently augmenting segment growth. For instance, in June 2024, Siegfried entered into a binding agreement with Curia Global to acquire an early-phase contract development and manufacturing organization (CDMO) facility in Grafton, Wisconsin, USA. This acquisition aims to enhance Siegfried's drug substance service offerings.

Service Insights

The contract manufacturing segment dominated in the U.S. small molecule innovator API CDMO market in 2024. The segment growth is due to rising demand for scalable, cost-efficient production. Biopharma and pharma companies increasingly outsource API manufacturing to CDMOs to focus on core R&D, reduce operational burden, and meet complex regulatory standards. In addition, growing pipeline of small molecule drugs, capacity expansions by CDMOs, and the need for GMP-compliant facilities are driving segment revenue growth.

On the other hand, the process development segment is witnessing considerable growth over the forecast period. The growing demand for robust, scalable, and cost-effective manufacturing solutions drives the segment growth. As pharmaceutical companies accelerate R&D for complex molecules, there is increased reliance on CDMOs for expertise in optimizing synthesis routes and improving yield. Additionally, regulatory emphasis on process validation and quality compliance boosts demand for integrated process development services, making it a critical value-added offering in early and late-stage drug development.

Customer Type Insights

The pharmaceutical segment dominated in the U.S. small molecule innovator API CDMO market in 2024. Some of the key factors contributing to growth are driven by rising demand for novel therapies and increasing outsourcing of R&D and manufacturing to enhance operational efficiency. Pharmaceutical companies rely on CDMOs to access advanced technologies, regulatory expertise, and scalable production. In addition, the shift toward specialty and orphan drugs, coupled with a strong pipeline of small molecule candidates, enhance pharmaceutical companies’ dependence on CDMOs for accelerated drug development and commercialization.

On the other hand, the biotechnology segment is witness considerable growth over the estimated period. The segment growth can be attributed to driven by substantial investments in novel small molecule drug discovery and early-stage development. Biotech firms, often lacking in-house manufacturing infrastructure, are increasingly outsourcing complex API development to CDMOs for speed, scalability, and regulatory expertise. Additionally, rising venture capital funding, a strong clinical pipeline, and strategic collaborations between biotech companies and CDMOs are accelerating demand, particularly for specialized capabilities in complex chemistry and high-potency API production.

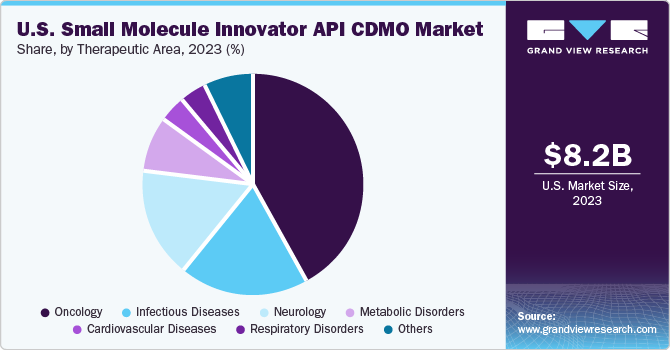

Therapeutic Area Insights

The oncology segment led the market with the largest revenue share in 2024 and is expected to grow at the fastest CAGR over the forecast period. The segment growth is owing to rising incidence of cancer, increased pharmaceutical R&D spending, and the growing demand for innovative oncology drugs. According to the Cancer Atlas, global cancer cases are projected to reach 29 million by 2040. Moreover, supportive government reimbursement policies and funding initiatives are fueling the development of small-molecule oncology therapies. For instance, in May 2023, PharmEnable secured a USD 7.5 million Pre-Series A investment to advance its pipeline of next-generation small-molecule drugs targeting high-need areas such as oncology and neurology. These developments are expected to propel market growth in the coming years.

The infectious diseases segment is anticipated to grow at the fastest CAGR over the analysis timeframe. The high segment growth is owing to the growing burden of bacterial, viral, and parasitic infections. Increased demand for novel therapies, accelerated by public health crises like SARS and COVID-19, is boosting R&D investment. Additionally, ongoing innovation in immunization and anti-infective drug development, along with strategic CDMO partnerships, facility expansions, and mergers, are boosting contract development & manufacturing demand across early and late phase clinical pipelines.

