U.S. Sludge Thickening And Dewatering Equipment Market Size, Share & Trends Analysis Report By Equipment (Sludge Thickening Equipment, Eye Protection) By Application (Municipal, Industrial), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-492-7

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Market Size & Trends

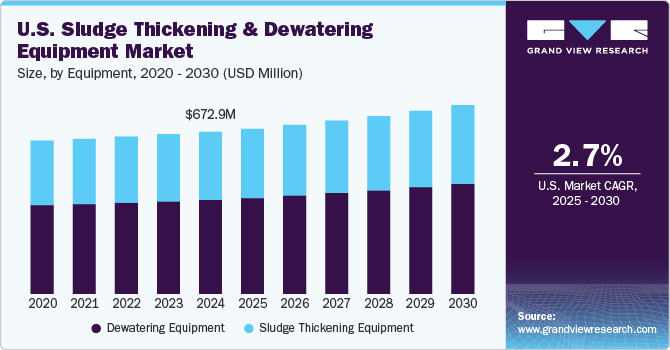

The U.S. sludge thickening and dewatering equipment market size was estimated at USD 672.9 million in 2024 and is anticipated to grow at a CAGR of 2.7% from 2025 to 2030. Increasing government initiatives aimed at enhancing access to clean drinking water are significantly fueling the demand for sludge thickening and dewatering equipment across the U.S. As concerns about water quality and effective wastewater treatment intensify, federal and state authorities are launching comprehensive upgrades to infrastructure to ensure safe drinking water for all, which will positively impact the growth of market.

Continuous advancements in sludge thickening and dewatering technology such as automated processes, improved materials, and energy-efficient systems are driving the industry growth. Moreover, the need to meet stricter environmental regulations and ensure safe sludge disposal further boosts the adoption of these technologies to improve water treatment operations and reduce environmental impact.

Drivers, Opportunities & Restraints

The growing population in the U.S. is significantly driving the demand for sludge thickening and dewatering equipment as the need for efficient wastewater treatment increases. As more people generate wastewater, municipalities are tasked with managing larger volumes of sludge. This results in a greater demand for advanced sludge treatment technologies, including thickening and dewatering systems, to handle the increased waste efficiently.

The installation and integration of advanced sludge treatment equipment can take years to complete due to the complexity of wastewater treatment processes and the necessary infrastructure upgrades. Furthermore, the ongoing maintenance and operational costs associated with sludge thickening and dewatering systems add another layer of financial burden. These factors restrain market growth.

As environmental concerns grow, municipalities and industries are increasingly focusing on sustainable practices, including recovering valuable resources from wastewater sludge. This awareness is pushing wastewater treatment facilities to adopt more advanced technologies that not only manage sludge but also extract useful materials, such as biogas, fertilizers, and phosphorous, which can be reused or repurposed.

Equipment Insights

Dewatering equipment was the dominant technology segment in 2024. Dewatering equipment is widely utilized to reduce sludge volume and enhance water recovery in industrial and municipal wastewater treatment facilities. In addition, advancements such as improved automation and control systems enhance the operational efficiency of dewatering equipment, enabling precise monitoring of parameters to optimize performance. The above factors are expected to positively influence the growth of the U.S. dewatering equipment market.

The sludge thickening equipment segment accounted for 42.0% of the revenue share in 2024 owing to the increasing need for efficient sludge management solutions to reduce volume and enhance solid concentration.

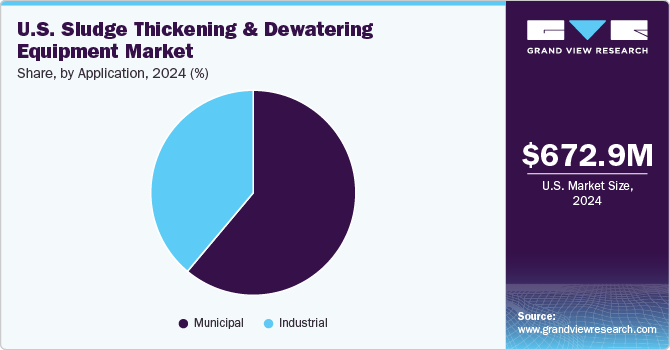

Application Insights

The industrial segment includes a diverse range of industries, including manufacturing, food processing, chemical production, and oil refining, among others. These industries generate significant quantities of sludge as a byproduct of their production processes, presenting unique challenges and opportunities for effective management and disposal. One of the key drivers of the industrial segment is the growing emphasis on environmental sustainability and regulatory compliance within the industrial sector.

The municipal segment accounted for 61.1% of the revenue share in 2024. The municipal segment is a vital component in the expansion of the U.S. market. Local governments are investing in advanced technologies to enhance the treatment processes and reduce the volume of sludge generated. Regulatory requirements aimed at improving environmental sustainability and public health are further leading to a rise in the adoption of innovative sludge thickening and dewatering equipment in this segment.

