- Home

- »

- Clothing, Footwear & Accessories

- »

-

U.S. Skiing And Snowboarding Market, Industry Report 2030GVR Report cover

![U.S. Skiing And Snowboarding Market Size, Share & Trends Report]()

U.S. Skiing And Snowboarding Market (2024 - 2030) Size, Share & Trends Analysis Report By Sport (Skiing, Snowboarding), By Product (Apparel, Footwear, Equipment), By Price Range (Mass, Premium), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-316-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Skiing And Snowboarding Market Trends

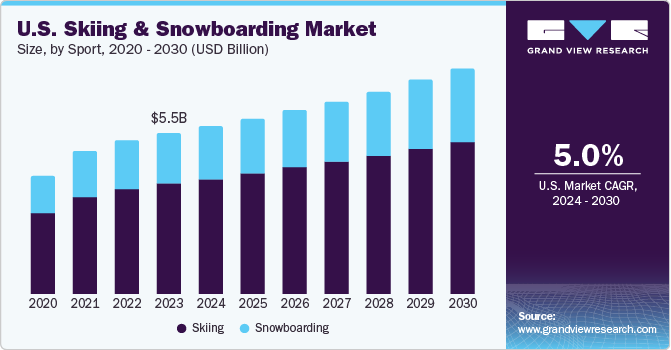

The U.S. skiing and snowboarding market size was estimated at USD 5.53 billion in 2023 and is expected to grow at a CAGR of 5.0% from 2024 to 2030. The rising prevalence of snow sports tournaments, competitions, and events is anticipated to have a notable effect on sales of skiing and snowboarding goods throughout the U.S. Such events serve as platforms for athletes and enthusiasts to demonstrate their abilities, attract sizable audiences, and generate increased interest in specialized skiing and snowboarding equipment.

National Governing Bodies (NGBs) of ski and snowboarding sports in the U.S. play a crucial role in organizing and administrating ski events at local competitions and international championships. In May 2022, U.S. Ski & Snowboard, the National Governing Body (NGB) for Olympic snowboarding and skiing in the U.S., announced that the International Ski Federation (FIS) granted provisional approval for the U.S. to host four Audi FIS Alpine Ski World Cup events during the 2022-23 season. This approval resulted in twice the number of Alpine World Cup events held in the U.S. compared to previous years. The 2022-23 FIS World Cup was scheduled on May 25th during the annual FIS Congress. Organizations spearheading such initiatives are instrumental in increasing participant numbers, thereby fueling the demand for ski and snowboarding products in the country.

Moreover, rising interest in winter sports such as skiing and snowboarding in the U.S. is driving the market demand. Similarly, the growing number of ski resorts and winter tourism destinations contributes to increased demand for skiing and snowboarding goods. Expansion and development of resorts, coupled with marketing efforts to attract visitors, are boosting the sales of skiing and snowboarding goods as more people seek out these experiences. Nowadays, sports organizations and government bodies are revitalizing their efforts through partnerships and collaborations with specialty retailers in outdoor sports gear and apparel. These initiatives aim to add new products to the existing product lineups to cater to the evolving demand for outdoor winter sports activities such as skiing and snowboarding in the U.S.

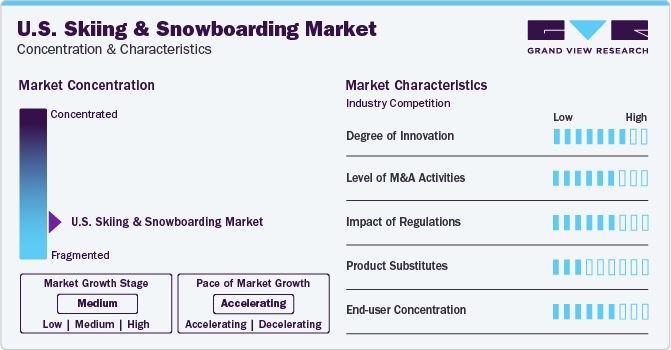

Market Concentration & Characteristics

The U.S. skiing and snowboarding market exhibits a high degree of innovation, illustrated by advancements such as Burton's Step On bindings, which streamline the process of securing boots to boards, and Rossignol's use of AI-powered designs to enhance ski performance. Smart equipment like PIQ ROBOT’s ski sensors provide real-time performance analytics, enhancing training and safety. Sustainability initiatives are evident in brands like Patagonia, which produces gear from recycled materials, and resorts like Aspen Snowmass, which implements energy-efficient snowmaking and solar power.

Regulations significantly impact the skiing and snowboarding market in the U.S. by ensuring safety, environmental sustainability, and operational standards. Safety regulations mandate the use of helmets and other protective gear, contributing to a decrease in injury rates among skiers and snowboarders. Environmental regulations, such as those enforced by the Environmental Protection Agency (EPA), require resorts to implement eco-friendly practices, like energy-efficient snowmaking, waste management, and water conservation, seen at resorts such as Aspen Snowmass and Park City.