Country Insights

West Group Small Molecule Innovator API CDMO Market Trends

The West Group dominated the U.S. small molecule innovator API CDMO market with the largest revenue share of 33.07%in 2024. The West region is further subdivided into California, Washington, and the rest of the West Group. The strong presence of biopharma hubs in California and Washington drives the regional growth. This region benefits from advanced R&D infrastructure, a high concentration of pharmaceutical innovators, and proximity to top academic institutions and tech partners. Additionally, favorable state-level policies, strong venture capital investment, and a robust talent pool support continuous innovation, making the West zone a key contributor to market leadership and long-term growth.

The small molecule innovator API CDMO market in California held the largest share in West group in 2024, due to its robust pharmaceutical and biotechnology ecosystem, extensive R&D investments, and advanced manufacturing infrastructure. The state's concentration of CDMO facilities and proximity to leading academic institutions foster innovation and collaboration, driving demand for contract development and manufacturing services.

Midwest Small Molecule Innovator API CDMO Market Trends

The small molecule innovator API CDMO market in Midwest is expected to witness the fastest CAGR over the forecast period. The Midwest segment includes Illinois, Missouri, North Carolina, and the rest of the Midwest. Innovations in these regions are expected to drive the market. The growing demand for small molecule therapies, particularly in areas such as cardiovascular diseases, oncology, and metabolic disorders, has led to increased reliance on CDMOs in the region for cost-effective and high-quality solutions. For instance, in March 2024, W. R. Grace & Co. (Grace), Inc. announced the expansion chemical contract development and manufacturing (CDM) facility in Michigan. The expansion aimed to broadened the company’s capacity to develop new projects and increase its custom pharmaceutical service offerings, including solid-state chemistry, analytical development, validation, process chemistry, stability studies, and commercialization.

The Illinois small molecule innovator API CDMO market held the largest share in Midwest in 2024, driven by robust drug innovation and a surge in clinical trials. The state's strong pharmaceutical infrastructure and strategic collaborations have elevated demand for small molecule APIs. For instance, in March 2023, PCI Pharma Services announced a USD 50 million expansion at its sterile injectables site in Rockford, Illinois. The new facility featured over 20 customer suites equipped with multiformat machines for assembling and packaging vials, prefilled syringes, auto-injectors, and pen-cartridge combinations.

Northeast Small Molecule Innovator API CDMO Market Trends

The small molecule innovator API CDMO market in Northeast held a significant share in 2024. The Northeast segment includes New Jersey, New York, and the rest of the Northeast. This region features a significant concentration of both established pharmaceutical companies and emerging biotech firms, making it a key area for research and production of active pharmaceutical ingredients (APIs). CDMOs in the Northeast offer a comprehensive range of services, including process development, analytical testing, scale-up, and regulatory support.

The New Jersey small molecule Innovator API CDMO market held the largest share in 2024. New Jersey is one of the key U.S. states in terms of pharmaceutical workforce. For instance, in January 2024, Enzene Biosciences, a subsidiary of Alkem Labs, launched a manufacturing site in New Jersey. The company aims to become a CDMO partner for U.S. pharma & biotech firms, helping them bring promising molecules to market.

South Small Molecule Innovator API CDMO Market Trends

The small molecule innovator API CDMO market in south held a significant share in 2024. The south region includes Texas, Florida, Georgia, and the rest of the south. The regional growth is primarily driven by a favorable business environment, a skilled workforce, and a strong presence of pharmaceutical companies. The region's robust infrastructure and accessibility to key resources make it an attractive location for companies looking to develop and produce APIs.

The Georgia small molecule Innovator API CDMO market held the largest share in South in 2024. The revenue growth is driven by its robust biopharma infrastructure and strategic location. The state hosts numerous contract research and manufacturing organizations, facilitating end-to-end drug development and production. Additionally, Georgia's supportive business environment and access to a skilled workforce further enhance its appeal as a hub for pharmaceutical manufacturing and innovation in the U.S.

Key U.S. Small Molecule Innovator API CDMO Company Insights

The key industry players operating across the U.S. market are adopting inorganic strategic initiatives such as partnerships, mergers, and acquisitions. The strategies companies adopt are mergers & acquisitions, service launches, partnerships & agreements, expansions, and others to gain a competitive edge in the significant market. For instance, in June 2024, Formosa Laboratories completed the acquisition of Synchem Inc., a prominent contract research laboratory in the U.S. This acquisition expanded company’s geographical presence in the U.S.

Key U.S. Small Molecule Innovator API CDMO Companies:

- Lonza

- Novo Holdings (Catalent, Inc.)

- Thermo Fisher Scientific, Inc.