Key U.S. Sludge Thickening And Dewatering Equipment Company Insights

Some players operating in the industry include Alfa Laval Inc. and HUBER Technology Inc.

-

Alfa Laval Inc. specializes in providing innovative and sustainable solutions for a variety of industries, including energy, environmental, food and beverage, marine, chemical, and wastewater treatment. With a presence in over 100 countries, the company operates production facilities, service centres, and research and development hubs around the world.

-

HUBER Technology Inc. specializes in the design, manufacturing, and service of equipment used in the treatment of municipal and industrial wastewater, as well as in industrial processes. It provides advanced sludge dewatering technologies, such as belt presses, centrifuges, and drying systems.

Key U.S. Sludge Thickening And Dewatering Equipment Companies:

- Alfa Laval Inc.

- HUBER Technology Inc.

- OVIVO

- Jernbro

- ALUMICHEM

- Esmil Corp

- ANDRITZ

- JWC Environmental

- Hiller Separation & Process GmbH

- Ecologix Environmental Systems, LLC

Recent Developments

-

In September 2024, Esmil Corp. introduced the JD Roller Press, a solution for dewatering abrasive and fibrous sludge. Manufactured in the U.S.A. at Esmil’s Akron, Ohio facility, this state-of-the-art equipment adheres to ASME standards and complies with the Buy American, Build America (BABA) policy, highlighting the company’s dedication to quality and domestic production.

-

In September 2023, ANDRITZ launched decanter centrifuges specifically designed for demanding industrial oil recovery applications. These robust and long-lasting machines are constructed with high-quality materials, including ceramic and tungsten carbide deposition tiles and nozzles to resist erosion. Furthermore, they come with the option for additional coating through flame deposition techniques when required.

U.S. Sludge Thickening And Dewatering Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 685.8 million |

|

Revenue forecast in 2030 |

USD 783.6 million |

|

Growth rate |

CAGR of 2.7% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Equipment, end use |

|

Key Companies |

Alfa Laval Inc.; HUBER Technology Inc.; OVIVO; Jernbro; ALUMICHEM; Esmil Corp.; ANDRITZ; JWC Environmental; Hiller Separation & Process GmbH; Ecologix Environmental Systems, LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Sludge Thickening And Dewatering Equipment Market Report Segmnetation

This report forecasts revenue growth at country level and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. sludge thickening and dewatering equipment market report based on the equipment and end use:

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Sludge Thickening Equipment

-

Gravity Belt

-

Rotary Drum

-

Dissolved air flotation (DAF)

-

Decanter Centrifuge

-

-

Dewatering Equipment

-

Decanter Centrifuge

-

Belt Filter Press

-

Plate & Frame Filter Press

-

Screw Press

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Municipal

-

Sludge Thickening Equipment

-

Gravity Belt

-

Rotary Drum

-

Dissolved air flotation (DAF)

-

Decanter Centrifuge

-

-

Dewatering Equipment

-

Decanter Centrifuge

-

Belt Filter Press

-

Plate & Frame Filter Press

-

Screw Press

-

-

-

Industrial

-

Sludge Thickening Equipment

-

Gravity Belt

-

Rotary Drum

-

Dissolved air flotation (DAF)

-

Decanter Centrifuge

-

-

Dewatering Equipment

-

Decanter Centrifuge

-

Belt Filter Press

-

Plate & Frame Filter Press

-

Screw Press

-

-

-

Frequently Asked Questions About This Report

b. The U.S. sludge thickening and dewatering equipment market size was estimated at USD 672.9 million in 2024 and is expected to reach USD 685.8 million in 2025.

b. The U.S. sludge thickening and dewatering equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 2.7% from 2025 to 2030 to reach USD 783.6 million by 2030.

b. The municipal segment dominated the market in 2024 accounting for 61.1% of the overall revenue share. As municipal wastewater plants face increasing pressure to meet environmental standards and sustainability goals, the demand for more efficient and eco-friendly sludge thickening & dewatering technologies is rising.

b. Some of the key players operating in the U.S. sludge thickening and dewatering equipment market are Alfa Laval Inc., HUBER Technology Inc., OVIVO, Jernbro, ALUMICHEM, Esmil Corp., ANDRITZ, JWC Environmental, Hiller Separation & Process GmbH, and Ecologix Environmental Systems, LLC

b. The key factors driving the U.S. sludge thickening and dewatering equipment market include the increasing emphasis on wastewater treatment and the growing need for effective solids management in various industries. Additionally, advancements in technology and regulatory frameworks supporting environmental sustainability are also significant contributors.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."