Mergers and acquisitions have significantly reshaping the market positions as the key players are striving for business expansion and forcusing on enhancement of consumer offerings. Notable examples include Vail Resorts' acquisitions of Whistler Blackcomb and several other resorts, which have expanded its market presence and introduced the Epic Pass, providing skiers access to a wide range of destinations. Similarly, Alterra Mountain Company's creation through the merger of Intrawest, Mammoth Resorts, and Squaw Valley Ski Holdings led to the development of the Ikon Pass, offering access to multiple top-tier resorts. These strategic consolidations enable companies to achieve economies of scale, streamline operations, and offer enhanced value and variety to customers, fostering a more competitive and dynamic market landscape.

End-user concentration in the U.S. skiing and snowboarding market is characterized by a diverse demographic, with a notable focus on the affluent and active lifestyles of consumers. The market caters predominantly to middle to high-income individuals, families, and adventure enthusiasts who are willing to invest in premium experiences, equipment, and travel.

Sport Insights

The skiing market accounted for a revenue share of over 68% in 2023. The increasing demand for ski areas reflects a growing appreciation for outdoor recreation opportunities and health and wellness trends. These factors contribute to the popularity of skiing and snowboarding as a winter activity and drive the demand for ski areas as destinations for leisure and enjoyment. The National Ski Areas Association (NSAA) observed an increase in the number of ski areas in operation during the 2022-23 season compared to the previous season, as reported by the Kottke National End-of-Season Survey. Specifically, 480 ski areas were operating during the 2022-23 season, representing a rise from the 473 ski areas reported during the 2021-22 season. The expansion of ski areas has strengthened participation and interest in skiing activities, consequently boosting the demand for skiing goods.

The U.S. snowboarding market is projected to grow at a CAGR of 5.4% from 2024 to 2030. the rising participation in snowboarding has further propelled the growth of the market over the forecast period. According to the Snowsports Industries America report in 2018, there were 7.1 million participants in snowboarding sports in the U.S., which further increased to 7.6 million in 2020. Popular snowboarding apparel brands include Burton, Volcom, and Oakley. Burton, for instance, offers a range of snowboarding jackets and pants, as well as base layers and other accessories. Its AK Gore-Tex Cyclic Jacket is a popular choice among snowboarders for its durability and waterproofing, while the AK Gore-Tex Swash Pant provides a comfortable and functional fit for riders.

Product Insights

The U.S. skiing and snowboarding equipment accounted for a revenue share of over 46% in 2023. Innovations in equipment design, such as lightweight materials, enhanced durability, and smart technology integration, attract enthusiasts seeking improved experiences on the slopes. Rising participation rates, fueled by the popularity of winter sports among younger generations and the expansion of ski resorts, boost demand for new gear. Additionally, heightened awareness of safety drives the adoption of advanced protective gear, like helmets and avalanche beacons.

The U.S. skiing and snowboarding apparel market is projected to grow at a CAGR of 5.2% from 2024 to 2030. The market is driven by technological innovations, fashion trends, and growing consumer awareness of environmental sustainability. Advances in fabric technology, such as moisture-wicking, breathability, and enhanced insulation, improve comfort and performance, making high-tech apparel highly desirable among enthusiasts. Fashion trends also play a significant role, with stylish and functional designs appealing to both serious athletes and casual participants.

Price Range Insights

Mass products accounted for a share of over 68% of the U.S. skiing and snowboarding revenues in 2023. The mass market segment targets budget-conscious consumers who prioritize affordability and value for money. Products in this segment typically offer basic features and functionality at lower price points. They include entry-level skis, snowboards, boots, and apparel made from standard materials and construction methods. Also, mass-market skiing and snowboarding goods are commonly found in large retail chains, department stores, sporting goods outlets, and online marketplaces catering to a broad customer base. Moreover, the international sporting goods brand aims to enhance customer engagement by expanding its presence through strategic partnerships with key retailers across the U.S. This approach allows the brand to make its offerings readily accessible to a broader audience.

The premium skiing and snowboarding premium-priced product market is projected to grow at a CAGR of 5.6% from 2024 to 2030. The premium segment of the U.S. skiing and snowboarding market is driven by various factors tailored to the evolving preferences of outdoor enthusiasts who prioritize top-tier quality, advanced features, and longevity. Consumer demand for superior materials, cutting-edge technology, and meticulous craftsmanship are factors influencing the demand for high-performance gear. This market segment typically consists of individuals who perceive outdoor activities as more than just hobbies but rather integral aspects of their lifestyle, hence placing emphasis on gear that enhances their overall experience.