- Siegfried Holding AG

- Recipharm AB

- CordenPharma International

- Samsung Biologics

- Labcorp

- Ajinomoto Bio-Pharma Services

- Piramal Pharma Solutions

- Jubilant Life Sciences (Jubilant Biosys Limited)

Recent Developments

-

In December 2024, API Innovation Center (APIIC) announced its partnership with Sentio BioSciences for development and production of two important pharmaceutical ingredients in the U.S. This partnership aimed to strengthen production of critical medicines and cater high drug demand in the U.S.

-

In December 2024, Novo Holdings A/S completed the acquisition of Catalent Inc. This acquisition enabled Novo Holdings to diversify its service portfolio, offering a broader range of capabilities in drug development, manufacturing, and commercialization. The move strengthens its position in the biopharmaceutical industry and enhances its ability to support clients across various therapeutic areas.

-

In August 2024, Lonza has added clinical bottling and labeling capabilities in its small molecules facility in Bend, Oregon. This expansion aimed to support for customers working on early-stage development.

U.S. Small Molecule Innovator API CDMO Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 9.41 billion |

|

Revenue forecast in 2030 |

USD 12.60 billion |

|

Growth rate |

CAGR of 6.0% from 2025 to 2030 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Stage type, service, customer type, therapeutic area, region |

|

Regional scope |

Northeast; Midwest; West Group; South |

|

State scope |

New Jersey; New York; Massachusetts; Illinois; Missouri; North Carolina; California; Washington; Texas; Florida; Georgia |

|

Key companies profiled |

Lonza Group Ltd.; Novo Holdings (Catalent, Inc.); Thermo Fisher Scientific, Inc.; Siegfried Holding AG; Recipharm AB; CordenPharma International; Samsung Biologics; Labcorp; Ajinomoto Bio-Pharma Services; Piramal Pharma Solutions; Jubilant Life Sciences (Jubilant Biosys Limited) |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Small Molecule Innovator API CDMO Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. small molecule innovator API CDMO market report based on stage type, service, customer type, therapeutic area, and region:

-

Stage Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Preclinical

-

Clinical

-

Phase I

-

Phase II

-

Phase III

-

-

Commercial

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Process Development

-

Preclinical Development

-

Clinical Development

-

Scale-up Optimization

-

-

Contract Manufacturing

-

Clinical

-

Commercial

-

-

Analytical Testing and Quality Control

-

Packaging and Supply Chain Solutions

-

Others

-

-

Customer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical

-

Small

-

Medium

-

Large

-

-

Biotechnology

-

Small

-

Medium

-

Large

-

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular Diseases

-

Oncology

-

Respiratory Disorders

-

Neurology

-

Metabolic Disorders

-

Infectious Diseases

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Northeast

-

New Jersey

-

New York

-

Massachusetts

-

-

Midwest

-

Illinois

-

Missouri

-

North Carolina

-

-

West Group

-

California

-

Washington

-

-

South

-

Texas

-

Florida

-

Georgia

-

-

Frequently Asked Questions About This Report

b. The U.S. small molecule innovator API CDMO market size was estimated at USD 8.80 billion in 2024 and is expected to reach USD 9.41 billion in 2025.

b. The U.S. small molecule innovator API CDMO market is expected to grow at a compound annual growth rate of 6.01% from 2025 to 2030 to reach USD 12.60 billion by 2030.

b. The clinical segment dominated the U.S. small molecule innovator API CDMO market, with a share of 54.68% in 2024. The segment's growth is owing to rising early-phase R&D activity, demand for rapid scale-up, and outsourcing preference by small to mid-sized pharmaceutical companies. In addition, CDMOs offering integrated development, regulatory support, and flexible batch production are crucial partners in accelerating timelines, managing costs, and navigating complex clinical trial requirements.

b. Some key players operating in the U.S. small molecule innovator API CDMO market include Lonza Group Ltd., Novo Holdings (Catalent, Inc.), Thermo Fisher Scientific, Inc., Siegfried Holding AG, Recipharm AB, CordenPharma International, Samsung Biologics, Labcorp, Ajinomoto Bio-Pharma Services, Piramal Pharma Solutions, and Jubilant Life Sciences (Jubilant Biosys Limited).

b. Key factors that are driving the market growth include increasing demand for complex and high-potency APIs, accelerated drug development timelines, stringent regulatory requirements, and a growing preference for outsourcing among pharmaceutical innovators. Technological advancements, rising focus on quality and compliance, and the need for scalable, cost-efficient manufacturing solutions further boost the overall market growth and strategic CDMO partnerships.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."