- Home

- »

- Advanced Interior Materials

- »

-

U.S. Small Caliber Ammunition Market, Industry Report 2030GVR Report cover

![U.S. Small Caliber Ammunition Market Size, Share & Trends Report]()

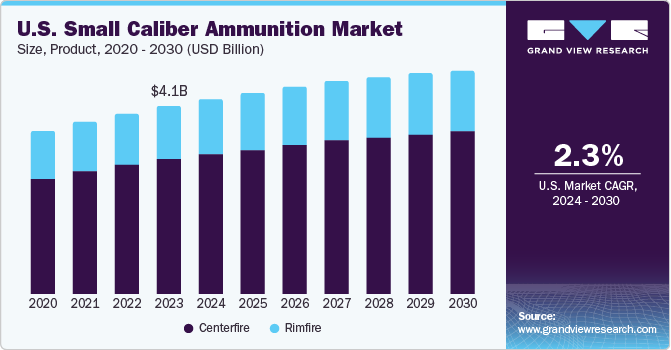

U.S. Small Caliber Ammunition Market (2024 - 2030) Size, Share & Trends Analysis Report By Caliber (5.56mm, 7.62mm, 9mm), By Product (Rimfire, Centerfire), And Segment Forecasts

- Report ID: GVR-4-68040-305-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Small Caliber Ammunition Market Trends

The U.S. small caliber ammunition market size was estimated at USD 4.05 billion in 2023 and is projected to grow at a CAGR of 2.3% from 2024 to 2030. The rising demand for small-caliber ammunition in the U.S. is predominantly influenced by the imperative requirement for personal safety, engagement in shooting sports, and participation in hunting activities. This encompasses the utilization of ammunition in handguns, shotguns, and rifles across various applications. Ammo.com, which operates as an e-commerce platform and wholesaler specializing in ammunition, in its report states that in 2023, 32% of the American population owned at least one firearm, with firearm ownership experiencing a 6.7% growth from 2017 to 2023.

The growth of the shooting sports sector has positively influenced the market growth. The increased involvement in shooting competitions, training courses, and recreational shooting activities has significantly boosted the demand for the utilized ammunition. In 2022, the NSSF, a significant representative of The Firearm Industry Trade Association, surveyed Sport Shooting Participation in the U.S. The survey revealed a 24.1% surge in adult engagement in sports shooting from 2009 to 2022. Notably, handgun target shooting at 16.9%, rifle target shooting at 15.6%, and outdoor range target shooting at 13.3% emerged as the top choices for recreational sports shooting among adults.

Government initiatives promoting firearm safety awareness and training programs contribute to the market’s growth. These programs create awareness about personal safety and security, leading to an increased interest in firearms for civil and commercial purposes. For instance, in January 2024, The Biden-Harris Administration introduced fresh executive measures to advance the secure storage of firearms, aligning with President Biden's Executive Order on promoting safe gun storage. Safe firearm storage acts as a physical barrier that restricts youth access to guns, contributing to the safety of young individuals, schools, and communities by preventing gun violence. These actions aim to diminish gun violence and enhance the protection of the communities.

The availability of small-caliber ammunition through various distribution channels, including retail shops and online stores, has made it more accessible to consumers. The convenience of purchasing ammunition from a wide range of brands and calibers online has contributed to the market's growth by catering to the needs of different customer segments. The ease of access and variety provided by online purchasing have significantly contributed to the market's growth by meeting the diverse needs of consumers in the ammunition sector. The U.S. government's investment in defense capabilities plays a significant role in boosting the demand for small-caliber ammunition. For Instance, in 2023, the U.S. military spending reached USD 1.537 trillion, which is more than twice the projected level.