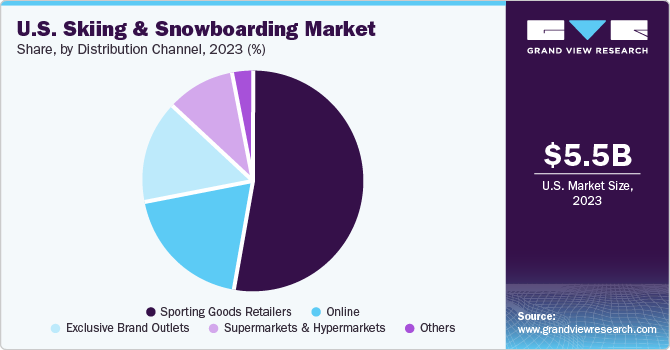

Distribution Channel Insights

The sale of skiing and snowboarding products through sporting goods retailers accounted for a revenue share of over 53% in 2023. Sporting goods stores play a significant role in the market as they serve as the primary channel through which consumers purchase skiing and snowboarding products. There are several factors driving the growth of this segment, one of which is the appeal of physical stores as a destination for skiers and snowboarders. Sporting goods stores provide a space where enthusiasts can connect with others who share their interests, receive customized advice and recommendations from experienced staff, and have the opportunity to physically examine and test products before making a purchase.

The sales of skiing and snowboarding products through online distribution channels are projected to grow at a CAGR of 6.2% from 2024 to 2030. Key players are increasingly launching e-commerce websites to capitalize on the rising popularity of online shopping among the young population. Many niche players are also setting up shop online and offering high-quality snow apparel for various sports. These players give tough competition to other established names in the market, such as The North Face, Arc'teryx, Patagonia Inc., and Salomon.

These manufacturer-owned online stores provide many benefits for consumers, including access to a more extensive range of products, competitive pricing, and direct access to product information and customer service. Therefore, consumers increasingly prefer online stores to purchase snow apparel products.

Key U.S. Skiing And Snowboarding Company Insights

The U.S. skiing & snowboarding market is highly competitive, with a range of companies offering various products. Many big players are increasing their focus on new product launches, partnerships, and expansion into new markets to compete effectively.

Key U.S. Skiing And Snowboarding Companies:

- Columbia Sportswear Company

- Skis Rossignol S.A.

- Burton Snowboards

- The North Face (VF Corporation)

- Salomon

- Arc’teryx - (Amer Product)

- SPYDER LLC

- Armada

- Norrona

- Black Crows

Recent Developments

-

In February 2024, Rossignol announced its 2024-2025 snowsports collection. The lineup will include a wide range of new and innovative skis, ski boots, snowboards, and other gear. The Rossignol Hero World Cup Boots and Rossignol Vizion Ski Boots have especially caught the attention of winter sports enthusiasts. These boots feature enhanced torsional rigidity in their bindings and are expected to deliver a superior level of performance and control to the wearer

-

In February 2024, Salomon introduced a revolutionary recyclable winter sports helmet, the Brigade INDEX. This ski and snowboard helmet features full recyclability at the end of its lifecycle.

-

In January 2024, Black Crows introduced the Ghost Resort collection, featuring exclusive sets of Duos Freebird poles, Draco Freebird skis, and Dorsa 27 X-Pac backpacks. These skis and poles are crafted with premium materials to guarantee durability and outstanding performance on the slopes.

U.S. Skiing And Snowboarding Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.78 billion

Revenue forecast in 2030

USD 7.74 billion

Growth rate (Revenue)

CAGR of 5.0% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sport, product, price range, distribution channel

Country scope

U.S.

Key companies profiled

Columbia Sportswear Company; Skis Rossignol S.A.; Burton Snowboards; The North Face (VF Corporation); Salomon; Arc’teryx - (Amer Product); SPYDER LLC; Armada; Norrona; Black Crows

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Skiing And Snowboarding Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. skiing and snowboarding market report based on sport, product, price range, and distribution channel:

-

Sport Outlook (Revenue, USD Million, 2018 - 2030)

-

Skiing

-

Snowboarding

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Apparel

-

Footwear

-

Equipment

-

Bindings

-

Poles

-

Helmets

-

Wrist Guards

-

Gloves

-

Goggles

-

Others (Skis, Snowboards, & Others)

-

-

-

Price Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass

-

Premium

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Sporting Goods Retailers

-

Supermarkets & Hypermarkets

-

Exclusive Brand Outlets

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. skiing and snowboarding market size was estimated at USD 5.53 billion in 2023 and is expected to reach USD 5.78 billion in 2024.

b. The U.S. skiing and snowboarding market is expected to grow at a compounded growth rate of 5.0% from 2024 to 2030 to reach USD 7.74 billion by 2030.

b. The skiing market accounted for a share of over 68% of the U.S. revenues in 2023. The increasing demand for ski areas reflects a growing appreciation for outdoor recreation opportunities and health and wellness trends.

b. "Some key players operating in U.S. skiing and snowboarding market include Columbia Sportswear Company, Skis Rossignol S.A., Burton Snowboards, The North Face (VF Corporation), Salomon, Arc’teryx – (Amer Product), SPYDER LLC, Armada, Norrona, black crows"

b. Key factors that are driving the market growth include rising prevalence of snow sports tournaments, competitions, and events in the country

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.