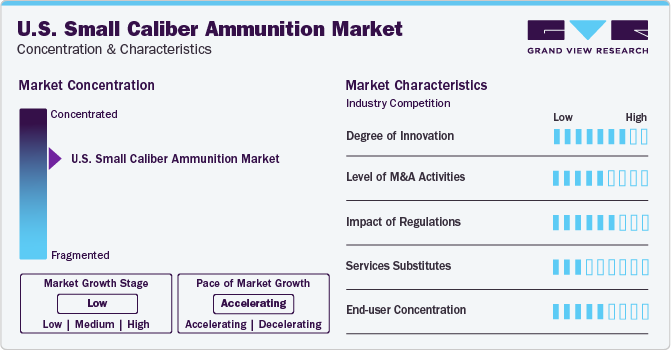

Market Concentration & Characteristics

The industry stage growth is low and the pace of its growth is accelerating. The market is characterized by a high degree of innovation owing to continuous technological advancements, such as improved materials, ballistics, and manufacturing processes, which have enabled the development of more efficient and effective ammunition designs. The market's growth potential, including opportunities, such as ammunition recycling, remanufacturing, and ammunition stockpiling, encourages manufacturers to invest in research and development for inventive solutions that enhance precision, terminal performance, and environmental sustainability.

The level of mergers and acquisitions (M&A) activity in the industry is moderate. For instance, in December 2022, Czechoslovak Group (CSG) completed notable, including the purchase of Fiocchi Munizioni, a renowned small-caliber ammunition manufacturer with production sites in the UK, the U.S., and Italy. Fiocchi Munizioni specializes in crafting high-quality small-caliber ammunition for shooting sports, hunting, and law enforcement. This acquisition led to the creation of a new division within CSG dedicated to small-caliber ammunition, CSG Ammo+.

The market is subject to strict regulations. The manufacturing, distribution, and use of ammunition are closely monitored to ensure safety, security, and accountability in the industry. These regulations are overseen by the government to regulate firearms and ammunition practices. There is a growing focus on gun control measures to reduce gun-related incidents, such as accidents, violence, and fatalities. This may lead to even stricter regulations in the future, which could make obtaining licensed rifles more complicated. The primary federal agency responsible for regulating firearms and ammunition, including small-caliber ammunition, is the Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF).

Product Insights

The centerfire segment accounted for the largest revenue share in 2023 and is expected to grow at the fastest CAGR from 2024 to 2030 due to its compatibility with a wide range of firearms, including military, police, and security forces weapons systems. This category is known for its ability to withstand high pressure and is used in various applications, which contributes to its dominance in the market. In addition, centerfire cartridges have thicker metal casing, which makes them more durable and suitable for rough handling without significant damage. This factor makes them particularly useful in military operations where reliability is crucial.

The centerfire ammunition is a preferred choice for shooters looking for enhanced performance. In January 2024, Federal Premium Ammunition introduced a new line of centerfire rifle ammunition featuring the all-new Federal Fusion Tipped design. This innovative design maintains the excellent terminal performance of the original bonded soft points but incorporates a polymer tip. The addition of the polymer tip serves to enhance the ballistic coefficient, resulting in flatter trajectories, increased energy, improved accuracy, and extended effective range for shooters. This new Federal Fusion Tipped ammunition is set to offer shooters a significant upgrade in performance and versatility, catering to those looking for enhanced ballistic characteristics without compromising on terminal effectiveness. With this latest development, Federal Premium aims to meet the evolving needs and expectations of modern shooters who demand both precision and reliability from their ammunition choices.

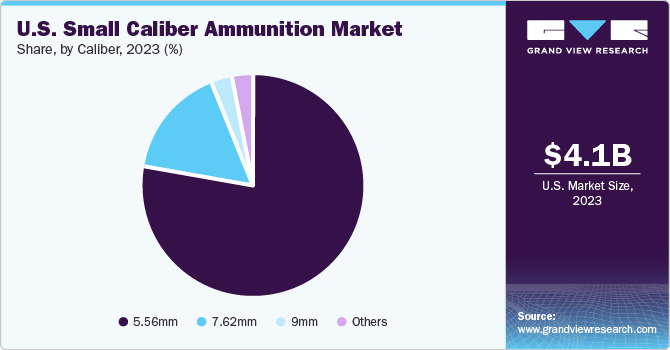

Caliber Insights

The 5.56mm caliber segment accounted for the largest revenue share of 77.8% in 2023 and is expected to register the fastest CAGR from 2024 to 2030. The 5.56mm caliber has been widely adopted by military forces around the world, including the U.S. Armed Forces. For instance, in April 2019, The U.S. army purchased small-caliber ammunition, including 5.56mm, 7.62mm, and Cal. 50 cartridges. This order was placed through Northrop Grumman's subsidiary, Alliant Techsystems Operations LLC, as part of a supply contract to manufacture small-caliber ammunition for the U.S. government. Northrop Grumman has been a crucial supplier of small-caliber ammunition for the U.S. Department of Defense.

Its standardization as a NATO round has significantly contributed to its prevalence in military applications. The 5.56mm cartridge offers a balance between range, accuracy, and recoil, making it suitable for various applications ranging from close-quarters combat to medium-range engagements. Its versatility has made it a preferred choice for military and civilian shooters. In addition to military use, the 5.56mm caliber is also popular among civilian gun owners for sporting and recreational shooting activities. The widespread availability of firearms chambered in 5.56mm further boosts its market share.

Key U.S. Small Caliber Ammunition Company Insights

Some of the key players in the market include Northrop Grumman., Visa Outdoor Operations LLC, Olin Corporation, Nammo AS, and FN HERSTAL.

-

Northrop Grumman’s services span a broad spectrum of aerospace and defense technologies, ranging from engineering and testing to radar systems development and integration. The company’s offerings are designed to address the complex needs of its customers in the military, government, and commercial sectors

-

FN Herstal is a company that specializes in designing, developing, manufacturing, and selling small-caliber firearms and associated ammunition. The company offers a unique range of innovative defense and security solutions centered on small arms and ammunition. These products are primarily intended for military, law enforcement, and special forces sales, subject to export licenses/permits

Key U.S. Small Caliber Ammunition Companies:

- FN HERSTAL

- Hornady

- Nammo AS

- Northrop Grumman

- Olin Corp.

- Remington Ammunition

- Rosoboronexport

- Sierra Bullets

- Visa Outdoor Operations LLC

- Winchester Ammunition

Recent Developments

-

In February 2024, the Sporting Products Business of Vista Outdoor was acquired by the Czechoslovak Group for USD 1.91 billion. This move will help the Czechoslovak Group broaden its selection of ammunition products by including popular brands, such as Federal, CCI, HEVI-Shot, Remington, and Speer. Vista Outdoor Inc. is a significant contender in the production of ammunition for commercial and law enforcement sectors in the United States, with expertise in all areas of ammunition production

-

In January 2020, Olin Corporation was awarded a U.S. Army contract modification worth over USD 75.7 million for the production of 5.56mm, 7.62mm, and .50 caliber ammunition.This contract modification is part of ongoing efforts to fulfill the U.S. Army’s ammunition needs and enhance its capabilities

U.S. Small Caliber Ammunition Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 4.8 billion

Growth rate

CAGR of 2.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Caliber, product

Key companies profiled

Northrop Grumman; Visa Outdoor Operations LLC; Olin Corp..; Nammo AS; FN HERSTAL; Hornady, Rosoboronexport; Sierra Bullets; Winchester Ammunition; Remington Ammunition

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Small Caliber Ammunition Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. small caliber ammunition market report based on caliber, and product:

-

Caliber Outlook (Revenue, USD Million, 2018 - 2030)

-

5.56mm

-

7.62mm

-

9mm

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Rimfire

-

Centerfire

-

Frequently Asked Questions About This Report

b. The U.S. small caliber ammunition market was valued at USD 4.05 billion in 2023.

b. The U.S. small caliber ammunition market is projected to grow at a compound rate (CAGR) of 2.3% from 2024 to 2030 to reach USD 4.8 billion by 2030.

b. The 5.56mm caliber segment accounted for the largest revenue share of 77.8% in 2023 and is growing fastest over the forecast period. The 5.56mm caliber has been widely adopted by military forces worldwide, including the U.S. Armed Forces.

b. Some of the key players in the market include Northrop Grumman., Visa Outdoor Operations LLC, Olin Corporation., Nammo AS, and FN HERSTAL.

b. The rising demand for small caliber ammunition in the U.S. is predominantly influenced by the imperative requirement for personal safety, shooting sports engagement, and hunting activities. This encompasses the utilization of ammunition in handguns, shotguns, and rifles across various applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.